My goal is to not have CC overnight Monday into Tuesday. China weekly numbers should be much higher this week with fewer exports now. Maybe open new positions Tuesday if numbers disappoint or don't cause a bump.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

R

ReddyLeaf

Guest

Interesting times ahead, though I still believe that the SP stays depressed through EOY (I originally thought $160 was the target, now I’m not so sure and maybe it’s $145-$150). Several things I’ve been looking at that have me worried, in both directions so I continue to have 12/30 -c160/-p160 strangles because I can’t predict the SP.Interesting that is the case, and CC premiums up to +15% and 3 weeks are so paltry — reinforces my inclination to stay away and enjoy having zero open CC for the holiday period. We’ll see if there is any SP movement by end-Jan re Jan2 P&D and ~Feb2 ER.

Negatives:

Still two weeks left for tax-loss selling, lots of TSLA losses this year.

Macros (amazingly negative and prescient YouTube trader)

Strange options: 12/23 p150-c160; 12/30 p145,p150,p160, no significant calls; additional future options just added at $1 increments BELOW $150, but NOT above (Hmmmm, suggests MMs know something). Massive number (43k) 2/17/23 $70 puts traded Friday. Hedge or attempted bear raid???? Insider information?

Positives:

Lots of 1/6 calls at 200, no real puts (maybe not significant). Also elevated IV, but that might just be for expected Jan 2nd IRA buying.

1/20/23 Real MaxPain is just below 200. Lots of puts below.

3/17/23 Massive increase in IV showing on MaxPain (in 120s vs 60s for earlier dates). Could someone @Yoona @dl003 with real tools verify? What do the MMs know or is this because it’s a quarterly? April is also elevated, but not May, June.

Be safe, GLTA, and help others less fortunate. Happy Holidays.

Edit: Perhaps $140 at the 0.618 Fibonacci level by EOY.

Last edited by a moderator:

Since I last posted the chart, TSLA is so far still respecting 3 out of 5 supports:

Blue falling wedge. This is IMO the strongest out of the 4. Just like I've never seen a true break upward from a rising wedge, neither have I ever seen a true break downward from a falling wedge unless (a) something seriously wrong with the fundamentals or (b) a severe market crash is starting next week. Let's pray it's not the latter since I don't think there's anything wrong with the fundamentals.

Purple rounding bottom. This pattern is a bit less frequently encountered than falling/rising wedges. Rounding bottoms often coincide with bullish divergence on the RSI and MACD. In this case, you can see that RSI and MACD haven't made new lows even though this low in the SP is 10% lower than the last. Rounding bottoms are also a bit more arbitrary by themselves. However, coupled with bullish divergences, I expect that the severity of the decline should slow substantially. We have P&D on tap in 2 weeks so you could say that shorts are playing with fire here.

Black support trendline running from Feb low. As of close on Friday, we haven't broken below. While the same thing can't be said about the AH, I give much less weight compared to what actually happens during trading hours.

Sadly, we've officially closed below the 200 WMA at 164 and 0.618 all time fib retracement at 157. This is the first time it's happened since June 2019.

What am I doing?

I think this is the time to deploy your capital into more shares if you can. If the market crashes, so be it. CSP also works. As for CC's, I want to be very cautious here. This low is nothing like those we've seen in the last 3 years. If I have to use 1 word to describe it, it will be "unthinkable." A rally backed by real fundamental news from this low can be just as ridiculous as the crash. 2 examples:

TSLA in June 2019. After bottoming out way below the 200 WMA, TSLA rallied 50% in 2 months without doing the minimum 50% retracement. Only the daily 200 SMA was able to stop the rally and force a consolidation. If it happens again and you're stuck with a 180 CC, you'll be in a world of hurt. We have endured so much pain to get to this point. Don't lose your shares here.

NVDA in 2022. After bottoming out slightly below the 0.618 all time fib retracement at 135, much like TSLA, as well as undercutting its 200 WMA at 130, also like TSLA, NVDA has been on a 50% rally without any substantial consolidation.

So, be careful out there. I can't guarantee it's going to shoot up from here, but the the damage caused by an ITM CC at this point is too high. If you can, take the next 2 weeks off. Be with your family. We've got some celebrating to do on 1/2/2023.

Blue falling wedge. This is IMO the strongest out of the 4. Just like I've never seen a true break upward from a rising wedge, neither have I ever seen a true break downward from a falling wedge unless (a) something seriously wrong with the fundamentals or (b) a severe market crash is starting next week. Let's pray it's not the latter since I don't think there's anything wrong with the fundamentals.

