We could get a thread with a Wiki summary that anyone could edit; that summary post could have a table with the relevant data. If that would be useful, I'll have an admin set that up.Good idea. I would think, Robert, the moderator of the investor area would support such an idea.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Long-Term Fundamentals of Tesla Motors (TSLA)

- Thread starter Robert.Boston

- Start date

-

- Tags

- elon is an ass investing TSLA

Benz

Active Member

We could get a thread with a Wiki summary that anyone could edit; that summary post could have a table with the relevant data. If that would be useful, I'll have an admin set that up.

Thanks for your assistance and help, Robert.

But I don't think that just everybody should be able to edit the data in the table/spreadsheet/wiki. We, the members, should only be allowed to collect Tesla Model S/X delivery data (from several sources) and post it in this particular thread, and we must mention the source where we will have collected the data from. After that the Admin or someone else must enter this delivery data in the table/spreadsheet/wiki. Just like how it works with that "Tesla Model X Tally" -thread. We should do it similarly, I think.

Please correct me if I have misunderstood what you have meant to say.

Thanks

FANGO

Active Member

I would be guilty not to post this article:

Apple? Google? Tesla? Which Will Be The First To Reach A $1 Trillion Market Cap?

Yes please.

Yes please.

Here are some fun calculations. Let's assume Apple current market cap = 500B. Apple TTM sales = 178B. If Tesla had to match the P/S ratio of apple, how many cars at an ASP of 50k does it need to sell to achieve a 1T market cap? The answer = 7.2M. Now lets add in grid storage and if we assume that 50% of Tesla revenues at this future point of 1T valuation come from storage, then the number falls to 3.6M. When will Tesla sell 3.6M cars? My guess is 2030. So here you go Tesla 1T by 2030.

Here are some fun calculations. Let's assume Apple current market cap = 500B. Apple TTM sales = 178B. If Tesla had to match the P/S ratio of apple, how many cars at an ASP of 50k does it need to sell to achieve a 1T market cap? The answer = 7.2M. Now lets add in grid storage and if we assume that 50% of Tesla revenues at this future point of 1T valuation come from storage, then the number falls to 3.6M. When will Tesla sell 3.6M cars? My guess is 2030. So here you go Tesla 1T by 2030.

Fun but unrealistic, since Apple's margins are way higher than Tesla's margins ever will be.

RobStark

Well-Known Member

Fun but unrealistic, since Apple's margins are way higher than Tesla's margins ever will be.

Tesla will in all likelihood never reach Apple's 39% margins but IMO is way more susceptible to being replaced as the most prestigious brand in its category.

Therefore putting unrelenting pressure on its margins.

Fun but unrealistic, since Apple's margins are way higher than Tesla's margins ever will be.

Yeah

MartinAustin

Active Member

Wouldn't it be better to conject that Tesla's market cap increases to what Toyota's is today?

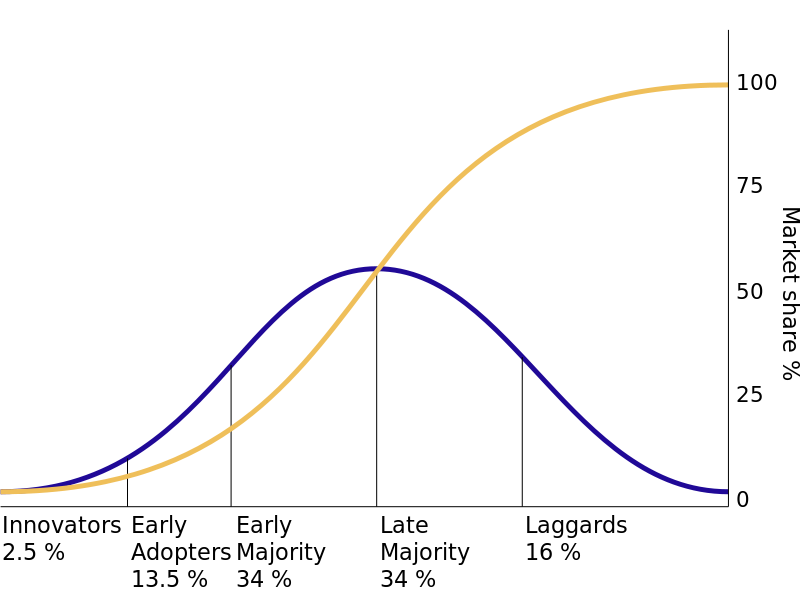

Tesla would be the world's largest electric car company by that point, producing more electric cars than anyone else, and also with fingers in the home battery storage markets, and charging infrastructure + battery recycling/production industries. This would probably be 15yrs from now in 2029, half-way through that adoption bell-curve diagram we have seen many times.

