That tool you're using looks pretty decent - are you a paid subscriber or just using the free version?Can you explain the choice of strikes for the IC, I’d like to try one and learn on the job.

It seems when I sold -C185 and -P160 this week I had inadvertently created a “naked” IC, meaning my shares or collateral/margin were at risk if either side went ITM (-C=shares; -P=collateral/margin).

If I understand correctly, a proper IC (like you have) protects shares and margin by buying the strike above the -C and below the -P.

1) What’s the practical difference if the +C and +P is $2-3 above or below or $5-10 (like you have above).

2) Is it true best practices it’s not to let it run to expiration but to close at 30-50% profit?

3) Lastly, do you find any need/benefit to close one leg (+P/-P; +C/-C) at a time surgically or all at once?

Thanks.

Here’s an example:

Is the loss potential shown below real? I thought the +P and +P are supposed to protect/limit loses:

View attachment 936333

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Whoa, a whole lot to unpack there. First of all, do NOT start out selling 150x of anything. Full stop. Second, spreads (and an IC is just two spreads, bull put and bear call) are absolutely real dollar losses, more so than selling cash-secured puts and covered calls. CSPs and CCs are fully covered (having the SP go ITM just means exchanging shares into cash or vice versa at the agreed strike price). When spreads go ITM at expiration the entire cash backing is lost. Your homework is to read upthread (Fall 2021-December 31, 2022) about the real financial and mortal danger of trading spreads when the SP goes against the position.

Ok, with those warnings, let’s discuss my rationale: Unfortunately, not much, but I like $10 wide spreads for simple, in my head calculations. 1x $10 wide spread is $1000 at risk of being lost if ITM. 100x is thus $100k at risk. Wider spreads have lower %premiums and require more cash backing at risk, while narrower spreads conversely lower dollars at risk but increase %premiums and chance of rapid losses. Narrower spreads can go from bad to worse to complete loss in the blink of a trading day. Spreads can be difficult to roll, or require dumping good money into a bad rolling position, for a worse loss in the future (read the numerous explanations by @adiggs upthread). My minimum spread width is $10, but I’m now trying $15, $20, and $30 just to experience the impacts on risk, premiums and rolling.

Why those strikes? Mostly just guessing that the inner strikes won’t be violated based on open/traded options on MaxPain and my newbie understanding of charting technical analysis. Obviously, the farther away from the SP, the lower the premiums and the less risk. Near ATM, inside of SP+/-10%, is pretty risky. Outside of SP+/-20%, much safer, but lower premiums. The choice is yours.

I’m not completely satisfied with my position, so don’t think it’s “perfect.” Ideally, I would only open on Wednesday (2 DTE) or preferably Thursday (1 DTE) for the highest theta decay, but unfortunately some of these are rolled from a previous losing position.

Finally, a few more points: Read my previous posts up thread for more details, but I’m gravitating toward wider spreads, 1-2 DTE, because the decay and cost of the protective +c and +p are lower. In the 5+ DTE range, the protective (long) options actually decay faster than the money-making (short) options because they are farther OTM. That’s difficult to watch. Furthermore, like adiggs just said, selling call spreads is nerve-racking because the SP can rocket at any time. I probably should not be selling ICs, but instead just stay with BPSs. When the SP goes up, the BPSs are hedging my CCs, while the BCS side of the IC will amplify the loses on the CCs.

Summary: If wanting to trade spreads, be very careful, start with single contracts 1-2 DTE, >10% OTM, and always be prepared for total loss of the spread value. Hope this helps.

Edit: Great explanation by @Chenkers above. Thanks.

Thank you. It’s clear now that it’s not a failsafe strategy where the + protects the - and everyone ends up happy. I’m glad I asked! I’ll read up more on this and sit out for now.

I appreciate the time you took to write it up and explain.

That tool you're using looks pretty decent - are you a paid subscriber or just using the free version?

I subscribe, it’s become an important tool for me and I use it every day to plan and track my option plays. While I have to enter trades manually (pretty quick and easy), once I do it’s a wonderful way to keep track of them and keep tabs on various aspects of the trade. Once you BTC or STC you enter that dollar amount, and then you have a record of all your transactions which can also be exported to excel.

Example of closed/previous trades screen:

Example active trade screen:

Last edited:

So, here we are, at the end of times... 15 minutes to go, pump, dump or sideways...?

I had a sleepless night trying to decide what to do with my 90x -c150's, which don't appear to have early assigned. I ran through every scenario imaginable and once I had decided option A was best, I immediately rethought it and came to option B, and so on

Of course a substantial drop after CPI would solve the issue, but failing that I'm not seeing a better way out than letting the shares go and then sell July ITM puts - 195's200's look good, to cover the upside and if not, will rebut the shares at the net cost I'm selling them for now ~165

I did think about 30x July -p230's, but they have so little extrinsic and low OI that they're quite likely to early assign, the lower strikes have lots of OI

For the moment I'm way more bullish on TSLA compared to a week ago, I see delivery records all over Europe, meaning the logistics are soothed out, costs should be down, hopefully the commodities are lower than Q1 and the "one time costs" Zach mentioned don't recur in Q2. Added the possibility of a CyberTruck order page at any moment, I'm feeling more confident to sell the ITM puts

