Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

You are much braver than I. I feel like a real man for rolling Friday 280CC down to 267.5 for another .19STO12/22 -C255 @$ 2.54

Last edited:

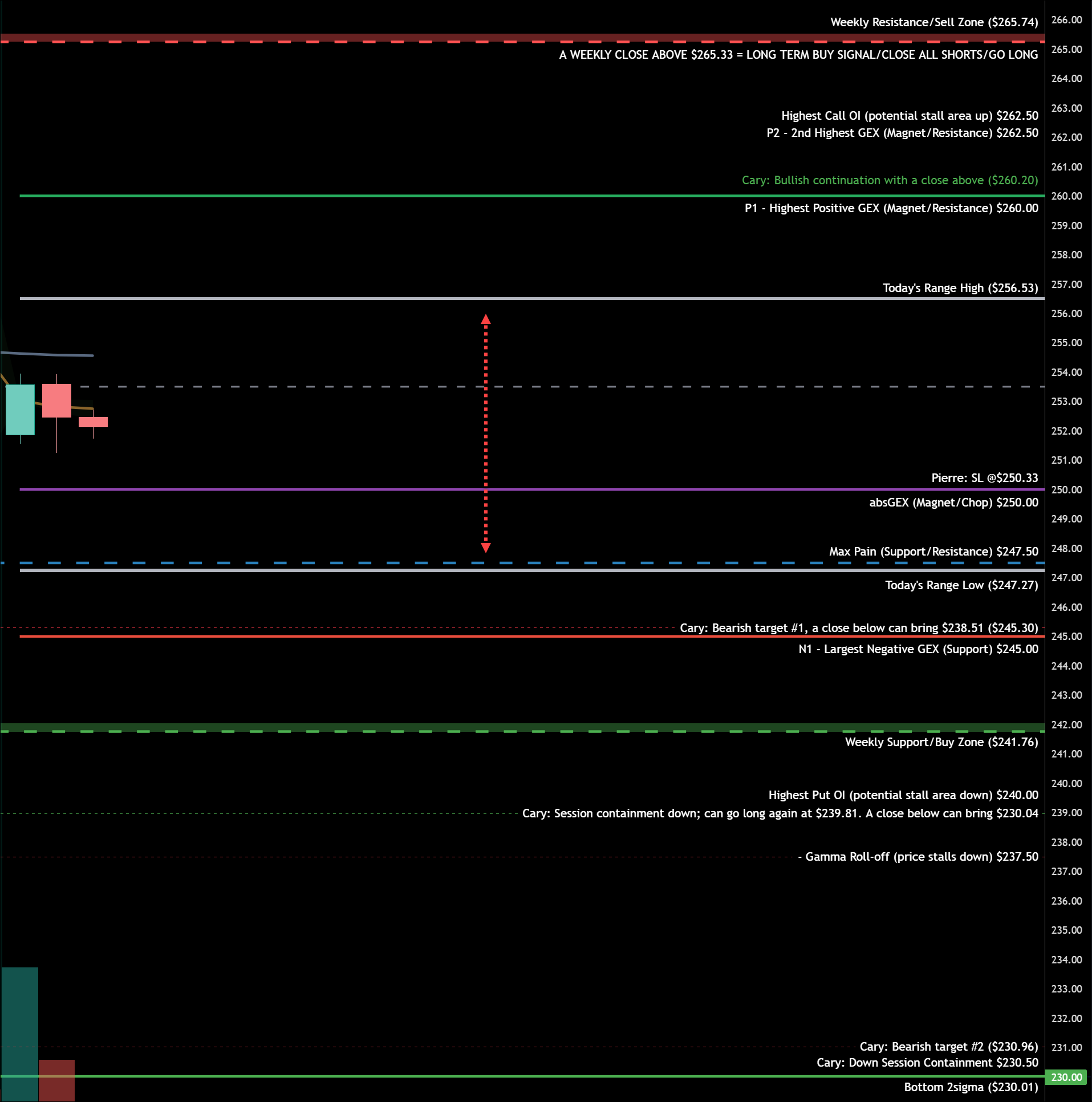

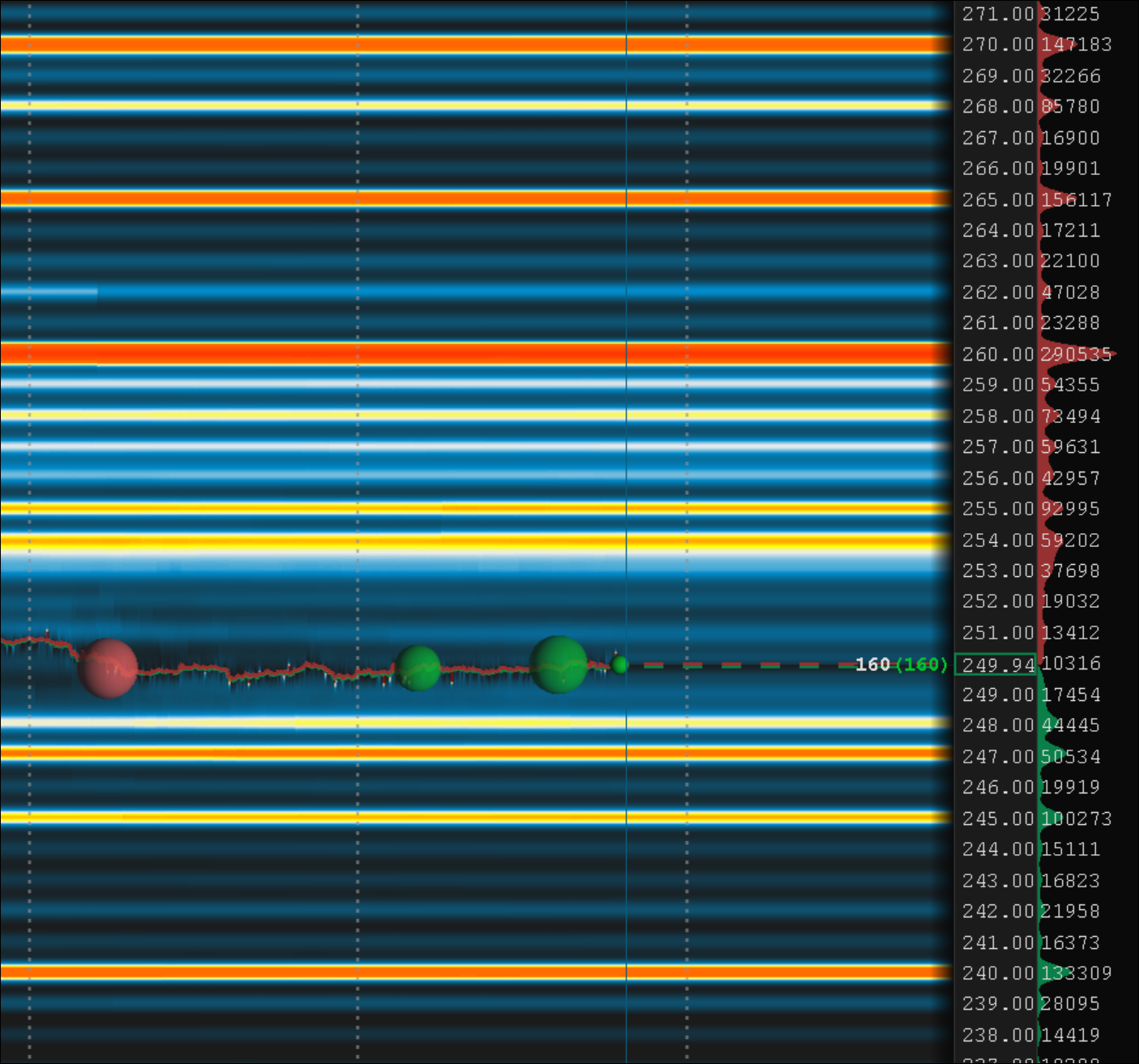

QTA Levels for today

12/22

12/29

12/22

12/29

SpeedyEddy

Active Member

SpeedyEddy

Active Member

tivoboy

Active Member

Decent probability of success..Access-A-Trader in his video yesterday said he was looking for a gap up at the open to play stocks to the downside again today....

