Sweet thx!

2021 Tax Code 179 and Bonus Depreciation Guide

Our updated 2021 Tax Code Section 179 guide for self-employed and business owners who buy qualifying vehicles in the 2021 calendar year.www.carprousa.com

the bonus depreciation rules are also known as Section 168(k)

If this is what you're planning on doing - Sign up for TeslaFi or TeslaScope for automatic logging of your miles.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Refreshed 2021+ Model X and Model X Plaid waiting room

- Thread starter Tiger

- Start date

Just replied to yoru PM, but 2022 is the final tax year for 100% bonus depreciation, it goes down to 80% starting in 2023 tax year.Sweet thx!

Fingers crossed for this to happen (selfishly)I’m betting most if not all of the Model X’s they’ll be making will be plaid

Oh boy, armed with this, I’m going to win so many debates. Thanks!

SteveinATX

Member

I’m the one that referenced the Tax Cut and Jobs Act way back when. Here is a brief write up from the IRS:Ask <several really good > accountants.

Somebody else posted that there’s at least one if not more than one legal workaround.

There was some Act or something that allowed the full value to be depreciated or deducted outside of IRS rules (it was something I’d never heard of) and somebody else said section 168 still applied. It’s in here, like I said maybe in the range of pages 250-500.

Section 13201 of the Act amended § 168(k) to extend and modify the additional

first year depreciation deduction for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2027. Section 168(k)(1) provides that, in the case of qualified property, the depreciation deduction allowed under § 167(a) for the taxable year in which the property is placed in service includes an allowance equal to the applicable percentage of the property’s adjusted basis (hereinafter, referred to as “§ 168(k) additional first year depreciation deduction”). Pursuant to § 168(k)(6)(A), the applicable percentage is 100 percent for qualified property acquired and placed in service after September 27, 2017, and placed in service before January 1, 2023, and is phased down 20 percent each year for property placed in service through December 31, 2026.

Here is an IRS FAQ page: Additional First Year Depreciation Deduction (Bonus) - FAQ | Internal Revenue Service

This only applies for “qualified property”.

The definition for “qualified property” doesn’t list heavy vehicles itself but here’s another article from a CPA website that talks about it (I’m sure you can find it in the IRS published opinions if you have the time):

Heavy Vehicles

Heavy SUVs, pickups and vans are treated for tax purposes as transportation equipment. So, they qualify for 100% first-year bonus depreciation and Sec. 179 expensing if used more than 50% for business. This can provide a huge tax break for buying new and used heavy vehicles.

- Business Vehicle Purchases: What Is Deductible for 2020? - Mize CPAs Inc.

The key is heavy vehicle- a vehicle with a GVWR of 6,000 pounds or greater (not weight but GVWR):

100% first-year bonus depreciation is only available when an SUV, pickup, or van has a manufacturer’s gross vehicle weight rating (GVWR) above 6,000 pounds. Examples of suitably heavy vehicles include the Audi Q7, Buick Enclave, Chevy Tahoe, Ford Explorer, Jeep Grand Cherokee, Toyota Sequoia, and lots of full-size pickups.

Save on taxes: Bonus depreciation for business vehicle purchase | WEX Inc.

Learn how to save on taxes from your small business purchase of a vehicle last year with a bonus depreciation.

What is the Tesla Model X Long Range GVWR?

This I’m not sure about. If it’s under the 6,000 lb GVWR “heavy equipment” then this won’t apply. The 2020 Model X LR+ we have is 6,788 pounds (it’s located at the very bottom by the FWD on the driver side door frame. The tire pressure is visible on a different sticker much higher up. This sticker is way down by your black exterior trim).

Well you guys are awesome. Thank you for this super informative post!I’m the one that referenced the Tax Cut and Jobs Act way back when. Here is a brief write up from the IRS:

Section 13201 of the Act amended § 168(k) to extend and modify the additional

first year depreciation deduction for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2027. Section 168(k)(1) provides that, in the case of qualified property, the depreciation deduction allowed under § 167(a) for the taxable year in which the property is placed in service includes an allowance equal to the applicable percentage of the property’s adjusted basis (hereinafter, referred to as “§ 168(k) additional first year depreciation deduction”). Pursuant to § 168(k)(6)(A), the applicable percentage is 100 percent for qualified property acquired and placed in service after September 27, 2017, and placed in service before January 1, 2023, and is phased down 20 percent each year for property placed in service through December 31, 2026.

