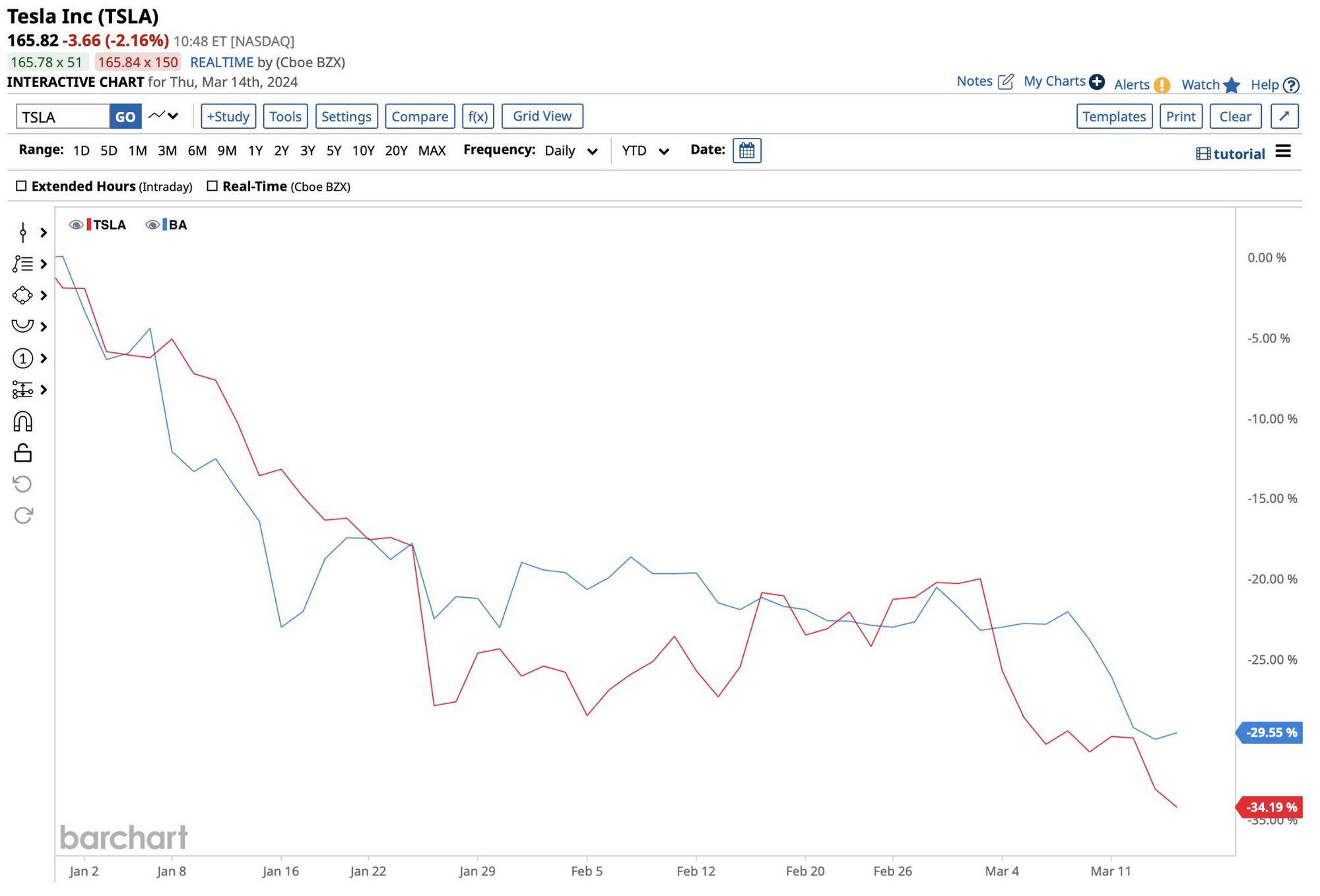

TSLA continues to get punished and is now the worst performer in the S&P 500 this year, yes, even worse than Boeing:

Credit: BarChart

Credit: BarChart

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

A close below 164.20 tomorrow could have us looking for 89.10 according to Cary

I am planning on buying LEAPS, June 2026 250strike,Honestly at that point I have to seriously consider selling all shares and buying the longest dated LEAPs I can, prob at 2:1 or 3:1 depending on what the premiums/strikes look like

