The brokerage does whatever it feels like when liquidating. You are probably better off deciding for yourself what you want to happen.STO at close -c $160 x 10 @ $0.25. This is so sickening. I'm probably going to get margin called around sp: $136.

I've been a lurking for a while and it's brought me a bit of comfort to read all your past experiences as we've fallen. Expensive lesson with margin. I remember the euphoria and thinking we'd never crash this hard. Thankfully I de-leveraged by about 50% when CGS started his synthetic shorts. I followed him with a few contracts of my own but closed way too early (still for a profit). Never thought we'd hit these levels without some serious fundamental changes and I would have just adjusted position if those ever occurred. Well here we are.

Curious, if/when we drop below $136 tomorrow, will TD just start liquidating my shares to keep margin % above maintenance requirements?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I feel like the SP has even exceeded the expectations of TSLAQ and that’s saying something.

Where are the buybacks? I deployed some of my dry powder today but surprised by this action.

What is interesting to see is stocks like AMZN(bloated PE) and META hold up like champs.

If its not Elon this time it has to be someone big. I just don’t think the shorts have this much courage. Did Leo throw in the towel? Where are the buybacks. Pretty crazy, just hang in there folks.

Edit: Maybe this is Elon selling again, he is back with his securities analysis 101 cop out lol.

Where are the buybacks? I deployed some of my dry powder today but surprised by this action.

What is interesting to see is stocks like AMZN(bloated PE) and META hold up like champs.

If its not Elon this time it has to be someone big. I just don’t think the shorts have this much courage. Did Leo throw in the towel? Where are the buybacks. Pretty crazy, just hang in there folks.

Edit: Maybe this is Elon selling again, he is back with his securities analysis 101 cop out lol.

Last edited:

Xepa777

Member

We're closing < $140 today, the selling pressure is relentless.

I am completely defeated here. I dont understand how a companies stock has lost > 50% of its value in less than 3 months. The only negative news is really the "miss" in Q3, Elon selling and the Twitter purchase. The Q3 delivery miss is somewhat related to the fundamentals of the company, but certainly not 50%. So I can rationalize a 15% haircut, but 50%? Makes it almost impossible to trade except to sell CC, until it isnt.

This price action has me questioning whether or not it WAS a bubble. There doesnt seem to be a floor, we're well below any technical support level. Is this just the opposite of what we experienced in 2021?

I keep hearing a fast recovery, but I am just not seeing it. It seems like Wall Street is deciding to revalue TSLA.

Bro, this is fear talking. This is a company with a PE ratio that's going to be in the 20s next month and an annual growth of 40-50% YoY for the next 4-5 years, and a legislative bill that's going to increase the margin power of most Tesla vehicles by over 15%. The company has billions in cash and can initiate a stock buyback with all excess cash. And real engineering moats with a multi-year lead.

2019 was significantly worse because after Q1 2019 and Elon saying Tesla would close all the physical stores in the US, you really could question the total demand / addressable market. This is not that. This is noise.

12/23 -p160/+p140 rolled again into same day 12/23 -p145/+p135/-c170/+c190, 0.57 credit

OTM probability now 61% instead of 17% last week

deployed a lot of cash to make this trainwreck hopefully die this week, all that work just to rescue what was in the beginning a -p175 before EM's selling

OTM probability now 75% instead of 17% last week

today's Close=137.80 supported by today's 1.618 fib extension 137.70

next supp i can find is

- weekly 1.618 fib 133.40 then 120.53

- daily 1.414 fib 136.40 then 133.40 then 125.33

Last edited:

Reasonable 21 per option. Break even of 230 15 months from now.208 strike in March 2024...

With a FED pivot in late 2023 and TSLA earnings going up that might be hit much sooner.... or not.

Personally been buying Jan 25 200 and 180 strikes. Already down a boatload!

Yeah, it's better than the poop in my portfolio, but I was expecting to see some short term play and figured I'd save others the effort of extracting the data.Reasonable 21 per option. Break even of 230 15 months from now.

With a FED pivot in late 2023 and TSLA earnings going up that might be hit much sooner.... or not.

Personally been buying Jan 25 200 and 180 strikes. Already down a boatload!

Break even on the trade is $230 at expiration.

Break even versus equivalent value of stock is $245.

I'm positioning though for the company results / financials to outweigh macros, at least up into the 200-250 range - I'll be unwinding some of my long stock and long leaps in that 200-250 range almost certainly (if we get there); I probably don't sell any cc until we're back in a 170ish range share price (or extended period at lower share price.

My sentiments and plan too on both range and cutting 2,800 shares at $250 if/when we get there. That’ll get me completely out of margin and bring in some cash to replenish what I’ve been burning on *SUGAR* puts to keep from a margin and maintenance call, and margin interest.

I don’t even bother playing with other stocks or put/calls much, my goal is only to survive now.

Godspeed to all of us!

STO at close -c $160 x 10 @ $0.25. This is so sickening. I'm probably going to get margin called around sp: $136.

I've been a lurking for a while and it's brought me a bit of comfort to read all your past experiences as we've fallen. Expensive lesson with margin. I remember the euphoria and thinking we'd never crash this hard. Thankfully I de-leveraged by about 50% when CGS started his synthetic shorts. I followed him with a few contracts of my own but closed way too early (still for a profit). Never thought we'd hit these levels without some serious fundamental changes and I would have just adjusted position if those ever occurred. Well here we are.

Curious, if/when we drop below $136 tomorrow, will TD just start liquidating my shares to keep margin % above maintenance requirements?

Huge reversal…

I have just enough money from my last paychecks to cover my 30k margin call tomorrow morning. The problem is that I kept that money to pay my annual taxes bill on January.

So I either transfer money, cover my margin call and delay the payment of my taxes for couples weeks. Or I liquidate TSLA shares and cover my margin call.

Pay my broker or pay the taxman?

Huge reversal…

I have just enough money from my last paychecks to cover my 30k margin call tomorrow morning. The problem is that I kept that money to pay my annual taxes bill on January.

So I either transfer money, cover my margin call and delay the payment of my taxes for couples weeks. Or I liquidate TSLA shares and cover my margin call.

Pay my broker or pay the taxman?

Just introduce your broker to the taxman and let them fight it out

In all seriousness are you able to buy some Puts to relieve some margin requirements, like 1/6/23 $140 P.

On my account every $500 spent on near the money puts frees up about $4,500 of requirement. Been helpful when I have been liquid enough to put more money in.

juanmedina

Active Member

Cory calling for a Santa rally and for Tesla he thinks we might get close to $197

Last edited:

So tomorrow I liquidate all my portfolio and buy 195 Calls expiring 2 weeks out?Cory calling for a Santa rally and for Tesla he thinks we might get close to $197

Last edited:

JSML

Member

A few comments. In order to sell options you need a margin account, they won’t let you do it with a cash account.you can do that, but you'll need margin or cash to cover the difference between the lower short strike and the higher long strike. E.g., if you have $200 long call and a $150 short call, you'll need 100 x 50 = $5000 in margin/cash, and you need to be prepared to lose this money should the short call be assigned

Margin calculations is different then cash calculations so you won’t need the full difference in strikes x contracts of margin when you open the covered call.

intelligator

Active Member

Blah, just blah. A 12/23 +130/-135 BPS wasn't safe, who would have thought? I may have some fallout in the morning. Last I looked, there was very little margin available for trading, I expect Fidelity will take action if I can't get in there first. GLTA!

EDIT: 12/23 +130/-135p - Thx @Yoona

EDIT: 12/23 +130/-135p - Thx @Yoona

Last edited:

-130/+135 or +130/-135?Blah, just blah. A 12/23 -130/+135 BPS wasn't safe, who would have thought? I may have some fallout in the morning. Last I looked, there was very little margin available for trading, I expect Fidelity will take action if I can't get in there first. GLTA!

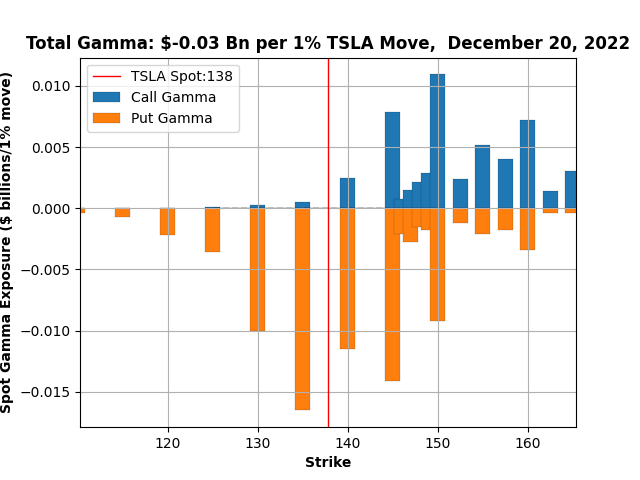

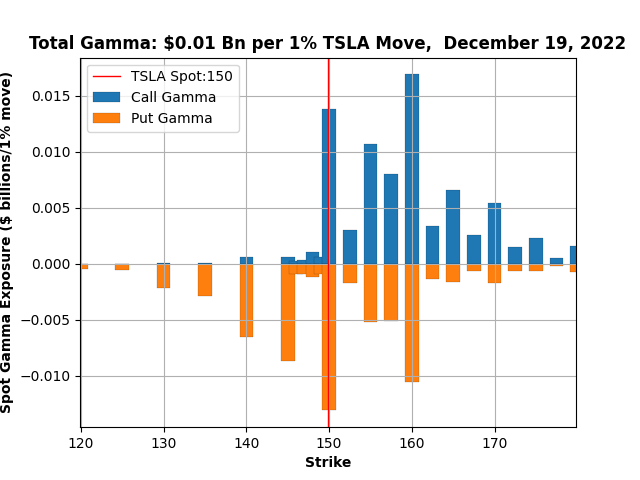

View attachment 887284 View attachment 887285

At this point I think there is better chance of hitting 97 lol.Cory calling for a Santa rally and for Tesla he thinks we might get close to $197

AimStellar

Member

Learn from my mistake. If you are in a margin call, take action before your brokerage does.

I had a margin call due today that could have been covered by selling 300 shares.

Instead of selling the 300 shares at the open, I opted to wait and see if we bounced with the rest of the market.

At 11am, I received a Fidelity notification “Trade request received.” Fidelity sold 2,800 shares when 300 would have done the trick.

I had a margin call due today that could have been covered by selling 300 shares.

Instead of selling the 300 shares at the open, I opted to wait and see if we bounced with the rest of the market.

At 11am, I received a Fidelity notification “Trade request received.” Fidelity sold 2,800 shares when 300 would have done the trick.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K