I like to tell myself that sometimes the best trade is no trade.Patience is not inaction.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Tes La Ferrari

Active Member

Anyone picking up any LEAPS at this time with the drop in IV?

If so, any (non-advice ) strike recommendations ?

If so, any (non-advice ) strike recommendations ?

Johann Koeber

Happy Owner

Anyone picking up any LEAPS at this time with the drop in IV?

If so, any (non-advice ) strike recommendations ?

Depends completely on your strategy.

This is what I do:

I like to take about half the stock price for a leverage of 2. Not technically LEAPS as I don't like to commit past the year end. For example +Dec23 135 @$138 (time value about $2.60). Delta is about 98% so these behave like stocks.

Against those I would sell weekly calls eg. -Aug04 282,50 @$1.59. These OTM short calls are time value (TV) only. Delta is about 20%. So there might be a 20% risk I might have to roll. I roll anyway, when 90% of the time value is expired - be it because the short call is ITM or OTM.

So I am buying TV for $2.60 and selling TV for $1.59. As I have 20 weeks till the long leg expires, I am confident to recover my outlay and then some.

intelligator

Active Member

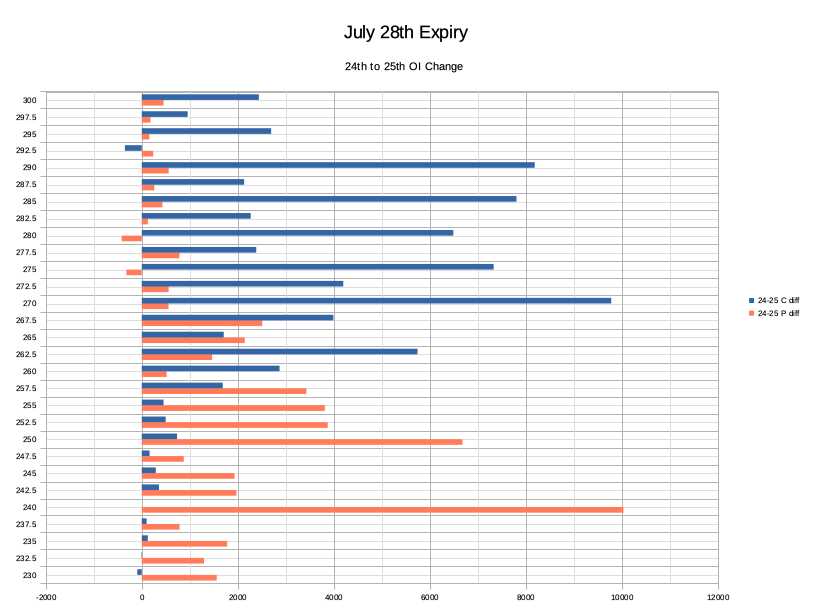

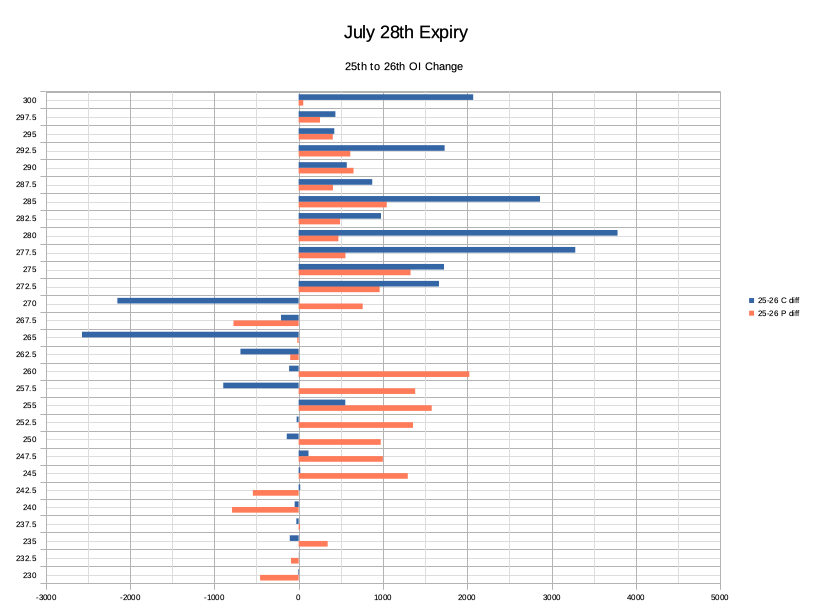

Lot's of OI increased from p240 to c290... feels like we'll hover 260 - 270 ... I have -c280 for Friday, not so smart, no trade would have been the best trade.

I have 2 counts, both pointing to an eventual pullback to 240. This can happen anytime between now and early October. This consolidation phase will be deceptive and designed to take as much money from both the bulls and the bears as possible.

I have 2 counts, both pointing to an eventual pullback to 240. This can happen anytime between now and early October. This consolidation phase will be deceptive and designed to take as much money from both the bulls and the bears as possible.

