Thanks for all the info. Just want to make sure the funds are there for states to maintain nice roads for my Model 3 It will be interesting to see how states adjust/change their revenue policies regarding EVs in future years. (I do think larger trucks should be charged more to correspond to their increased wear and tear on the roads.)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Loss of Gas Tax Revenue For Roads

- Thread starter AZGirl

- Start date

-

- Tags

- Tesla Inc.

I did the math for my car. I've been keeping track of every cent I've spent on gas for the last 4+ years. The app I use conveniently records how many GALLONS of gas I've used as well so it was easy to figure out how much in TAXES I paid over the years.

Now, for my 30MPG Camry, I was spending around $200/mo in taxes. I would be perfectly fine with setting up an auto-pay of $20/mo to my town and they could forward the federal part of my taxes to Washington. I don't believe in getting something for nothing - the roads need to be maintained. But I'll be saving so much on gas (more if I get solar panels) when my Model 3 is delivered, I won't mind giving an extra few buck a year to keep the roads in good shape (or GET them to good shape.

Now, for my 30MPG Camry, I was spending around $200/mo in taxes. I would be perfectly fine with setting up an auto-pay of $20/mo to my town and they could forward the federal part of my taxes to Washington. I don't believe in getting something for nothing - the roads need to be maintained. But I'll be saving so much on gas (more if I get solar panels) when my Model 3 is delivered, I won't mind giving an extra few buck a year to keep the roads in good shape (or GET them to good shape.

TaoJones

Beyond Driven

I would much rather see higher taxes based upon the number of gallons of gas or diesel consumed.

Charge EVs more? Um, no. Charge gas guzzlers and hybrids more. The hybrid tax could be called the "commitment issues tax". There's a novel idea. Don't like it? Buy an EV.

Alright, fine - back to gas guzzlers. Ratchet up those local, state, and federal taxes per gallon and as a percentage of the total price. Ever wonder why California gas prices are typically higher? Part of it is because there's sales tax in there as well.

Taxing vehicles that don't pollute is fairly absurd when there are competing incentives to promote adoption. Meta-redistribution? What?

Insofar as road damage is concerned, eastern and midwestern states have nooooo problem charging tolls, ostensibly for road maintenance, although the tollways are an industry unto themselves in places such as New York. Beyond that, we already get hammered in California for absurdly high registration fees. There's even a $1/year reflective plate fee. I'd like to meet the skeevy cretin who came up with that one - I bet he or she got a raise for that - twice. The first time for coming up with the idea, and the second time for making it perpetual.

The predicted, "Oh, but those EV owners - they're not paying their share" is crap. In a scenario with 100% EVs on the road, what would happen? Weight-based recurring fees would be the most logical solution for road maintenance. Hard to argue with that one. You can argue all day long against mileage-based schemes. That said, you can bet that the day after implementation of a weight-based fee structure, some bureaucrat would whine that lighter cars should pay more because, wait for it... "they're not paying their share".

And so it goes.

Charge EVs more? Um, no. Charge gas guzzlers and hybrids more. The hybrid tax could be called the "commitment issues tax". There's a novel idea. Don't like it? Buy an EV.

Alright, fine - back to gas guzzlers. Ratchet up those local, state, and federal taxes per gallon and as a percentage of the total price. Ever wonder why California gas prices are typically higher? Part of it is because there's sales tax in there as well.

Taxing vehicles that don't pollute is fairly absurd when there are competing incentives to promote adoption. Meta-redistribution? What?

Insofar as road damage is concerned, eastern and midwestern states have nooooo problem charging tolls, ostensibly for road maintenance, although the tollways are an industry unto themselves in places such as New York. Beyond that, we already get hammered in California for absurdly high registration fees. There's even a $1/year reflective plate fee. I'd like to meet the skeevy cretin who came up with that one - I bet he or she got a raise for that - twice. The first time for coming up with the idea, and the second time for making it perpetual.

The predicted, "Oh, but those EV owners - they're not paying their share" is crap. In a scenario with 100% EVs on the road, what would happen? Weight-based recurring fees would be the most logical solution for road maintenance. Hard to argue with that one. You can argue all day long against mileage-based schemes. That said, you can bet that the day after implementation of a weight-based fee structure, some bureaucrat would whine that lighter cars should pay more because, wait for it... "they're not paying their share".

And so it goes.

3Victoria

Active Member

I had always understood that most road damage was ftom trucks and buses.

timk225

Active Member

If the roads in Pittsburgh are any indication of how wisely Pennsylvania spends its gasoline taxes to fix the roads.... then they don't need my money.

And with a heavy trailer truck, its weight will flex the road surface far more than a car ever could, which causes cracks, then potholes, then Pennsylvania roads. I've seen many asphalt roads near stoplights, where the vehicles get into lanes and stop, over time the pavement will move and flow and create grooves like on an old dirt road out in the woods. Pavement softens up in the summertime heat and direct sunlight.