Purple rounding bottom. This pattern is a bit less frequently encountered than falling/rising wedges. Rounding bottoms often coincide with bullish divergence on the RSI and MACD. In this case, you can see that RSI and MACD haven't made new lows even though this low in the SP is 10% lower than the last. Rounding bottoms are also a bit more arbitrary by themselves. However, coupled with bullish divergences, I expect that the severity of the decline should slow substantially. We have P&D on tap in 2 weeks so you could say that shorts are playing with fire here.

Black support trendline running from Feb low. As of close on Friday, we haven't broken below. While the same thing can't be said about the AH, I give much less weight compared to what actually happens during trading hours.

Sadly, we've officially closed below the 200 WMA at 164 and 0.618 all time fib retracement at 157. This is the first time it's happened since June 2019.

What am I doing?

I think this is the time to deploy your capital into more shares if you can. If the market crashes, so be it. CSP also works. As for CC's, I want to be very cautious here. This low is nothing like those we've seen in the last 3 years. If I have to use 1 word to describe it, it will be "unthinkable." A rally backed by real fundamental news from this low can be just as ridiculous as the crash. 2 examples:

TSLA in June 2019. After bottoming out way below the 200 WMA, TSLA rallied 50% in 2 months without doing the minimum 50% retracement. Only the daily 200 SMA was able to stop the rally and force a consolidation. If it happens again and you're stuck with a 180 CC, you'll be in a world of hurt. We have endured so much pain to get to this point. Don't lose your shares here.

