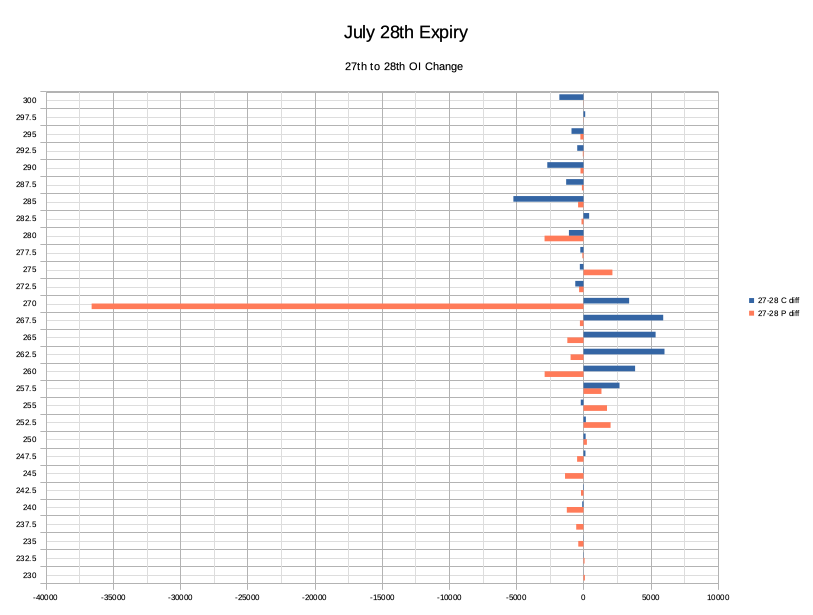

Ugly for my -p270's, but obviously fine for the -c270's... and makes buying back -c200's easier, although generating money from puts becomes more difficult... likely will roll -p270 to -p270 and -c270 to -c260 -> get-out-of-jail-free for the calls is the October -c300 strike roll

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I have 260 puts expiring tomorrow - kind of glad for this pull back as I'll be taking assignment on those.

Bigger picture is I'd like to have as many as 4 positions going at a time. 2 puts and 2 calls using alternating weekly expirations, and wheeling them back and forth when needed. Right now I have 2 - 260p expiring tomorrow and 250p expiring next week.

Assignment on the 260s for tomorrow will get me shares for a call position, and with share price down, I'll probably open the week-after-next puts tomorrow, getting me 3 total positions (2 puts, 1 call). I don't know when I'll open that call position, and whether it'll be a 1 week or 2 week position yet; I'll figure that out once its clear I have shares from this.

I might "take assignment" by closing the put and buying shares for 261.10 or something - pay a .10 premium to get the shares before the weekend so I can also sell the calls before the weekend. Something like that.

Bigger picture is I'd like to have as many as 4 positions going at a time. 2 puts and 2 calls using alternating weekly expirations, and wheeling them back and forth when needed. Right now I have 2 - 260p expiring tomorrow and 250p expiring next week.

Assignment on the 260s for tomorrow will get me shares for a call position, and with share price down, I'll probably open the week-after-next puts tomorrow, getting me 3 total positions (2 puts, 1 call). I don't know when I'll open that call position, and whether it'll be a 1 week or 2 week position yet; I'll figure that out once its clear I have shares from this.

I might "take assignment" by closing the put and buying shares for 261.10 or something - pay a .10 premium to get the shares before the weekend so I can also sell the calls before the weekend. Something like that.

Thinking to roll down 73x 10/20 -c300's to 8/4 -c250/255, if we're in for a bit of a pull-back it's an opportunity to get these expired, and give a little downside protection in the process, following which selling $2 OTM weeklies would then help knock-off the remaining -c200's

