.

Daily Trading Charts

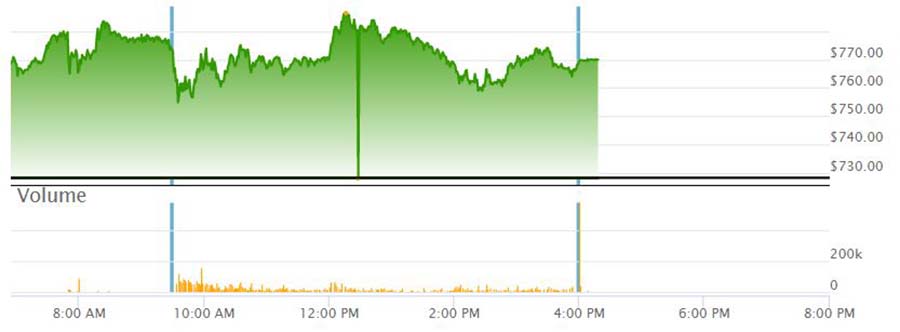

TSLA chart above

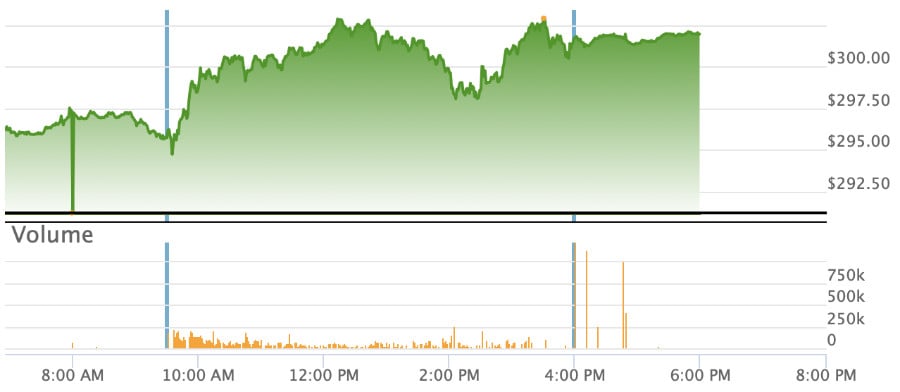

QQQ chart above

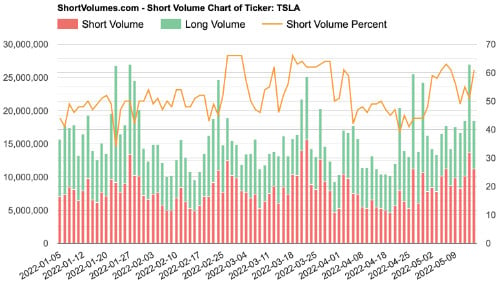

How is it possible for TSLA to close up nearly 6% on Friday and I still feel like I had my pockets picked? Read on. TSLA volume was 30 million shares on Friday as tech stocks rallied. The NASDAQ closed up 3.82%, placing TSLA's gains of 5.71% well below its normal 2.1X beta. Moreover, the trading showed the fingerprints of manipulations with percent of TSLA selling rising to 61% (see chart below). For comparison purposes, on Friday NVDA closed up 9.5%, ARKK up 11.8%, Ford up 8.5% and GM up 7.5%.

Here's how the day went. As TSLA approached market open, it was up 4.2X QQQ's gains. Slightly after noon when both QQQ and TSLA temporarily peaked, TSLA was up 8% and QQQ up 4% for a 2X multiple. Unfortunately, as the day progressed you could see the usual afternoon dip into close being engineered with TSLA, and it closed at a mere 1.5X multiple to QQQ.

