Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

Thanks mate! Found it. So he thinks that this week will establish how much higher we go. So I assume his covering himself if earnings are a beat for all mega caps, then we could bump up a little more but he thinks then we get a little profit taking or something along those lines. "air pocket" he calls it.

Many are calling 194.35 area resistance. Calling today possible dead cat bounce. I don't know if I should wait for 195 to roll my 192.5CC for Friday or just do it tomorrow morning. Get harder to roll the more ITM it gets....

Have a look at Cary’s update today, he says if TSLA is trading around $196 after 1pm tomorrow and/or into close augurs well for bullish continuation to $217 in 3-5 days or by the end of next week and so to be ready to close shorts if TSLA actually closes over $198. Until then trading below $198 keeps TSLA susceptible to $177.Many are calling 194.35 area resistance. Calling today possible dead cat bounce. I don't know if I should wait for 195 to roll my 192.5CC for Friday or just do it tomorrow morning. Get harder to roll the more ITM it gets....

Considering that I was planning to add leaps around $200, missing out on the $180 share price from Friday and buying around the $190 share price today is a great outcome - even if the shares were off after that. I added a pile of leaps - about 1/3rd of the total pile I would like to get, but I need another push down in the share price for the next big buy. If I don't get that push down, then that's ok too - I'll do well with the new leaps added today.

The way I'm setup the one outcome between now and end of next week that is really bad is for the share price to stay at 185. Down to 160 is great - up to 200-210 is great. I just need some movement, with a personal preference for down - that'll be an excuse to buy another batch of leaps.

I had a stack of -200p/+170p put spreads that I split in half on there last roll. Half stayed at that strike and rolled to Feb 9. The other half flipped over into -165c/+195c call spreads. As long as there is movement away from 185 then half of the bad position will get better . I've also got some long puts for Feb 9 in case of a serious drop this week or early next week.

. I've also got some long puts for Feb 9 in case of a serious drop this week or early next week.

The way I'm setup the one outcome between now and end of next week that is really bad is for the share price to stay at 185. Down to 160 is great - up to 200-210 is great. I just need some movement, with a personal preference for down - that'll be an excuse to buy another batch of leaps.

I had a stack of -200p/+170p put spreads that I split in half on there last roll. Half stayed at that strike and rolled to Feb 9. The other half flipped over into -165c/+195c call spreads. As long as there is movement away from 185 then half of the bad position will get better

-165c/+195c ???Considering that I was planning to add leaps around $200, missing out on the $180 share price from Friday and buying around the $190 share price today is a great outcome - even if the shares were off after that. I added a pile of leaps - about 1/3rd of the total pile I would like to get, but I need another push down in the share price for the next big buy. If I don't get that push down, then that's ok too - I'll do well with the new leaps added today.

The way I'm setup the one outcome between now and end of next week that is really bad is for the share price to stay at 185. Down to 160 is great - up to 200-210 is great. I just need some movement, with a personal preference for down - that'll be an excuse to buy another batch of leaps.

I had a stack of -200p/+170p put spreads that I split in half on there last roll. Half stayed at that strike and rolled to Feb 9. The other half flipped over into -165c/+195c call spreads. As long as there is movement away from 185 then half of the bad position will get better. I've also got some long puts for Feb 9 in case of a serious drop this week or early next week.

Yep - not at all a position that I wanted to be in. It's half of the -200p/+170p that I had. This half I flip rolled into calls which put me equally DITM but on the other side of the share price. I nice drop to 160 by end of next week would be really convenient-165c/+195c ???

A bump back over 200 by end of next week will also be good - in either case half of the bad position gets cleaned up, and in both cases I have long options that will perform well that will offset some or all of the losses on the side that will be losing badly.

Next up will be figuring out what to do with the half that does badly, given that we do move in either direction, as the losing half will be rapidly heading into max loss territory.

That's why I buy longer puts now, gives plenty of time to sell against and recover the premium, as well as giving downside protectionYes, But my +180P and -192.5CC look like

SpeedyEddy

Active Member

Could we see an island reversal today? So gapping up a lot, without falling back (FOMC!)

that would be a clear sign to get out of any short position and conclude that this $180-ish was just like the 2023 Jan 8th $102-ish. In that case (don’t make my 2023 mistake to wait and) get my LEAPS in place ASAP.

that would be a clear sign to get out of any short position and conclude that this $180-ish was just like the 2023 Jan 8th $102-ish. In that case (don’t make my 2023 mistake to wait and) get my LEAPS in place ASAP.

