Q4'19 - Q4'21 PDF

Q4'19 - Q4'21 Excel

Q4'19 - Q4'21 Numbers

I just expanded this model so I'd be able to account for differences in prices, costs, and margins between Fremont, Giga 3, and Giga 4. So it's rather large. Lots of notes at the bottom.

Automotive

View attachment 496229

View attachment 496230

View attachment 496231

Energy

View attachment 496232

Income

View attachment 496233

EDIT: Thanks to

@Todesbuckler for pointing out a small error. I forgot to add a "-" sign before the interest expenses in 2021, so the GAAP Profit, and GAAP EPS are off a bit. EBIT remains correct though.

- Don't pay too much attention to regular solar. I'm not sure how accurate the separation between regular solar leases and regular solar cash and loan is going to be. I'm not assuming much growth there anyway, so it makes up a small % of overall Energy.

- The biggest assumption in this model is no battery supply issues. It assumes that Tesla realised their battery cell supply issues 12-18 months ago, and has taken the steps necessary to not be constrained in this aspect during the next 12-24 months.

- The second biggest assumption is that Fremont can produce 15k cars per week by mid 2021. It seems like @EVNow is sceptical about this for now.

- A third smaller assumption is that Giga 3 has the capability to produce 500k cars per year. I think this is pretty likely though, especially considering the rumors that are already floating around suggesting 280/cars per 10 hours. If these are true, they could already produce 280 / 10 * 24 * 7 = 4704 cars per week if there were to be zero downtime at the factory.

- About the 30% Giga 3 margins, I calculated these by calculating ASPs and COGS separately. ASPs are based off of MiC M3 price + subsidies + ~$1.5k for options (paint, FSD). The COGS were calculated by assuming M3 SR+ to be 15% margin on an ASP of $40.5k in Q3'19 in Fremont, and keeping this the same at Giga 3. So considering that Giga 3 is supposed to have been more capital efficient per unit of production, margins at Giga 3 could exceed 30% long term.

- No M3 production at Giga 4 by the end of 2021, because they've said they will start with Model Y there.

Besides the two big assumptions (cell supply and Fremont 15k/week), the model assumes solid execution of ramp ups of Giga 3 and Model Y, but I don't think these are overly aggressive. I could maybe see Model Y at Fremont ramping faster than this if things go really well.

The

yearly runrates of 1.4M deliveries, $80B revenue, $20B gross profits, and $12B EBIT at the end of 2021 are pretty mind-boggling.

Feel free to poke holes in this and find places where it's incorrect or assumes the impossible. Constructive criticism is always helpful to improve my model.

P.S. Do we know if there are any plans to produce LR and P models at Giga 3 and/or Giga 4 in the future? Last I heard is SR+ only.

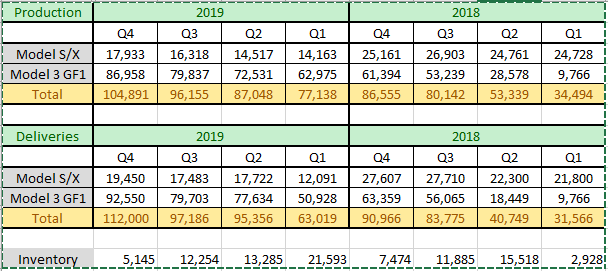

P.P.S. Got too carried away with next two years, but looks like I'm more pessimistic about Q4'19 than

@EVNow, and pretty much the same as

@Todesbuckler (although my revenue is higher). I have $7.22B in revenue and $203M in GAAP profits. I think there could be potential upside compared to my Q4'19 numbers, because I'm a bit conservative in Energy, and I have a decent uptick in OPEX.