Today, Toyota is $189billion. TSLA stock would be $1,524 at that size, assuming no stock splits etc..

Tesla would be the world's largest electric car company by that point, producing more electric cars than anyone else, and also with fingers in the home battery storage markets, and charging infrastructure + battery recycling/production industries. This would probably be 15yrs from now in 2029, half-way through that adoption bell-curve diagram we have seen many times.

Today, Toyota is $189billion. TSLA stock would be $1,524 at that size, assuming no stock splits etc..

Tesla will in all likelihood never reach Apple's 39% margins but IMO is way more susceptible to being replaced as the most prestigious brand in its category.

Therefore putting unrelenting pressure on its margins.

Sure it'll have a higher P/E right now because it's growing faster. But to compare P/S ratio of Apple and infer that it's possible for Tesla to reach that someday isn't realistic because margins are different in tech vs auto.

- - - Updated - - -

Wouldn't it be better to conject that Tesla's market cap increases to what Toyota's is today?

Tesla would be the world's largest electric car company by that point, producing more electric cars than anyone else, and also with fingers in the home battery storage markets, and charging infrastructure + battery recycling/production industries. This would probably be 15yrs from now in 2029, half-way through that adoption bell-curve diagram we have seen many times.

Today, Toyota is $189billion. TSLA stock would be $1,524 at that size, assuming no stock splits etc..

Tesla has higher margins than Toyota (and likely will continue to do so in the future). So even if Tesla sells the same # cars as Toyota (ie., revenue), their profit will be greater and that will lead to a higher stock price than what the market gives Toyota right now.

Sure it'll have a higher P/E right now because it's growing faster. But to compare P/S ratio of Apple and infer that it's possible for Tesla to reach that someday isn't realistic because margins are different in tech vs auto.

Interesting debate/discussion. If you factor in the battery storage market potential I wonder if it could reach those margins? Probably not, but I wonder what margins would be on that segment of TM business.

Interesting debate/discussion. If you factor in the battery storage market potential I wonder if it could reach those margins? Probably not, but I wonder what margins would be on that segment of TM business.

Apple reaching close to 40% gross margin on hardware is unique. The big reason for this is because phones (especially in the U.S.) are on 2 year contracts, cost spread out over time, and only a few major carriers to choose from. So Apple is able to charge $600+ for a phone that costs them like $200-$250(?) to make. They make huge margins on the iPhone and that offsets the lower margin they make on all their other products (i.e., Macs, iPads, iPod Touches, etc). I'd imagine if Apple didn't have the iPhone that their margins would be under 30%, and maybe even under 25% (though I haven't researched this).

Regarding battery storage market, I don't see it as a particularly high margin business because the bulk of the cost is going to be the batteries, and then it's the value on top of that that the software, servicing, etc brings. I think Tesla could make some money by providing servicing contracts where Tesla monitors and maintains the battery storage units and makes sure they are always running in optimal conditions providing the best energy savings for the customer. This is where the bulk of the profit will likely come from IMO. But overall, I would imagine margins might be in the same ball park as their cars over time.

Apple reaching close to 40% gross margin on hardware is unique. The big reason for this is because phones (especially in the U.S.) are on 2 year contracts, cost spread out over time, and only a few major carriers to choose from. So Apple is able to charge $600+ for a phone that costs them like $200-$250(?) to make. They make huge margins on the iPhone and that offsets the lower margin they make on all their other products (i.e., Macs, iPads, iPod Touches, etc). I'd imagine if Apple didn't have the iPhone that their margins would be under 30%, and maybe even under 25% (though I haven't researched this).

Regarding battery storage market, I don't see it as a particularly high margin business because the bulk of the cost is going to be the batteries, and then it's the value on top of that that the software, servicing, etc brings. I think Tesla could make some money by providing servicing contracts where Tesla monitors and maintains the battery storage units and makes sure they are always running in optimal conditions providing the best energy savings for the customer. This is where the bulk of the profit will likely come from IMO. But overall, I would imagine margins might be in the same ball park as their cars over time.

