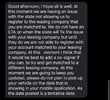

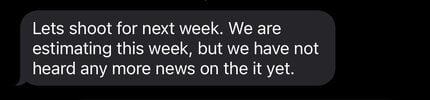

So, I’m ordering my first ever Tesla and was excited for the delivery date which was supposed to be Tuesday the 11th. Apparently, it won’t be that day anymore.

I applied for the lease and was approved for it. No issues and hasn’t been an issue for the month I’ve waited. Now they’re saying that they can’t match me to the leasing company I was matched to. They’re also saying that they won’t know when it’ll be fixed or if it’ll be fixed and their opinion is to get a “co-signer”. My question is, if that was the case, why approve me in the first place? Why all of a sudden now this is an issue when I got approved? Only guess is I did ask to switch to a black interior because I didn’t want to wait for the whit anymore but I asked them if I would have to re-apply and they said no and switched it for me. But that shouldn’t really affect much since it’s cheaper—at least I hope it didn’t. I called customer service and someone picked up—which surprised me—and he said he doesn’t even know what’s going on. He also said he submitted a ticket to the finance department but it can take up to 3 days—which sucks.

Has this happened to anyone else? Or do I have really bad luck? Guess at this rate I should’ve just waited for the white seats lol.

I applied for the lease and was approved for it. No issues and hasn’t been an issue for the month I’ve waited. Now they’re saying that they can’t match me to the leasing company I was matched to. They’re also saying that they won’t know when it’ll be fixed or if it’ll be fixed and their opinion is to get a “co-signer”. My question is, if that was the case, why approve me in the first place? Why all of a sudden now this is an issue when I got approved? Only guess is I did ask to switch to a black interior because I didn’t want to wait for the whit anymore but I asked them if I would have to re-apply and they said no and switched it for me. But that shouldn’t really affect much since it’s cheaper—at least I hope it didn’t. I called customer service and someone picked up—which surprised me—and he said he doesn’t even know what’s going on. He also said he submitted a ticket to the finance department but it can take up to 3 days—which sucks.

Has this happened to anyone else? Or do I have really bad luck? Guess at this rate I should’ve just waited for the white seats lol.