I'd worry about it more if the rest of big tech, SPY and QQQ wasn't all at ATH, seems long overdue for a pull-back IMO. Doesn't mean this will happen, but feels a bit over-cookedCould we see an island reversal today? So gapping up a lot, without falling back (FOMC!)

that would be a clear sign to get out of any short position and conclude that this $180-ish was just like the 2023 Jan 8th $102-ish. In that case (don’t make my 2023 mistake to wait and) get my LEAPS in place ASAP.

I have 100x -c185, but thanks to buying 100x Jan 2025 +c100, I have an escape roll to September -c270, or possibly might go lower strike with 50x given that I'm not convinced the SP is going up in a hurry

intelligator

Active Member

Anyone know what happens almost daily at 8am to cause the SP to pop or drop for 5 to 10 minutes? It doesn't appear to have an effect, just curious.

Anyone know what happens almost daily at 8am to cause the SP to pop or drop for 5 to 10 minutes? It doesn't appear to have an effect, just curious.

View attachment 1013556

Some say it's algos coming online and programming for the day, but that could just be a tinfoil theory.

juanmedina

Active Member

Thanks mate! Found it. So he thinks that this week will establish how much higher we go. So I assume his covering himself if earnings are a beat for all mega caps, then we could bump up a little more but he thinks then we get a little profit taking or something along those lines. "air pocket" he calls it.

He did an update last night.

Tom was wrong almost all year last year and was at the point of being ridiculed on CNBC until the year end rally starting Oct 31st.

He's been a bull and his POV is great, and is always worth listening to.

With my Vanguard index fund (bought on Oct 31st from money market[got lucky] )up more than 38% since Oct 31st(parabolic move), I'm getting itchy in trying to time the market, and doing so a bit ahead is OK

Last edited:

What does @tivoboy think - is this a reversal or just a DCB?Could we see an island reversal today? So gapping up a lot, without falling back (FOMC!)

that would be a clear sign to get out of any short position and conclude that this $180-ish was just like the 2023 Jan 8th $102-ish. In that case (don’t make my 2023 mistake to wait and) get my LEAPS in place ASAP.

The talk of $50 or $20 TSLA prices has some of us LEAP-buying simpletons wondering.

intelligator

Active Member

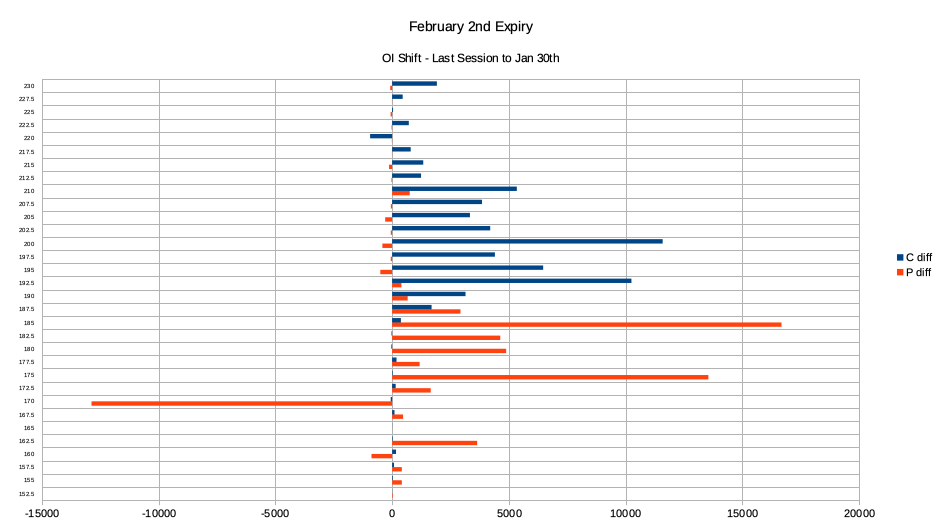

Doesn't appear to be a drastic OI shift up or down. Also note that these diffs are based on option market end of day, the pump was after hours. c200 added about 11k, c192.5 about 10k, p185 16.6k, p175, 13.5k, overlap at 185 to 192.5, mp sticky at 187.5 , put:call .73

EDIT: 2/2 +gex at 187.5, -gex at 185 ... will the price retreat?

EDIT: 2/2 +gex at 187.5, -gex at 185 ... will the price retreat?

I've "bought the dip" so many times only to be out of funds for further TSLA price drops... I'm gonna hold all my remining cash in case we see sub-$170 and save some for buying LEAPS all the way down to crazy low TSLA prices of even $50 or so; it's unlikely, but the number of cheap LEAPS I could buy with even modest funds if it drops that low would be crazy to pass up.What does @tivoboy think - is this a reversal or just a DCB?

The talk of $50 or $20 TSLA prices has some of us LEAP-buying simpletons wondering.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K