Brave or stupid is decided Friday eveningYou are much braver than I. I feel like a real man for rolling Friday 280CC down to 267.5 for another .19

tivoboy

Active Member

Well, in all technicality it IS efficient. But that doesn’t mean it can’t be manipulated…TSLA was the OG for options based manipulation starting well before the pandemic."Efficient Markets", eh?

The only positive at this point is, that this play can’t be played too often or too soon again. Not everyone will jump as quickly or equally as they did this time around. I’m not sure how that plays out with the MM who were forced to hedge out, but if that were the case - well then the terms are a changin’

Last edited:

SpeedyEddy

Active Member

Chances are, if I would wait for that... (call wall rising though)Brave or stupid is decided Friday evening

SpeedyEddy

Active Member

BTC 12/22 C255 (chickened out, but) with profit $1.26 in the pocket. Plan to STO 12/22 252.50 on a rug-pull (down on higher volume)You are much braver than I. I feel like a real man for rolling Friday 280CC down to 267.5 for another .19

SpeedyEddy

Active Member

Seems you forgot what happened last week on risky tradesquite clear. STO 12/22 250 (even!) @ 2.87

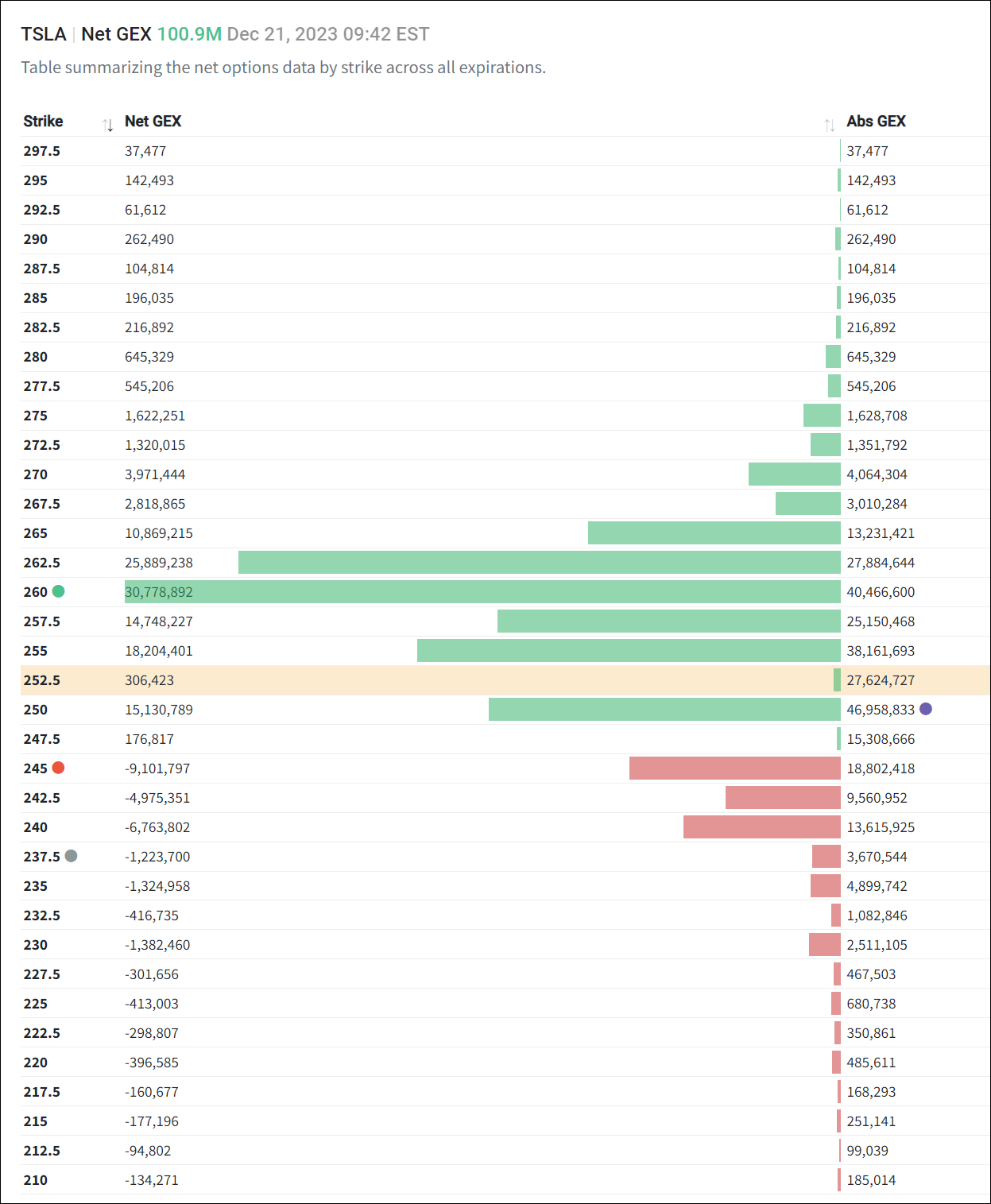

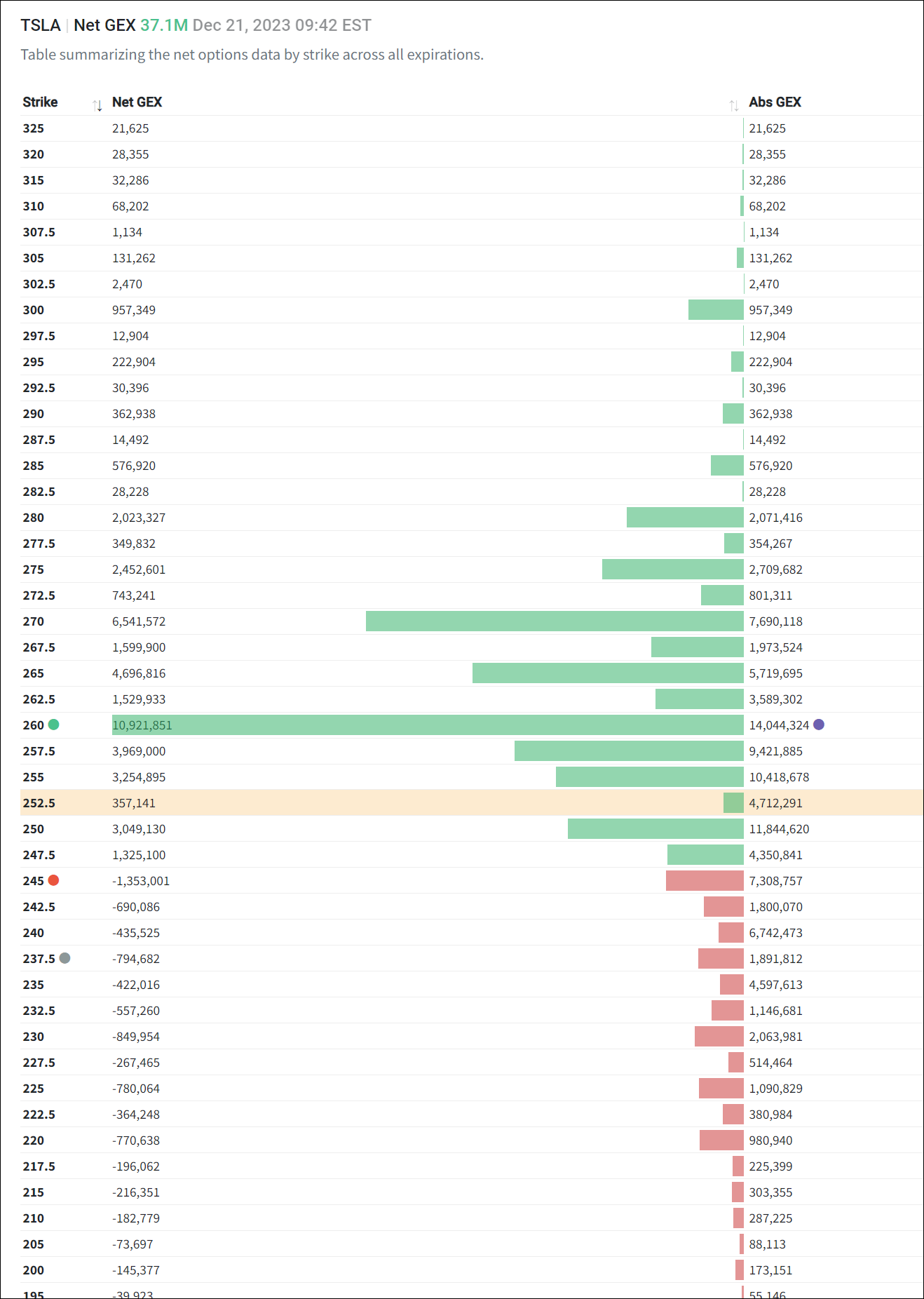

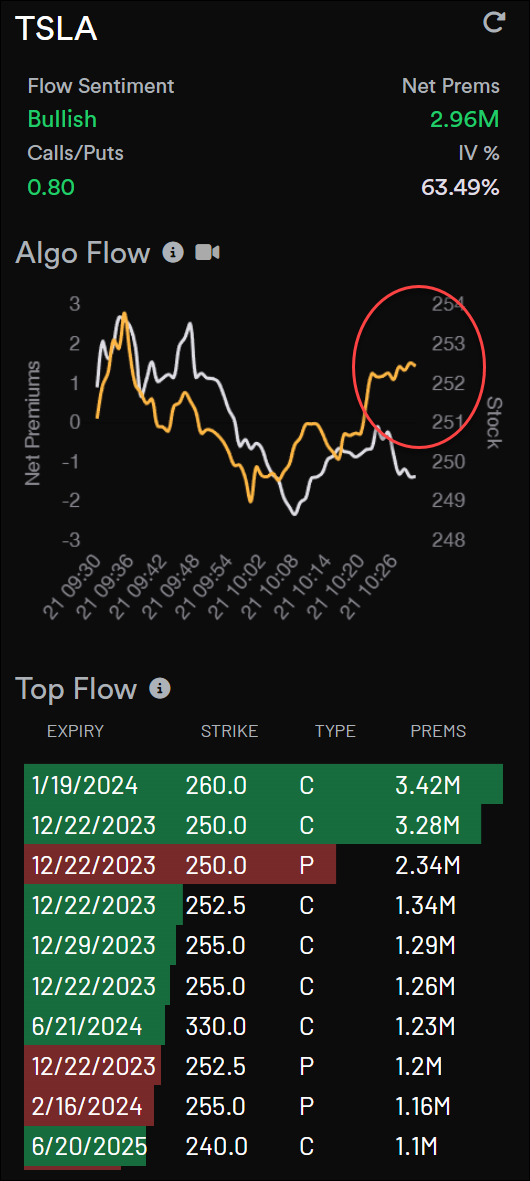

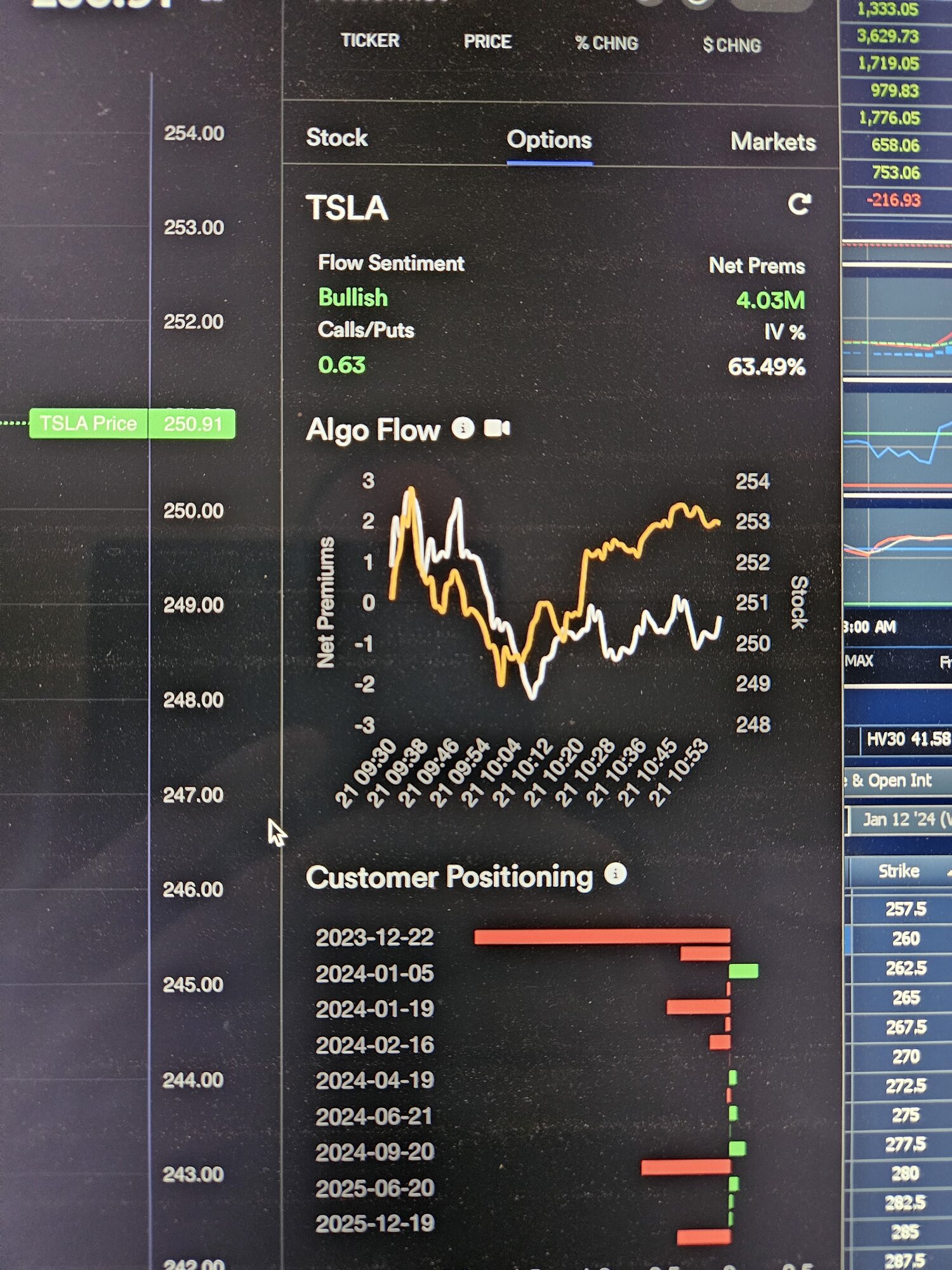

Options algo flow leaning toward more upside ~$253

Selling seems to have quieted down for now:

Selling seems to have quieted down for now:

SpeedyEddy

Active Member

yeah, was too early, took a .49 loss closing that one (BTC 12/22 C250) I will just do day trades, trying to read volumes, so will better not update you with all of them.

[Edit] remember I also still got the -C237.50 for tomorrow (sold $12.10, expect that to be closed on one of the dips profitably or roll) [/edit]

[Edit] remember I also still got the -C237.50 for tomorrow (sold $12.10, expect that to be closed on one of the dips profitably or roll) [/edit]

sold 265 CCs for .11, 4th milking session this weekYou are much braver than I. I feel like a real man for rolling Friday 280CC down to 267.5 for another .19