Hmm, so lets take net margins. Apple net margin = 21%. IF Tesla can have net margins of 10.5%? Then with the P/E of Apple, they need to sell 7.2M cars at an ASP of 50k + equivalent in storage to get to 1T. I'd guess 2035 for that. But that requires that a new gigafactory shows up every year starting 2020.

Hmm, so lets take net margins. Apple net margin = 21%. IF Tesla can have net margins of 10.5%? Then with the P/E of Apple, they need to sell 7.2M cars at an ASP of 50k + equivalent in storage to get to 1T. I'd guess 2035 for that. But that requires that a new gigafactory shows up every year starting 2020.

I think your numbers are too optimistic:

1. If/when Tesla sells 7.2M cars, it will be because they got into economy cars (ie., $20-30k) and the economy cars will make up the majority of their sales. Therefore ASP will likely be $35k (maybe $40k if they're lucky). Of course this all depends on inflation as well (so I'm talking more in today's dollars).

2. Energy storage - so you're estimating they can sell $360 billion (!!!) of energy storage per year? Hmmm. I don't see where you're getting those numbers. Have they even sold $10M of energy storage yet?

3. P/E for the auto industry is generally much lower than tech (ie., Apple). Look at the P/E of BMW, Mercedes, Toyota, etc... they are all currently growing at a decent rate but have P/E of around 10.

I think your numbers are too optimistic:

1. If/when Tesla sells 7.2M cars, it will be because they got into economy cars (ie., $20-30k) and the economy cars will make up the majority of their sales. Therefore ASP will likely be $35k (maybe $40k if they're lucky). Of course this all depends on inflation as well (so I'm talking more in today's dollars).

2. Energy storage - so you're estimating they can sell $360 billion (!!!) of energy storage per year? Hmmm. I don't see where you're getting those numbers. Have they even sold $10M of energy storage yet?

3. P/E for the auto industry is generally much lower than tech (ie., Apple). Look at the P/E of BMW, Mercedes, Toyota, etc... they are all currently growing at a decent rate but have P/E of around 10.

I know they are too optimistic

I don't even know how to begin to anticipate the storage market. At what point will storage be the mechanism for utilities to shave off peaks? When will businesses and residential customers use it to shave off peak pricing? What would be the market for that? What will be solar/wind penetration 20 years from now? Will it be standard to have a battery with the system by then? What would be the size of a standard battery? How many kWh of batteries would sell per kW of solar?

But we can guess how much Tesla will have for storage. Assume that 35GWh/factory is for cars and 15 is for storage. Then 15 gigafactories * 15GWh = 225GWh at $200/kWh = $45billion. Can the margins on this be 50%?

jhm

Well-Known Member

Let's do a little back of the envelope on the size of the stationary energy storage market. In 2008, the globe consumed 143,851 TWh of electricity. Suppose Tesla could address 1% of that with stationary storage. That works out to nearly 3,941 GWh of daily storage. Let's suppose that Tesla systems lose out 10% capacity every year with 365 daily cycles. And suppose that the global energy market grows 3% per year. So steady state about the annual demand for new systems is about 13% of existing capacity. In 2025, then, we're looking at 5,455 GWh of existing installed capacity and annual demand of 709 GWh for new systems. At $200/kWh, that's $142B in annual sales for 1% of the global electricity market.

The above is just a steady state analysis. It doesn't really describe how we get there. The near-term dynamics are complex. There will be many different applications and critical price points at which storage becomes economical. Consider just one pathway, rooftop solar. Because of intermittency, solar without storage can only supply a fraction of the daily need for a home or business. Let's say no more than 10 kWh/day of the average 30 kWh/day per resident. This limits how much solar a resident might install. With 10 to 20 kWh in storage, one can install maybe two or three times as much solar. Basically, once the cost of storage comes down low enough to beat grid prices, it will be economical to buy storage coupled with solar. Thus, the growth rate of storage will be coupled with solar. So if solar continues to double every 2 to 3 years, then so will demand for storage coupled with solar. Moreover, this coupling could also accelerate growth in solar as solar installed per roof is doubled or tripled. Once we hit the tipping point in price, i suspect the only thing holding back storage will be supply constraints.

I don't see how Tesla could possibly exhaust the opportunity in this market. Opening one new Gigafactory every year for 15 years won't be nearly enough.

