Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Papafox's Daily TSLA Trading Charts

- Thread starter Papafox

- Start date

-

- Tags

- elon is an ass TSLA

I have a spreadsheet of all my holdings, that I update weekly. It forces me to pay attention to the gross movements in stock prices (mostly of other stocks, since I watch TSLA closely). I wouldn't have noticed the error if I hadn't already noticed the exact amount while updating on Friday evening. Sorry to be a pest.Thanks, correction made.

Three trading days after the ER Conference Call dip, TSLA has returned to pre-dip levels. Here's hoping those of you hoping to add shares took advantage of this buying opportunity. Elon was busy with another tweetstorm this weekend, taunting shorts and even Warren Buffet. The net result of the tweets and other events is that both longs and shorts are feeling emboldened in their separate views, which is really setting TSLA up for a nice run when the Model 3 production numbers reach levels that will bring profitability to the company. Here are some examples of long vs. short thinking:

* Production numbers- Bloomberg gives morale of shorts a boost by showing only 1750 Model 3s/wk as latest production rate, yet Tesla just registered another 5,000 VIN numbers today for future assignments, a suggestion to longs that TSLA is preparing to really ramp up production (but not a confirmation of actual production numbers).

* Elon's predictions of coming short squeeze- According to one survey of TSLA shorts, the vast majority discounted Elon's talk of a coming short squeeze and with 61% of TSLA trading done today was by shorts, this level of short activity suggests doubling down. Meanwhile, Elon bought $10 million of TSLA today, a move that longs see as bullish. Overall, longs see short interest over 40 million shares as TSLA is rising and getting closer to Model 3 reaching 5,000 units/wk as reinforcing the possibility of a dramatic short squeeze.

Comparing today's TSLA trading chart to the NASDAQ daily chart, TSLA responded to the NASDAQ daily chart below, you can see lots of exaggerated responses by TSLA to NASDAQ movements, but also some noteable exceptions. For example, look at TSLA's dip between about 9:45am and 10:20am. The NASDAQ was pretty level during this time, which suggests the TSLA dip was a methodical walking down of the price by short-sellers. When the NASDAQ ran up in a little hill at about 10:30am, TSLA zoomed up, undoing the work of the shorts. Every time TSLA peaked, it descended slowly until it suddenly burst upward. I would say the short-sellers had to be disappointed with today's trading, given the extent of their participation and the poor results.

Looking at the technical chart above, you can see that TSLA has now run away from the middle bollinger band and has nearly reached the upper bb. Breaking above the middle bb is significant if you look at the chart, because the only other time in recent trading when TSLA approached the upper bb was on ER date. The good news is that TSLA will be pushing both the upper bb and mid bb higher if it stays at this level or rises more. The blue 50 day moving average line will be turning upward as well as soon as TSLA crosses it. The bad news is that the upper bb tends to act as resistance and so you may see TSLA simmering down a bit as it bumps up against the upper bb.

With the exceptionally high level of short interest, with a share price that is still considered an attractive buying price by most longs, and with positive momentum, TSLA is well positioned to rise quickly when the Model 3 production rate runs upward. Now all we have to do is wait for the production numbers to actually rise to meet investor expectations.

TSLA finishing the day with a big jump upwards and then rising over $1 in after-hours trading bodes well for tomorrow's trading. The proximity of the upper bb to today's closing SP suggests a small rise is more likely than a large move.

Conditions:

* Dow up 95 (0.39%)

* NASDAQ up 56 (0.77%)

* TSLA 302.77, up 8.68 (2.95%)

* TSLA volume 8.4M shares

* Oil 70.06, down 0.67 (0.95%)

* Percentage of TSLA selling by shorts: 61%

Last edited:

Here's how I see the day. After-hours trading on Monday suggested this rally still had a bit more energy left in it, and sure enough we saw a run-up into the green after the barely-one-nanosecond mandatory morning dip. Shortly after 10am TSLA bumped its head on the upper bollinger band. Shorts started working the price down, it ran up to the upper bb, bumped its head again, and then it was pretty clear that TSLA wasn't going to close above the upper bb today. Some traders may have unloaded a bit, and of course with 61% of the selling today, shorts felt the need to see how far they could push TSLA down after the upper bb noggin bump, but any time TSLA approached or dipped below 300, buyers overwhelmed the efforts of the shorts, the stock ran back up. A game of whack-the-mole ensued several times to keep TSLA out of the green, but every time TSLA dipped the buying cranked up and it was like a pingpong game for the afternoon with buyers protecting 300 and shorts preventing TSLA from finding green. Finally, TSLA found green again close to end of trading. This didn't sit well with the shorts so they sold in the final 20 minutes and achieved a less than $1 decline today. For that 80 cent decline on a day with relatively neutral macros, the shorts expended a ton of energy and didn't make any money or much progress.