Here is an IRS FAQ page: Additional First Year Depreciation Deduction (Bonus) - FAQ | Internal Revenue Service

This only applies for “qualified property”.

The definition for “qualified property” doesn’t list heavy vehicles itself but here’s another article from a CPA website that talks about it (I’m sure you can find it in the IRS published opinions if you have the time):

Heavy Vehicles

Heavy SUVs, pickups and vans are treated for tax purposes as transportation equipment. So, they qualify for 100% first-year bonus depreciation and Sec. 179 expensing if used more than 50% for business. This can provide a huge tax break for buying new and used heavy vehicles.

- Business Vehicle Purchases: What Is Deductible for 2020? - Mize CPAs Inc.

The key is heavy vehicle- a vehicle with a GVWR of 6,000 pounds or greater (not weight but GVWR):

100% first-year bonus depreciation is only available when an SUV, pickup, or van has a manufacturer’s gross vehicle weight rating (GVWR) above 6,000 pounds. Examples of suitably heavy vehicles include the Audi Q7, Buick Enclave, Chevy Tahoe, Ford Explorer, Jeep Grand Cherokee, Toyota Sequoia, and lots of full-size pickups.

Save on taxes: Bonus depreciation for business vehicle purchase | WEX Inc.

Learn how to save on taxes from your small business purchase of a vehicle last year with a bonus depreciation.www.wexinc.com

What is the Tesla Model X Long Range GVWR?

This I’m not sure about. If it’s under the 6,000 lb GVWR “heavy equipment” then this won’t apply. The 2020 Model X LR+ we have is 6,788 pounds (it’s located at the very bottom by the FWD on the driver side door frame. The tire pressure is visible on a different sticker much higher up. This sticker is way down by your black exterior trim).

NGKempf

2018 M3 LR. 2022 MX 6 Seat LR - [1/14/21 Ord]

For sure, but $30-40k profit margin on a $5k WI sales tax bill where I’m registering, still not bad.You'd have to pay sales and registration. Not sure you can defer

It’s always interesting that people automatically think a personal car purchase through a business is a “qualified asset” when the car isn’t really for a business purpose. Of course you can put anything on your taxes and likely it will be fine because audits are very rare.

100% of my income is my business. Not sure about others.It’s always interesting that people automatically think a personal car purchase through a business is a “qualified asset” when the car isn’t really for a business purpose. Of course you can put anything on your taxes and likely it will be fine because audits are very rare.

A lot of issues come with people taking overall losses in a tax year, or offsetting personal income with "startup costs". My tax liability is effing huge and I pay it, on time.

Last edited:

lol weeeeelll… about that… yeah no.It’s always interesting that people automatically think a personal car purchase through a business is a “qualified asset” when the car isn’t really for a business purpose. Of course you can put anything on your taxes and likely it will be fine because audits are very rare.

You should have a legit business purpose. Now, there are lots of ways to create a business purpose, but yeah I’m not an accountant and even I would say: read the rules and follow the rules.

And my business has been audited by the IRS (came through Squeaky Clean thank God; yeah that was in the middle of a horrible divorce; I am familiar with hell).

Medvin

Member

Thanks for this info. While depreciating 100% in the year it gets put into use is a big tax break keep in kind your business needs to have the income to offset the purchase.I’m the one that referenced the Tax Cut and Jobs Act way back when. Here is a brief write up from the IRS:

Section 13201 of the Act amended § 168(k) to extend and modify the additional

first year depreciation deduction for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2027. Section 168(k)(1) provides that, in the case of qualified property, the depreciation deduction allowed under § 167(a) for the taxable year in which the property is placed in service includes an allowance equal to the applicable percentage of the property’s adjusted basis (hereinafter, referred to as “§ 168(k) additional first year depreciation deduction”). Pursuant to § 168(k)(6)(A), the applicable percentage is 100 percent for qualified property acquired and placed in service after September 27, 2017, and placed in service before January 1, 2023, and is phased down 20 percent each year for property placed in service through December 31, 2026.

