Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

Nice lift from the MMD... but may see it stall here. I'm still holding -c167.5/+c157.5 , now tempted to close half.

Lots of money to be made here trading in/out of positions, but impossible as I’m visiting Philadelphia today

So just holding the 167.50 straddles - my risk management is to only have written against 40% of my cash and 20% of my LEAPS - fairly easy to add more contracts in either direction in case of a roll. And if the SP were to really dump then I’ll be delighted to buy back some shares

On the subject of risk, it’s my observation that if you take profit on every trade, even 10% you’ll accumulate very fast, but it’s psychologically difficult

So just holding the 167.50 straddles - my risk management is to only have written against 40% of my cash and 20% of my LEAPS - fairly easy to add more contracts in either direction in case of a roll. And if the SP were to really dump then I’ll be delighted to buy back some shares

On the subject of risk, it’s my observation that if you take profit on every trade, even 10% you’ll accumulate very fast, but it’s psychologically difficult

Last edited:

Update - Sold more $180P's this morning for $15 each....I am sitting on some $180P's sold Friday for $12 each - these are down right now but I am sticking with them.

Definitely do not think Elon is stepping down and there is movement to be had after the AGM - this was part of a Collar that included some $175C's that were bought and got stopped out on lost value at the 12% mark Friday.

Good luck to all - when there is no run up and in fact a sell off before an event - that to me is time for risk on.

At least IV is ticking up today

Gut feeling only - not financial advice.

Giga Shanghai news this morning on both expansion and Model 3 - Freemont model 3 line, lots of good news!

Thank you. I didn't expect a 5 points bounce like that.BTC -P165 5/19 for small gains. Sux to leave 85% on the table but that's the cost of risk management I guess.

Can always hop back in when there's more clarity.

Now TSLA can rally. You're welcome ;- )

Thank you. I didn't expect a 5 points bounce like that.

My pleasure

This stuff really messes with my head. Of course I BTC at lows of the day when TSLA appeared to be breaking down.

Now the question is whether to short here. I'm not, the whole point was to be flat into tonight.

Still holding 170-175 calls and 170 puts. Shareholders meetings have usually been non-events but I think there’s more fear around this one because of the dump we took after Elon sold last year.

Given the stock price performance over the last 1.5 years, I think they want to put their best foot forward today. I don’t see them saving bad news to drop on us, and I’m still holding out hope for a buyback announcement.

Hoping to buy to close some 170c on a dip before end of day. I still think we’re range bound until we have concrete signs of margin improvement but wouldn’t be surprised with a small bump since we didn’t really get any buy the rumor.

Given the stock price performance over the last 1.5 years, I think they want to put their best foot forward today. I don’t see them saving bad news to drop on us, and I’m still holding out hope for a buyback announcement.

Hoping to buy to close some 170c on a dip before end of day. I still think we’re range bound until we have concrete signs of margin improvement but wouldn’t be surprised with a small bump since we didn’t really get any buy the rumor.

intelligator

Active Member

Nice lift from the MMD... but may see it stall here. I'm still holding -c167.5/+c157.5 , now tempted to close half.

Ended up closing this BPS for a 10% loss, (gave back premium +) which isn't terrible as a de-risk move. Will look for a position to recover and call it a wash.

EDIT: I realize now I reported the position as call spread, it was a put spread all along. I didn't want to risk having shares out to me at 167.5 if we may head down.... Small loss until a new direction forms, it is.

Last edited:

