@adiggs yes, exactly. I've been trying to follow that particular gem (selling BPS into weakness, calls into strength). I closed out this week's BPS yesterday on the strong up. Waited today for a re-entry point, and when it looked like it was just going to continue to rocket up, made the decision to open new positions anyway, even though it wasn't a down day - but rather a day i expected it to go up farther. I may or may not have captured the optimal amount of premium, but certainly did well enough for my weekly goals.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

mickificki

Member

Yeah, I posted this earlier today with more references from Adamhoov, referencing this as a potential threat to opened CCs.

Moderator deleted my tweets, because, apparently, to him people burning on CCs is not relevant to this thread.

R

ReddyLeaf

Guest

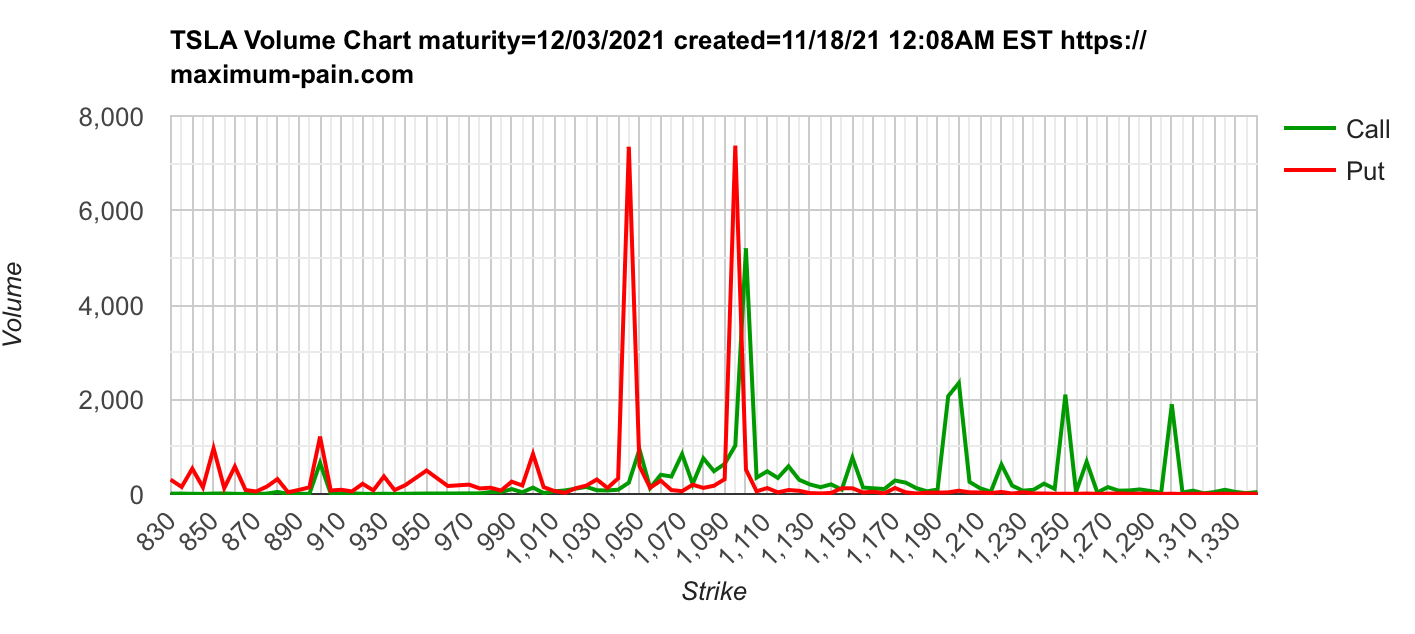

Today’s Dec 3rd options volume. Approx 7330 contracts at p1045/p1095. $37M risk, $22/sh= $16M premium. Plus another 5000x c1100 @ $50/sh = $25M if I did the calculation correctly. Pays off pretty nicely if the SP closes between $1095-$1100.

samppa

Active Member

I briefly scanned the thread.

He doesn't seem to realize that Tsla does not have enough authorised shares to do another split, so a split would require shareholder vote (unless they split like 1:1.9 or sg like that).

Not saying a split can't happen, but it will take more time than just a few days, and more work than just announcing it.

Yeah, I posted this earlier today with more references from Adamhoov, referencing this as a potential threat to opened CCs.

Moderator deleted my tweets, because, apparently, to him people burning on CCs is not relevant to this thread.

It was removed because this thread doesn't need crazy conspiracy theories based on extremely unlikely juggling with numbers. The strength of this thread is its focus on option selling. If these fringe theories belong anywhere, it's in the main thread. But other mods are trying to keep it on a leash also there for being too far fetched.

I

I am still asking myself if I roll or not my 19/11 1155 CCs for a credit to next week. I guess I’ll wait to see how easy the SP breaches the 1100 call wall easily or not. Following closely what you are doing with your 1100s.