Here is an IRS FAQ page: Additional First Year Depreciation Deduction (Bonus) - FAQ | Internal Revenue Service

This only applies for “qualified property”.

The definition for “qualified property” doesn’t list heavy vehicles itself but here’s another article from a CPA website that talks about it (I’m sure you can find it in the IRS published opinions if you have the time):

Heavy Vehicles

Heavy SUVs, pickups and vans are treated for tax purposes as transportation equipment. So, they qualify for 100% first-year bonus depreciation and Sec. 179 expensing if used more than 50% for business. This can provide a huge tax break for buying new and used heavy vehicles.

- Business Vehicle Purchases: What Is Deductible for 2020? - Mize CPAs Inc.

The key is heavy vehicle- a vehicle with a GVWR of 6,000 pounds or greater (not weight but GVWR):

100% first-year bonus depreciation is only available when an SUV, pickup, or van has a manufacturer’s gross vehicle weight rating (GVWR) above 6,000 pounds. Examples of suitably heavy vehicles include the Audi Q7, Buick Enclave, Chevy Tahoe, Ford Explorer, Jeep Grand Cherokee, Toyota Sequoia, and lots of full-size pickups.

Save on taxes: Bonus depreciation for business vehicle purchase | WEX Inc.

Learn how to save on taxes from your small business purchase of a vehicle last year with a bonus depreciation.www.wexinc.com

What is the Tesla Model X Long Range GVWR?

This I’m not sure about. If it’s under the 6,000 lb GVWR “heavy equipment” then this won’t apply. The 2020 Model X LR+ we have is 6,788 pounds (it’s located at the very bottom by the FWD on the driver side door frame. The tire pressure is visible on a different sticker much higher up. This sticker is way down by your black exterior trim).