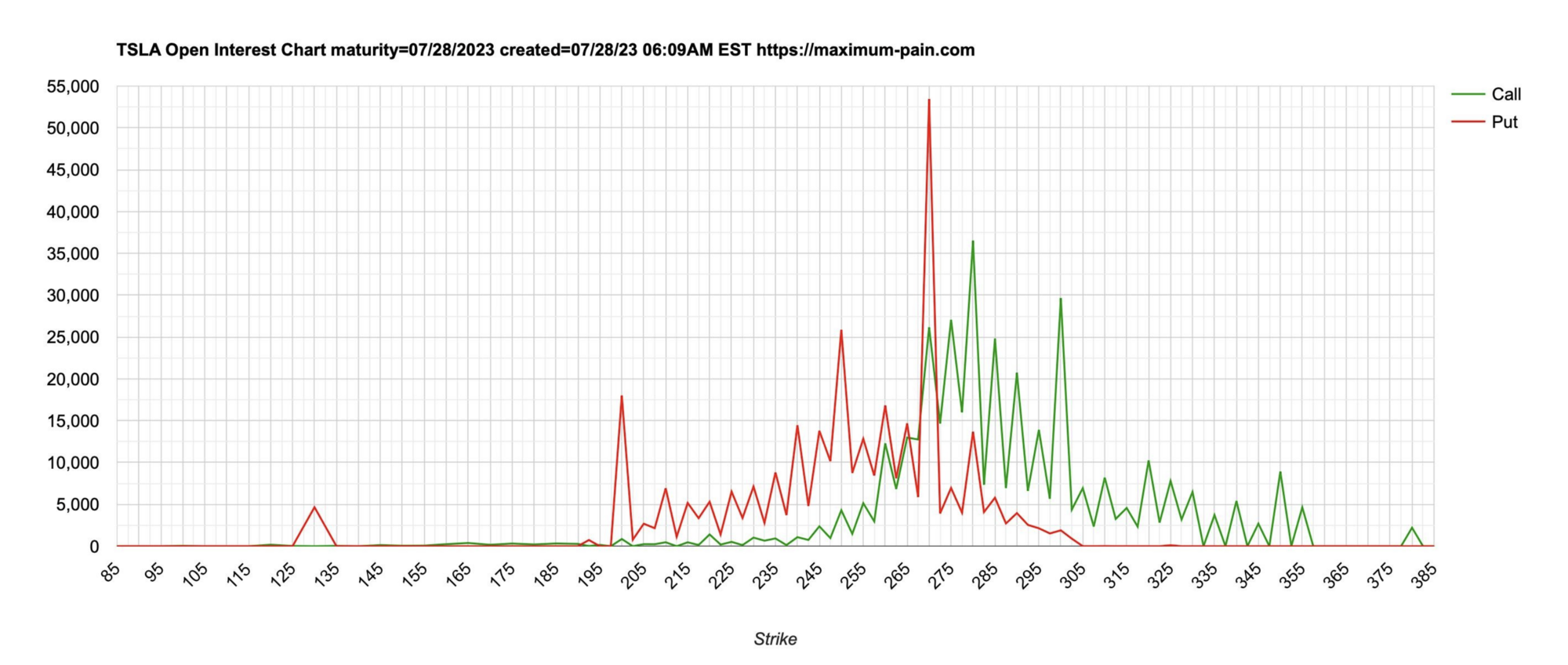

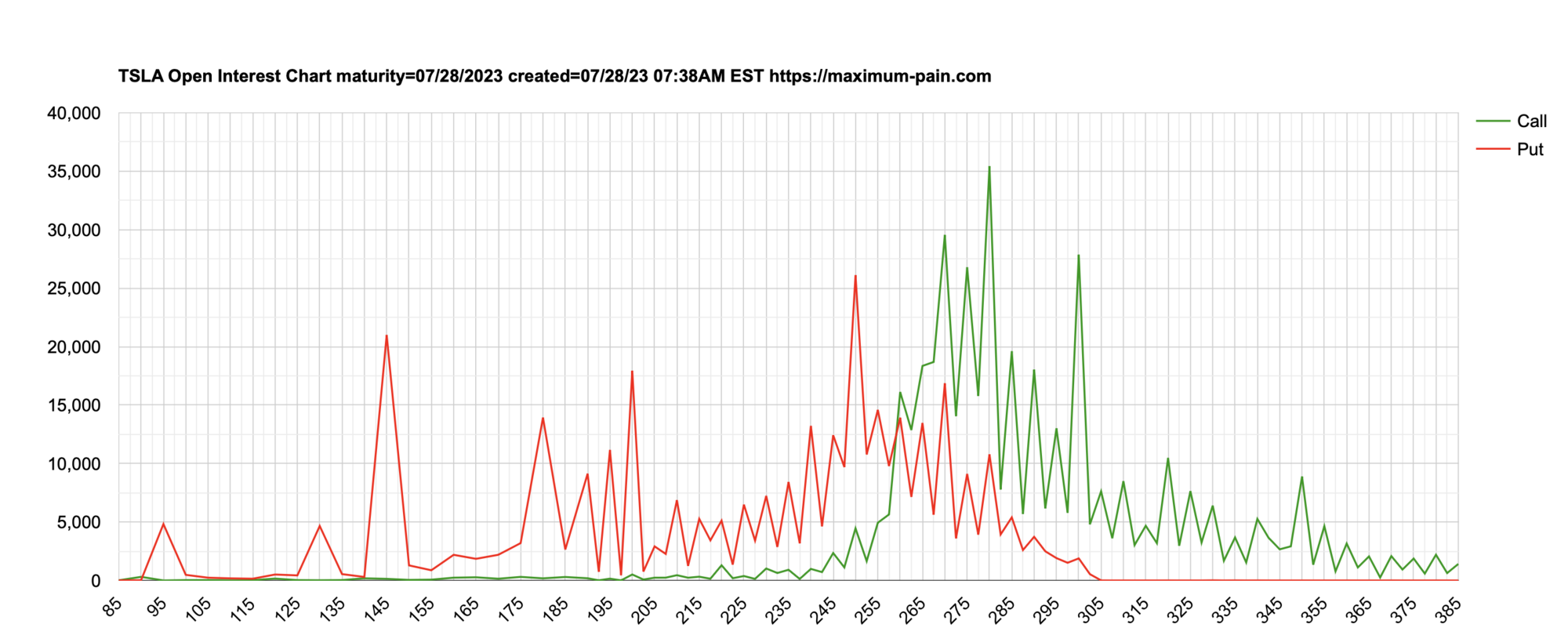

