I'm a little bit confused about SGIP. If we go through Tesla directly, does it mean there's no more SGIP funding available?

Energy Incentives | Tesla Support

Looks like we'll need to go through 3rd party installers to get SGIP? Do 3rd party installers charge extra $$$?

How much is the total cost to add powerwall in SoCal?

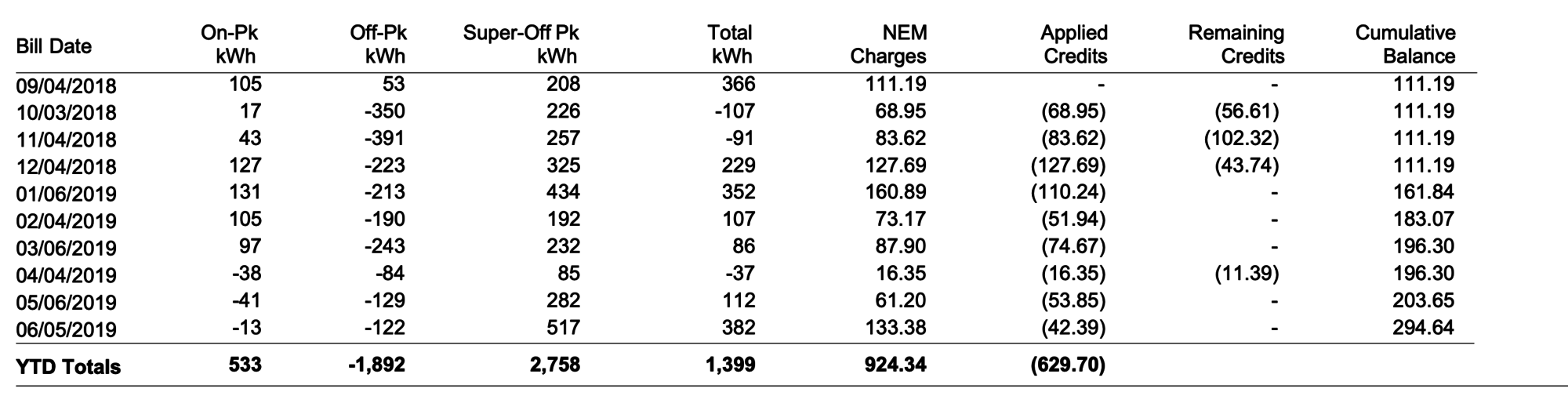

I currently have 5.5kw solar system. Since we got MX off peak usage has skyrocketed. Our projected offpeak kwh is at least ~700kwh this month. We are on TOU-DR, with two teslas it's difficult to stay below 130% baseline.

Does it make sense to switch to EV TOU5? And adding a powerwall?

Thanks.

Energy Incentives | Tesla Support

Looks like we'll need to go through 3rd party installers to get SGIP? Do 3rd party installers charge extra $$$?

How much is the total cost to add powerwall in SoCal?

I currently have 5.5kw solar system. Since we got MX off peak usage has skyrocketed. Our projected offpeak kwh is at least ~700kwh this month. We are on TOU-DR, with two teslas it's difficult to stay below 130% baseline.

Does it make sense to switch to EV TOU5? And adding a powerwall?

Thanks.