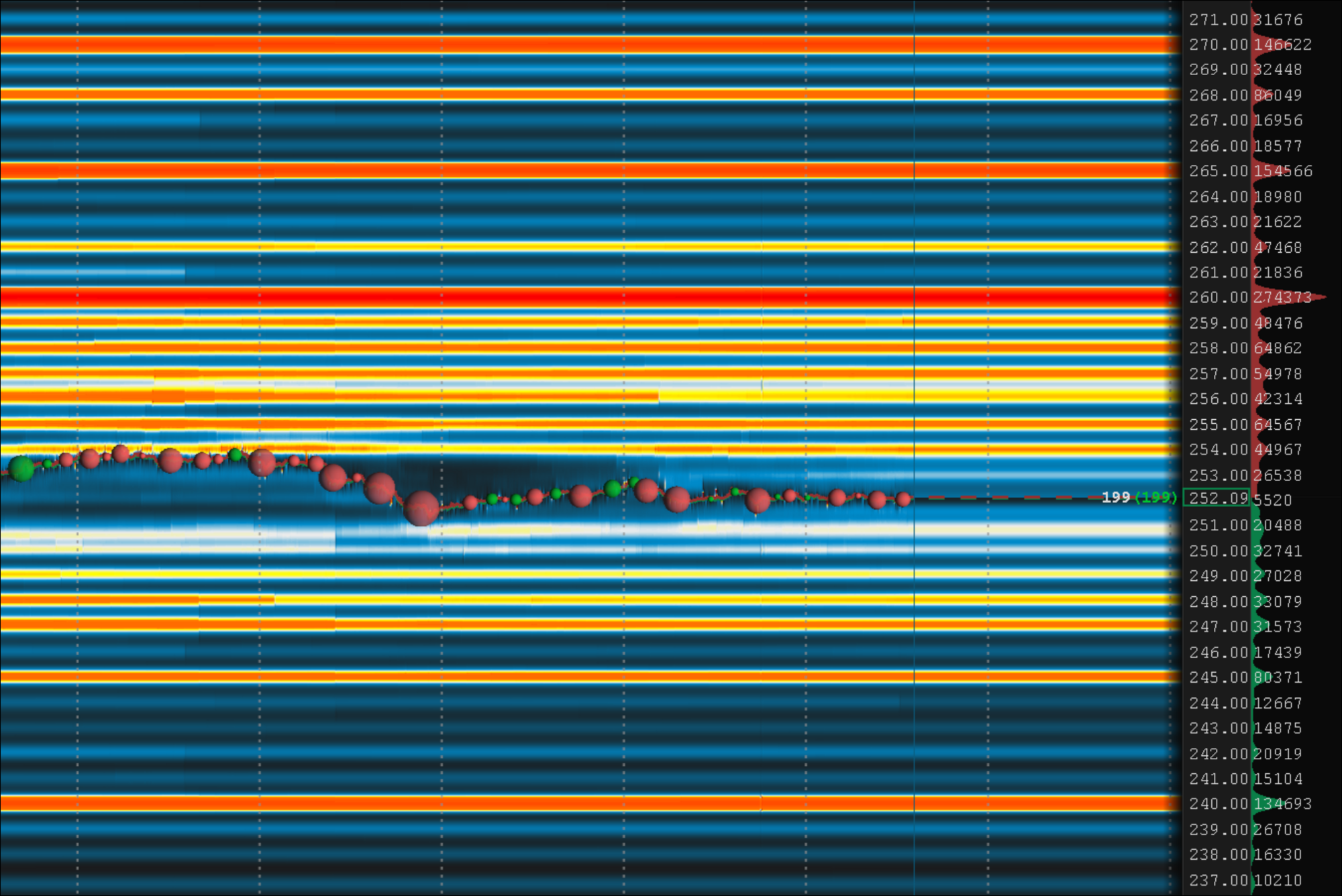

I did a little 100 share test. I'm looking at the Algo Flow stock price divergence. Decided to buy 100 shares at 250 when the Options were saying 253. Sold them after a $1 gain. Would have been $1,000 profit if I had done 1,000 shares. Will keep playing with this to see how reliable a large gap is when it develops. I wish the graph would update in real time instead of having to refresh constantly....

Edit: I also wonder if this becomes more reliable as we get to the end of the week. Friday especially.

Edit: I also wonder if this becomes more reliable as we get to the end of the week. Friday especially.

can u let us know daily how reliable is this for daytrading? i might sign up againI did a little 100 share test. I'm looking at the Algo Flow stock price divergence. Decided to buy 100 shares at 250 when the Options were saying 253. Sold them after a $1 gain. Would have been $1,000 profit if I had done 1,000 shares. Will keep playing with this to see how reliable a large gap is when it develops. I wish the graph would update in real time instead of having to refresh constantly....

Edit: I also wonder if this becomes more reliable as we get to the end of the week. Friday especially.

View attachment 1001767

TexasGator

Member

x2 i might sign up LOLcan u let us know daily how reliable is this for daytrading? i might sign up again

would have come in handy - when the SP appeared pinned at 250, sold 10x C270 for next week for $1 missed a bit of premium had i waited

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K