Thanks. How are you playing the next 1-2 months?

Also, what short calls strikes are “safe” for this week and even the next few?

On the put side I'm sticking to weekly -245P. On the call side I'm selling 300+ calls as the stock approaches the next downtrend resistance. Keep my positions small and scattered throughout the week. The hourly trend resistance 273.3 stopped today's rally. If that's broken then I'll wait for the next line at 278 to sell more calls.Thanks. How are you playing the next 1-2 months?

Also, what short calls strikes are “safe” for this week and even the next few?

Got this email today.

I am not a unique flower. lol

I am not a unique flower. lol

$878.98 — Woa! Is that a prediction for next week or the week after?

R

ReddyLeaf

Guest

Ok, it’s pretty obvious that TSLA is being driven by the options market this week. Up down and close within pennies of $270. Yes, I’m pretty happy about it, with IBs at +p250/-pc270/+c290 and ICs at +p250/-p260/-c280/+c290. Bought back 275&280 CCs during the MMD and resold $272.50s when we got back to $270 this afternoon. Willing to roll if needed. Didn’t get the best price, but better timing than my usual. GLTA

Edit: everything on my watch list except TSLA & RIVN are green. Apparently the hedges hate EVs.

Edit: everything on my watch list except TSLA & RIVN are green. Apparently the hedges hate EVs.

Both ran up hugely on massive call inflow. Those calls weren't all gone at 254. Any attempt at a rally is an opportunity for those calls to be liquidated. 271-273 was the first test and we failed on the first attempt. Here's my projection for the next 2 months.Ok, it’s pretty obvious that TSLA is being driven by the options market this week. Up down and close within pennies of $270. Yes, I’m pretty happy about it, with IBs at +p250/-pc270/+c290 and ICs at +p250/-p260/-c280/+c290. Bought back 275&280 CCs during the MMD and resold $272.50s when we got back to $270 this afternoon. Willing to roll if needed. Didn’t get the best price, but better timing than my usual. GLTA

Edit: everything on my watch list except TSLA & RIVN are green. Apparently the hedges hate EVs.

Last edited:

The red and blue squigglies tracking the daily share price moves - what indicator is that? Is it something auto generated, or something you draw in yourself? If I've got the name, I can go read about it.Both ran up hugely on massive call inflow. Those calls weren't all gone at 254. Any attempt at a rally is an opportunity for those calls to be liquidated. 271-273 was the first test and we failed on the first attempt. Here's my projection for the next 2 months.

View attachment 959552

R

ReddyLeaf

Guest

Thanks. What’s the duration scale? Are those hourly points? It looks too fine for daily. Also, what’s the approximate cycle time of your up/down zigzags? Looks like about a week up, and a week down.Both ran up hugely on massive call inflow. Those calls weren't all gone at 254. Any attempt at a rally is an opportunity for those calls to be liquidated. 271-273 was the first test and we failed on the first attempt. Here's my projection for the next 2 months.

View attachment 959552

Its called supertrend.The red and blue squigglies tracking the daily share price moves - what indicator is that? Is it something auto generated, or something you draw in yourself? If I've got the name, I can go read about it.

It looks like the first low should be made by the end of next week but this part is close to voodoo if the path turns out to be 100% correct. What I think is the 1st of 1st leg down was very aggressive and so the follow up should be equally as aggressive. Together theyll do most of the damage and the 2nd big leg in red will be mostly chopping sideway till P&D.Thanks. What’s the duration scale? Are those hourly points? It looks too fine for daily. Also, what’s the approximate cycle time of your up/down zigzags? Looks like about a week up, and a week down.

I am waiting for a possible additional pul back before pulling the triggerAnyone picking up any LEAPS at this time with the drop in IV?

If so, any (non-advice ) strike recommendations ?

intelligator

Active Member

Fewer horses traded yesterday, put call ratio .94 , can't say whether the decrease at C265 and C270 are the increase at C275 and C280. ER gap fill is the 260-267 ? I am contemplating buying back some -C280 and sell a few closer to the money but don't necessarily want to let shares go... hmmm.

EDIT1: Thx @dl003 , it may be good that I buy back some -C280's, will leave a couple to raise cash.

