@Max Plaid can you take a look at this ITM 9/20/24 -P290 position and let me know if the $3.34 extrinsic is enough for me to hold onto it or should I roll now? There's 242 days to expiration remaining. If we go below $200 would the extrinsic disappear faster? Not sure how that works.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

Even pump master NVDA cannot sustain a break over 600. The Macro take a breather before pumping again this week.Except QQQ dropped 0.25%, TSLA >1%

Tesla is it own animal. It's been disconnected from Macro for weeks now while M7 was pumping ATH.

For the fellow last month who was sad since Tesla was not cheap enough so he can load his boat - here come the opportunity.....

Load them up.

If TSLA keeps this up soon no one will want it even at $60For the fellow last month who was sad since Tesla was not cheap enough so he can load his boat - here come the opportunity.....

Load them up.

thenewguy1979

"The" Dog

I don't know.............Max said he was aiming to add 10K shares by the end of the year.If TSLA keeps this up soon no one will want it even at $60

I’ll sell mine for $2.50I don't know.............Max said he was aiming to add 10K shares by the end of the year.

I guess you can never say never, but the general rule-of-thumb here is that there needs to be less than $1 extrinsic and close to expiry before you start sweating on early assignment. In this case looks OK down to $190, doesn't help that IV is pretty low@Max Plaid can you take a look at this ITM 9/20/24 -P290 position and let me know if the $3.34 extrinsic is enough for me to hold onto it or should I roll now? There's 242 days to expiration remaining. If we go below $200 would the extrinsic disappear faster? Not sure how that works.

View attachment 1011287

On the other hand, consider that there's quite a bit of OI with 3314 open positions and no volume

I had a bit of a similar situation with Sep 2024 -p300's, that I could see would look a bit tight if the SP dropped, so I rolled them down to -p270 and sold -c270's to cover the premium gap (which I rolled in and out of a few times, then wrote 2x in the end)

More like mid 2025, but if it dropped to $60 I'd buy them tomorrow - and it's only 8k shares, I already have 2k...I don't know.............Max said he was aiming to add 10K shares by the end of the year.

Then I'll sell 100x $1 weekly calls + puts for the rest on my life for a $1m annual income, that's the idea

one more c220, but for next week 2/2

I guess you can never say never, but the general rule-of-thumb here is that there needs to be less than $1 extrinsic and close to expiry before you start sweating on early assignment. In this case looks OK down to $190, doesn't help that IV is pretty low

On the other hand, consider that there's quite a bit of OI with 3314 open positions and no volume

I had a bit of a similar situation with Sep 2024 -p300's, that I could see would look a bit tight if the SP dropped, so I rolled them down to -p270 and sold -c270's to cover the premium gap (which I rolled in and out of a few times, then wrote 2x in the end)

View attachment 1011294

Thanks. I’ll definitely keep an eye on it then maybe roll down if it gets sweaty.

What does the high 3,314 OI and 0 volume imply in your comment?

juanmedina

Active Member

Man the sentiment is horrible. I think most Tesla stock holder are extremely down because all other stocks are performing so well. I sold some $180 puts for Friday again after closing them this morning.

2/9 looks a lot more put heavy than 2/2, which is odd given that earnings are 1/24

2/2

2/9

2/16

2/23 (turns bullish)

3/1

2/2

2/9

2/16

2/23 (turns bullish)

3/1

A while back someone on here was asking if there was a site with historic options pricing (Sorry can't find that post) but here is a site that has historic options prices.

Yeah, and I’d like to get PAID to buy then. ;-)

Ah, so you're planning to close them on any run $217-$235 between now and March 15 (if we get one), and/or you don't expect TSLA to be below $190 by expiration. More likely you're seeing a run of some sorts on the menu where you plan to close them and get PAID, yeh?

-P185 3/15/24 currently @$5.55

-P190 3/15/24 currently @$7.05

Musskiah

DisGruntled

I love this video. I haven't watched it in a couple years.

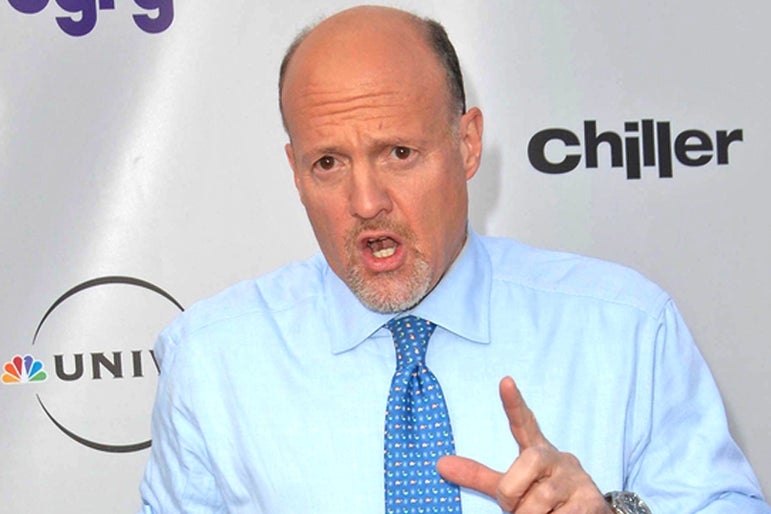

Jim Cramer Predicts Tesla 'Would Be First To Fall' From 'Magnificent 7' Stock Group: 'We Have A CEO Getting A Little Petulant...Again' - Microsoft (NASDAQ:MSFT), Advanced Micro Devices (NASDAQ:AMD)

Cramer is a big fan of Nvidia and its CEO, so much so that he has named his dog after the company.www.benzinga.com

Cramer...inversed Cramer time...we pump guys

Well if you're on a strike with plenty of OI and some get exercised early, then less chance will be your positions, also as no)one is trading them they're more likely longer term setupsThanks. I’ll definitely keep an eye on it then maybe roll down if it gets sweaty.

What does the high 3,314 OI and 0 volume imply in your comment?

But that's just my opinion, I have no facts to back that up

Broader EV sector is getting crushed, I don't think it's a Tesla specific issue, rather the general narrative that has been setup that EV's aren't selling anymoreMan the sentiment is horrible. I think most Tesla stock holder are extremely down because all other stocks are performing so well. I sold some $180 puts for Friday again after closing them this morning.

View attachment 1011307

No doubt the pirates use this to amplify the signal in TSLA to reap more rewards...

Very strong China numbers, again...

Indeed the anti-EV FUD is really strong right now, and the only narrative you see about Tesla is price-cuts and margins, but reality is that they are delivering a lot of cars right now where the other manufacturers are struggling - even BYD's much publicised "beating Tesla" is not the fun story given that they have >70 days of inventory at their dealers (which have bene counted as sales)

So do we have another disconnect from the company and stock, once again?

Indeed the anti-EV FUD is really strong right now, and the only narrative you see about Tesla is price-cuts and margins, but reality is that they are delivering a lot of cars right now where the other manufacturers are struggling - even BYD's much publicised "beating Tesla" is not the fun story given that they have >70 days of inventory at their dealers (which have bene counted as sales)

So do we have another disconnect from the company and stock, once again?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K