@dl003 U okay? Missing your excellent commentary here at these junctures.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

This is the saving grace. If Tesla won’t give us gains in 2024 then we’ll generate them ourselves with creative option plays from the sideways action and being the house.2024 and probably early 2025 is all about side income from options it seems.

Maybe he's sitting on a beach, earning 20%...@dl003 U okay? Missing your excellent commentary here at these junctures.

Certainly with all the Waves A B and C there's plenty waterMaybe he's sitting on a beach, earning 20%...

Closed this up.I expect that management of the position - close the winning leg for a near max gain in an hour or so, and roll the losing side out a week. Straddle that with a replacement contract. I've got so much bias in the rest of my account to a move up that I'm more likely to roll this trivial position down a strike or 2. With little time value at roll I should be able to choose my own strike between 200 and 220.

The -210p was closed for .05; .59 in, .05 out. $54 in my pocket!

Meanwhile the -210c was rolled to next Friday -220c for ~1.50 credit. This call is backed by shares purchased for $214 or so. I like the credit and I'm not looking to sell the shares when I just bought them, but its also not a bad outcome if they do end up being called away.

To keep the tight strangle action going and get more experience with this, also add -210p for next week, putting me in a -210p / -220c for next Friday. The 210p is good for about 4.90.

Big credits, but wow I'm not used to being this close to the money

StarFoxisDown!

Well-Known Member

While I don't really want the scenario of TSLA being completely flat till mid 2025 (because it would just be more easy on the nerves if TSLA rallied from here), it would actually allow me to roll the LEAPS I own, purchase a handful more, and probably give me a chance to materially increase my share count especially if the company I work for IPO's or sells itself by the end of this year.This is the saving grace. If Tesla won’t give us gains in 2024 then we’ll generate them ourselves with creative option plays from the sideways action and being the house.

If only I could get so lucky......

thenewguy1979

"The" Dog

Maybe he's sitting on a beach, earning 20%...

We hope so. Last check he had a boatload of -225p for the week.

Knowing how careful he is probably close them long ago.

Probably looking at us now chuckling how scare we all look with the constant dump.

Shouting Big Ass Bear Trap….. you wuss

JK - @dl003 if your around and doing ok just let us know.

john tanglewoo

2012 Roadster Owner

We hope so. Last check he had a boatload of -225p for the week.

Knowing how careful he is probably close them long ago.

Probably looking at us now chuckling how scare we all look with the constant dump.

Shouting Big Ass Bear Trap….. you wuss

JK - @dl003 if your around and doing ok just let us know.

I bet he'll pop in and say "Nothing's changed from what I've been saying, we might be done with wave C. It now rests on ER."

Super Micro (supplier of server racks) ripped ER's face off today, propelling semis to the stratosphere.SO hard to watch NVDA, AMD, and even SPY, QQQ ripping making new ATH's each day while we TSLA diehards get the nosebleed seats. Yes, yes, I could dabble in other tickers instead of grousing, but I don't know how they behave and don't want to get smacked down by me making stupid moves. I guess grousing will do for now