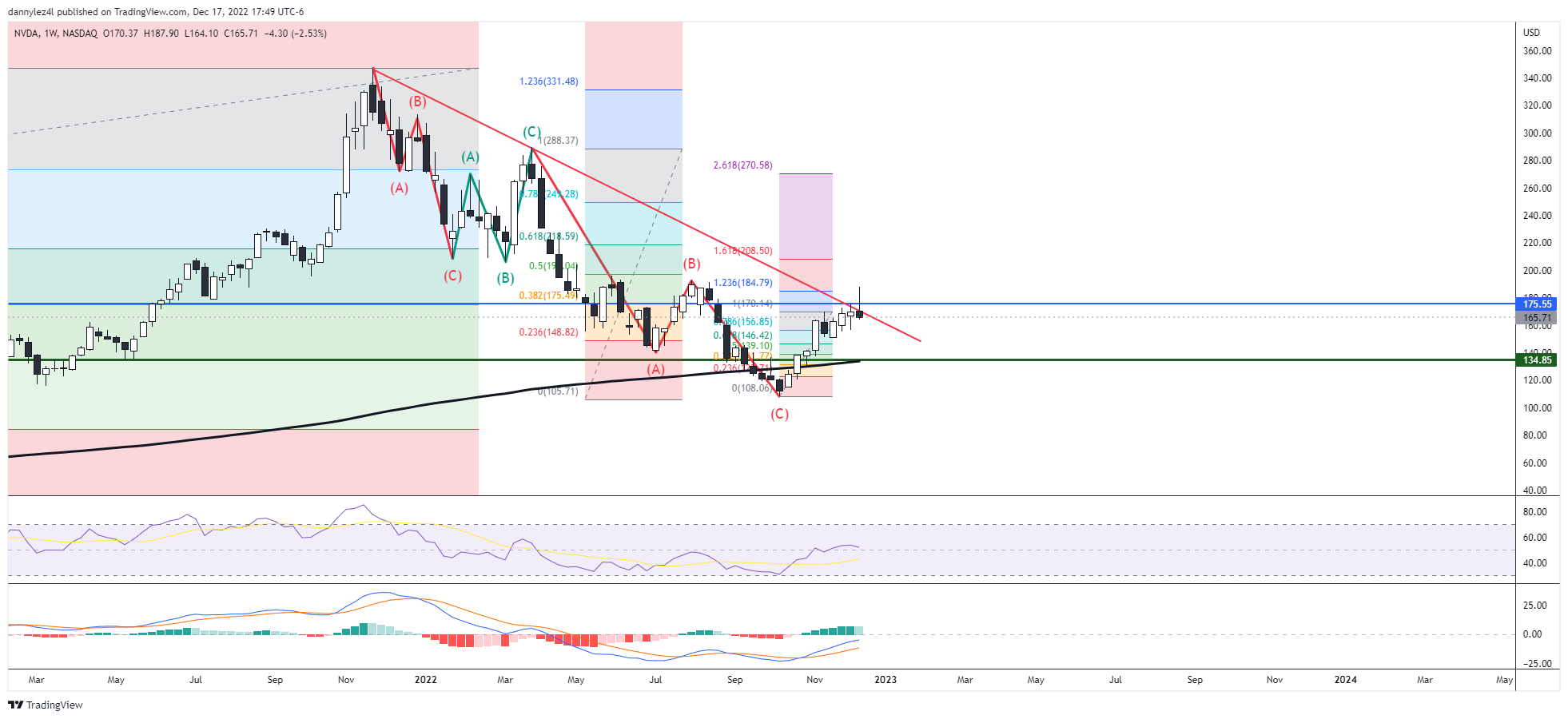

NVDA in 2022. After bottoming out slightly below the 0.618 all time fib retracement at 135, much like TSLA, as well as undercutting its 200 WMA at 130, also like TSLA, NVDA has been on a 50% rally without any substantial consolidation.

So, be careful out there. I can't guarantee it's going to shoot up from here, but the the damage caused by an ITM CC at this point is too high. If you can, take the next 2 weeks off. Be with your family. We've got some celebrating to do on 1/2/2023.

A question on early assignment of a BPS... if you want to just re-open the position by selling the assigned shares and reselling the short put, do you need to do this in a single trade ticket? Or should you do one of those before the other?

I don't see any reason why, but just want to make sure I don't get stuck if it happens to me soon.

I don't see any reason why, but just want to make sure I don't get stuck if it happens to me soon.

OptionsGrinder

Member

whoa in that NVDA example it actually went down to $108 (~20% below the all-time 0.618)… if that were to happen with TSLA we’d be looking at the mid $130’s … and it spent a few weeks below the .618 tooSince I last posted the chart, TSLA is so far still respecting 3 out of 5 supports:

Blue falling wedge. This is IMO the strongest out of the 4. Just like I've never seen a true break upward from a rising wedge, neither have I ever seen a true break downward from a falling wedge unless (a) something seriously wrong with the fundamentals or (b) a severe market crash is starting next week. Let's pray it's not the latter since I don't think there's anything wrong with the fundamentals.

Purple rounding bottom. This pattern is a bit less frequently encountered than falling/rising wedges. Rounding bottoms often coincide with bullish divergence on the RSI and MACD. In this case, you can see that RSI and MACD haven't made new lows even though this low in the SP is 10% lower than the last. Rounding bottoms are also a bit more arbitrary by themselves. However, coupled with bullish divergences, I expect that the severity of the decline should slow substantially. We have P&D on tap in 2 weeks so you could say that shorts are playing with fire here.

Black support trendline running from Feb low. As of close on Friday, we haven't broken below. While the same thing can't be said about the AH, I give much less weight compared to what actually happens during trading hours.

Sadly, we've officially closed below the 200 WMA at 164 and 0.618 all time fib retracement at 157. This is the first time it's happened since June 2019.

View attachment 886198

What am I doing?

I think this is the time to deploy your capital into more shares if you can. If the market crashes, so be it. CSP also works. As for CC's, I want to be very cautious here. This low is nothing like those we've seen in the last 3 years. If I have to use 1 word to describe it, it will be "unthinkable." A rally backed by real fundamental news from this low can be just as ridiculous as the crash. 2 examples:

TSLA in June 2019. After bottoming out way below the 200 WMA, TSLA rallied 50% in 2 months without doing the minimum 50% retracement. Only the daily 200 SMA was able to stop the rally and force a consolidation. If it happens again and you're stuck with a 180 CC, you'll be in a world of hurt. We have endured so much pain to get to this point. Don't lose your shares here.

View attachment 886203

NVDA in 2022. After bottoming out slightly below the 0.618 all time fib retracement at 135, much like TSLA, as well as undercutting its 200 WMA at 130, also like TSLA, NVDA has been on a 50% rally without any substantial consolidation.

View attachment 886204

So, be careful out there. I can't guarantee it's going to shoot up from here, but the the damage caused by an ITM CC at this point is too high. If you can, take the next 2 weeks off. Be with your family. We've got some celebrating to do on 1/2/2023.

Last edited:

EVNow

Well-Known Member

If you are handy with a spreadsheet I can post the spreadsheet I use. You can vary SP, dates, DTE, IV etc etc. Calculate a number of different variations are the same time etc. Imagination is the only limit. let me know.I debit rolled Jun '24 -383.33p spreads to Jan '25 -290p , same width. Before roll they were $1-2 extrinsic, now have 7 or so. I don't know how long that buffer will last. Which greek (s) would be best to calculate projected extrinsic at SP 140, 130, etc. Is it possible?