Could TSLA have done worse than expected because of news? Actually, the news was significantly positive for TSLA on Friday. Elon had tweeted that his acquisition of Twitter was on hold. Previously, Gary Black had suggested a 10% bump upward if Elon bowed out of his Twitter acquisition, but of course Elon did not do so, he put the acquisition on hold pending a look into Twitter's claim that only 5% of its userbase consists of bots. Typically, the market will discount such news according to how likely the news is to lead to Elon dropping his acquisition, so we should have see at least a portion of that +10% reflected in TSLA's Friday trading. Even if the acquisition goes through, however, there's now a likelihood of a renegotiation of the price of Twitter (especially in light of the huge dip we saw in the market over recent weeks). A lower price paid for Twitter would mean less financial liability for Elon both because of the lower price and because the lower price would attract more investors. Thus, with this news TSLA really should have been trading at more than its normal 2.1X multiple to the NASDAQ, not less.

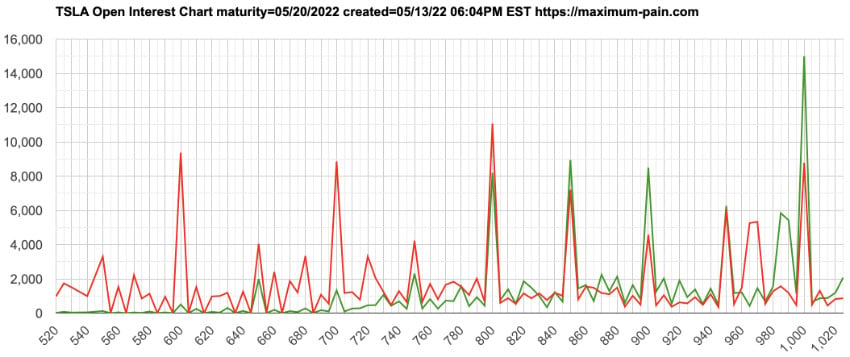

So, who would be working on manipulating TSLA so that its climb was reigned in on Friday? Let's look at two groups: market makers and everybody else. Market makers were committed to keep TSLA from running above the call wall at 800 and would do best with a closing price near Friday's max pain of 780. The 765 closing price of TSLA suited these needs nicely. Might the market rally early in the coming week when it realizes TSLA was artificially constrained on Friday? Of course, and guess what? Max pain for this coming Friday is 900! Friday May 20 is a monthly options expiration and for this reason we have lots of bets that were placed when TSLA was quite a bit higher. In the max pain open interest chart, look at all those strike prices where calls and puts are both sky high? TSLA could gain more than $130 this coming week and the option sellers will still make out like bandits. The MMs just needed to keep TSLA down on Friday and they succeeded.

How about the other manipulators out there? You have big shorts, you have hedge funds which are net short in TSLA, big dogs who plan to load up on TSLA but want an even lower buy-in price, and you even have big money individuals who want to keep Elon from acquiring Twitter (for political or personal reasons). Keeping price pressure on TSLA as long as possible suits the needs of these forces.

The big question for the coming week is whether the big money will start buying back into tech (as was happening on Friday) or will they try to manipulate the market lower for better buy-in prices? I've come to regard the afternoon turnaround of tech stocks as perhaps the kind of manipulations we've seen frequently with TSLA but including a few other very visible tech companies and involving multiple hedge funds. Once these stocks start turning down, the rest of the market follows. There's enormous pricing control if this theory is in fact true.

A rise to 61% of selling by shorts suggests substantial manipulations on Friday. If you liked TSLA's rise, you would have REALLY liked the rise without these efforts

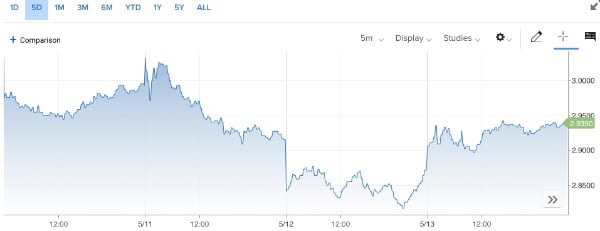

10 yr. treasury bond yields ended the week just a smidgen under 2.95%

Max pain for this coming Friday is 900. If TSLA rallies early in the week that max pain number will rise. Market makers have little to worry about if TSLA gets frisky going into the new week. Looking at specific call and put walls, the MMs would like TSLA to at least close above that 800 put wall. It's strange but even 950 is neutral in terms of puts vs. calls.

