Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

DarkKnight83

Member

How confident are you on 245-250 target?Thanks DI003. Welcome back and Happy Holiday.

Got some +250p/-245p spread for the week. Also selling Call -260C.

Little agressive on the C but the SP has bounce down numerous time also with Big Call Wall @260.

exit plan is to bailed as SP head toward 245-250 realm. If 260C ITM then roll to next week.

thenewguy1979

"The" Dog

Based on the team feedbacks I would say very confident, especially from DI003 - our TA expert and Yoona.How confident are you on 245-250 target?

However, nothing is certain. I usually just read, ask question, and make my own judgement. Prepare an exit plan.

CONGRATS!! I am 113026xxx, so I guess I might not hear till late next year.OT, but VERY excited. Just got the invite to configure my CT!

Says delivery Jan-March

OT, but VERY excited. Just got the invite to configure my CT!

Says delivery Jan-March

Sweet! Which state are you in fly? (If you care to share)

Utah. Based on Sawyers news on X, most states are represented, so that doesn't appear to be a limiting factor.Sweet! Which state are you in fly? (If you care to share)

Morning!

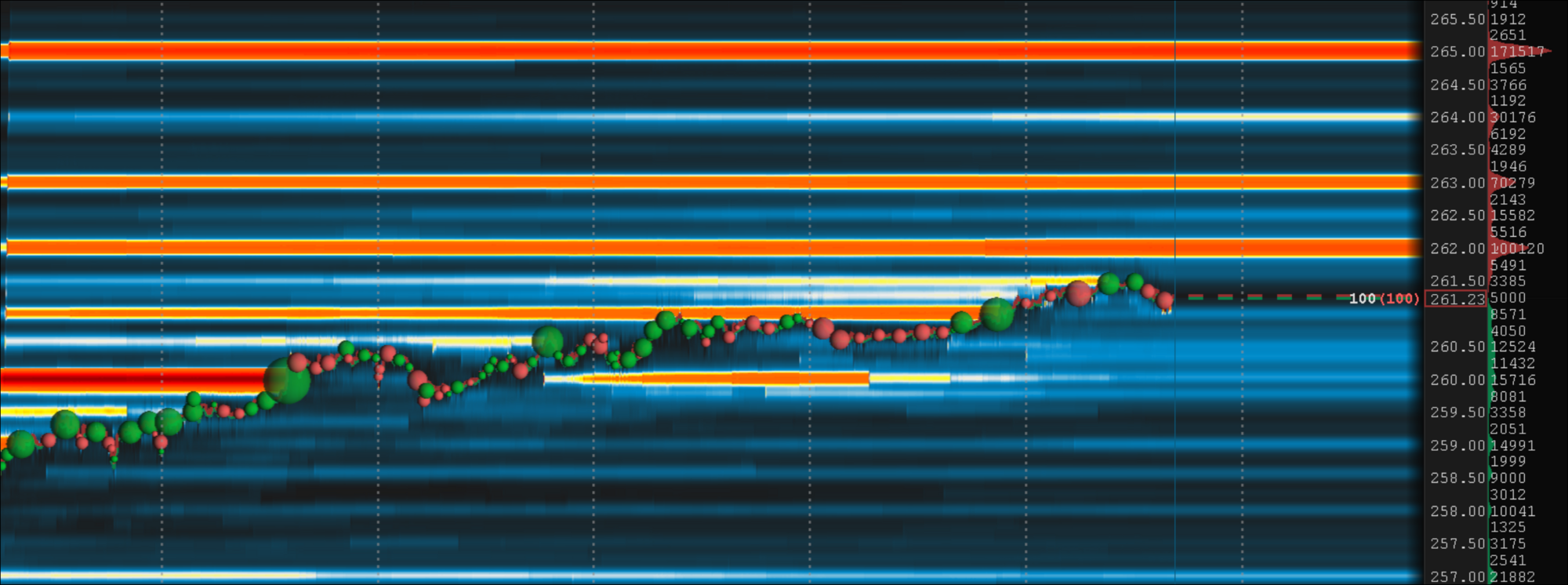

Maybe today at open we get a $260 touch/break?

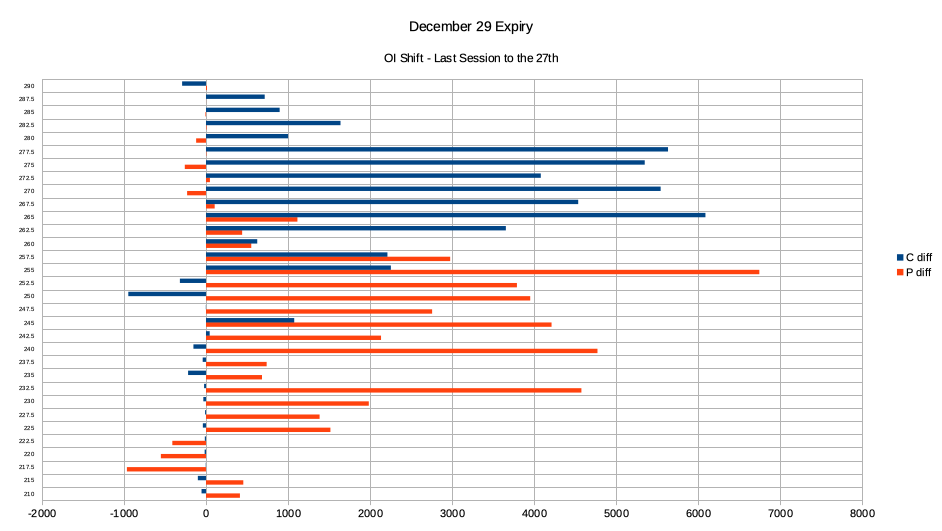

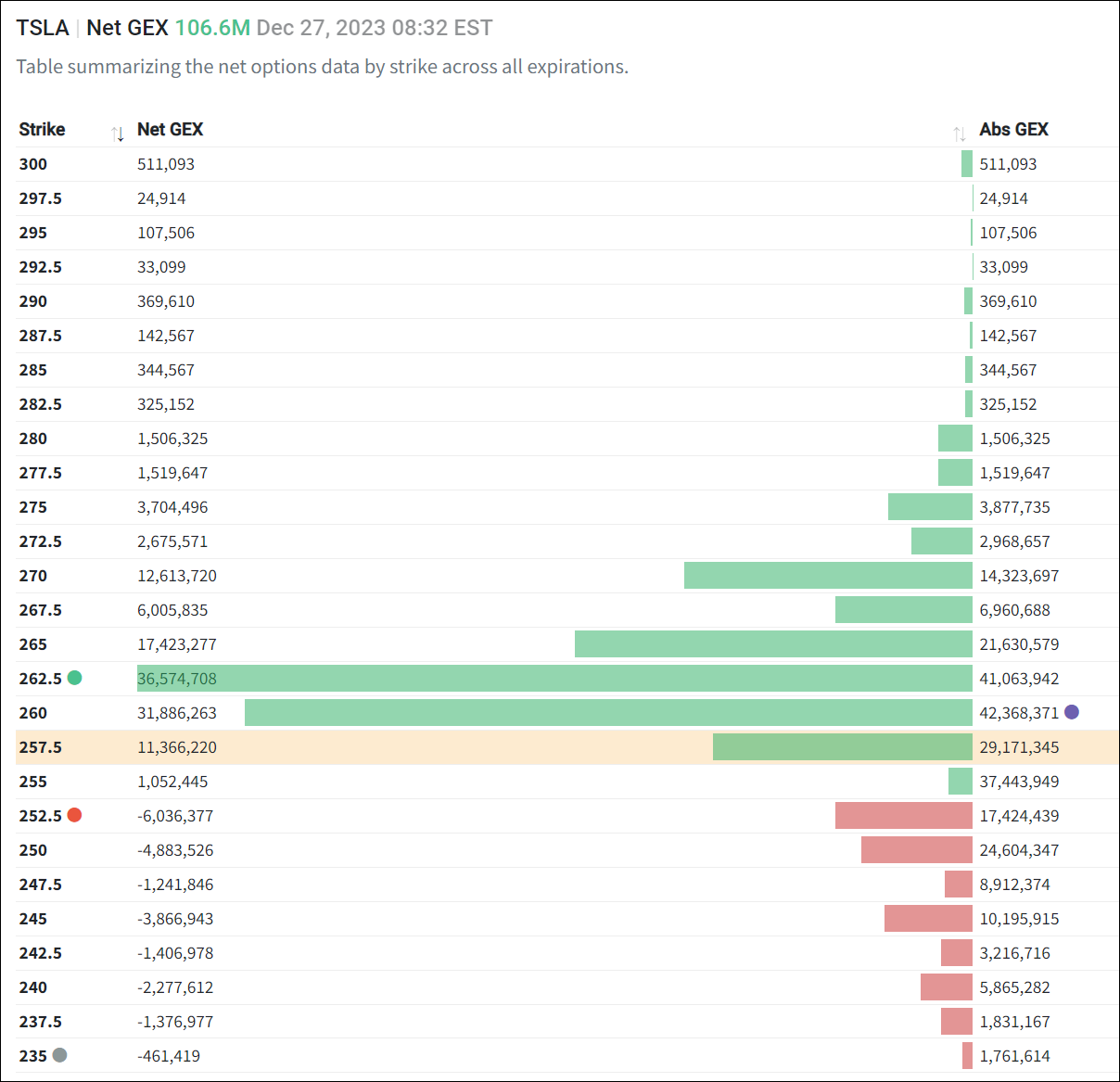

Largest +GEX wall moved up to $262.50

Highest Call OI (potential stall area up) $262.50

Max-Pain moved up to $250

Largest -GEX wall moved up to $252.50

Highest Put OI (potential stall area down) $250.00

Bullish pivot up $261.05

Bearish pivot down $251.29

I set a sell order for $260 on longs in one of my accounts, will take the cash if it hits and watch. If we continue closing candles over $261-$262 I'll likely buy back in. Usually there's a surge at open before it backs off, so let's see if the order fills.

Cary/WS maintains that below $259.12 keeps $231.89 in reach as a 1-2 week objective.

Let the games begin!

Maybe today at open we get a $260 touch/break?

Largest +GEX wall moved up to $262.50

Highest Call OI (potential stall area up) $262.50

Max-Pain moved up to $250

Largest -GEX wall moved up to $252.50

Highest Put OI (potential stall area down) $250.00

Bullish pivot up $261.05

Bearish pivot down $251.29

I set a sell order for $260 on longs in one of my accounts, will take the cash if it hits and watch. If we continue closing candles over $261-$262 I'll likely buy back in. Usually there's a surge at open before it backs off, so let's see if the order fills.

Cary/WS maintains that below $259.12 keeps $231.89 in reach as a 1-2 week objective.

Let the games begin!

Last edited:

I'm glad I was traveling yesterday. Based on the ALGO split in the afternoon, I would have sold shares. We can see it never came together. Is that because it was early in the week, or is P&D FOMO over powering the options pull? Need to be cautious with buying/selling shares based on this data for now until I understand it better.

Edit: It looks like I could have scalped a dollar if I sold shares right after the Algo went straight down hard around 13:44

Edit: It looks like I could have scalped a dollar if I sold shares right after the Algo went straight down hard around 13:44

Last edited:

intelligator

Active Member

Adding to ^^^ , OI has increased across all strikes from 240 through 275, less so at 260 which seems to be the dividing line. Going to try again to open 12/29 -c275/+c305 today; wasn't around yesterday morning to take advantage of.

EDIT: at market open +c305 is $0 , have to tighten spread to+c295 +c300...

EDIT: at market open +c305 is $0 , have to tighten spread to

Last edited:

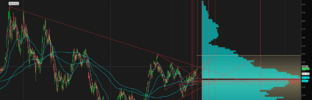

2 year downtrend line is broken at around 262 now, and it is getting lower everyday. I think we break it this week, which could lead to a lot more upside....

QTA levels + various commentary

12/29

12/29

jeewee3000

Active Member

Rolled my 255cc's for this week to 260cc's for next Friday at a credit ($1.18 or so).

Still have some 260cc's open for this Friday.

STO some 250cc's for next Friday at $14.00 when SP was around $260 to hedge against a drop. The goal is not to have these expire worthless, but to repurchase them at a profit should we retrace to say $255 or $250.

Leaving 1/3 of shares "unbound" by cc's to manage positions in case I need to.

Still have some 260cc's open for this Friday.

STO some 250cc's for next Friday at $14.00 when SP was around $260 to hedge against a drop. The goal is not to have these expire worthless, but to repurchase them at a profit should we retrace to say $255 or $250.

Leaving 1/3 of shares "unbound" by cc's to manage positions in case I need to.

How do you use the 1/3 of your shares to manage a losing position? I don't grasp that strategy.Rolled my 255cc's for this week to 260cc's for next Friday at a credit ($1.18 or so).

Still have some 260cc's open for this Friday.

STO some 250cc's for next Friday at $14.00 when SP was around $260 to hedge against a drop. The goal is not to have these expire worthless, but to repurchase them at a profit should we retrace to say $255 or $250.

Leaving 1/3 of shares "unbound" by cc's to manage positions in case I need to.

I have the 2-year ATH downtrend at 269.50 today.Bounced right off the 2-year....

Attachments

You have shares available to sell new CCs to raise premium to help roll the ITM ones.How do you use the 1/3 of your shares to manage a losing position? I don't grasp that strategy.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K