Just sell the shares. Then you can do a 3 leg trade to sell the new long put, and roll the short put. I tried timing it with SP movement (sell shares high, roll low) but that has not worked out well....A question on early assignment of a BPS... if you want to just re-open the position by selling the assigned shares and reselling the short put, do you need to do this in a single trade ticket? Or should you do one of those before the other?

I don't see any reason why, but just want to make sure I don't get stuck if it happens to me soon.

So did you have to sell the 1500 shares at $150?Had all my Jan 2025 430p assigned Thursday too. Sold back the 1500 shares and Sold Jan 2025 380p.

Now I have more than 50k on margin to pay with selling agressive CCs and working more! How fun!

If the stock rockets and I have to roll my 155CCs to Jan2024 at 410 strike price for the same $3.50 premium this would mean all my underwater puts would expire worthless, I would have lost no shares to margin call and would again have the hesitation to retire.Since I last posted the chart, TSLA is so far still respecting 3 out of 5 supports:

Blue falling wedge. This is IMO the strongest out of the 4. Just like I've never seen a true break upward from a rising wedge, neither have I ever seen a true break downward from a falling wedge unless (a) something seriously wrong with the fundamentals or (b) a severe market crash is starting next week. Let's pray it's not the latter since I don't think there's anything wrong with the fundamentals.

Purple rounding bottom. This pattern is a bit less frequently encountered than falling/rising wedges. Rounding bottoms often coincide with bullish divergence on the RSI and MACD. In this case, you can see that RSI and MACD haven't made new lows even though this low in the SP is 10% lower than the last. Rounding bottoms are also a bit more arbitrary by themselves. However, coupled with bullish divergences, I expect that the severity of the decline should slow substantially. We have P&D on tap in 2 weeks so you could say that shorts are playing with fire here.

Black support trendline running from Feb low. As of close on Friday, we haven't broken below. While the same thing can't be said about the AH, I give much less weight compared to what actually happens during trading hours.

Sadly, we've officially closed below the 200 WMA at 164 and 0.618 all time fib retracement at 157. This is the first time it's happened since June 2019.

View attachment 886198

What am I doing?

I think this is the time to deploy your capital into more shares if you can. If the market crashes, so be it. CSP also works. As for CC's, I want to be very cautious here. This low is nothing like those we've seen in the last 3 years. If I have to use 1 word to describe it, it will be "unthinkable." A rally backed by real fundamental news from this low can be just as ridiculous as the crash. 2 examples:

TSLA in June 2019. After bottoming out way below the 200 WMA, TSLA rallied 50% in 2 months without doing the minimum 50% retracement. Only the daily 200 SMA was able to stop the rally and force a consolidation. If it happens again and you're stuck with a 180 CC, you'll be in a world of hurt. We have endured so much pain to get to this point. Don't lose your shares here.

View attachment 886203

NVDA in 2022. After bottoming out slightly below the 0.618 all time fib retracement at 135, much like TSLA, as well as undercutting its 200 WMA at 130, also like TSLA, NVDA has been on a 50% rally without any substantial consolidation.

View attachment 886204

So, be careful out there. I can't guarantee it's going to shoot up from here, but the the damage caused by an ITM CC at this point is too high. If you can, take the next 2 weeks off. Be with your family. We've got some celebrating to do on 1/2/2023.

paging the Short Straddle experts...

i had -p175 before EM's selling, which i rolled it into BPS -p160/+p140 this week with credit

i am assuming 12/23 will close 140-160 and i ***THINK*** that is the range the next few weeks

so i decided i just want to get rid of the BPS instead of rolling forever, and start the new year all-cash

what do you think of converting that 12/23 BPS into a 12/23 SS -p150/-c150? i don't care if sp lands on the breakeven 140-160 edges (and i have tiny loss) - i just want the BPS gone

any not-advice is much appreciated

TIA!

i had -p175 before EM's selling, which i rolled it into BPS -p160/+p140 this week with credit

i am assuming 12/23 will close 140-160 and i ***THINK*** that is the range the next few weeks

so i decided i just want to get rid of the BPS instead of rolling forever, and start the new year all-cash

what do you think of converting that 12/23 BPS into a 12/23 SS -p150/-c150? i don't care if sp lands on the breakeven 140-160 edges (and i have tiny loss) - i just want the BPS gone

any not-advice is much appreciated

TIA!

Last edited:

R

ReddyLeaf

Guest

You typically need to sell the shares first. Depending on your account setup and margin position, you may get a maintenance margin shortfall if you try to sell the Puts first.A question on early assignment of a BPS... if you want to just re-open the position by selling the assigned shares and reselling the short put, do you need to do this in a single trade ticket? Or should you do one of those before the other?