A healthy thing for TSLA to do now would be to consolidate for a while, let the upper bb rise, and then resume the climb when news warrants..

TSLA Technical Chart

TSLA bounced off the upper bb twice before accepting the reality that it needs more good news to rise above it just yet. Fortunately, the mid and upper BBs will be rising if TSLA has a relatively level consolidation for a while. Naturally, the shorts will try for lower.When you consider the high level of short activity today, a relatively neutral close can still be considered a positive for longs.

Conditions:

* Dow up 3 (0.01%)

* NASDAQ up 2 (0.02%)

* TSLA 301.97, down 0.80 (0.26%)

* TSLA volume 12.0M shares

* Oil 70.20, up 1.14 (1.65%)

* Percentage of TSLA trading by shorts: 61%

Last edited:

Hehe, I love days like this. My expectations were to see a chart similar to above that existed prior to the 3 pm rally. Shorts were determined to keep TSLA from running up and were playing an all-star quality game of "whack-the-mole" any time TSLA stuck its head up into the green zone. Meanwhile, buyers were getting a bit hungrier than yesterday and TSLA was being turned around a bit quicker before it reached 300 than yesterday. Two things happened to change this arrangement. Looking at the NASDAQ daily chart, you can see what shorts didn't want to see: a big NASDAQ rally starting at 11 am. Shorts managed to keep the situation under control for four hours, but then at 2:51 pm more than 15,000 shares were bought within a minute, and shorts no longer had enough ammo to counter such a surge. If you want to see a classic example of running-out-of-ammo, I think this is it.

TSLA running above 306 today is important because 306 and 308 are both considered resistance to climbing higher. One technical trader suggested that if TSLA reaches 310, it'll be running up much higher from there. So... we have to consider the attractive possibility of TSLA working its way to that magical number and then running up from there. If TSLA keeps pushing the upper limits of the upper bb, it'll force the upper bb to move quicker and the whole pace of appreciation speeds up. Fingers crossed.Whether the stock runs up higher soon or consolidates for a while depends upon how many days such as today we see. Thank you macros for making today's run possible!

NASDAQ daily chart

Looking at the technical chart, you can see TSLA trading in almost the same range as yesterday but closing at the top of that range rather than more than halfway down. Fortunately, this trading could all be done below the upper bollinger band allowing any big institutional investors to pick up shares without catching a bad case of outside-the-bollinger-band-fever.

Meanwhile, Model 3 production rate sources that longs are looking at show Model 3 closing in on the 3,000/wk rate while the source likely viewed most by shorts, the Bloomberg estimate, shows only 1750/wk. As long as the media keeps reassuring the shorts that nothing dramatic is happening, the shorts will likely stay in the game, which will heighten the run-up of the SP when it comes.

Conditions:

* Dow up 182 (0.75%)

* NASDAQ up 73 (1.00%)

* TSLA 306.85, up 4.88 (1.62%)

* TSLA volume 5.6M shares

* Oil 71.24, up 2.18 (3.16%)

Last edited:

Percentage of TSLA trading today by shorts: 59%

Note: What the shorts don't understand is that there is no real "dread" in the longs at the moment and dread is absolutely necessary for scaring the longs into abandoning some shares and allowing for a deep dip. Conversely, Elon introduced some dread into the short community this weekend with his talk about the upcoming squeeze. The Q1 ER was a source of dread for longs because everyone suspected the financials would look pretty bad. Fortunately, we saw some nice surprises along with the red ink. Since the M3 ramp is heading upward and the only question is "How fast?", longs are expecting an improved Q2. If Elon announces that Tesla has become a cash-flow positive company, the Q2 ER will be a success, even if the numbers don't look pretty.