Today and tomorrow I will be looking to open positions for next week, I am no longer sure 30% OTM CCs are safe with Elon selling that has to end at some point. I was interested in selling puts around 20% for next Friday however it might get impacted by a clash in the tweetosphere during the week end. I am in an overanalysis paralysis because the stock is at 1100 when I expected it to be at 900.

everyday I am flabbergasted on how the stock is moving exactly on the exact opposite I was expecting, 3 days straight and now we are on for a 4th consecutive day. It seems I am mediocre at gambling.This is something I am NOT good at. I often don't close positions on the basis that I don't see a new trade I want to enter in to yet. I need to learn to be patient being out of a position. Case in point, all of my BCS were in the 80-90% profit range earlier this week. 1100/1150, 1140/1240, 1230/1280. I should have closed and then waited to re-enter rather than NEEDING to have a new position ready to go.

I'm ready to roll and manage any of them, but could have been an easy situation of having closed them on Monday to re-enter them today for next week. Instead I chased a few more pennies. That said, I did practice that advice on my BPS earlier this week and have fought the urge to chase pennies on another round of BPS for this week.

In other words, today was a long day of waiting. We got our first close back above 20MA, but below 10MA. That on a very red day in broader market (EV names crushed, growth names crushed, macros down slightly). So, it reads like a bullish day, but not so bullish that I am convinced we've reversed our down trend.

I am still asking myself if I roll or not my 19/11 1155 CCs for a credit to next week. I guess I’ll wait to see how easy the SP breaches the 1100 call wall easily or not. Following closely what you are doing with your 1100s.

Today and tomorrow I will be looking to open positions for next week, I am no longer sure 30% OTM CCs are safe with Elon selling that has to end at some point. I was interested in selling puts around 20% for next Friday however it might get impacted by a clash in the tweetosphere during the week end. I am in an overanalysis paralysis because the stock is at 1100 when I expected it to be at 900.

Last edited:

I think this only works if the SP drops, otherwise you will keep chasing higher puts without being assigned while the stock becomes more expensive.Not necessarily the same price. Just really profitable Puts where you actually want assignment because you are trying to replace shares from the CC.

As someone trading in a tax-free account, I think I'd rather keep rolling CCs in that case, not earning premium but keeping possession of the stock.

Thoughts?

tradenewbie

Member

The pre-market is getting crazy, now I am getting worried about my BCS -1200/1400 and 1200ccroll up my 1150cc to 1200cc for the same expiry this week, would rather earn a tiny premium instead of worrying tomorrow that would jump to 1150.

So remaining cc are all 1200cc, and BCS is -1200/1400 for this week.

Haven't opened any cc/BCS/BPS for next week yet, probably will wait till next week to do it or may take a break.

There is no single correct strategy. The goal is to make money. Some traders here have gone to cash and no longer hold TSLA. Chasing higher Puts without being assigned can make you a ton of money if you are selling near the money without fear each week.I think this only works if the SP drops, otherwise you will keep chasing higher puts without being assigned while the stock becomes more expensive.

As someone trading in a tax-free account, I think I'd rather keep rolling CCs in that case, not earning premium but keeping possession of the stock.

Thoughts?

Last edited:

I agree the CC side is scarier. Yesterday I took a small debit to change my 11/26 1300/1500 to 1350/1550 to give a little more room next week. Puts at 900 don't scare me at all because the SP is not going to run away from you in the down direction, and 1) naked Puts are easy to roll 2)ITM Puts are easy to keep rolling ITM without changing the strike for great returns (as long as you do it early enough to avoid assignment risk).I

everyday I am flabbergasted on how the stock is moving exactly on the exact opposite I was expecting, 3 days straight and now we are on for a 4th consecutive day. It seems I am mediocre at gambling.

I am still asking myself if I roll or not my 19/11 1155 CCs for a credit to next week. I guess I’ll wait to see how easy the SP breaches the 1100 call wall easily or not. Following closely what you are doing with your 1100s.

Today and tomorrow I will be looking to open positions for next week, I am no longer sure 30% OTM CCs are safe with Elon selling that has to end at some point. I was interested in selling puts around 20% for next Friday however it might get impacted by a clash in the tweetosphere during the week end. I am in an overanalysis paralysis because the stock is at 1100 when I expected it to be at 900.

My not-advice is to sell 900 strike Puts (possibly for 12/3). With your CC, roll for maximum strike improvement (no credit) if we breach 1120 or 1130.

Last edited:

I assume you are not earning premium because you keep rolling up.I think this only works if the SP drops, otherwise you will keep chasing higher puts without being assigned while the stock becomes more expensive.

As someone trading in a tax-free account, I think I'd rather keep rolling CCs in that case, not earning premium but keeping possession of the stock.

Thoughts?