I had a sleepless night trying to decide what to do with my 90x -c150's, which don't appear to have early assigned. I ran through every scenario imaginable and once I had decided option A was best, I immediately rethought it and came to option B, and so on

Of course a substantial drop after CPI would solve the issue, but failing that I'm not seeing a better way out than letting the shares go and then sell July ITM puts - 195's200's look good, to cover the upside and if not, will rebut the shares at the net cost I'm selling them for now ~165

I did think about 30x July -p230's, but they have so little extrinsic and low OI that they're quite likely to early assign, the lower strikes have lots of OI

For the moment I'm way more bullish on TSLA compared to a week ago, I see delivery records all over Europe, meaning the logistics are soothed out, costs should be down, hopefully the commodities are lower than Q1 and the "one time costs" Zach mentioned don't recur in Q2. Added the possibility of a CyberTruck order page at any moment, I'm feeling more confident to sell the ITM puts

intelligator

Active Member

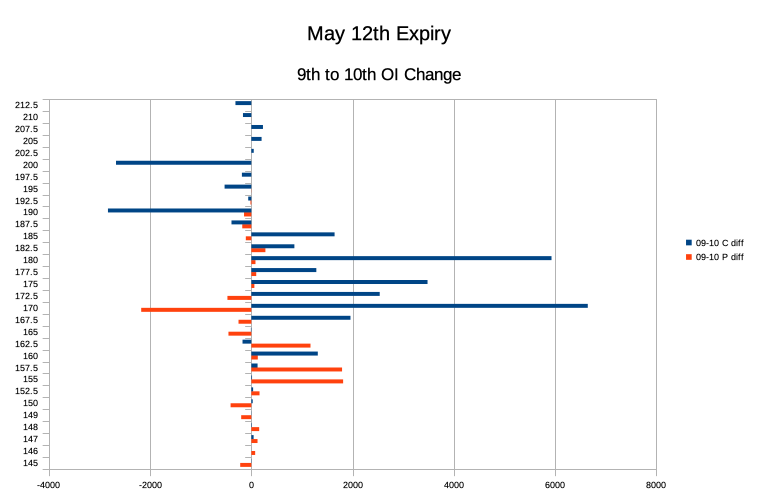

OI increased by 6646 and 5930 at c170 and c180 respective, retracting some at c190, c200, and p170. EDIT: I'll be looking for 5/12 below -152.5 put spread if we near mid to low 160s.

Last edited:

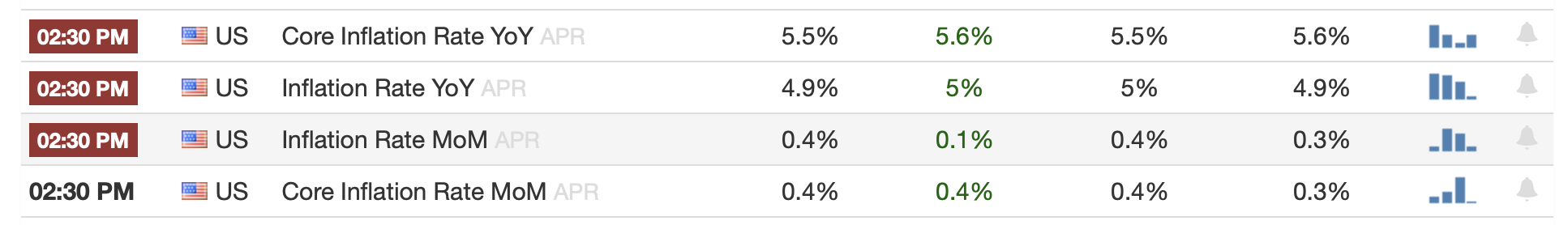

Inflation fairly neutral I would say, some slightly higher, some slightly lower than forecast/consensus...

No idea where markets go with this, it doesn't really add to the debate on FED hike/pause

No idea where markets go with this, it doesn't really add to the debate on FED hike/pause

Inflation fairly neutral I would say, some slightly higher, some slightly lower than forecast/consensus...

No idea where markets go with this, it doesn't really add to the debate on FED hike/pause

View attachment 936432

According to @dl003 TSLA is up from here (“watch out above”) since it retested the breakout at $166 area yesterday. Now we wait to see how high to know when to close -Ps and +Cs, and open new -Cs for short.

@dl003 What are you seeing coming next?

You seem to be taking @dl003's word as gospel. Be careful basing your decisions on a stern conviction of where he thinks the stock might be headed. I really appreciate his views and agree with you that a lot of what he predicts seems to pan out. But he is human like all of us and TA is fallable. Don't bet the farm on it.

You seem to be taking @dl003's word as gospel. Be careful basing your decisions on a stern conviction of where he thinks the stock might be headed. I really appreciate his views and agree with you that a lot of what he predicts seems to pan out. But he is human like all of us and TA is fallable. Don't bet the farm on it.

100%

@dl003 himself cautions the same. It’s all about probabilities and it’s good to gather as much data from good sources so we could all make our personal decisions.