Note: What the shorts don't understand is that there is no real "dread" in the longs at the moment and dread is absolutely necessary for scaring the longs into abandoning some shares and allowing for a deep dip. Conversely, Elon introduced some dread into the short community this weekend with his talk about the upcoming squeeze. The Q1 ER was a source of dread for longs because everyone suspected the financials would look pretty bad. Fortunately, we saw some nice surprises along with the red ink. Since the M3 ramp is heading upward and the only question is "How fast?", longs are expecting an improved Q2. If Elon announces that Tesla has become a cash-flow positive company, the Q2 ER will be a success, even if the numbers don't look pretty.

Last edited:

@Papafox I'm surprsised you didn't mention that the stock reacted immediatly on large volume when California regulators approved the plan to mandate solar panels on new home construction:

California regulators approve plan to mandate solar panels on new home construction

This is what triggered the mini-squeeze for sure.

California regulators approve plan to mandate solar panels on new home construction

This is what triggered the mini-squeeze for sure.

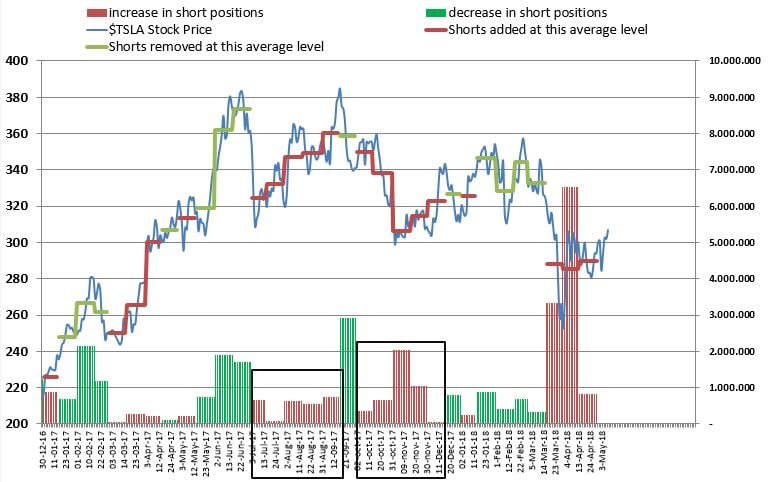

The Nasdaq market site updated the official short interest data on $TSLA :

Tesla, Inc. (TSLA) Short Interest - NASDAQ.com

another increase of ~834K shares SHORT at the end of April 30th.

I updated my chart with this new data:

Tesla, Inc. (TSLA) Short Interest - NASDAQ.com

another increase of ~834K shares SHORT at the end of April 30th.

I updated my chart with this new data:

@Papafox Do you have a chart that shows % of short volume by time of day? If what you suppose is true I'd expect we would see strategic shorting during the day and covering at the end of the day. This pattern has been evident for a while now in the chart. It would be interesting if we could confirm this.Percentage of TSLA trading today by shorts: 59%

Note: What the shorts don't understand is that there is no real "dread" in the longs at the moment and dread is absolutely necessary for scaring the longs into abandoning some shares and allowing for a deep dip. Conversely, Elon introduced some dread into the short community this weekend with his talk about the upcoming squeeze. The Q1 ER was a source of dread for longs because everyone suspected the financials would look pretty bad. Fortunately, we saw some nice surprises along with the red ink. Since the M3 ramp is heading upward and the only question is "How fast?", longs are expecting an improved Q2. If Elon announces that Tesla has become a cash-flow positive company, the Q2 ER will be a success, even if the numbers don't look pretty.

@Papafox Do you have a chart that shows % of short volume by time of day? If what you suppose is true I'd expect we would see strategic shorting during the day and covering at the end of the day. This pattern has been evident for a while now in the chart. It would be interesting if we could confirm this.

@Papafox Do you have a chart that shows % of short volume by time of day? If what you suppose is true I'd expect we would see strategic shorting during the day and covering at the end of the day. This pattern has been evident for a while now in the chart. It would be interesting if we could confirm this.

