R

ReddyLeaf

Guest

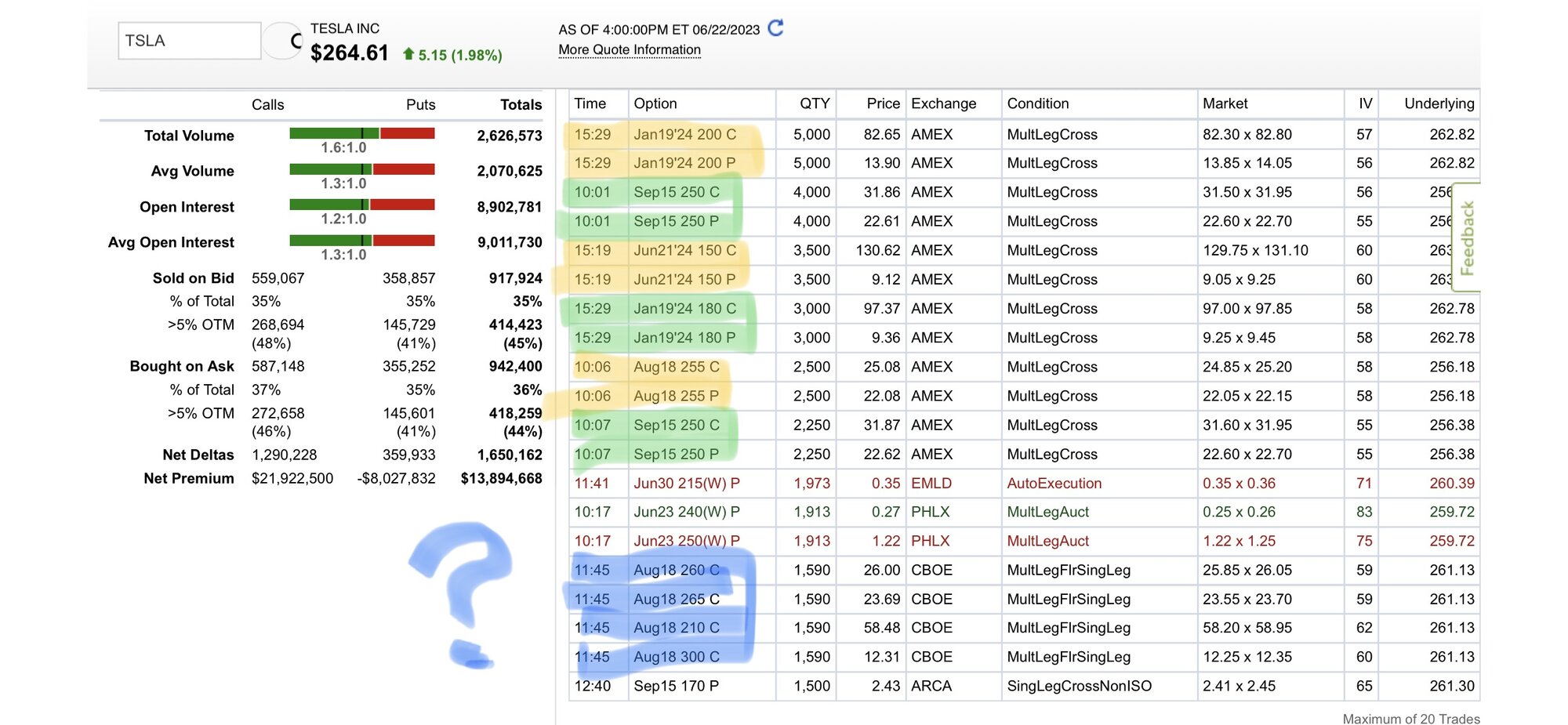

Lots of synthetic long positions created today!!!!!!! The whales know the golden cross is mathematically 100% certain. Not sure how that Aug 18th 4-leg spread works.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Maybe +--+Lots of synthetic long positions created today!!!!!!! The whales know the golden cross is mathematically 100% certain. Not sure how that Aug 18th 4-leg spread works.

View attachment 950001

My big options lesson is Steve Jobs died, causing a significant drop in AAPL stock that my overly aggressive investment strategy nearly broke me. (I had naked puts that were the worst issue.) Lesson Learned: you need to be able to quantify your risks and exposure in terms of price and time and have an exit strategy if things go pear shaped.Can you share some more rules/tips you’ve learned regarding managing LEAPS that are two years out for maximum effectiveness?My

It will be fine $265+ close today - not advice.....So without boring you all with the details, all my own fault, but I can't login to my broker until they send me new codes via snail-mail (3-5 days), and I have 30x -p260's expiring today

I can, in theory call them and place an order, but never did that before and don't really know how it would work. Thinking I might let them run, whichever way, 3000x TSLA would be quite facilitative at this point in time...