And with a heavy trailer truck, its weight will flex the road surface far more than a car ever could, which causes cracks, then potholes, then Pennsylvania roads. I've seen many asphalt roads near stoplights, where the vehicles get into lanes and stop, over time the pavement will move and flow and create grooves like on an old dirt road out in the woods. Pavement softens up in the summertime heat and direct sunlight.

ItsNotAboutTheMoney

Well-Known Member

I don't think they can go by miles. I live near Kansas City. This is a city and Metro area split by a state line. If I work and shop downtown, but live just a few miles over in Kansas, who do I pay?

I think a flat yearly fee, or one by vehicle mass, is the way to go.

In Oregon's trial there is a basic all-miles option, or a managed GPS-based option where the GPS determines which miles you have to pay for. That's how I see it going.

SageBrush

REJECT Fascism

The proportion is far from linear. I have read up to x^41semi = 1000 cars worth of damage to roads? how come? Semi's here weigh 44 tonnes (96,800lb), which on average is approximately 30 times the weight of a car. The Semi has more axles to spread the weight (typically 6 axles, vs 2), so the weight per axle is roughly 16,100lb. A car would be about 1,500lb per axle, so maybe they mean that a semi does 10 times as much damage as a car.

DFibRL8R

Active Member

In Virginia they charge an EV tax on the registration every year. That's in addition to an annual property tax that all vehicles pay in Virginia. Additionally...

Here is my issue with Virginia's annual personal property tax on cars (It is about a 5% assessment by the way State and locality every year based on the assessed value of the car).

The problem is EVs (and hybrids) cost more and have a higher value than comparable ICE vehicles. As a result a hybrid Camry pays about 5-10% more than a full ICE Camry in initial sales tax and annual personal property tax. For an EV, it's even worse with such a huge percentage of the price of the car due to the battery. The gas tax is a pittance in comparison. So anyone who has an annual personal property tax on their car is more than paying their "fair" share especially when you consider the transportation of fuel on large trucks (with road damage and sometimes massive fireballs etc) and the cost in life years of smog from ICE engines.

We should tax the hell out of gasoline until people stop using the stuff now that there are good alternatives (IMHO).

Last edited:

SageBrush

REJECT Fascism

This article is quite comprehensive in discussing road wear and tear from different weighted vehicles, and effects from other factors like type of roads, tyre setups and suspension differences. This snippet is for the lazy:

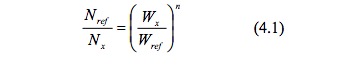

4.2 Experimental findings: static axle load As stated in Section 3.2, the concept of number of equivalent standard axles, and the so called fourth power law, has been a highly debated topic. There has been many different reports in the literature regarding the exponent n in the load equivalence equation. This relation, comparing the damage caused by axles of different loads is

where Wx and Wref are axle loads and Nx and Nref are the corresponding number of load applications. Cebon concludes that for flexible pavements, values of 1.3 – 6 has been reported in the literature, while for composite and rigid pavements, values are thought to be as high as 8 – 33. COST 334 makes a distinction between individual distress modes, and reports that cracking of bituminous layers has a value of 4 − 7, permanent deformation of the subgrade has an exponent of perhaps 3 − 4 and permanent deformation of bituminous layers a value of 1 − 2.

And it's even more if the tire pressures between the duals are unequal or one is flat.This article is quite comprehensive in discussing road wear and tear from different weighted vehicles, and effects from other factors like type of roads, tyre setups and suspension differences. This snippet is for the lazy:

SageBrush

REJECT Fascism

No doubt that a single truck damages a road more than 1000 EVs, but that is only part of the story because it does not factor in what fraction of road maintenance costs are vehicle weight related. That is not information I have been able to find, but this article reports that the externalized vehicle weight costs from costs are about 6 cents a mile on interstates, some 30 cents a mile on arterial roads, and 88 cents a mile on roadways for an 80k pound truck

Uncle Paul

Well-Known Member

Biggest problem I have with additional road taxes is that over the past 20 years or so, the taxes that were charged on gasoline have been raided by the government to spend on their own pet projects, having nothing to do with roads.

Only if they were to replace those stolen funds, should anyone be OK with additional fees being levied.

Government already taxes electric vehicle use, with the taxes they charge for delivering electricity through the grid. Those taxes should be used for road expenses first, before gouging for additional miles taxes.

Only people getting a free ride are those with personal solar, or using Superchargers. All others already pay taxes that could be used to maintain roads.

Only if they were to replace those stolen funds, should anyone be OK with additional fees being levied.

Government already taxes electric vehicle use, with the taxes they charge for delivering electricity through the grid. Those taxes should be used for road expenses first, before gouging for additional miles taxes.

Only people getting a free ride are those with personal solar, or using Superchargers. All others already pay taxes that could be used to maintain roads.

TaoJones

Beyond Driven

Biggest problem I have with additional road taxes is that over the past 20 years or so, the taxes that were charged on gasoline have been raided by the government to spend on their own pet projects, having nothing to do with roads.

Only if they were to replace those stolen funds, should anyone be OK with additional fees being levied.

Government already taxes electric vehicle use, with the taxes they charge for delivering electricity through the grid. Those taxes should be used for road expenses first, before gouging for additional miles taxes.