That's what a lot of us have said in hindsight to have been the better "option" on the 102 bottom... So You're right!Honestly at that point I have to seriously consider selling all shares and buying the longest dated LEAPs I can, prob at 2:1 or 3:1 depending on what the premiums/strikes look like

I am planning on buying LEAPS, June 2026 250strike,

at 150 SP cost $25

assuming a SP double to 300 before expiration the LEAPS value would be $120

so a 3.8x v SP 1x

I am missing something besides the obvious & that being if the SP does not recover before Jun 2026

now we just need a few doors flying off moving cars to get a nice bump to where BA is.TSLA continues to get punished and is now the worst performer in the S&P 500 this year, yes, even worse than Boeing:

View attachment 1027934

Credit: BarChart

the business doing rather OK (and later this year splendid) things will turn abruptly, but when? I am sidelined again, so:TSLA continues to get punished and is now the worst performer in the S&P 500 this year, yes, even worse than Boeing:

View attachment 1027934

Credit: BarChart

Given I already have lot of bleeding calls (and CC's against) ...I am planning on buying LEAPS, June 2026 250strike,

at 150 SP cost $25

assuming a SP double to 300 before expiration the LEAPS value would be $120

so a 3.8x v SP 1x

I am missing something besides the obvious & that being if the SP does not recover before Jun 2026

FWIW, at some high level, I see selling all share (bearish) and at the same time buying LEAPs (bullish) as contradictory. You’re selling because you think it would go down further as the trend continues, in which case waiting until you think bottom is close to buy LEAPs would make sense. You’re buying LEAPs because you have a contrarian perspective to current trend, which you don’t as you’re selling all shares.Honestly at that point I have to seriously consider selling all shares and buying the longest dated LEAPs I can, prob at 2:1 or 3:1 depending on what the premiums/strikes look like

FWIW, at some high level, I see selling all share (bearish) and at the same time buying LEAPs (bullish) as contradictory. You’re selling because you think it would go down further as the trend continues, in which case waiting until you think bottom is close to buy would make sense. You’re buying LEAPs because you have a contrarian perspective to current trend, which you don’t as you’re selling all shares.

This is not an attack, just an unsolicited view that I feel we owe one another. I’m in the same boat btw.

We're so close to that gap fill I don't see anyway we don't fill it at this point, at least on a intraday level. To me at least, the real question is if that will be in the line in the sand that holds or if we really are about to drop all the way to the 2023 lows.

FWIW, at some high level, I see selling all share (bearish) and at the same time buying LEAPs (bullish) as contradictory. You’re selling because you think it would go down further as the trend continues, in which case waiting until you think bottom is close to buy LEAPs would make sense. You’re buying LEAPs because you have a contrarian perspective to current trend, which you don’t as you’re selling all shares.

This is not an attack, just an unsolicited view that I feel we owe one another. I’m in the same boat btw.

+LEAPs are great bets I agree; I can’t help but reflect on Adiggs’ perspective earlier this morning. If SP continues lowers, the same LEAP would be at a lower price…to buy; perhaps your point is it will be lower but not at the same rate as that of SP.I may be wrong but I think the reasoning may be LEAPS lose value slower than shares, and TSLA >$100 in 2026 seems like a pretty good bet.

But there are other implications that one should know about before doing such a conversion.

Where/when are you expecting the calls to be worth $120?I am planning on buying LEAPS, June 2026 250strike,

at 150 SP cost $25

assuming a SP double to 300 before expiration the LEAPS value would be $120

so a 3.8x v SP 1x

I am missing something besides the obvious & that being if the SP does not recover before Jun 2026

Jim do you care to discuss the other implications?I may be wrong but I think the reasoning may be LEAPS lose value slower than shares, and TSLA >$100 in 2026 seems like a pretty good bet.

But there are other implications that one should know about before doing such a conversion.

$69 MAYBE $100 a monthFair enough; pure lane centering is useless for me with some of the road conditions I drive. What do you place the dollar value of FSD Beta for your commute?