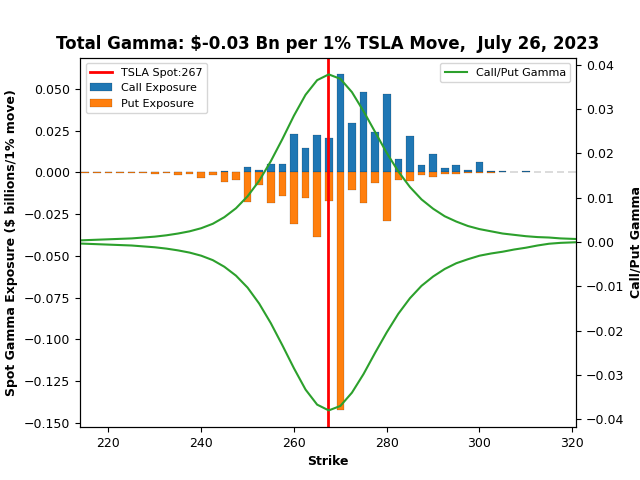

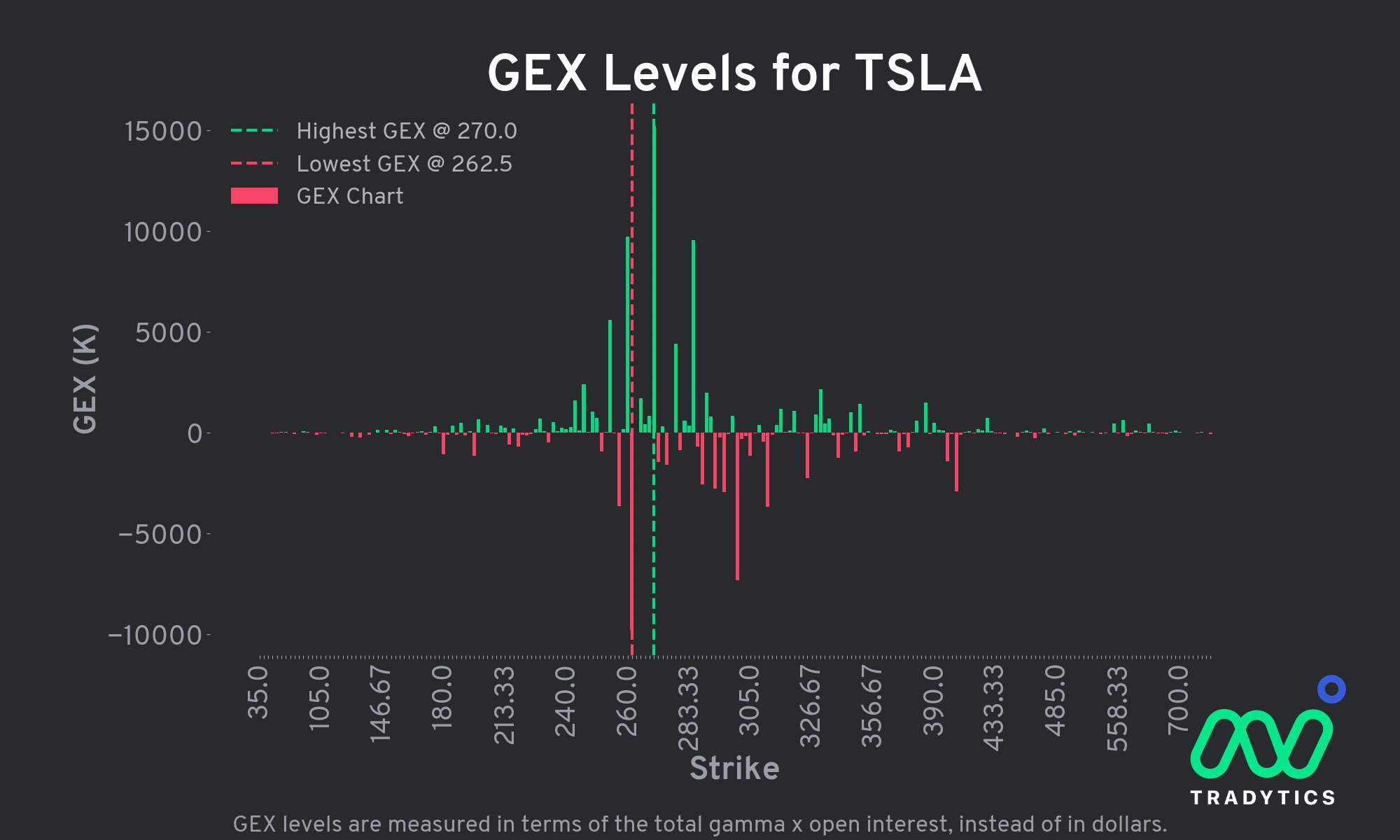

EDIT2: Added Gamma Exposure, backs same @Jim Holder is seeing ...

EDIT1: Thx @dl003 , it may be good that I buy back some -C280's, will leave a couple to raise cash.

EDIT2: Added Gamma Exposure, backs same @Jim Holder is seeing ...

Last edited:

the gap is 291-280.Fewer horses traded yesterday, put call ration .94 , can't say whether the decrease at C265 and C270 are the increase at C275 and C280. ER gap fill is the 260-267 ? I am contemplating buying back some -C280 and sell a few closer to the money but don't necessarily want to let shares go... hmmm.

View attachment 959753

GEX currently implying buy 262.50 > Sell 270.

Let's see if it can get over 270 this week, it's a monster +GEX wall...

Let's see if it can get over 270 this week, it's a monster +GEX wall...

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K