Only people getting a free ride are those with personal solar, or using Superchargers. All others already pay taxes that could be used to maintain roads.

People do tend to forget the misappropriation of public funds, and with some regularity. Politicians and bureaucrats in particular, who have no trouble with an overdeveloped sense of entitlement at the public trough.

I would add to the above only that those with solar arrays and who use SCs are still disproportionately taxed through other means, depending upon their choice of domicile. See the thousands of dollars collected over time via California registration fees, HOV account fees even though largely exempt, and the list goes on - versus, say, anyone who lives in a sensible state. Oddly, those monies never seem to be enough, either.

1semi = 1000 cars worth of damage to roads? how come? Semi's here weigh 44 tonnes (96,800lb), which on average is approximately 30 times the weight of a car. The Semi has more axles to spread the weight (typically 6 axles, vs 2), so the weight per axle is roughly 16,100lb. A car would be about 1,500lb per axle, so maybe they mean that a semi does 10 times as much damage as a car.

because a road is like your back, imagine you are lying down and a 2 year child is jumping on your back, that is a back massage.

now imagine that child is now an overweight (75% percentile) american male who is at the heaviest he will ever be, jumping on your back in the same way as a 2 year old.

2 year old child is about 27 pounds

50 year old overweight american is about 210 pounds

not quite as extreme as the weight ratio between a loaded semi and a passenger car, but its should be instructive. Road wear is far more based on weight, than distance.

The same American male, if he chooses to take the bus, is personally causing more road damage, than if he drove a midsize car like the Camry/Altima.

CHG-ON

Still in love after all these miles

This is a big deal for CA. Personally, I would be happy to pay for my use of the roads, provided it was reasonable and the money ACTUALLY gave us well maintained roads. I would very happily pay for that.

This is a big deal for CA. Personally, I would be happy to pay for my use of the roads, provided it was reasonable and the money ACTUALLY gave us well maintained roads. I would very happily pay for that.

2 issues

1 fuel tax / road tax is not representative of actual road wear (refer 4th rule for weight)

2 fuel tax/ road tax tends to be diverted for other uses

neither of which seems to be improved by a per mile tax, actually both are probably even more distant with a per mile tax.

SageBrush

REJECT Fascism

I should have written this all in one post but editing is disallowed after an hour. So, part #3 of my drawn out analysis but first a summary:

Heavy trucks have an externalized cost of 5 - 89 cents a mile depending mostly on the road used, and put about 10% of miles on US roads. Starting from somewhere in middlish of this range of 30 cents a mile and normalizing for use, the country is missing out on about 3 cents of every traveled mile in taxes. Since combined state and US fuel taxes are around 48 cents a gallon, the trucking externality is about 6%.

Fine. When EVs are 6% of miles traveled, the politicians will be well justified to fix both EV and trucking

Heavy trucks have an externalized cost of 5 - 89 cents a mile depending mostly on the road used, and put about 10% of miles on US roads. Starting from somewhere in middlish of this range of 30 cents a mile and normalizing for use, the country is missing out on about 3 cents of every traveled mile in taxes. Since combined state and US fuel taxes are around 48 cents a gallon, the trucking externality is about 6%.

Fine. When EVs are 6% of miles traveled, the politicians will be well justified to fix both EV and trucking

SageBrush

REJECT Fascism

Awww, crap. Dumb error to correct:I should have written this all in one post but editing is disallowed after an hour. So, part #3 of my drawn out analysis but first a summary:

Heavy trucks have an externalized cost of 5 - 89 cents a mile depending mostly on the road used, and put about 10% of miles on US roads. Starting from somewhere in middlish of this range of 30 cents a mile and normalizing for use, the country is missing out on about 3 cents of every traveled mile in taxes. Since combined state and US fuel taxes are around 48 cents a gallon, the trucking externality is about 6%.

Fine. When EVs are 6% of miles traveled, the politicians will be well justified to fix both EV and trucking

Combined state and federal taxes are 48 cents a gallon, so about 2 cents a mile. Heavy trucks cause damage equal to 150% of that fund in damages they do not cover. But we are really, really worried about the 0.1% of EVs on the road ?!?

It's more complex than that because there is also the money spent to clean up spilled oil that EVs don't do. (And not just when a truck, tanker, or pipeline spills either, it's every drip that comes off of a car or truck.)I should have written this all in one post but editing is disallowed after an hour. So, part #3 of my drawn out analysis but first a summary:

Heavy trucks have an externalized cost of 5 - 89 cents a mile depending mostly on the road used, and put about 10% of miles on US roads. Starting from somewhere in middlish of this range of 30 cents a mile and normalizing for use, the country is missing out on about 3 cents of every traveled mile in taxes. Since combined state and US fuel taxes are around 48 cents a gallon, the trucking externality is about 6%.

Fine. When EVs are 6% of miles traveled, the politicians will be well justified to fix both EV and trucking

Similar threads

- Replies

- 62

- Views

- 2K

- Replies

- 3

- Views

- 823

- Replies

- 2

- Views

- 396

- Replies

- 4

- Views

- 657