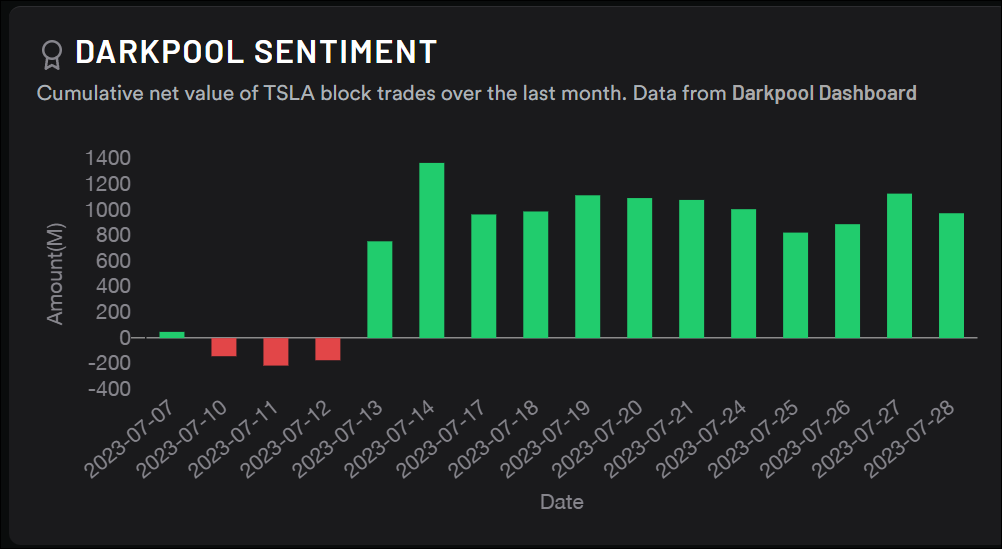

p270's evaporated since yesterday... build-up at p145 now...