Thanks for the reminder!

Once we reach 180, it will be the end of the playbook Im following. Will have to observe further from there.

Gave everyone the bullish pattern, the 171.5 top, and 165 backtest. Now we are looking at an island reversal to the upside at open. This is a nightmare for the bears.

juanmedina

Active Member

Once we reach 180, it will be the end of the playbook Im following. Will have to observe further from there.

Gave everyone the bullish pattern, the 171.5 top, and 165 backtest. Now we are looking at an island reversal to the upside at open. This is a nightmare for the bears.

So is $180 too risky for this week? I was thinking at opening all the contracts that I closed yesterday at either $180's for this week at $0.50 or $190's next week. I am thinking more about opening contracts for this week since we have the shareholders meeting Tuesday next week and maybe Tesla decides to open the Cybertruck configurator.

When has this ever worked out?So is $180 too risky for this week? I was thinking at opening all the contracts that I closed yesterday at either $180's for this week at $0.50 or $190's next week. I am thinking more about opening contracts for this week since we have the shareholders meeting Tuesday next week and maybe Tesla decides to open the Cybertruck configurator.

I already closed my 180C yesterday on the backtest so now I'm more in favor of wait and see.

jeewee3000

Active Member

Well said. This goes for following any opinion regarding future price action. Don't enter trades blindly/lightly.You seem to be taking @dl003's word as gospel. Be careful basing your decisions on a stern conviction of where he thinks the stock might be headed. I really appreciate his views and agree with you that a lot of what he predicts seems to pan out. But he is human like all of us and TA is fallable. Don't bet the farm on it.

intelligator

Active Member

In for 152.50/145 put spreads on 5/19 (.60).

My recent experience is that I open positions for next week, and see enough profit this week that I close them this week. Of course I'd like that to repeat. In the past it was opening this week and closing this week. I don't have any deep insight into that - just an observation.

I opened same yesterday at .65 , it's now at .23 , might take that to the bank, as is.

juanmedina

Active Member

When has this ever worked out?

I already closed my 180C yesterday on the backtest so now I'm more in favor of wait and see.

Never, it is just my speculation. We are about 4 months from when Elon said that the delivery event will happen. I sold a few $180's at $0.60. I am going to add a few $190's for next week.

Last edited:

On Monday and Tuesday, even though it was volatile, call IVs remained firm for TSLA, which made me confident that the retracement will not last long. This morning, even though it has recovered those losses, call IVs have softened. One vital indicator that I've created for myself is IV vs SP movement. It tells me whether the stock is rallying because of delta hedging, meaning bullish bets are being placed specifically on TSLA, or simply piggybacking off the broader market, aka SPY. As call sellers, we don't mind when it piggybacks off SPY; SPY doesn't usually do crazy rallies and even a beta of 2x won't make TSLA spiral out of control. Think about it this way: if TSLA is simply piggybacking off SPY, it means the whole market is seeing injection of money and there are simply many choices to buy other than TSLA. It's serious only when bullish bets are being placed specifically on TSLA. You don't know if someone knows something. Today is a broader market rally. It looks like bullish bets placed on TSLA the last 3 days are being cashed in.Sold 190C for 5/19 for 0.55

Also, the retracement that happened within 5 minutes after the open was quite steep. Most likely it means 1 thing: wave 3 of this degree, the most impulsive wave, has terminated at 173.88. The next leg up will be wave 5. Since wave 3 is quite large relative to wave 1 (167.2 - 173.88 vs 166.5 - 167.6), wave 5 likely won't enjoy the same level of impulsiveness. After wave 5 will be a correction so a bit of room for error here, going with the 190s.

Last edited:

Sold 190C for 5/19 for 0.55

Thanks for posting

Legged into a Collar for 05/19 this morning -

STO - 05/19 $175P - $4 each

BTO - 05/19 $180C - $1.75 each

Net credit - $2.25 each

Also - opened some 05/19 $185P's for $14 each - this is a smaller position because I opened the Collars and like to do all CSP's

Cheers!

(closed my left over C's for this week yesterday on the dip down in the $166 area for $3.75 each - total net for the Straddle this week was $5.50 each)

Edit - was too early on this one.... going to ride this or let stop losses get me out....

STO - 05/19 $175P - $4 each

BTO - 05/19 $180C - $1.75 each

Net credit - $2.25 each

Also - opened some 05/19 $185P's for $14 each - this is a smaller position because I opened the Collars and like to do all CSP's

Cheers!

(closed my left over C's for this week yesterday on the dip down in the $166 area for $3.75 each - total net for the Straddle this week was $5.50 each)

Edit - was too early on this one.... going to ride this or let stop losses get me out....

Last edited:

Well said. This goes for following any opinion regarding future price action. Don't enter trades blindly/lightly.

In my case it's when I get an absolute conviction about something and go "all in", then it invariably does the opposite

So that's the position I find myself in now, about to sell all my shares for net $164

However, I see a bright future selling puts in the run-up, I think OK to be aggressive, but just use 50% of my available cash, so that if it does go against me I have the possibility to double-up for rolling down...

If I end up buying back in at that same price, I'm fine with that too

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K