Why does the calculation on "Effect on net salary" not take into account the reduction in pension payment if the deductions are made before the NHS pension calculations?

I'm just trying to get my head around what it actually all means.

Lets say you earn £35k that means your pension contribution is 9.3% and the NHS 14.3%

So (roughly) before tax the salary is £2916 a month, from that you get £417 of pension contribution and also get deducted £271 of contributions - so £688 goes into the pension pot.

Now if you get a quote of £648 (and effect on net salary of £341) for your car, we're saying that this is quite possibly deducted before pension. Making your salary drop to 2268 a month and therefore the NHS pension contribution drops £92 and you're paying £60 less , so your pension pot loses out £153 a month .... however you're paying out less contribution so surely this should be deducted from the effect on net salary... so that £341 deduction is nearer £300..... but you're losing out on £92 a month of NHS contributions, and really you should bump up your personal contributions....

My main advice to anyone thinking about the NHS scheme is

TO FORGET THE WORD CONTRIBUTIONS. It's entirely, completely, 100% irrelevant. How much your employer pays in makes NO difference to your pension, nor does how much you pay (although how much you pay is linked to the sacrificed amount, you shouldn't think about it as a contribution)

The NHS scheme is a defined benefit scheme, not a defined contribution scheme. Your contribution is literally just a membership fee, and your employer's contribution is essentially them paying for previous employees. It makes zero difference to anything: your employer could change their contribution to 0% or 100% (assuming the government let them) tomorrow and your pension wouldn't change by so much as a penny.

ALL that matters is your gross salary, and whether you pay your membership fee.

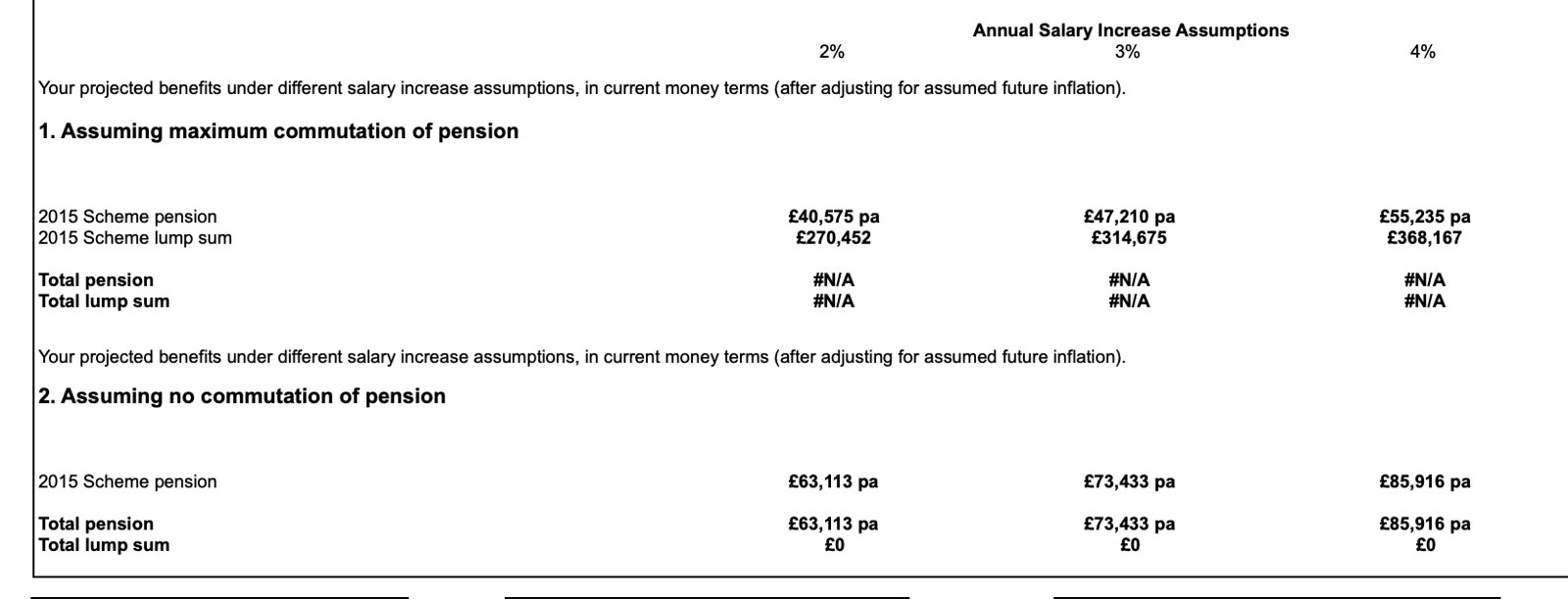

Take your gross annual salary, divide it by 54. Every year you are a member of the scheme, you "accrue" that amount per year of pension. So on £35k, after 1 year you have £648/year in your pension (meaning your pension will pay you £54/month after you retire). Alternately, if you prefer to work things out monthly, the maths is the same: divide your gross monthly by 54 and that's how much pension you accrue every month.

So let's run the numbers...

If you sacrifice £5k on a car, you "accrue" based on £30k, rather than £35k. You now accrue £555/yr of pension, meaning you will now be paid £46 a month instead of £54/mo when you retire, in exchange for being a member of the scheme this year

So the actual "pension cost" of your car is 1/54th of your sacrificed amount. If you sacrifice £5k, you lose £92/yr, or £7.70/mo, once you retire.

However, you're saving money on that £5k every year too, because you don't have to pay:

- 12% National Insurance (£600)

- 9.3% Pension (£456)

- 20% Tax (£1000)

- Possibly 9% student loan (£450)

So each year, you're saving yourself £2056 in Tax/NI/Pension payments, or £2506 if you have a student loan.

Stick that £2500 in a bank account and you can pay the £92/yr pension "shortfall" for 27 years after retirement....(22 years without student loan)

If you sacrifice £5k/yr for 40 years of your career, you'll lose out on £3700/yr of pension, but you'll have £82k (closer to £100k with student loan, exact amount depends on whether you'd pay it off or when it would be written off) in the bank. I'm ignoring inflation here because you'd get interest on your savings and the pension is re-valued with inflation anyway, so we can just look at the base numbers.

So there is a pension hit, but it's nowhere near as big as people make out... and the "But I'll lose out on 13.5% of employer contributions" angle is

complete nonsense to be ignored because it's entirely, completely, 100% irrelevant to how your pension is calculated