SebastienBonny

Member

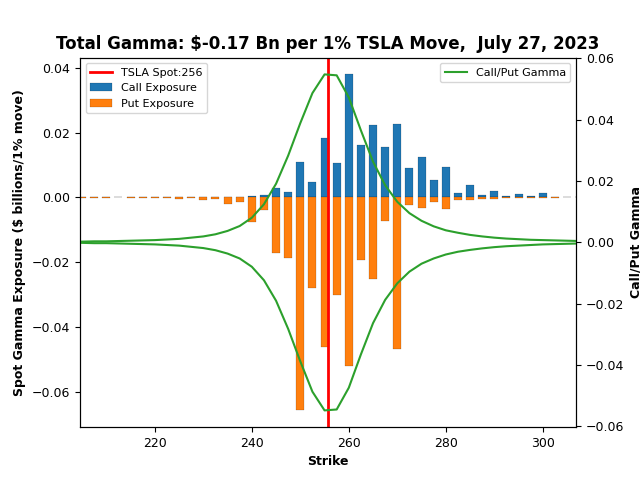

Based on that chart as of now I would say 257.50, but positions evolve during the day, so if the calls on 260 get closed out then 262.50 would come into playSo somewhere between 250 and 270 today seems the sweet spot for today...

PCE numbers, due in 10 minutes, can change everything

Edit: decent numbers, mostly as forecast or slightly better, should get some green macro on the back of this, especially core PCE lower than both forecast and consensus...

Attachments

Last edited:

tivoboy

Active Member

that is not a good looking chart IMOp270's evaporated since yesterday... build-up at p145 now...

View attachment 960316

View attachment 960315

We've gapped up in pre-market 80% of days over the last month with an average gap up of $2.60 (pre-market 30min high - after market close). It's becoming a very obvious pattern that makes up a relatively large proportion of the stock moves. Doesn't help options trades so much because you can't trade them in pre-market and a big move can be either very good or bad for positions. (I wonder if this is on purpose).We gapped up at the open yesterday too.... The TA people I follow think there is more downside potential right now.

What do you think positive or negative low-volume pre-market activity tells us about same day trading during open hours?We've gapped up in pre-market 80% of days over the last month with an average gap up of $2.60 (pre-market 30min high - after market close). It's becoming a very obvious pattern that makes up a relatively large proportion of the stock moves. Doesn't help options trades so much because you can't trade them in pre-market and a big move can be either very good or bad for positions. (I wonder if this is on purpose).

OK, I compromised:

BTC 18x 7/28 -c270

BTC 4x 10/20 -c200

BTC 73 x 10/20 -c300

STO 45x 8/4 -c260

STO 50x 8/4 -c250

BTC 18x 7/28 -c270

BTC 4x 10/20 -c200

BTC 73 x 10/20 -c300

STO 45x 8/4 -c260

STO 50x 8/4 -c250

Last edited:

I haven't noticed any clear pattern in early pre-market direction setting a trend for the main session. It could be that early pre-market bullishness is its own thing.What do you think positive or negative low-volume pre-market activity tells us about same day trading during open hours?

Today looking like an unexpected up-trending day so far.

intelligator

Active Member

Strange moves , especially the "-p270 evaporating" @Max Plaid  , was it one player or coordinated?

, was it one player or coordinated?

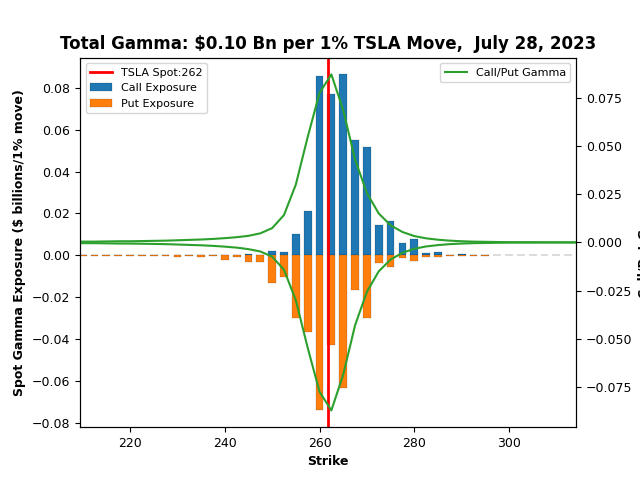

Decided pre-market to buy back -p255 and -p252.5, placed and filled orders to lock in 90% credit. Had I prepared this morning's gamma chart in advance of orders, it might have been enough to caused me to ride it out... end of day Thursday had me fretting, why risk to gain a few pennies.

What to do for next week ... it's a hard read. GLTA!