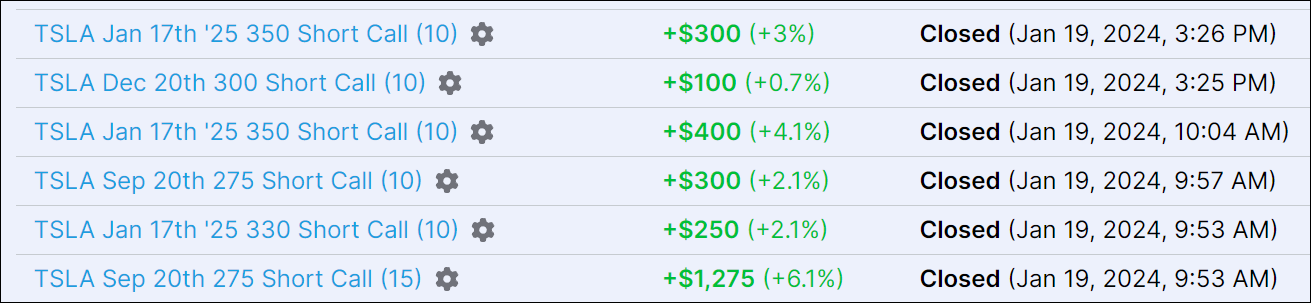

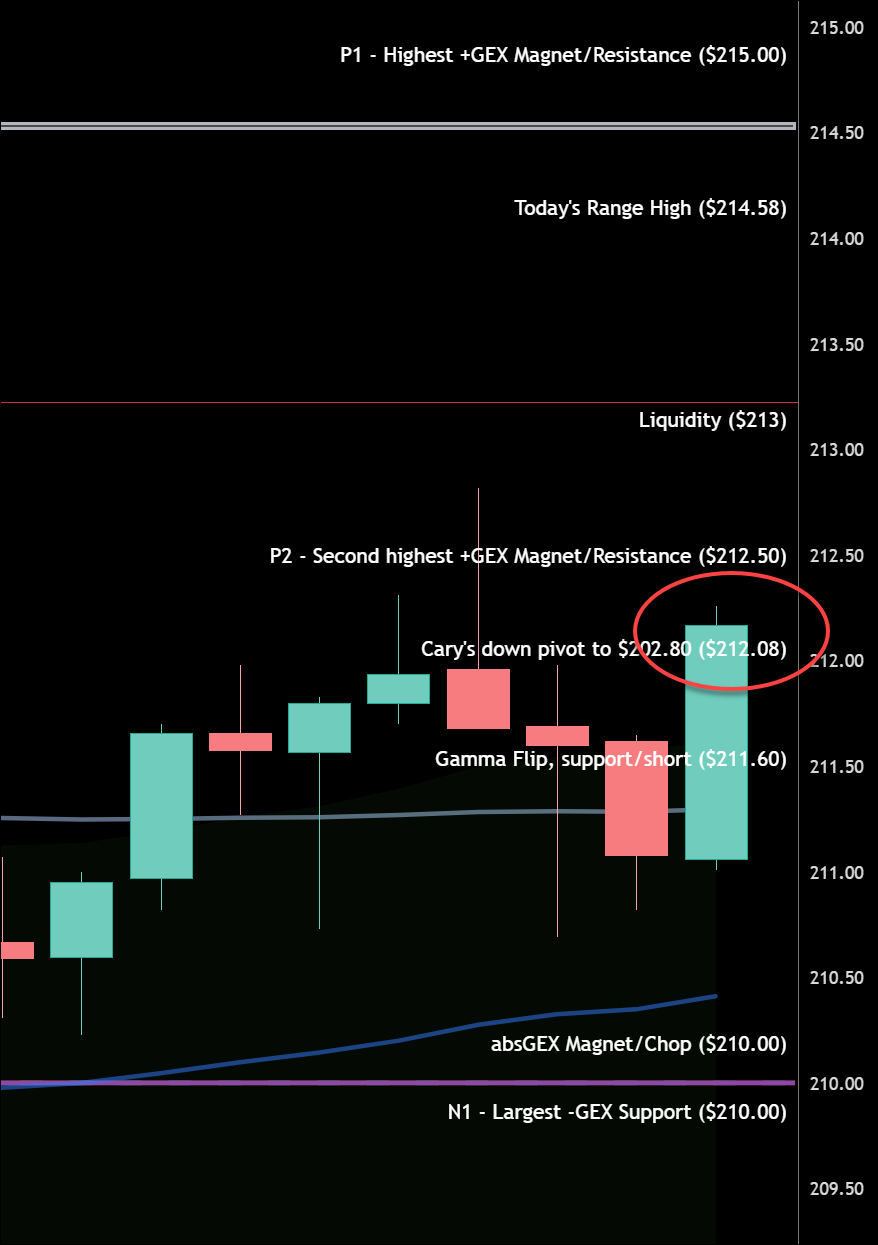

K, time to wrap things up. Done scalping CC's today, happy with $2,600 for a few clicks and $11k for the shortened week. Not planning on selling new CC's into the weekend in case of a Monday grind higher into ER. Will look to sell into strength next week, plus IV should be higher to juice premiums.