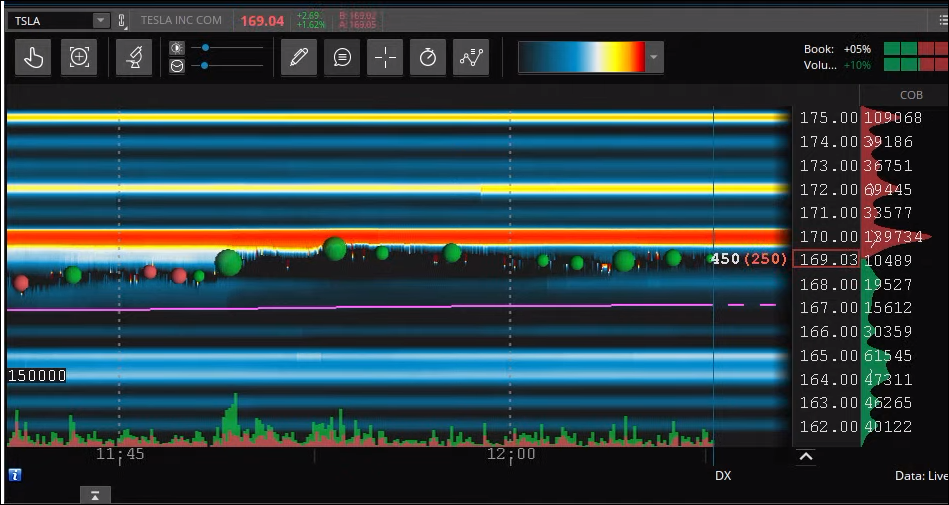

I'm surprised at all the buying (green blobs) heading into the event.

Maybe we're being a bit overly worried?

Red cones on right is stacked selling orders. Green cones buy orders.

Red blobs = selling (bigger is stronger); Green blobs = buying (bigger is stronger)

Here's a link to a YouTube channel that posts a free stream of the bookmap for a few Beta stocks, incl. TSLA, live daily. Need to refresh each morning via the channel:

Maybe we're being a bit overly worried?

Red cones on right is stacked selling orders. Green cones buy orders.

Red blobs = selling (bigger is stronger); Green blobs = buying (bigger is stronger)

Here's a link to a YouTube channel that posts a free stream of the bookmap for a few Beta stocks, incl. TSLA, live daily. Need to refresh each morning via the channel:

juanmedina

Active Member

I bought some puts for next week because I was feeling nervous. I hate throwing money away but at least I am just giving back some of my wins just in case. I also sold some $185cc for next week at $0.95.

I want to be a little cautious too. Which Puts did you buy?I bought some puts for next week because I was feeling nervous. I hate throwing money away but at least I am just giving back some of my wins just in case. I also sold some $185cc for next week at $0.95.

Anyone else's thoughts? Thanks.

juanmedina

Active Member

I want to be a little cautious too. Which Puts did you buy?

This is the first time I ever bought insurance puts and I got them to soon... $157.5, $150, and $140's for next week.

Thanks, The few times I've bought them, I'd wished I'd bought later expirations...This is the first time I ever bought insurance puts and I got them to soon... $157.5, $150, and $140's for next week.

EVNow

Well-Known Member

I'm surprised at all the buying (green blobs) heading into the event.

Maybe we're being a bit overly worried?

We almost always see some FOMO leading up to any event. Besides there are day traders who will buy at support and sell at resistance - perhaps even creating that support and resistance ...

Here's a link to a YouTube channel that posts a free stream of the bookmap for a few Beta stocks, incl. TSLA, live daily. Need to refresh each morning via the channel:

https://www.youtube.com/@LiveLevel2data/streams

This is great. Wish I had found this earlier.

Make sure to always check that LIVE is clicked. Otherwise the data is stale. If I go to another tab and come back, sometimes it's no longer LIVE. The red dot indicates that it's live. Otherwise it can really mess you up.We almost always see some FOMO leading up to any event. Besides there are day traders who will buy at support and sell at resistance - perhaps even creating that support and resistance ...

This is great. Wish I had found this earlier.

Position in profit. I just need to buy a June call to keep margin low. Probably I will pick the 210 call. But I have till Friday to make up my mind.Made a profit of USD 145 on the Aprils but invested USD 253 in the May butterflies which are in loss. But I use the may butterfly as hedge for a June position.

I am buying a June 170 call and sell 2 June 185 calls. The 170 call I buy for USD 1120, the 185 call I sell for USD 570 each which makes USD 1140. USD 20 in plus.

Which gives me the following position:

1 Call June 170

-2 Call June 185

1 Call may 200

-2 Call may 220

1 Call may 240

Profit/loss:

+145

-253

+20

Investment USD 88.

Closed 9x -c170c at about breakeven. Holding 5x -c170; 10x -c172.5; 4x -p170.

Hoping for some catalysts to get the share price moving up again but I'm prepared to be disappointed.

Hoping for some catalysts to get the share price moving up again but I'm prepared to be disappointed.

juanmedina

Active Member

It seems that I wasted my money on puts but that makes me happy.

EVNow

Well-Known Member

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K