Decided pre-market to buy back -p255 and -p252.5, placed and filled orders to lock in 90% credit. Had I prepared this morning's gamma chart in advance of orders, it might have been enough to caused me to ride it out... end of day Thursday had me fretting, why risk to gain a few pennies.

What to do for next week ... it's a hard read. GLTA!

Range support 255-269

Still showing hold/long:

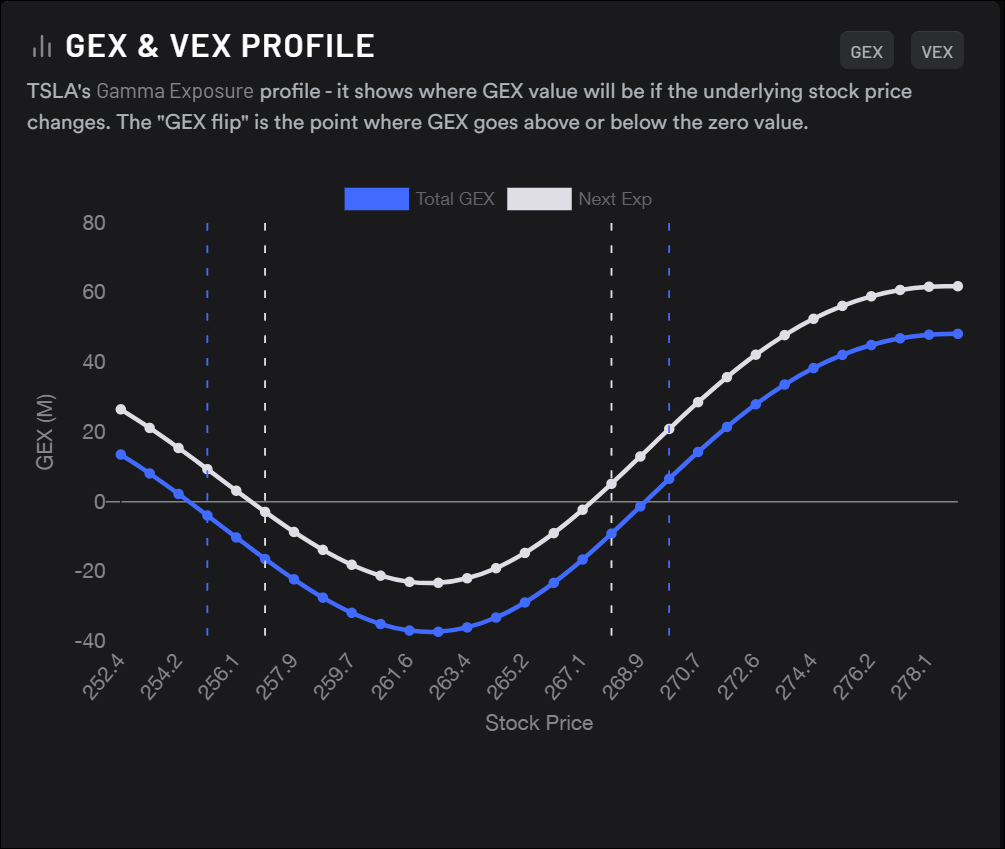

GEX Levels today

Red GEX=Attracts

Green GEX=Repels

The behavior of the MM/dealer will change as the price approaches the strike in question either from above or below. The end result is that Red -GEX levels will usually attract price and hold it there, while Green +GEX will repel the price and bounce it back up or reject it back down.

Red -GEX acts as a magnet passthrough, whereas Green +GEX acts as support/resistance (repels price).

Can typically see big bounces off Green +GEX.

There is always a bounce on a GEX level, that's why one takes profits at any GEX level.

One can expect reversals off a green GEX level.

Typically try to stay outside the low and high gamma bars

30-min

Wookie-Jookie meter:

Still showing hold/long:

GEX Levels today

Red GEX=Attracts

Green GEX=Repels

The behavior of the MM/dealer will change as the price approaches the strike in question either from above or below. The end result is that Red -GEX levels will usually attract price and hold it there, while Green +GEX will repel the price and bounce it back up or reject it back down.

Red -GEX acts as a magnet passthrough, whereas Green +GEX acts as support/resistance (repels price).

Can typically see big bounces off Green +GEX.

There is always a bounce on a GEX level, that's why one takes profits at any GEX level.

One can expect reversals off a green GEX level.

Typically try to stay outside the low and high gamma bars

30-min

Wookie-Jookie meter:

Pardon my ignorance, but what's a wookie-jookie meter? And how is it determined?

Pardon my ignorance, but what's a wookie-jookie meter? And how is it determined?

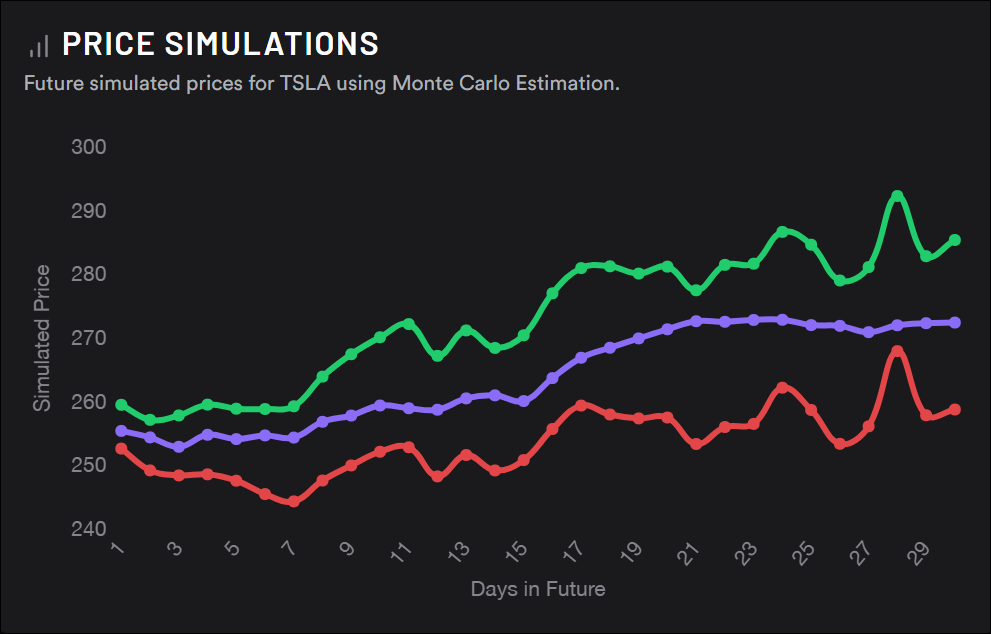

It's from TradyTics and is future simulated prices for TSLA using Monte Carlo estimation (Google). I call it Wookie-Jookie since it's close to voodoo and while it's more often right than wrong, it's not something I take too seriously and trade off. It's a bit like an x-ray on the overall market trend for a particular stock. IMO it's more useful for indicating safe ranges outside of action for writing short calls/puts and overall trends. Last month it was showing TSLA going to 220's in August and that updated higher (240's) based on option flow and market action since then.

STO -C280 8/4 @ $1.35.

I plan to close it Monday if over 267.50.

I plan to close it Monday if over 267.50.

Agree with that, but thought you might differ after seeing the earlier thought. Thanks.I haven't noticed any clear pattern in early pre-market direction setting a trend for the main session. It could be that early pre-market bullishness is its own thing.

Today looking like an unexpected up-trending day so far.

strago13

Member

Yesterday during that dip, I rolled $265P's 7/28 to $262.5P's 8/4 for a credit.

Should have waited longer

Should have waited longer

A couple of trades today generated only a couple $k credit, but improved positioning:

- In smaller more active IRA, closed 28Jul$270 for $0.09 (99%) and 11Aug$260 (loss), then sold same number of contracts for 25Aug $270 for a small gain and a good bump in strike.

- Goal: maintain strikes ATM on 100% of shares.

- in larger core Roth IRA, closed half of 4Aug$300 position for $0.21 (98%), and sold same number of contracts for 25Aug$300, leaving half to expire or assign (at $300, I want to sell this x00 of underlying shares to hold to my overall TSLA exposure cap). May close the residual out and enter GTC limit order.

- Goal: lower number of shares covered in this account from 65% to <25% given near-term catalysts.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K