Depending on the broker, you should be able to give them the same direction.. “market sell/buy, limit sell/buy, ITTT, etc”. Figure out your exit plan and put it in. The only downside is if you want to be nimble, and track real time pricing and make real time changes - ur at the mercy of a phone call and getting an advisor.So without boring you all with the details, all my own fault, but I can't login to my broker until they send me new codes via snail-mail (3-5 days), and I have 30x -p260's expiring today

I can, in theory call them and place an order, but never did that before and don't really know how it would work. Thinking I might let them run, whichever way, 3000x TSLA would be quite facilitative at this point in time...

OT - I missed seeing you around sir.Depending on the broker, you should be able to give them the same direction.. “market sell/buy, limit sell/buy, ITTT, etc”. Figure out your exit plan and put it in. The only downside is if you want to be nimble, and track real time pricing and make real time changes - ur at the mercy of a phone call and getting an advisor.

At the TIME was one simply trading, for sure, one had to have the $$ to cover or take the placement - but it’s a good lesson as well that IF one was actually PUT AAPL back then, that money is worth about 15X today.. that’s hard to get elsewhere… sure, TSLA at that time would be worth what, 200x at peak, 150x today? many other possibilities…but they are few and far between and often very uncertain. I parked $$ in MSFT at that time for a LTH, today it’s ‘only’ 15x, but builds a nice foundation and asset for call selling. On the $MSFT position from that period, my adjusted share price (fortunately the IRS doesn’t consider this when calculating capital gains!) is NEGATIVE ~$80 per share. ;-)My big options lesson is Steve Jobs died, causing a significant drop in AAPL stock that my overly aggressive investment strategy nearly broke me. (I had naked puts that were the worst issue.) Lesson Learned: you need to be able to quantify your risks and exposure in terms of price and time and have an exit strategy if things go pear shaped.

I was thinking the same seeing MP at 257.50 and more puts than calls at 260, although what we often see is allowing the SP to dip to encourage this with +c260's to sell, then let the price meander up to wipe-out the puts before closeIt will be fine $265+ close today - not advice.....

Edit - lol.... I was very wrong so far....

Yeah, this is what I figured... I'll see where we are around 1 hour before closeDepending on the broker, you should be able to give them the same direction.. “market sell/buy, limit sell/buy, ITTT, etc”. Figure out your exit plan and put it in. The only downside is if you want to be nimble, and track real time pricing and make real time changes - ur at the mercy of a phone call and getting an advisor.

Yeah, this is what I figured... I'll see where we are around 1 hour before close

It all worked out in the end, just a lot of pain in the middle. My issue was I was selling puts so I could buy calls. Right after Jobs died and the price dropped significantly I had a lot of trouble trying to figure out what my risk was; I treated each option in isolation rather than looking at my overall portfolio... which was at least 90% AAPL. (I think it was actually leveraged at 130% AAPL at the time...).At the TIME was one simply trading, for sure, one had to have the $$ to cover or take the placement - but it’s a good lesson as well that IF one was actually PUT AAPL back then, that money is worth about 15X today.. that’s hard to get elsewhere…

Well the war with Ukraine may be over when Russians are starting to kill eachother…FYI, lots of reports on Twitter of a Russian coup with Putin on the run. Market may go crazy this week depending on how quickly this goes and in what direction. Just a reminder that hell can break loose at any time.

Edit: Now on mainstream news as well.

It is indeed very interesting and unexpected news..I doubt nearly ANYONE had “possible power shift in Russia” or “possible end to Ukraine conflict” on their bingo cards this weekend .I would expect sometime in the next 72 hours, oil markets to FALL farther which is a bit unexpected - although we were on that path already due to China and other global factors, over supply being the biggest IMO.FYI, lots of reports on Twitter of a Russian coup with Putin on the run. Market may go crazy this week depending on how quickly this goes and in what direction. Just a reminder that hell can break loose at any time.

Edit: Now on mainstream news as well.

Frankly, I never really say things like this but this leads me to think GS simply didn’t get enough $TSLA during the last pull backs… but anyway, IF they truly believe that then they could only sound believable if they downgrade the entire sector? If anyone is going to win a price war - and well nobody really wins a price war at least not initially - it would be Tesla at this point what with their near total vertical integration and long term commodities and input contracts-and relative deep pockets if just compared to their true BEV counterparts.Goldman Sachs downgrades Tesla, citing difficult pricing environment for electric vehicles