I *think* it's the delayed import of transaction data, such as from darkpool trades that do not need to be reported in real-time, but can be reported up to x hours later into the consolidated tapeAnyone know what happens almost daily at 8am to cause the SP to pop or drop for 5 to 10 minutes? It doesn't appear to have an effect, just curious.

View attachment 1013556

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

In some territories pre-market doesn't open until 7:00EST and 8:00ESTn which is why you get the flurry of action around these two momentsAnyone know what happens almost daily at 8am to cause the SP to pop or drop for 5 to 10 minutes? It doesn't appear to have an effect, just curious.

View attachment 1013556

I can't set a pre-market order until 8:00EST (14:00CET), which is valid until 9:15EST after which is it cancelled if not yet triggered

This guy regularly posts good and level-headed info on TSLA, worth a follow:

Gave back all the premium I had earned, and then a slight debit on top, to roll 80X 192.5CC for Friday to 205 next week. I am waiting for more of a pop to sell new CCs for this Friday at 205 or higher. I will sell half today and half tomorrow after FOMC.

Edit: Too early in the week to wait and see if the 192.5CCs would have finished OTM. Also I think the ER drop was fabricated so I expect to be back to 210+ very soon. Auto margins improved. Operating margins improved. Free cash flow over $2B completely surpassed estimates. It was a good quarter except for the lack of 2024 guidance which I think is a nothing burger.

Edit: Too early in the week to wait and see if the 192.5CCs would have finished OTM. Also I think the ER drop was fabricated so I expect to be back to 210+ very soon. Auto margins improved. Operating margins improved. Free cash flow over $2B completely surpassed estimates. It was a good quarter except for the lack of 2024 guidance which I think is a nothing burger.

thenewguy1979

"The" Dog

STC my +195C for $200 gain.

will reenter if we hold 198 or fell below 185.

will reenter if we hold 198 or fell below 185.

StarFoxisDown!

Well-Known Member

That gap up definitely tells me we're coming back down at least 189.99 by Friday.

Playing out so far. Keeping TSLA in check.Macros green today. I wonder if Red tomorrow before FOMC rebound Wednesday.

Are you in any puts or just your regular IC's?

waiting to ladder in more; 40 wide nowAre you in any puts or just your regular IC's?

juanmedina

Active Member

Tom was wrong almost all year last year and was at the point of being ridiculed on CNBC until the year end rally starting Oct 31st.

He's been a bull and his POV is great, and is always worth listening to.

With my Vanguard index fund (bought on Oct 31st from money market[got lucky] )up more than 38% since Oct 31st(parabolic move), I'm getting itchy in trying to time the market, and doing so a bit ahead is OKwill patiently wait for such an event and make $ in money market fund

I wish I was that wrong....