BryWay

Velocitron II

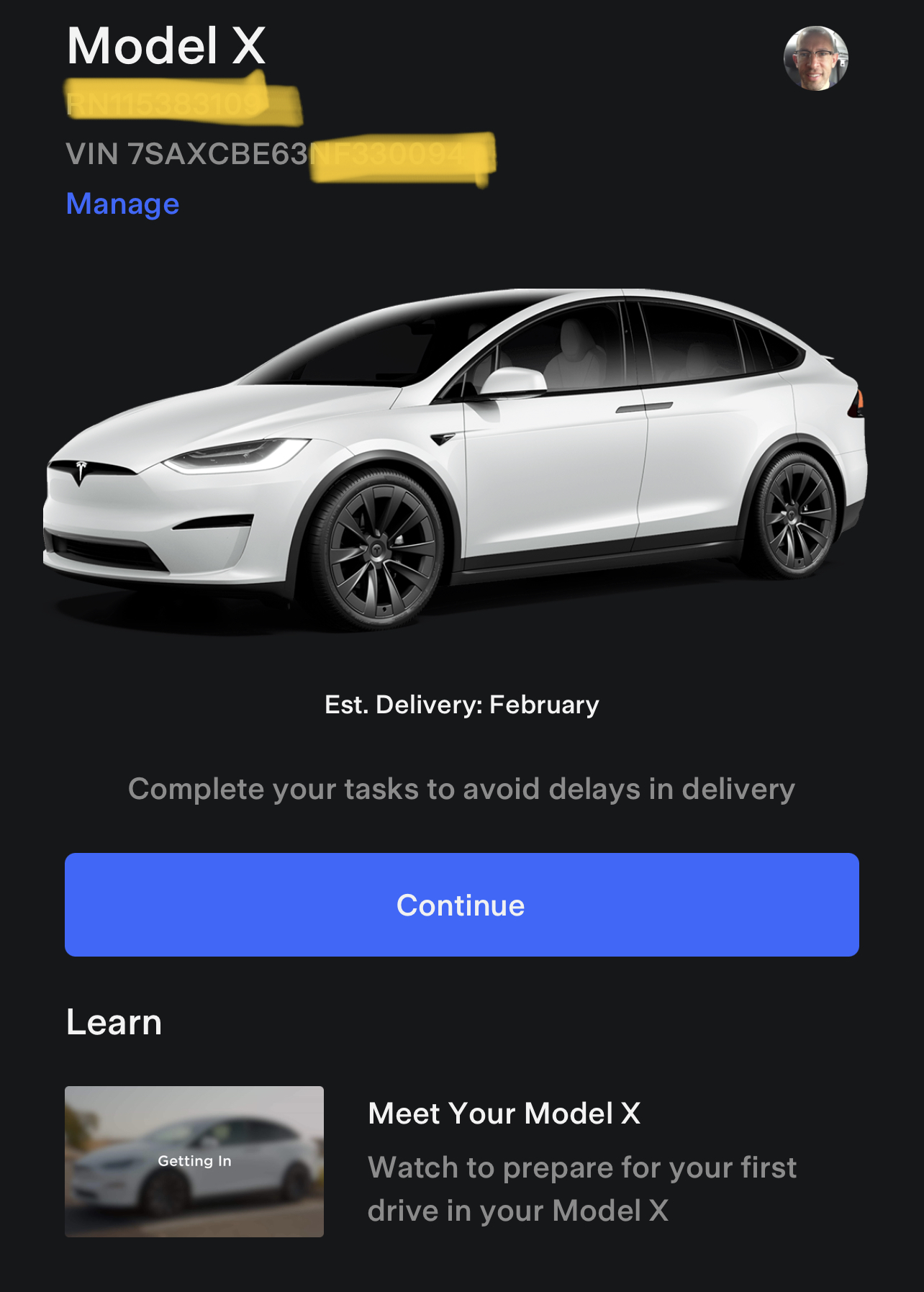

I got my VIN today!! 2022 MX Plaid (white / white / carbon fiber / 6-seat / 22” wheels / FSD) still showing February delivery, so hopefully having been assigned my VIN means that window is now secure. Ordered toward the end of July 2021.

NiceI got my VIN today!! 2022 MX Plaid (white / white / carbon fiber / 6-seat / 22” wheels / FSD) still showing February delivery, so hopefully having been assigned my VIN means that window is now secure. Ordered toward the end of July 2021.

View attachment 750684

And I would NOT be surprised if that drone photo includes yours

orenal

Member

So.... I guess I'm not getting my car "Before the end of the year"...

Happy new year !

Happy new year !

Idk if any of you watch the ball drop but I just realized I’m seeing lots of Kia EV advertising, even right under the ball.

Idk anything about other EVs other than that every time I’ve looked into them I’ve kinda been “meh.”

I hope the Kia isn’t like some non-Tesla EVs I’ve read about… so bad that they turned off the owners to repeat EV purchases (coincidence or traditional mfr intent?

)

)

Idk anything about other EVs other than that every time I’ve looked into them I’ve kinda been “meh.”

I hope the Kia isn’t like some non-Tesla EVs I’ve read about… so bad that they turned off the owners to repeat EV purchases (coincidence or traditional mfr intent?

Watch your phone. You never know.So.... I guess I'm not getting my car "Before the end of the year"...

Happy new year !

Stro

Unhappy MX Owner

Happy New Year, folks! I hope you and your families have a fantastic year in 2022 and that we all get our MXs as soon as possible.

Grassright

Member

The paint job was not perfect lol. So I add her VIN here NF3300XX. Glad to see RN1153* starts to get delivery.I got my VIN today!! 2022 MX Plaid (white / white / carbon fiber / 6-seat / 22” wheels / FSD) still showing February delivery, so hopefully having been assigned my VIN means that window is now secure. Ordered toward the end of July 2021.

View attachment 750684

usctrojan98

Member

Wait what? July 2021 Plaid got a VIN? Where are you taking delivery?I got my VIN today!! 2022 MX Plaid (white / white / carbon fiber / 6-seat / 22” wheels / FSD) still showing February delivery, so hopefully having been assigned my VIN means that window is now secure. Ordered toward the end of July 2021.

View attachment 750684

ironwill96

Member

Plaid definitely getting priority now with jumping people who ordered 8 months earlier.Wait what? July 2021 Plaid got a VIN? Where are you taking delivery?

Similar threads

- Replies

- 24

- Views

- 2K

- Replies

- 3

- Views

- 3K

- Marketplace listing

- Replies

- 0

- Views

- 235

- Replies

- 23

- Views

- 3K

- Marketplace listing

- Replies

- 2

- Views

- 713