Where the short covering at end of day is most evident is when we see high volume in the final minute of trading. That time spot lets lots of shorts cover without raising the SP. I've seen as high a 500,000 shares traded in that final minute, but something closer to 50,000 or 100,000 is more common. Watch for that today. Unfortunately, when I receive my short trading percentage info from FINRA, it is only for the whole day and does not break down the short trading into time of day.

@Papafox I'm surprsised you didn't mention that the stock reacted immediatly on large volume when California regulators approved the plan to mandate solar panels on new home construction:

California regulators approve plan to mandate solar panels on new home construction

This is what triggered the mini-squeeze for sure.

I've been time constrained lately. Can you tell me the timing of the California solar announcement so that we can fit it into the picture? If the run-up happened right after the announce (a few minutes to begin the run-up) then your theory has strong evidence supporting it.

Most of the articles have expired from Yahoo Finance (where I normally read them), but I did notice at the time that the increase in volume and start of the run upward were at about the same time as the reports of the vote.

Waiting4M3

Active Member

This is 2 of the earlier tweets I found at ~2:57pm EST

zerohedge on Twitter

"SOLAR ETF GAINS AS CALIF TO REQUIRE SOLAR PANELS ON NEW HOMES"

Mashable on Twitter

"California says new homes must have solar panels, in push to go all-renewable https://trib.al/T5Io3X2 "

zerohedge on Twitter

"SOLAR ETF GAINS AS CALIF TO REQUIRE SOLAR PANELS ON NEW HOMES"

Mashable on Twitter

"California says new homes must have solar panels, in push to go all-renewable https://trib.al/T5Io3X2 "

Last edited:

Yesterday I became excited when I saw TSLA run up in the final hour of trading. I thought at long last longs are playing some of the tricks normally reserved for the shorts. Alas, reality set in as a few of you reminded me that the late afternoon run-up in TSLA began almost immediately after word of California's mandatory solar for new homes came out. Yep, it was news related, not a new spirit of push the stock price up by TSLA longs. Consequently, we could see consolidation here as we await more news of Model 3 ramp up. The good news is we should hear by next week that TSLA is over 3,000 M3/wk now, which should give the SP a bit of a boost. I'm thinking 3500/wk will also have a positive effect. In the meantime, the shorts are putting on the pressure, with 58% of TSLA trading today. The pattern lately seems to be positive stock action in the mornings and then negative in the afternoons as shorts go to work with their mischief. The good news is that when news of Model 3 ramps up, all the mischief by shorts will be of no avail and the SP will run up regardless of their efforts.

Conditions:

* Dow up 197 (0.80%)

* NASDAQ up 65 (0.89%)

* TSLA 305.02, down 1.83 (0.60%)

* TSLA volume 5.6M shares

* Oil 71.27, down 0.09 (0.12%)

* TSLA shorts percentage of trading: 58%

The drama continued today as longs and shorts pulled TSLA in two different directions. The recent trend is for TSLA to run up quickly at start, be pushed down, recover and then during the afternoon the shorts push it down a bit. Also, we saw previously that there were buyers standing by as TSLA approached 300, which appeared to be the case today. With significant trading by short-sellers today (62% of TSLA) they're not giving up and a consolidation is the likely result until substantial news sways sentiment one way or the other.

Some circumstantial but potentially very good news is coming forth. Don't bet the farm on it or think TSLA is running to Mars next week (this attitude can cost you lots of money), but add these tidbits to your view of TSLA's Model 3 ramp up. This week we heard word that a supplier of parts to TSLA is substantially increasing parts in the coming two months. We've been misled by such claims in the past, so please take it with a grain of salt. Next, Elon has said that dual-motor Model 3s and white interiors will not be made available until Tesla hits 5,000/wk production rate, but today Elon tweeted that dual-motor and performance Model 3s get opened up for configuring next week, with first production in July. Sounds like he's confident of the 5,000/wk rate by July. Finally, one of this threads regulars, @Lbkmxp100d, had this to say in the General Discussion thread about Model 3 production rate: "The 4126 was for last 7 days. not since Wednesday. I asked him what total was for Wednesday output but he didn't know. He is going to get me 7 day output and also single day output when he goes back to work Sunday." So, if Tesla in burst mode can hit 4100 Model 3s in a week's time, they should be capable of such a sustained rate once the Gigafactory can supply sufficient quantities of batteries, and that threshold could be crossed as early as next week. Very sweet if true.