The above is just a steady state analysis. It doesn't really describe how we get there. The near-term dynamics are complex. There will be many different applications and critical price points at which storage becomes economical. Consider just one pathway, rooftop solar. Because of intermittency, solar without storage can only supply a fraction of the daily need for a home or business. Let's say no more than 10 kWh/day of the average 30 kWh/day per resident. This limits how much solar a resident might install. With 10 to 20 kWh in storage, one can install maybe two or three times as much solar. Basically, once the cost of storage comes down low enough to beat grid prices, it will be economical to buy storage coupled with solar. Thus, the growth rate of storage will be coupled with solar. So if solar continues to double every 2 to 3 years, then so will demand for storage coupled with solar. Moreover, this coupling could also accelerate growth in solar as solar installed per roof is doubled or tripled. Once we hit the tipping point in price, i suspect the only thing holding back storage will be supply constraints.

I don't see how Tesla could possibly exhaust the opportunity in this market. Opening one new Gigafactory every year for 15 years won't be nearly enough.

JRP3

Hyperactive Member

FANGO

Active Member

Tesla's cells should not drop 10% of capacity after only 365 cycles, more like 1000+ cycles.

Also a cycle is a full charge to full discharge, not just partial cycle of the pack.

Btw one way we could get to a trillion is with mergers. What if scty buys up solar installers and producers, and merges with tsla? Add spacex for good measure, maybe Toyota or Mercedes or something too. There's your trillion. We would be diluted but were just talking about mkt cap here.

doggusfluffy

Closed

Let's do a little back of the envelope on the size of the stationary energy storage market. In 2008, the globe consumed 143,851 TWh of electricity. Suppose Tesla could address 1% of that with stationary storage. That works out to nearly 3,941 GWh of daily storage. Let's suppose that Tesla systems lose out 10% capacity every year with 365 daily cycles. And suppose that the global energy market grows 3% per year. So steady state about the annual demand for new systems is about 13% of existing capacity. In 2025, then, we're looking at 5,455 GWh of existing installed capacity and annual demand of 709 GWh for new systems. At $200/kWh, that's $142B in annual sales for 1% of the global electricity market.

The above is just a steady state analysis. It doesn't really describe how we get there. The near-term dynamics are complex. There will be many different applications and critical price points at which storage becomes economical. Consider just one pathway, rooftop solar. Because of intermittency, solar without storage can only supply a fraction of the daily need for a home or business. Let's say no more than 10 kWh/day of the average 30 kWh/day per resident. This limits how much solar a resident might install. With 10 to 20 kWh in storage, one can install maybe two or three times as much solar. Basically, once the cost of storage comes down low enough to beat grid prices, it will be economical to buy storage coupled with solar. Thus, the growth rate of storage will be coupled with solar. So if solar continues to double every 2 to 3 years, then so will demand for storage coupled with solar. Moreover, this coupling could also accelerate growth in solar as solar installed per roof is doubled or tripled. Once we hit the tipping point in price, i suspect the only thing holding back storage will be supply constraints.

I don't see how Tesla could possibly exhaust the opportunity in this market. Opening one new Gigafactory every year for 15 years won't be nearly enough.

Additionally, SolarCity is building a massive factory for panels. It seems to me this is the equivalent of the Fremont plant requiring X batteries for X car production. SolarCity builds X panels for a complete home/commercial storage battery consumer of X Tesla cells.

Hogfighter

Professional Lurker

Regarding margins, 3 things to keep in mind:

1) Margins will undoubtedly increase with economies of scale. TSLA will have significantly higher margins building 500k cars per year than currently. Perhaps not AAPL margins, but certainly much, much higher than Toyota or Ford.

2) Battery technology in 10-15 years will greatly improve, reducing TSLA's largest expense, enhancing margins.

3) Once EVs go mainstream (I believe that they will, especially when #2 happens), competition will be stiffer. Although that will cut into margins somewhat, AAPL (since they are the market leader) is able to maintain higher margins than its competitors, and I believe the same will be the case for TSLA.

1) Margins will undoubtedly increase with economies of scale. TSLA will have significantly higher margins building 500k cars per year than currently. Perhaps not AAPL margins, but certainly much, much higher than Toyota or Ford.

2) Battery technology in 10-15 years will greatly improve, reducing TSLA's largest expense, enhancing margins.

3) Once EVs go mainstream (I believe that they will, especially when #2 happens), competition will be stiffer. Although that will cut into margins somewhat, AAPL (since they are the market leader) is able to maintain higher margins than its competitors, and I believe the same will be the case for TSLA.

Similar threads

- Replies

- 0

- Views

- 76

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 1

- Views

- 497

- Replies

- 23

- Views

- 840

- Replies

- 21

- Views

- 6K