Have a couple of CCs in my retirement that I am rolling in this manner, although I make sure to always get at least a point or two. This works, but keep in mind the opportunity cost. Also since it is in tax free account, doesn’t cost you anything to go in and out of stock.

Different strokes…

Ignoring spreads and taxes:I agree the CC side is scarier. Yesterday I took a small debit to change my 11/26 1300/1500 to 1350/1550 to give a little more room next week. Puts at 900 don't scare me at all because the SP is not going to run away from you in the down direction, and 1) naked Puts are easy to roll 2)ITM Puts are easy to keep rolling ITM without changing the strike for great returns (as long as you do it early enough to avoid assignment risk).

My not-advice is to sell 900 strike Puts. With your CC, roll for maximum strike improvement (no credit) if we breach 1120 or 1130.

Sell cash covered puts: get premium, lose all stock upside, exposed to any drop below strike

Sell share covered calls: get premium, lose any stock upside beyond strike, exposed to all stock downside

Rolling repeats this. On the run up, I did better buying back CC at a 'loss' to ride the share price increase. (I say 'loss' because I'd already missed out on stock rise, the call value just is a representation of that).

If you think the the stock will go up: CC

If you think it will go down: puts

Of course, strike and premium play into it. If you sell a put and the stock goes up less than the premium, you're still ahead. Same, but opposite, for calls.

DITM is cash up front, but premium gain is less than strike movement.

True, but with a company like Tesla growing at >50%, the downside risks are minimal and short lived. Upside risk is the greater risk. I believe TSLAs upside rapid move happened in the last two years. It will keep climbing, but you can double or triple your cash account with aggressive Puts if TSLA is climbing and probably not lose anything compared to owning stock.Ignoring spreads and taxes:

Sell cash covered puts: get premium, lose all stock upside, exposed to any drop below strike

Sell share covered calls: get premium, lose any stock upside beyond strike, exposed to all stock downside

Not sure I agree with this part, Maybe you can explain a little more. I would think if the stock is going up then covered calls are highly risky. Similarly if you think the stock is going down then BPS would be risky

If you think the the stock will go up: CC

If you think it will go down: puts

Of course, strike and premium play into it. If you sell a put and the stock goes up less than the premium, you're still ahead. Same, but opposite, for calls.

DITM is cash up front, but premium gain is less than strike movement.

samppa

Active Member

Not really related to Tesla or selling options, but I rather post here than in the mess of the main thread:

I bought some shares of Sono, they ipoed yesterday. I like the Sion, and like how they appoach development. Valuation is still reasonable, not something nuts like Rivian.

I bought some shares of Sono, they ipoed yesterday. I like the Sion, and like how they appoach development. Valuation is still reasonable, not something nuts like Rivian.

Solar on Every Vehicle | Sono Motors

Sono Motors will integrate its solar technology exclusively into third-party vehicles. However, the Sion program will be terminated.

sonomotors.com

This was as regards straight sells, not spreads.Not sure I agree with this part, Maybe you can explain a little more. I would think if the stock is going up then covered calls are highly risky. Similarly if you think the stock is going down then BPS would be risky

If stock goes up, the risk is having less gain than not having sold the call. On a sold call, this occurs if stock goes above strike + premium. On a sold put, this occurs at current price + premium (ignoring strike vs price share count adjustment) .

However, for each dollar of strike increase you get less than a dollar of premium. So OTM calls may work out better than ITM puts (less premium, but less miss out on a climb).

This was as regards straight sells, not spreads.

If stock goes up, the risk is having less gain than not having sold the call. On a sold call, this occurs if stock goes above strike + premium. On a sold put, this occurs at current price + premium (ignoring strike vs price share count adjustment) .

However, for each dollar of strike increase you get less than a dollar of premium. So OTM calls may work out better than ITM puts (less premium, but less miss out on a climb).

But... you said if you sell a put you expect the stock price to go DOWN. At best, that's playing with fire! It may be that you'll maximise theoretical dollars if the stock price goes down a tiny bit, but then if it goes past your put strike, oops.

I think over the longer term you'd be much better off selling the put, watching the stock price rise and letting it expire, selling a higher-price put, rinse and repeat. You'll rake in a lot of premium over time, and it still works when the stock price levels off. You're only in trouble if there's a big/lasting dip. Which feels like the opposite of what you're saying?

I guess you're talking about the very short-term and small stock price movements, and I'm thinking of how the stock behaves, say, over the course of a year while you're selling weekly options all the while?

scubastevo80

Member

Unbelievable that in the matter of a $10 swing, I watched my BCS $1200/$1300 for 11/26 go from being down 100% to down 200% around the open, and now have dropped back to just over 100% (these were the ones I wrote at the top of the first leg up on 11/16). I'm not concerned about my options for next week but still trying to learn how to better time all of this to take advance of increased IV.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K