In potentially negative news, today we found out that VP of Engineering Doug Field is taking a leave of absence, which will be exploited by the shorts as yet another top executive jumping ship at Tesla. Another explanation is quite likely, however. Field has likely lived through hell this past year in an effort to get Model 3 spun up, and if we can believe reports that the Grohmann battery module assembly line could be running at GF1 as early as next week and that over a 7 day period recently Tesla built over 4100 Model 3s, it would appear that the hard work is now completed and a subordinate could carry the project the rest of the way to the finish line. Personally, I wouldn't blame Field for taking a leave of absence after such an experience.

TSLA closed at 301.06 today, up 6.97 from Last Friday's 294.09. Enjoy your weekend!

Conditions:

* Dow up 92 (0.37%)

* NASDAQ down 2 (0.03%)

* TSLA 301.06, down 3.96 (1.30%)

* TSLA volume 4.6M shares

* Oil 70.70, down 0.66 (0.92%)

* Percentage of TSLA trading by shorts: 62%

I think the best way to explain today is with words by BDY0627 in this post, "Right now, many people are making money swing trading TSLA..." Basically, until solid word of the Model 3 ramp moves TSLA out of its recent trading range, there are traders making money by selling hard to get it running downhill when it is towards the top of the trading range and buying at the low end in order to ride it up. The problem with such a strategy now is that this stock is on the edge of doing something fantabulous, if you believe reports of M3 run rates exceeding 4K/wk. Personally, I'm going to sit out the speculation and hang onto my heavy number of shares and leaps and wait for the fun to begin soon enough.

In looking at bad news vs. good news today, the accident in which a young lady ran into a fire truck at 60mph, allegedly on autopilot, and sustained a broken ankle as a result, strikes me as a great advertisement for the safety of the vehicle. Oh yes, I believe she admitted to using her phone just prior to the accident. It's hard to believe how this negative news could overshadow two important bits of positive news. First, T. Rowe Price has become Tesla's largest institutional owner with some $5 billion worth of shares. Fidelity reduced its holdings, but T. Rowe Price increased theirs by more than double the Fidelity decrease. Bottom line, smart money is moving into TSLA. Also, word comes from China that Tesla may be about ready to break ground on a factory in Shanghai. Apparently cars made in this factory will not only avoid the import tariff but will also also bring monetary bonuses to the buyers. Sweet.

Please consider today an effort by your friendly neighborhood short-sellers to give you another chance at below-$300 TSLA shares prior to the big Model 3 ramp up rally. Shorts accounted for 60% of TSLA trading today, according to FINRA, so it took some work!

Papafox's article on Model 3 Gross Margin appeared today in Clean Technica.

Conditions:

* Dow up 68 (0.27%)

* NASDAQ up 8 (0.11%)

* TSLA 291.97, down 9.09 (3.02%)

* TSLA volume 7.1M shares

* Oil 71.01, up 0.05 (0.07%)

* Short percentages of TSLA trading: 60%

Last edited:

Loved your article.

As we approached 3pm, today, buyers started picking up shares and the dip appeared over. Then came a big dip around 3pm when Reuters released news that Tesla was taking a pause in Model 3 production for six days in late May to upgrade the production line. The dip didn't last long, but shorts who had missed the low for covering their short positions had another opportunity. Reuters, of course, didn't just hear about this piece of news (which Tesla already said was planned). Rather, Reuters likely knew about the news and was awaiting the right opportunity to cause the most turmoil when the news was released. Their timing was dead-on.

Fortunately, you can see that TSLA climbed into the close today. Too many investors realized that we've been watching a side-show the past couple of days and that this is a great price at which to buy TSLA before the financial community actually acknowledges that Model 3 is ramping up well. I'll call this the "last chance below 300 dip" for TSLA.

Conditions:

* Dow down 193 (0.78%)

* NASDAQ down 60 (0.81%)

* TSLA 284.18, down 7.79 (%)

* TSLA volume 9.3M shares

* Oil 71.31, up 0.35 (0.49%)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 21

- Views

- 6K

- Replies

- 6

- Views

- 1K

- Replies

- 1

- Views

- 329

- Article

- Replies

- 276

- Views

- 21K