Although yesterday suggested that today would be a positive trading day (shorts lost some battles, SP closed in green, SP rose nearly $2 in after-market trading), the situation changed when both Google and Amazon announced big beats on their 3Q ERs. The stage was set for the NASDAQ having a huge up day and it didn't disappoint with a 2.2% gain for the day. On such a day, it is important in the strategy of the shorts to get a big enough dip going early in the morning to encourage traders to take their money to more reliable stocks for following the NASDAQ up and define TSLA as an underperformer (as usual) on such days. The shorts benefitted from negative interpretations of an Asian supplier of parts to Tesla being asked to cut back deliveries of those parts in the short run (no big surprise because of the several week delay already in ramping up Model 3 production) and from a price target downgrade by an analyst who somehow concluded that planned Model 3 2018 and 2019 Model 3 deliveries should be reduced. The net result was red trading at open which was exacerbated by long traders moving TSLA money to other NASDAQ stocks shortly after open and to the usual short-selling to induce as big a mandatory morning dip as possible.

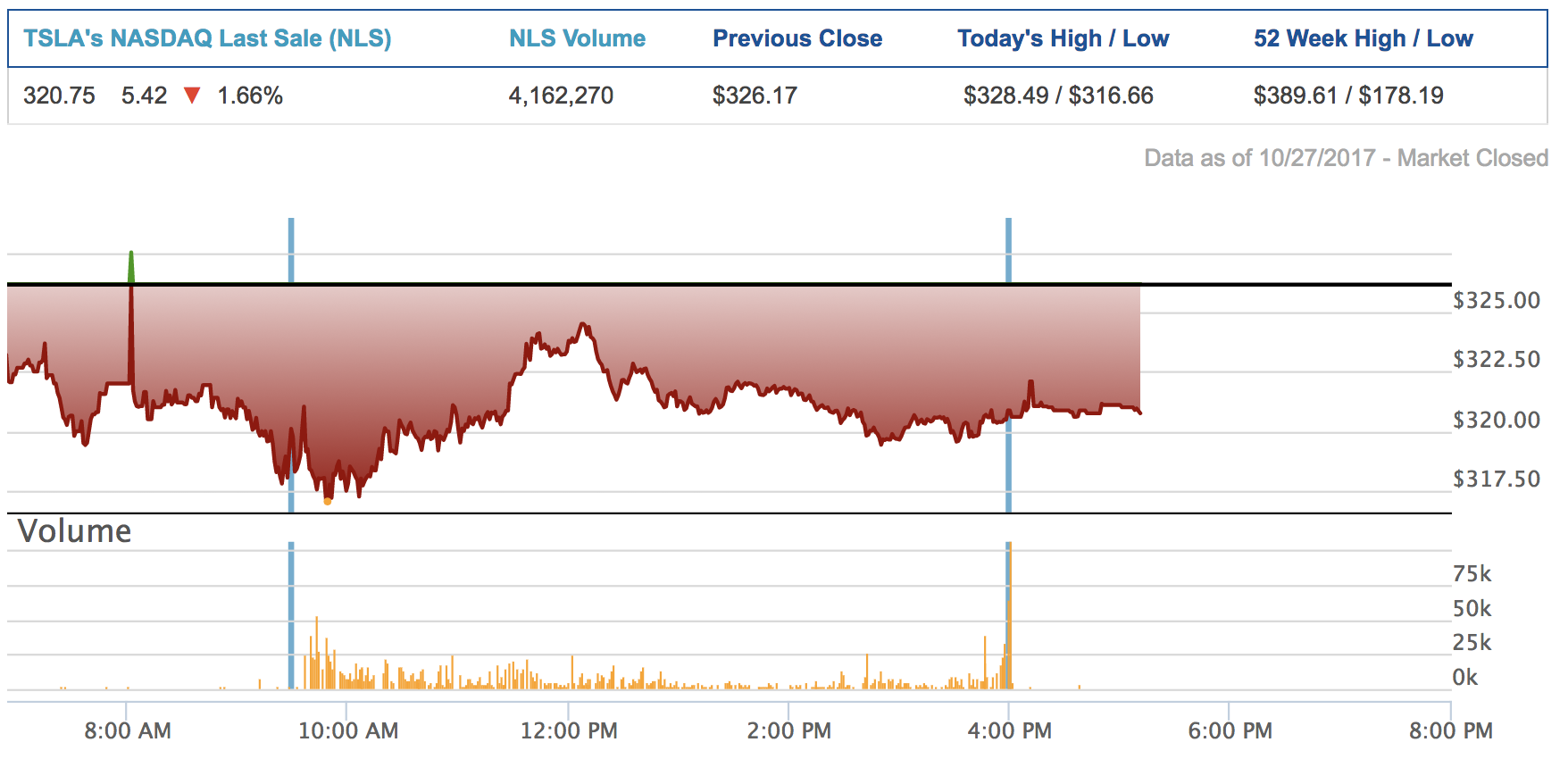

Much of the rest of the day followed a predictable pattern. TSLA recovered most of the early morning losses by lunch time but then declined in the typically lower-volume, more easily manipulated afternoon hours. As close approach, volume picked up and TSLA climbed during the final half hour on buying pressure. We saw 65,000 shares trade hands at 3:59pm and 106,000 shares at 4:00pm. It is entirely possible that the late trading included many short sellers who were closing positions so as to carry on their manipulations next week.

In the technical chart, you can see that the 200 day moving average provided support. No doubt the shorts will retest that support, but if it holds until Wednesday, it will have served its purpose. Also, notice that the big price changes in TSLA has led to a widening of both the upper and lower bollinger bands. We are close to retaking the lower bb and the upper bb lying at 369+ gives lots of room to run if good news comes our way soon.

One of two developments would put a stop to the decline. A better than expected 3Q ER could cause a rise in the stock and mark the turnaround point. A slightly disappointing result could also ironically lead to an end of the decline because there is some dread about the ER at present and that dread disappears when the ER has come and gone (much like Neroden's speculation). The other cause to end the decline and get TSLA heading upward (likely at an enthusiastic clip) would be news that the Model 3 bottlenecks are falling by the wayside and Model 3 will soon be ramping up. Both the 3Q ER effect and the clarification of the Model 3 ramp issues very possibly could be resolved on Wednesday after-hours as the 3Q ER is presented. Even if Elon's clarification of the Model 3 ramp up issues includes additional delays, the clarification of what is going on will likely have a more positive effect than the current lack of information on the Model 3 ramp up. Finally, sightings of higher M3 VIN numbers this weekend (600s, 700s, etc.) could put some upward pressure on the stock Monday morning (keep your eyes open!). Don't be surprised to see Monday morning green turn into Monday afternoon red, though, because this has been the pattern lately and we may need to get through Wednesday before clarification allows TSLA to shake off the downtrend and find its mojo again.

For the week, TSLA closed today at 320.87, down 19.23 from last Friday's 345.10. No substantial negative news other than some bottlenecks in the Model 3 ramp up process has become known between the time TSLA fell from 360 to today's numbers. Better days lay ahead. Have a good weekend.

Conditions:

* Dow up 33 (0.14%)

* NASDAQ up 144 (2.2%)

* TSLA 320.87, down 5.30 (1.62%)

* TSLA volume 7.0M shares

* Oil 53.90, up 1.26 (2.39%)