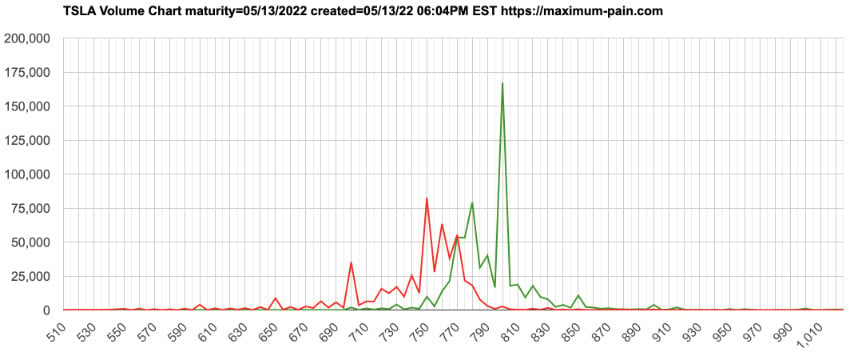

Here's a chart of option volumes for expiration this past Friday

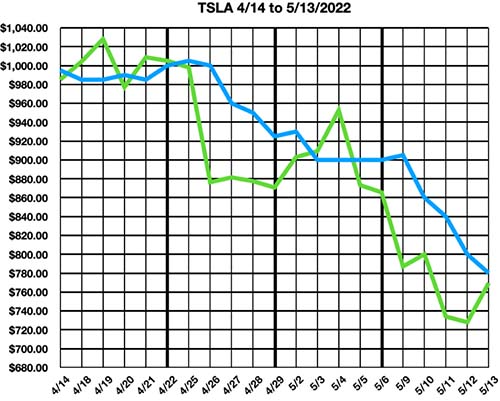

Despite the ginormous fluctuations in stock price the past four weeks, look at how closely max pain and stock price have come together each Friday. Coincidence? You already know the answer. (chart thanks to @JimS ). I just have a request for Jim: could you please give us a chart next week where the green line goes mostly up and to the right?

What's interesting about the tech chart is how closely TSLA closed to its opening price on such a strong macro day. Add this to your list of signs that manipulations have been underway (provided negative news was absent).

For the week, TSLA closed at 769.59, down 96.06 from the previous Friday's 865.65. With any luck, the NASDAQ may have bottomed out on Thursday. Looking forward to the ride back up, when it comes. Hoping you enjoy your weekend.

Conditions:

* Dow up 466 (1.47%)

* NASDAQ up 434 (3.82%)

* SPY up 9 (2.39%)

* TSLA 769.59, up 41.59 (5.71%)

* TSLA volume 30.5M shares

* Oil 110.5

* IV 74.6, 97%

* Max Pain 780

* Percent of TSLA selling tagged to shorts: 61%

Daily Trading Charts

TSLA chart above

QQQ chart above

How is it possible for TSLA to close up nearly 6% on Friday and I still feel like I had my pockets picked? Read on. TSLA volume was 30 million shares on Friday as tech stocks rallied. The NASDAQ closed up 3.82%, placing TSLA's gains of 5.71% well below its normal 2.1X beta. Moreover, the trading showed the fingerprints of manipulations with percent of TSLA selling rising to 61% (see chart below). For comparison purposes, on Friday NVDA closed up 9.5%, ARKK up 11.8%, Ford up 8.5% and GM up 7.5%.

Here's how the day went. As TSLA approached market open, it was up 4.2X QQQ's gains. Slightly after noon when both QQQ and TSLA temporarily peaked, TSLA was up 8% and QQQ up 4% for a 2X multiple. Unfortunately, as the day progressed you could see the usual afternoon dip into close being engineered with TSLA, and it closed at a mere 1.5X multiple to QQQ.

