Remember: I never said we will dump to 140. I only said it's a possibility in the event of a hard reject at 240.Just afraid of that pump and dump DI0003 was talking about - 240 then 140 drop..... maybe that changed?

With that in mind:

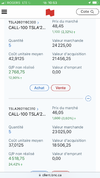

a. 194 was the bottom

b. We're running up in a clear 5 wave impulsive fashion

c. I believe we just hit the highest range possible for this first leg

d. There will be a second leg after a few days of consolidation. Maybe target the 210 gap test

e. Please don't ask me how I'm positioned for this coming week