i am curious why it's BTC for a loss instead of rolling? 30-wide and OTM means you will have credit AND strike improvement of at least -5 to -p225Unlike @Jim Holder with his incredible beginning of year run, Fidelity made a few bucks on fees, I made none but also avoided having to fret over the downward pressure; spreads need constant oversight, especially when there's a sudden directional shift! I set an order to close out the losing spread at what I paid for it, it hit early afternoon after we blipped over 241.50! I wasn't feeling good about the position a half hour after I opened it, decided to get out of it at first opportunity. Resetting tomorrow morning, see what's left for the week.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

If I'm looking at this correctly, you are getting a better cash return scalping long dated Calls than short dated ones, even though percentage wise they don't improve as much on a dip?Went flat on all short calls into the nice fade at close, including the new ones I sold today at mid-day $241 pop, for a $14,200 win. Not intending to brag but to demonstrate how scalping can add up. Up almost $20k since start of the year without touching my longs.

Today's scalps:

View attachment 1005502

I left three positions open:

-P290 9/20/24 @58.65

-P250 1/17/25 @46.18

+C150 12/2025 @122.82

Yes, tilted bullish, but I'm prepared to flip bearish again and re-sell short calls if we don't get relief tomorrow.

Fun!

I've actually done well this week legging in and out of CCs.

I have two different BPSs that I might have to manage.

+190/-220

+195/-225

I really only worried about the -225. I might keep expiration the same (for this Friday) but roll it down to -220 and help pay the debit by selling another +190/-220 for every contract I roll down.

I have two different BPSs that I might have to manage.

+190/-220

+195/-225

I really only worried about the -225. I might keep expiration the same (for this Friday) but roll it down to -220 and help pay the debit by selling another +190/-220 for every contract I roll down.

Kinda. Some of the long dated ones with the bigger returns (like the -C300 9/2024 $6,880) I held a few weeks until they ripen, but yes some move more with price action than others.If I'm looking at this correctly, you are getting a better cash return scalping long dated Calls than short dated ones, even though percentage wise they don't improve as much on a dip?

CelticGreen

New Member

Just out of curiosity, do you have a specific time span that you prefer when entering a trade? I have seen you reference 65 min a few times, is that your go-to or it just depends??

i don't look at any to "time the market" based on lines; my preference is observing momentum since i'm an options seller (not really daytrading stocks)Just out of curiosity, do you have a specific time span that you prefer when entering a trade? I have seen you reference 65 min a few times, is that your go-to or it just depends??

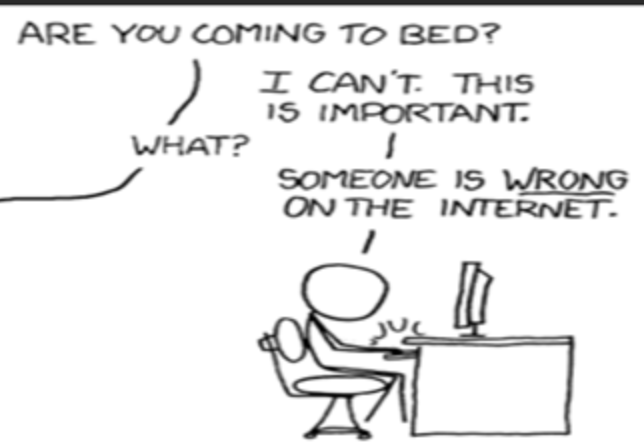

#2 and #4 are wrong and misleading, i am tempted to go pick a fight (but better not since he's a bit cute)

puts bought above ask = bearish

calls bought above ask = bullish

puts sold below bid = bullish

calls sold below bid = bearish

puts bought above ask = bearish

calls bought above ask = bullish

puts sold below bid = bullish

calls sold below bid = bearish

Last edited:

intelligator

Active Member

True, I could have done that, I agree. At the time that I placed the close order, I was on my way out for the rest of the day. After the price dropped to $236 (just under $10 from the open) I'd realized I opened too early and was concerned the slide would continue. I decided to place a close order and reset to another strike pair in the morning. If it'd not filled (SP continued to slide), I'd do exactly as you described, roll for credit, strike improvement, or both, Thursday or Friday if needed. I effectively closed the position for the transaction fees (which is technically a loss, I agree). The BPS was opened at .60 , closed at .60 , with fees on each side, $20 cost without losing sleep over it.i am curious why it's BTC for a loss instead of rolling? 30-wide and OTM means you will have credit AND strike improvement of at least -5 to -p225

Knightshade

Well-Known Member

EVNow

Well-Known Member

I now have 270 and 255 calls, 230 and 225 puts. I'm hoping for a Friday close around 240 and won't have to roll the 230 or 225.

Oh I'll deal with the -p270's, the SP will come back up at some point, I'll roll them, can push them out to September straddles and reduce the contracts from 40x to 15x, lots of possibilities, hell if I really thought it was going to dump hard then I could flip some to dITM calls, but I suspect that would jsut be setting-up another issue to deal with in the future...Yeh, it looks like a lot of work but it really isn’t, I just respond to price movements via alerts and trade batches 2-3 times a day max.

Great work on those realized gains for 2024! I know you will find a way to climb out from whatever is thrown at you.

Cheers for great fun and definitely entertainment ahead!

Right now my preference is to roll them while I get some credit, or most likely down a strike each week straddled (of course) with calls until we get a reversal, so now I have -p270 + -c260, logical roll would be both at -265

I'm also thinking to let some, or even all of them assign, would be net share price of $200, which would be OK if we get a recovery, but less interesting if we drop further from here, tempted to let ALL of them assign, but that would make a serious dent in my cash pile, maybe after rolling a bit and some further cash accumulation

Anyway, we'll see; I'm more annoyed with myself than anything else - writing -c270's was a good trade with sound logic underlying, the puts, somewhat tenuous... 20x was OK, 40x was not smart

Last edited:

Like the man had calluses from pressing BUY and SELL.Jeeze, that looks like a lot of work

...

/s

Well took 'em all morning, but they managed to push it red in PM, bears in the yard... AAPL and AMZN not helping, both dow, heavily dragging the indexes with them...

Access a Trader's Dan Shapiro was saying last night that a gap down at the open, that gets bought and goes green today, is a better setup than a gap up at the open, which would probably get sold off. We'll see....

Edit: He did not say we are definitely going up today. In fact, the QQQ went below the 20 day (I think that was the line) and has room to fall now.

Edit: He did not say we are definitely going up today. In fact, the QQQ went below the 20 day (I think that was the line) and has room to fall now.

Last edited:

On the Algo issue, below is what the developer says about it. Seems intended for short term sentiment off option flow and not a prediction of actual price direction. So for the one this morning, for example, it means keep an eye for possible upside movement developing, it doesn't mean to position heavily for it. If used correctly it can be helpful as an additional indicator as part of DD.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K