Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

SpeedyEddy

Active Member

Did you pee these lines doggy?Yep, AAPL is weakening.

thenewguy1979

"The" Dog

Trying to keep AAPL under 182.5 with those pee lines.....not strong enough......errr we'll see by end of day.

Good Lord. Am I going to be right again?!?Short sellers are so weak! We are going to close above 220 again. My 230CC just won't die.

Seems to be a new thing as of late, dump TSLA at open, then it

SPY and QQQ are due a lower-low, not really happening, but normally should before going back up

Barring macro pull-back, I also think TSLA melts-up into CT event, am thinking -230 straddles for next week to position for that

All my junk is time-decaying nicely right nowDidn't you check the post from Yesterday from big dog, Max Plaid? He holding up the market

Guess they ran out of steam.....But seem like Macro is not too bad hence keep SP up.

SPY and QQQ are due a lower-low, not really happening, but normally should before going back up

Barring macro pull-back, I also think TSLA melts-up into CT event, am thinking -230 straddles for next week to position for that

Last edited:

thenewguy1979

"The" Dog

Tesla and the markets traded flat today. Guess that good for option sellers, unless your ITM?

Ahh -- good question!This is actually risky, right ?

Let us say you have 230 CC.

- You can close on Tuesday if the option goes below 0.10. You want to do that in case the SP goes up rest of the week.

- But if you sell next week's CC, you might end up with it nearly ATM by the end of this week !

This has happened to me. I close early because of SP movement and sell next week's option. But a sharp reversal would make my option ATM (or ITM !) this week itself. So I've one more week for expiration and I'm staring at possibly DITM option.

Isn't it better to close early sit the market out till Friday / Monday ?

ps : Also, if we use the usual % OTM, it would be riskier because of larger number of days. Delta based selling would even out the risk, though.

pps : Now 197.50 put I sold for 50 cents is at 0.08 cents. Should I close it and open a new put tomorrow ? If so at what strike ? I'd probably open 190 at 50 cents (currently 42), for an improvement in strike.

The dilemma is because when closing early we are avoiding residual risk. But by opening a new position we are negating that residual risk avoidance move. Lets take a look at two of the possibilities -

1. SP moves down and closes at 200, safely above strike of 197.5. In this case it would have been better to close early (so as to avoid anxiety) but open new position only on Friday (or next Monday) for a strike of something like 175 or 180, a much better strike.

2. SP stays around 220. In this case closing early doesn't provide any benefit - but opening next week's put early either improves strike or gets us more premium.

One of my trading rules is that I don't open a replacement position the same day that I close a winning position. It's a bit broader than that, but the idea is that a good day and time for closing a trade, also tends to be a relatively bad day for opening a new trade.

So in my made up example, if I were to take the good and early close on Tuesday, then the soonest I would open the replacement trade is Wednesday. What I'm really looking for is a favorable move for the open on the new position - even a bit of one. It's not TA by any stretch - its just my own attempt to sell calls at relatively high share prices, btc those calls at relatively low share prices (similar idea on the put side).

I actually will open a replacement position the same day, but I need a significant move in my favor. That's really what I'm looking for with these rules, and close-today-open-tomorrow is a simplification.

To make up an example - if I wake up tomorrow and we're at 210, then I'll take that great close opportunity for my 230cc, and plan to wait at least a day to open new cc for the next week. If the shares then trade back to 220 during the day, then I'm likely to open the replacement position that same day anyway. What I really wanted, and got, was a significant move in the right direction for a relatively good open ("relatively" good can still be actually bad

-- the 197.50 put. Yes, I would take the .08 early close, and be looking for a new position tomorrow, fully realizing that the shares might go the wrong way and I don't have a put open for a few days (or even weeks!). Usually its just a few days out of the market.

A significant component of this approach is that I'm generating income, but I also don't need to always be in the market to generate adequate income. The freedom to be out of the market, sometimes for a few weeks at a time, is something I find immensely valuable.

I love these sideways days.Tesla and the markets traded flat today. Guess that good for option sellers, unless your ITM?

I'll have a heaping helping please!

Polestar has lowered their guidance due to "low EV demand." TSLA down a little AH because stupid people don't realize Tesla is not Polestar....

My CCs thank the stupid people.

My CCs thank the stupid people.

intelligator

Active Member

Crazy to think this, -c230 for Friday (safe) seems a go. Just saying... we've been sideways through Wednesday, not much on the horizon we don't already know about, what could crush this thought?

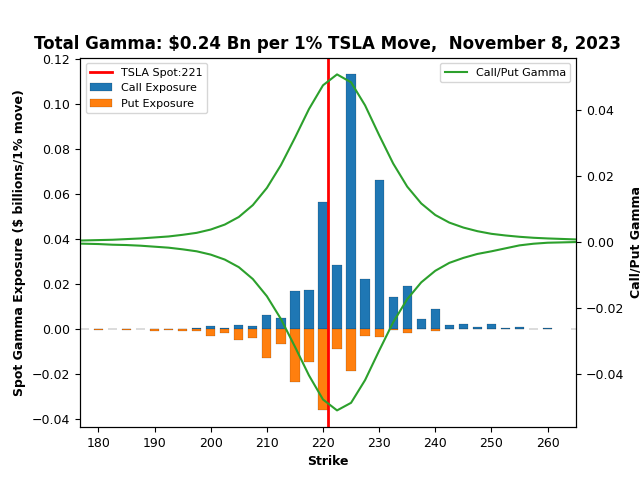

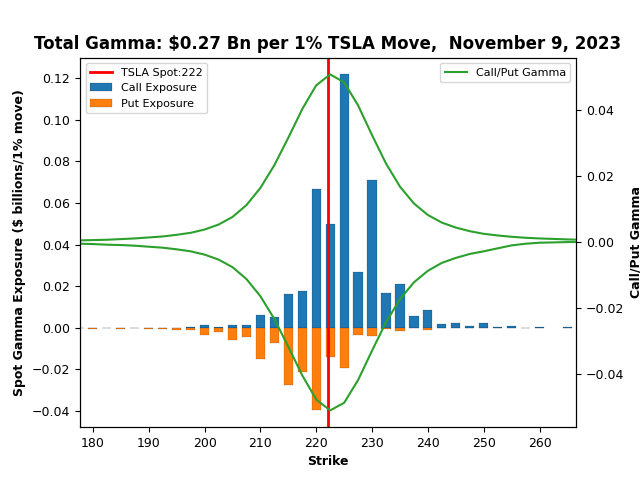

From a gamma standpoint, c225 stands taller than ever, p220 is stacking as well. I'll put this out again in the morning to see where we sit. I'm not looking for support, just your perspective.

From a gamma standpoint, c225 stands taller than ever, p220 is stacking as well. I'll put this out again in the morning to see where we sit. I'm not looking for support, just your perspective.

Last edited:

intelligator

Active Member

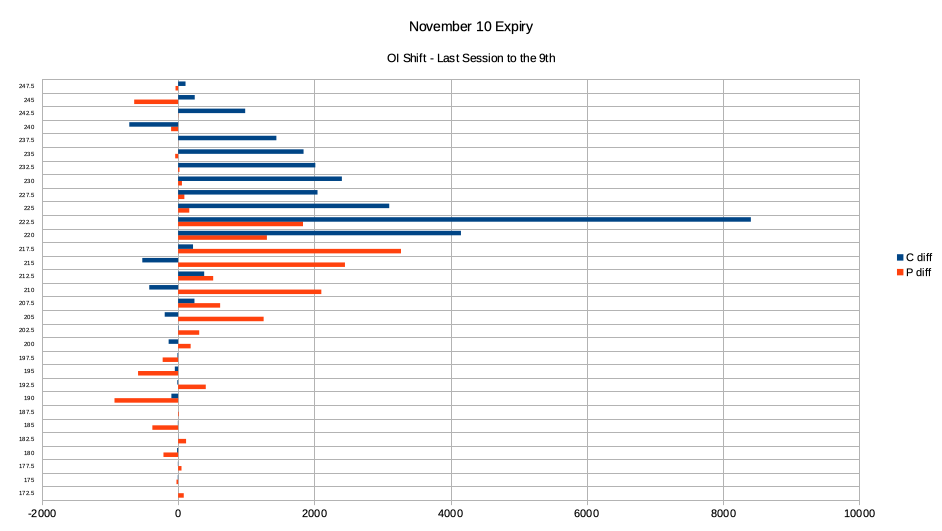

Subtle change at c220 through c227.5, c222.5 the largest move, added 8k to now 20k. Put call ratio came down to .86 from .89, 36K new positions, max-pain remains at 217.5 ... gamma not much different than what was posted last night.

Last edited:

Same opening push-down we've seen all week... BTC 20x -c200 @$1.45 for around 70% profits

Not feeling inclined to close out this -c230's though - especially with $500 broker fees on those

Maybe the China price increases weren't enough, plus we had a BS $145PT initiated from HSBC...?

Edit 1: OK, I gave in, BTC 200x -c230 @12c, around 90% profit with the charges taken into account. Reason to close them out is purely to free-up the contracts for writing next week in the case of a reversal from here (OTM premiums above c230 drop dramatically from Friday to Monday, so...)

Edit 2: STC 100x March 2024 +p240 @$16.1 -> a modest +$3.7 profit on these, but I fear the SP going up and them going worthless fast, still have 100x that I'm writing against

Not feeling inclined to close out this -c230's though - especially with $500 broker fees on those

Maybe the China price increases weren't enough, plus we had a BS $145PT initiated from HSBC...?

Edit 1: OK, I gave in, BTC 200x -c230 @12c, around 90% profit with the charges taken into account. Reason to close them out is purely to free-up the contracts for writing next week in the case of a reversal from here (OTM premiums above c230 drop dramatically from Friday to Monday, so...)

Edit 2: STC 100x March 2024 +p240 @$16.1 -> a modest +$3.7 profit on these, but I fear the SP going up and them going worthless fast, still have 100x that I'm writing against

Last edited:

intelligator

Active Member

Update on open position: Closed out 11/17 -c235/+c255 , keeping just under 40% of the roll credit, could have done better waiting but price could have also gone other way just as easily. I'll be away next week, can't trade, will be watching from the bleachers.

SpeedyEddy

Active Member

still sidelined partially, waiting for 212 and if straight through 205 to be back in -P200 and + C 220 2026 plus rebuy shares. Hard to NOT act too early.... wait wait, you can do it Eddy.....

SpeedyEddy

Active Member

D

Did not happen ...... so I got back in -of course still profitable- around 214.10 and 215.10, thinking this (213.33) was the local bottom ... As always a dollar and a bit above the projected low?) Not back into any 2026 options though, might wait for those a bit longer and as @Max Plaid pointed out maybe go for some 6 months away ones that indeed seem a bit more interesting (never looked at those before, only very close or very far away, but 6 months out is kind of a sweet spot.)wait wait, you can do it Eddy.....

thenewguy1979

"The" Dog

I offload all my AAPL Puts this morning. Wave 5 is invalidated for now. Waiting for DI0003 to updates if it still a play then can get back in at cheaper price. AAPL too hot. Burned a lots of my furs last few days.....

Waiting for Tesla SP to reach 210 before going long.....

Waiting for Tesla SP to reach 210 before going long.....

tivoboy

Active Member

“Whites of their eyes”still sidelined partially, waiting for 212 and if straight through 205 to be back in -P200 and + C 220 2026 plus rebuy shares. Hard to NOT act too early.... wait wait, you can do it Eddy.....

EVNow

Well-Known Member

No.D

Did not happen ...... so I got back in -of course still profitable- around 214.10 and 215.10, thinking this (213.33) was the local bottom ... As always a dollar and a bit above the projected low?)

My put orders for 190 got filled early too.

Worth noting that the HSBC idiot chose a PT very close to the $143 gap, I wonder if this was just a signal to the bear and shorty to jump in?

I have to say with Q4 deliveries looking great, M3H getting rave reviews, some price increases this quarter and CT event coming up, not sure it's the time to short $TSLA

But what the hell do I know...?

I have to say with Q4 deliveries looking great, M3H getting rave reviews, some price increases this quarter and CT event coming up, not sure it's the time to short $TSLA

But what the hell do I know...?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K