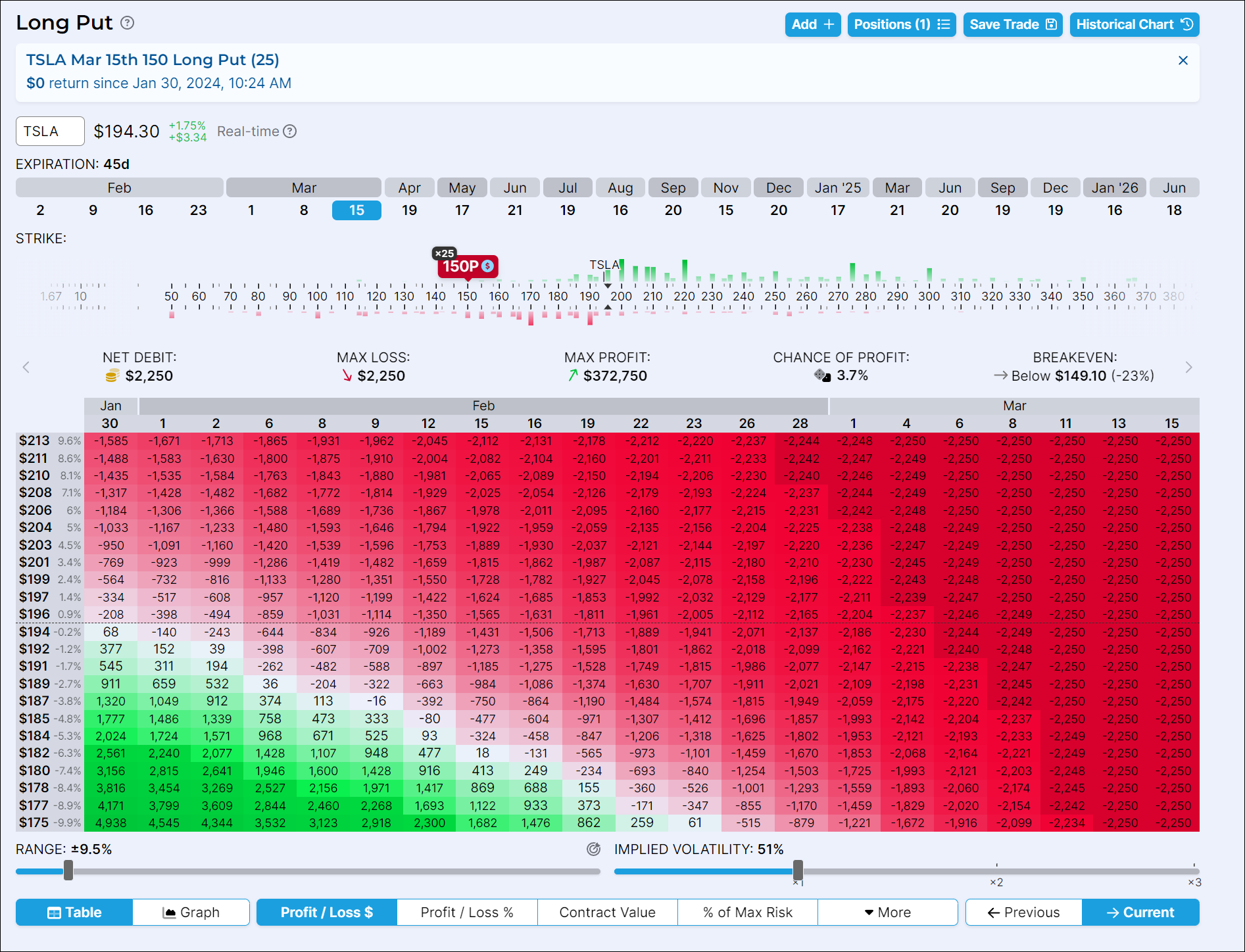

BTO 25x +P150 3/15 @0.90

Just insurance for my short put LEAPS, to keep from worrying about maintenance call, even though I have plenty extrinsic.

Would be funny if I made money on these bought puts, but SP dropping below $180 won't be good for my longs and the rest of us. Would prefer they expire worthless. I can always cut the +P's if we get over $200 decisively to salvage what's left. Will wait and see.

Just insurance for my short put LEAPS, to keep from worrying about maintenance call, even though I have plenty extrinsic.

Would be funny if I made money on these bought puts, but SP dropping below $180 won't be good for my longs and the rest of us. Would prefer they expire worthless. I can always cut the +P's if we get over $200 decisively to salvage what's left. Will wait and see.

Last edited:

was wrong almost all year last year and was at the point of being ridiculed on CNBCI wish I was that wrong....

... means he appeared wrong all year, but turned out to be right ...cheers!!

thenewguy1979

"The" Dog

did @tivoboy and @dl003 went on vacation together?

If so - have a good times guys. Please give us a hollar when you’re back.

The team here misses your TA prowesses.

Dont worry we got Jim and Yoona holding up the house for now

Doggy me still trying to pee straight. Gotten lot better with the team guidances.

If so - have a good times guys. Please give us a hollar when you’re back.

The team here misses your TA prowesses.

Dont worry we got Jim and Yoona holding up the house for now

Doggy me still trying to pee straight. Gotten lot better with the team guidances.

SpeedyEddy

Active Member

Being afraid to (on a serious next drop)get assigned April -P 205 I already sold a September -P185, which gives me peace of mind up unto SP165. Money caught up 5 months longer, but with a more bullish market I sure can bail out somewhere sooner. First must see SP continuing upward a few weeks to continue the LEAP-buying.

Holding the -P205 until we turn downward, but sure before close, so this is kind of a a time-stretched roll, scalping a little bit extra on daily delta up, I hope.

Holding the -P205 until we turn downward, but sure before close, so this is kind of a a time-stretched roll, scalping a little bit extra on daily delta up, I hope.

If TSLA hangs out in the $196-$197 area this afternoon, then $198 can fall next and see $200 this week and $217 follow-though next week if macro doesn't bomb.

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K