Have a great weekend all!

We should sell T-Shirts "I survived OPEX and all I got was a dump below the 200-day."

Today

This week

Have a great weekend all!

We should sell T-Shirts "I survived OPEX and all I got was a dump below the 200-day."

Today

This week

The topic of assignment is well worth everybody here digging into and getting more depth on.Way to go !!!

My understanding is that assignment or having shares called away doesn't happen during the day; it happen after hours, your broker will match random underwater positions at that time. On Fridays you may get a call from your broker for that day's expiry if you are close or underwater.

My understanding is that day time assignment of options can happen though this is rare.

For expiration (rather than assignment), all of the options that are .01 ITM are automatically exercised and shares purchased or sold as necessary to satisfy the exercise. The important thing here is that if you've got long calls backing short calls, and the short calls get exercised, then the broker DOES NOT sell off your long calls (or exercise them) to get everything all matched up. The broker will sell shares short to satisfy the call assignment, and then you get to deal with short shares on Monday.

For assignment (option holder exercised their option prior to expiration) the options clearing house folks choose a random broker to satisfy the assignment. The broker then chooses a random option seller to satisfy the assignment. This is how random assignments can show up.

BUT in practice being assigned is rare. I'd say that the board's experience, recounted over the last couple of years, is that DITM puts are more likely to be assigned than DITM calls. Neither are likely to be assigned though if they have time value. Even $1 of time value makes early assignment valuable to the option seller - the person exercising their option early is giving away that $1 in time value (they can sell the option to also get that $1 in time value).

It seems like, though I have no evidence to support this, early assignment on DITM puts comes from people that want shares now, and they would like to get them without moving the share price. Or at least move it as little as possible. They still won't pay much in the way of time value though. I figure once the time value gets small enough that its well inside of a rounding error in the bid / ask spread then you're at risk for early assignment. This is a minor reason for sticking to the big strikes on long dated options - more volume = smaller bid/ask spread.

We've all done it, Fido, some folks here remember the "Evergrande Affair" and my fat-finger 420x spreadSold an Iron butterfly today for $1.5 targeting 210.

Thought it was a home run then noticed date of expiration 1/26...........doggy fingers.

Now that was stressful, but a learning experience. What doesn't kill you, eh?

Per Yoona, this was the first time in the last 3 years we have had 5 red weeks in a row. Hard to believe we will smash the record completely with 6 next week....

SpeedyEddy

Active Member

I made two far OTM bigger volume bets , one earlier this week BTO 1/26 +P145 for a few cents and now BTO 1/26 +C262

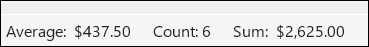

today's Close = 212.19for some reason, my MP is diff

today's High = 213.19

today's PM High = 212.93

my 213.33 MP is probably the right one

Yoona - 1

3 Other Pretenders - 0

Last edited:

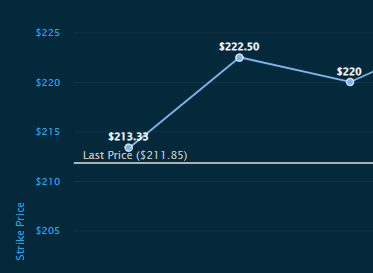

Hopeful close, right over the $208 line in the sand for bullish continuation next week:

EVNow

Well-Known Member

Thats the thing with stats ... there's always a first time.Per Yoona, this was the first time in the last 3 years we have had 5 red weeks in a row. Hard to believe we will smash the record completely with 6 next week....

ps : Funny story. There were people in 2008 claiming McCain was sure to win, inspite of large polling deficits, because no African American had ever won a presidential election

pps : Bought back 230 calls and 200 & 205 puts for a cent. Next week I'll probably sit out or sell 15/20% OTM options.

SpeedyEddy

Active Member

And I finally got my 1/26 -C 232.50 for a decent 1,30 a few hours ago, before leaving for some blues tunes, 3x Leffe blond and an Aventinus Eisbock (really nice tasting) ago!

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K