Could TSLA have done worse than expected because of news? Actually, the news was significantly positive for TSLA on Friday. Elon had tweeted that his acquisition of Twitter was on hold. Previously, Gary Black had suggested a 10% bump upward if Elon bowed out of his Twitter acquisition, but of course Elon did not do so, he put the acquisition on hold pending a look into Twitter's claim that only 5% of its userbase consists of bots. Typically, the market will discount such news according to how likely the news is to lead to Elon dropping his acquisition, so we should have see at least a portion of that +10% reflected in TSLA's Friday trading. Even if the acquisition goes through, however, there's now a likelihood of a renegotiation of the price of Twitter (especially in light of the huge dip we saw in the market over recent weeks). A lower price paid for Twitter would mean less financial liability for Elon both because of the lower price and because the lower price would attract more investors. Thus, with this news TSLA really should have been trading at more than its normal 2.1X multiple to the NASDAQ, not less.

So, who would be working on manipulating TSLA so that its climb was reigned in on Friday? Let's look at two groups: market makers and everybody else. Market makers were committed to keep TSLA from running above the call wall at 800 and would do best with a closing price near Friday's max pain of 780. The 765 closing price of TSLA suited these needs nicely. Might the market rally early in the coming week when it realizes TSLA was artificially constrained on Friday? Of course, and guess what? Max pain for this coming Friday is 900! Friday May 20 is a monthly options expiration and for this reason we have lots of bets that were placed when TSLA was quite a bit higher. In the max pain open interest chart, look at all those strike prices where calls and puts are both sky high? TSLA could gain more than $130 this coming week and the option sellers will still make out like bandits. The MMs just needed to keep TSLA down on Friday and they succeeded.

How about the other manipulators out there? You have big shorts, you have hedge funds which are net short in TSLA, big dogs who plan to load up on TSLA but want an even lower buy-in price, and you even have big money individuals who want to keep Elon from acquiring Twitter (for political or personal reasons). Keeping price pressure on TSLA as long as possible suits the needs of these forces.

The big question for the coming week is whether the big money will start buying back into tech (as was happening on Friday) or will they try to manipulate the market lower for better buy-in prices? I've come to regard the afternoon turnaround of tech stocks as perhaps the kind of manipulations we've seen frequently with TSLA but including a few other very visible tech companies and involving multiple hedge funds. Once these stocks start turning down, the rest of the market follows. There's enormous pricing control if this theory is in fact true.

A rise to 61% of selling by shorts suggests substantial manipulations on Friday. If you liked TSLA's rise, you would have REALLY liked the rise without these efforts

10 yr. treasury bond yields ended the week just a smidgen under 2.95%

Max pain for this coming Friday is 900. If TSLA rallies early in the week that max pain number will rise. Market makers have little to worry about if TSLA gets frisky going into the new week. Looking at specific call and put walls, the MMs would like TSLA to at least close above that 800 put wall. It's strange but even 950 is neutral in terms of puts vs. calls.

Here's a chart of option volumes for expiration this past Friday

Despite the ginormous fluctuations in stock price the past four weeks, look at how closely max pain and stock price have come together each Friday. Coincidence? You already know the answer. (chart thanks to @JimS ). I just have a request for Jim: could you please give us a chart next week where the green line goes mostly up and to the right?

What's interesting about the tech chart is how closely TSLA closed to its opening price on such a strong macro day. Add this to your list of signs that manipulations have been underway (provided negative news was absent).

For the week, TSLA closed at 769.59, down 96.06 from the previous Friday's 865.65. With any luck, the NASDAQ may have bottomed out on Thursday. Looking forward to the ride back up, when it comes. Hoping you enjoy your weekend.

Conditions:

* Dow up 466 (1.47%)

* NASDAQ up 434 (3.82%)

* SPY up 9 (2.39%)

* TSLA 769.59, up 41.59 (5.71%)

* TSLA volume 30.5M shares

* Oil 110.5

* IV 74.6, 97%

* Max Pain 780

* Percent of TSLA selling tagged to shorts: 61%

Last edited: