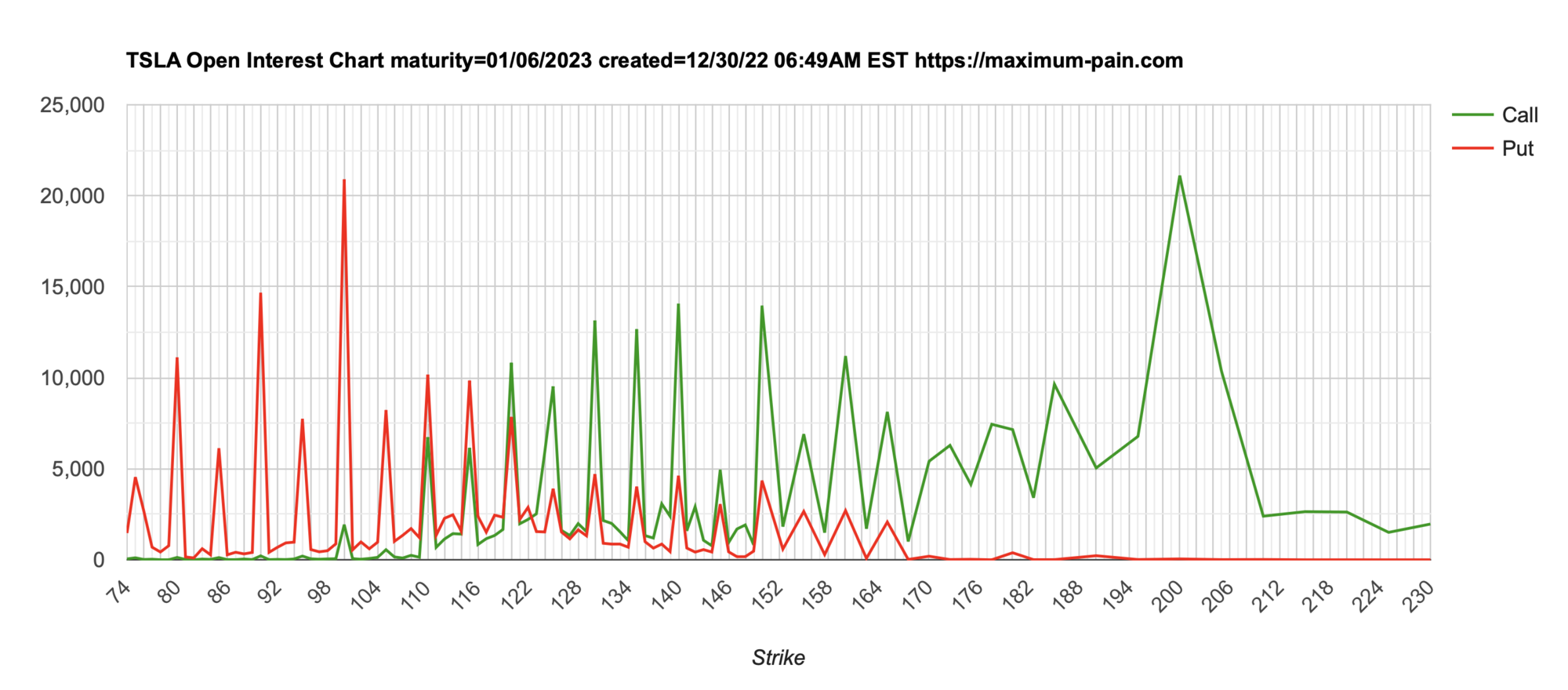

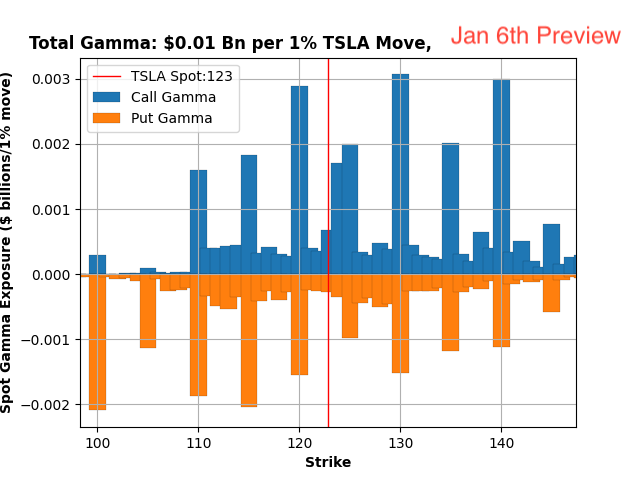

Heads-up, the OTM puts beginning to accumulate for 6th Jan expiry:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

CGS thinking it’s a dead cat bounce since there was no consolidation phase down to signal a bottom.

Some other saying it’s not dead at bounce because volume is high so a lot of buyers stepping in.

Cory from stocks channel calling for a rally to 173 or even 196 because we just saw full blown capitulation so now buyers can step in

MauroBianchi calling for W-4 wave flushing to $80 and got a target in the 70-80 zone for March, pretty much like CGS

I wonder what @dl003 sees with technical analysis as the predictions are all over the charts!

$120 on a buy-write on $115 shares, looks like rock and roll! Would be amazing to see $150!Has anyone opened any CC's for next week. I am thinking about 155-150's? I might wait until tomorrow.

1) The minimum CC strike is $60Thanks for your post; excellent opportunity to clarify the strategy in my mind:

1) You bought a 60c LEAP for $70 -

does this mean your minimum CC strike is $130 ($60+70)?

2) If you sell a LEAP based $150c and the SP blows through it -

what is the management strategy - buy it back? rolling? cash in the LEAP?

3) As the Expiration approaches,

do you roll it, exercise it, sell it…?

4) The pros seem good enough; if I went ALL IN,

what are the cons to having a ONLY LEAPS portfolio?

Taxes? Risks? Liquidity? Leverage?

2) I'll roll one week out or up a little bit. As I mentioned, 150-160 resistance is very hard to break within 1 week. Especially when the stock jump all the way from 108-150 (almost 50%), it has to have some kind of exhaustion before going anywhere. Worst case scenario, I will cash the LEAP and let my shares go.

3) If you're asking when the LEAP expiration approaches, I might just STC 6-9 months before that date.

4) @adiggs and @Max Plaid got excellent points. I don't really have an answer as this is just an experiment for me.

Hope that helps.

Last edited:

A word of caution. TSLA can and has done in the past what you are saying can't happen.1) The minimum CC strike is $60

2) I'll roll one week out or up a little bit. As I mentioned, 150-160 resistance is very hard to break within 1 week. Especially when the stock jump all the way from 108-150 (almost 50%), it has to have some kind of exhaustion before going anywhere. Worst case scenario, I will cash the LEAP and let my shares go.

3) If you're asking when the LEAP expiration approaches, I might just BTC 6-9 months before that date.

4) @adiggs and @Max Plaid got excellent points. I don't really have an answer as this is just an experiment for me.

Hope that helps.

Most recently last year - with the announcement of Hertz buying a couple of cars... Then we ran wayyyy past all resistance in a Gamma squeeze up.

It can and will happen again, but these are the types of problems we hope to have.

Just this month we have experienced a Gamma squeeze down - going from $200+ down to $106.. most of us here didn't think that would happen either.

Just be safe - and that is advice.

A word of caution. TSLA can and has done in the past what you are saying can't happen.

Most recently last year - with the announcement of Hertz buying a couple of cars... Then we ran wayyyy past all resistance in a Gamma squeeze up.

It can and will happen again, but these are the types of problems we hope to have.

Just this month we have experienced a Gamma squeeze down - going from $200+ down to $106.. most of us here didn't think that would happen either.

Just be safe - and that is advice.

I close my 6/1 129CCs at the end of the 28th when I converted all my shares to LEAPS. If we have a squeeze up that be the best time in history for me

CrunchyJello

Member

? You can make money by1) The minimum CC strike is $60 ...

(a) buying the $60 LEAP call for $70, and

(b) selling it for $60 ??

Those LEAPS must be doing very nicely @OrthoSurg

TSLA swimming against the tide once again, whales still feeding? If I'd shorted below this price I'd be quite concerned right now...

I have 26x -c150's expiring today, I'm not expecting they'll come into play

TSLA swimming against the tide once again, whales still feeding? If I'd shorted below this price I'd be quite concerned right now...

I have 26x -c150's expiring today, I'm not expecting they'll come into play

intelligator

Active Member

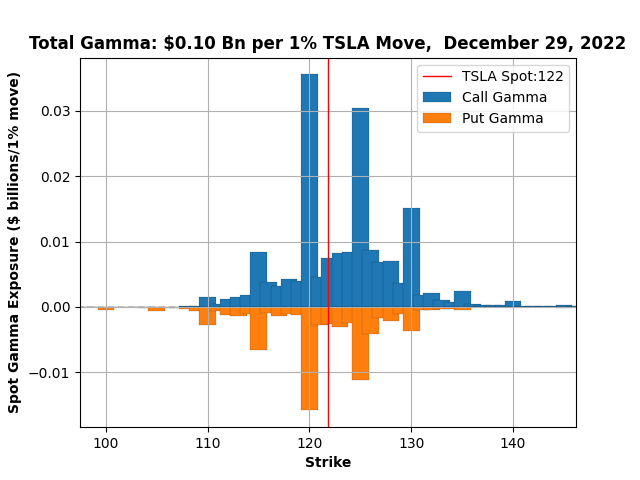

Yesterday we had continued inflow between 120 and 130. As another data point, here's a peak at next week based on Thursday night options pricing data.

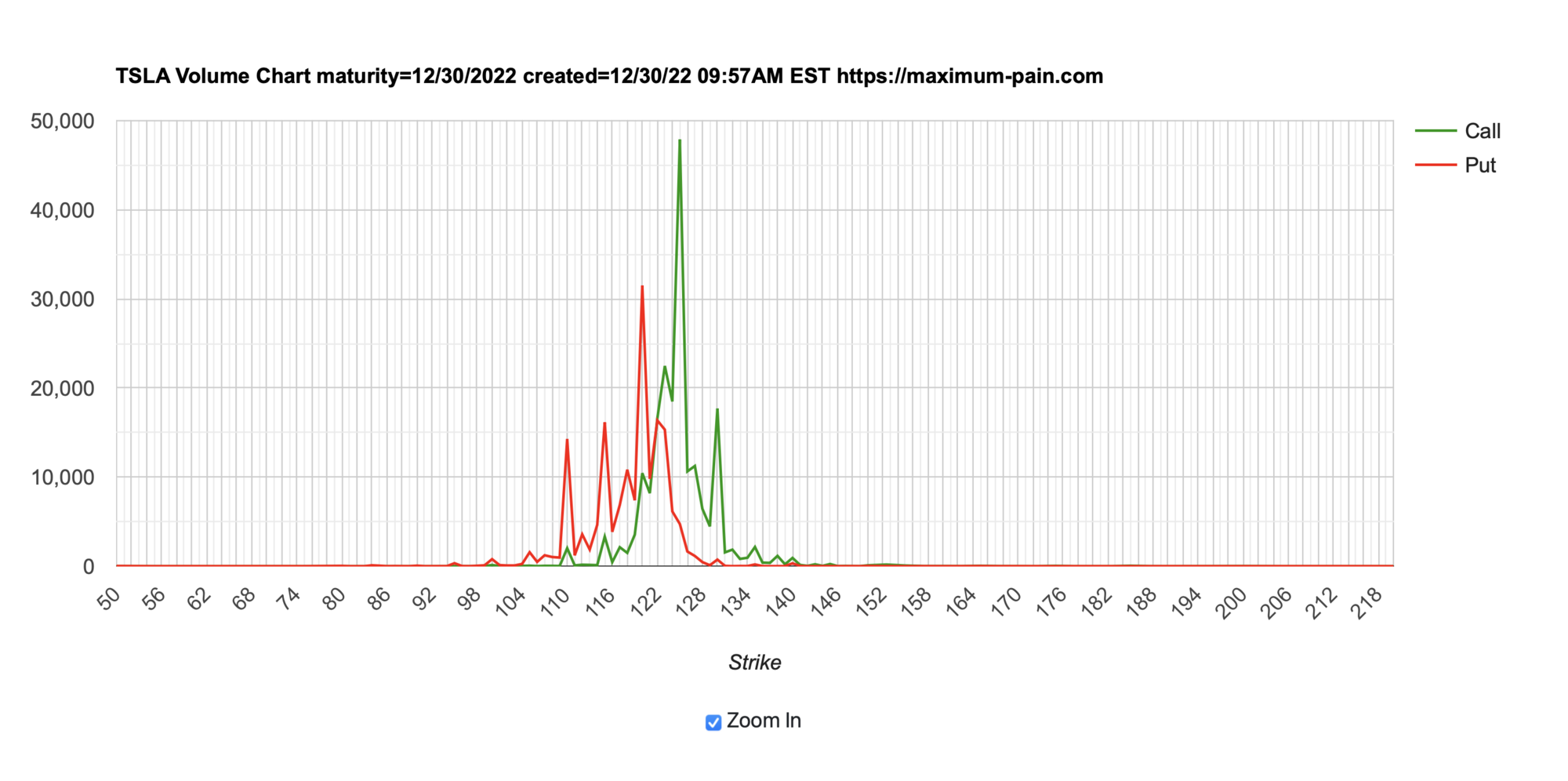

All happening at c125 so far today, looking like this week's shitputs are all going to expire worthless, a battle may be won, but the war not yet..

MM's/Hedgies/Wedgies would likely love to pin 120 at close...

MM's/Hedgies/Wedgies would likely love to pin 120 at close...

hope for the best, plan for the worst

instead of letting it expire, i rolled my 12/30 -c109 temp DITM B/W to 1/6 just in case red next week; purpose is to milk it some more

if green, ok to lose the shares

instead of letting it expire, i rolled my 12/30 -c109 temp DITM B/W to 1/6 just in case red next week; purpose is to milk it some more

if green, ok to lose the shares

The market has already set up for a buy the news on the P and D. The SP was discounted to disaster.

It will not be a disaster. That would be below 370 deliveries (still a record lol).

400 feels pretty tepid.

420 and above starts looking nice.

A tepid report may allow the market to retest the lows of past week. Don't see how it can break through that without a disaster.

450 and above may send the SP soaring to above 150 FAST (and then we would have gaps to worry about...).

Based on the SP reset of the past month, hard not to tilt bullish for the P and D report. Sell the rumor, right? And boy was it sold...

It will not be a disaster. That would be below 370 deliveries (still a record lol).

400 feels pretty tepid.

420 and above starts looking nice.

A tepid report may allow the market to retest the lows of past week. Don't see how it can break through that without a disaster.

450 and above may send the SP soaring to above 150 FAST (and then we would have gaps to worry about...).

Based on the SP reset of the past month, hard not to tilt bullish for the P and D report. Sell the rumor, right? And boy was it sold...

Dead cat bounce: DCBs lead to lower lows. Just because we haven't seen consolidation doesn't mean we're in a DCB. We may very well go down again to near the low and chop around for a bit. That'd be the consolidation needed. I think we went way past the point of consolidation, though, as this crash in TSLA stock is beyond reasons. Past 160, market participants have had ample time and opportunities to load up on the stock on zero valid fundamental concerns at all so if we have a good P&D, I say we just rocket up from here. No lookie backsie.CGS thinking it’s a dead cat bounce since there was no consolidation phase down to signal a bottom.

Some other saying it’s not dead at bounce because volume is high so a lot of buyers stepping in.