I don't see any reason why, but just want to make sure I don't get stuck if it happens to me soon.

If there is some time value left on the BPS, then selling both the shares and P+ should get you this time value back. If you sell the shares and then sell the P+ at a lower stock price, then you effectively gain the difference in profit. For example, 10xP-/1000 shares assigned, sell the shares at $160 and then the P+ at $158, will gain you around an extra $2k profit. It doesn't matter what the price is, just the differential between when you sell the shares and P+. The danger of course is that the share price can rocket up after you sell the shares and the P+ loses value resulting in a significant extra loss. So timing can be critical and I usually try to sell both during a strong downtrend (eg MMD).

The other option and possibly the safest is to early exercise the P+ through your broker. This closes the P+ and sells the shares in one go but does result in any remaining time value being lost.

strago13

Member

My plan for tomorrow is that I will do the following:

Sell XXX shares that are under water this year for tax harvesting loss purposes

BTC XX Jun 2024 367 puts

STO XX Jan 2025 270 puts

STO XX Jan 2025 350 CC on all my shares

Buy XX Jan 2025 220 leaps

This would get me out of my current set of problems, increases my margin, pays my massive tax bill, pushes off escaping a forced liquidation and assignment of a bunch of the Jun 2024's, I and also gives me a bit of upside of we rally hard, give me time to get the cash to secure the 270's. Most importantly, it also protects my long term shares. I recognize I am now introducing the CC, but that is a price I would be happy to part with my shares at. Additionally, I would be able to roll out if necessary. Effectively, I would now have a 270-350 straddle.

Anyways, just some thoughts for others in the same predicament as me.

Any other ideas?

Sell XXX shares that are under water this year for tax harvesting loss purposes

BTC XX Jun 2024 367 puts

STO XX Jan 2025 270 puts

STO XX Jan 2025 350 CC on all my shares

Buy XX Jan 2025 220 leaps

This would get me out of my current set of problems, increases my margin, pays my massive tax bill, pushes off escaping a forced liquidation and assignment of a bunch of the Jun 2024's, I and also gives me a bit of upside of we rally hard, give me time to get the cash to secure the 270's. Most importantly, it also protects my long term shares. I recognize I am now introducing the CC, but that is a price I would be happy to part with my shares at. Additionally, I would be able to roll out if necessary. Effectively, I would now have a 270-350 straddle.

Anyways, just some thoughts for others in the same predicament as me.

Any other ideas?

AquaY

Member

No. And Maybe.Close=150.23 but 149.76 AH, does that mean -p150 lost today? (for those who didn't BTC)

Closing pirce is used by the OCC , under the CBOE for automatic assignments but someone may exercise their long puts after hours if they wish to do so.

So they would not be automatically assigned but someone may decide to do so after hours , up to 5:30PM

The stock market closes at 1600 NY Time ( 4:00 PM) and the closing price is used by the OCC for automatic exercising of options.I thought options could be exercised for 1-2 hours after market close, so the battle may not be over

The OCC allows up to 1730 hours ( 5:30 PM NY Time) for notification of exercise.

So, if someone likes to personally use the AH prices for their decesion processimng they have until 5:30 NY Time to do so.

EVNow

Well-Known Member

I debit rolled Jun '24 -383.33p spreads to Jan '25 -290p , same width. Before roll they were $1-2 extrinsic, now have 7 or so. I don't know how long that buffer will last. Which greek (s) would be best to calculate projected extrinsic at SP 140, 130, etc. Is it possible?

Here. I found the original sheet - so I don't have to cleanup my sheet and post. (ps : I downloaded this 4 years back and then it was clean .... so, as with any download make sure you have your anti-virus turned on and scan it.)

Free Excel Black-Scholes Model Template Download

Need to calculate some puts and calls? The Spreadsheet Shoppe has got you covered! Our Black-Scholes Model spreadsheet is free to download and easy to use!

EVNow

Well-Known Member

Problem is that this thread is fundamentally about short-term...

Considering converting some shares to ITM LEAP calls and do poor man's covered calls on the weekly. Anyone else had success with this or considering it at this time?

It's takes a lot more management than share covered calls and take into account that the long LEAP might be ITM now, but could go OTM and stay there - and yeah, "unlikely", right, that's that's exactly what I thought with my my Jan 24 -c233's, almost worthless more than one year out

EVNow

Well-Known Member

True .... but atleast we can avoid leverageProblem is that this thread is fundamentally about short-term...

ps : Funny thing is LEAPS are long term but leveraged ...

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K