Cory from stocks channel calling for a rally to 173 or even 196 because we just saw full blown capitulation so now buyers can step in

MauroBianchi calling for W-4 wave flushing to $80 and got a target in the 70-80 zone for March, pretty much like CGS

I wonder what @dl003 sees with technical analysis as the predictions are all over the charts!

In term of wave count, I don't agree with Mauro. See, if the market has seen terrible P&D and ER and decided the stock should crash below 160 then yes, we can talk about wave counts which are interpretations followed by predictions of human psychology. In this case, the market hasn't seen P&D or ER. It hasn't seen demand destruction but the deed has already been done. I'm more in Cory's camp. At this point, it's a screaming buy.

intelligator

Active Member

Thinking of liquidating more shares to close out two more DITM BPS, reduces stress, would start the new year with less baggage. Based on Fidelity Margin Calculator, the account value would increase and end with a margin credit, margin interest payments would go away as well. There'd be two remaining positions, a Jan '25 -240/+180 BPS and a Sep '24 -290 CSP. The BPS has good extrinsic to survive down to $100 SP, the CSP doesn't. I need to fix that to avoid shares put to me, introducing another wash sale, losing two ways. Any ideas? I'm not seeing a reasonable way out of it other than rolling down and in some after I clean up the account and get margin back to cover that roll.

decision time for my 12/30 -c122 B/W, cost basis 122... to roll or not to roll, that is the dilemmaAll happening at c125 so far today, looking like this week's shitputs are all going to expire worthless, a battle may be won, but the war not yet..

MM's/Hedgies/Wedgies would likely love to pin 120 at close...

View attachment 890384

if it expires today, i don't want to carry these shares into next week in case P&D is bad

on the other hand, i want these shares moved to next week (good 5.60 credit)

thinking

thinking

Well, they say market only bottoms after most people have given up. This retail (me) had already given up. I stopped checking the SP first thing every morning and accepted it may just go down and I was ok with that. I talked to my SO about temporarily lowering our standard of living for a year or 2. Now we can go up - I say this in the most dispassionately manner possible.

Same here, I had resigned myself to the stock dropping to $60 and spoke to the wife about the situation, we both agreed that it made no sense to sell at these prices and to ride out the stormWell, they say market only bottoms after most people have given up. This retail (me) had already given up. I stopped checking the SP first thing every morning and accepted it may just go down and I was ok with that. I talked to my SO about temporarily lowering our standard of living for a year or 2. Now we can go up - I say this in the most dispassionately manner possible.

So yeah, that for me was a mental capitulation and I stopped stressing about it and kinda started laughing instead

I would say it depends whether you need, or would be more comfortable, with the cash. Otherwise, if it were me, I'd take the credit for the roll and I'd keep rolling them until I couldn't, but that's me and not advice to youdecision time for my 12/30 -c122 B/W, cost basis 122... to roll or not to roll, that is the dilemma

if it expires today, i don't want to carry these shares into next week in case P&D is bad

on the other hand, i want these shares moved to next week (good 5.60 credit)

thinking

thinking

I'm looking for feedback on a diagonal collar to limit short term paper losses financed by writing a medium term call at a higher price. There's still downside risk but a lot of potential upside gains with P&D and ER coming out.

The diagonal collar is free but I've never tried it.

For example, for every 100 TSLA ($122 currently) I buy, I limit SP drop to $110 in Jan with max upside of $165 until April. The loss/gain would be limited to -12/+43 share for Jan / April to combat short term risks. If SP shoots up, I could always roll the April call, but making 34% gains with low downside doesn't sound bad either.

100 TSLA

-165c Apr 21 and +110p Jan 27 = $.20 credit

Opinions?

The diagonal collar is free but I've never tried it.

For example, for every 100 TSLA ($122 currently) I buy, I limit SP drop to $110 in Jan with max upside of $165 until April. The loss/gain would be limited to -12/+43 share for Jan / April to combat short term risks. If SP shoots up, I could always roll the April call, but making 34% gains with low downside doesn't sound bad either.

100 TSLA

-165c Apr 21 and +110p Jan 27 = $.20 credit

Opinions?

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K