another not-advice tip is wait 3dte (or less) for nvda/smci/mstr sto, but that's just meSlow and steady , selling .04 and .05 delta and forming 100 wide IC legs is working well, thanks for the suggest !

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

Seem 10 for 10. Last 10 weeks NVDA has closed the week higher then the week before, regardless of the intraweek drop.

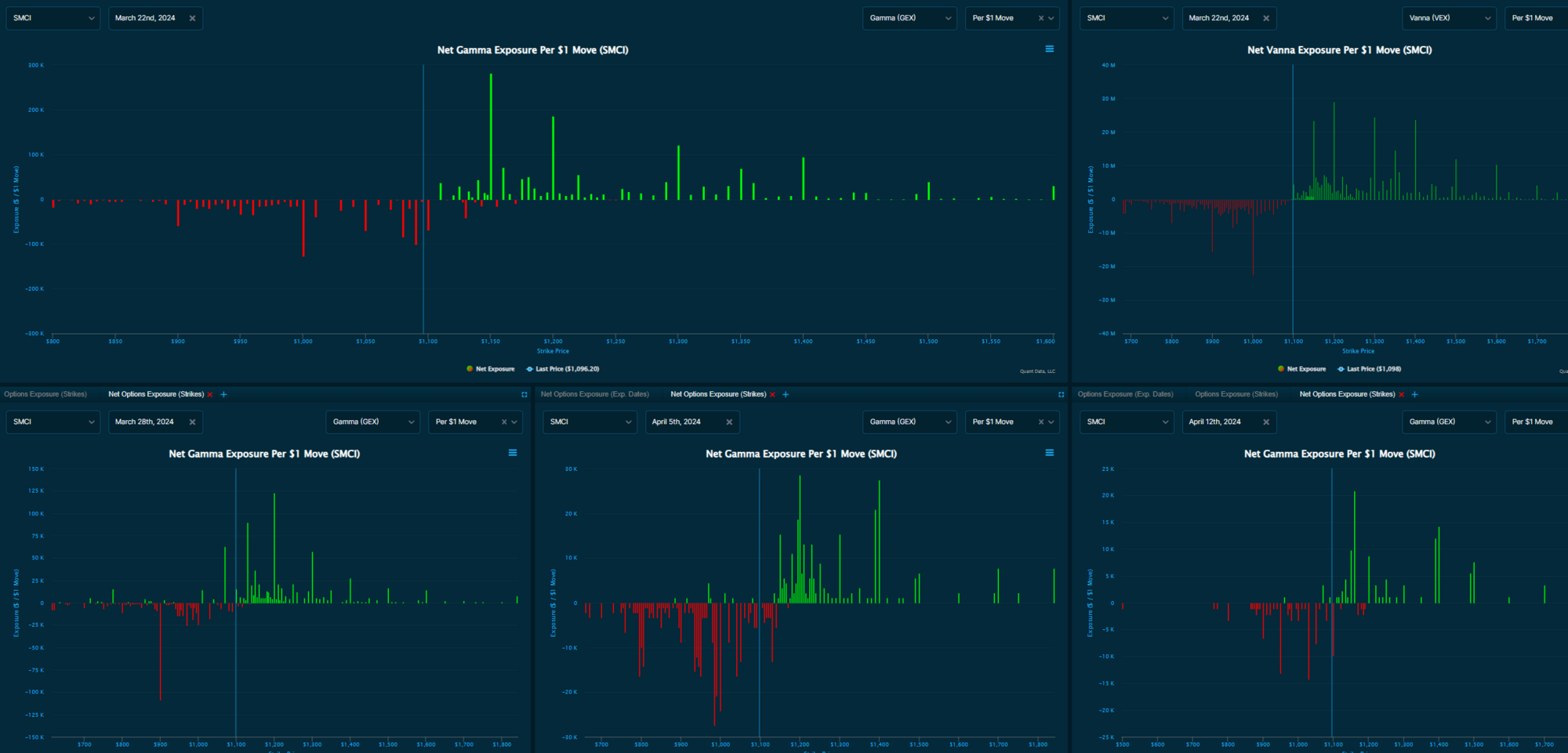

looking 1 month ahead (if you don't understand gamma/vanna: treat gamma as OI walls, treat vanna as range that dealers prefer)

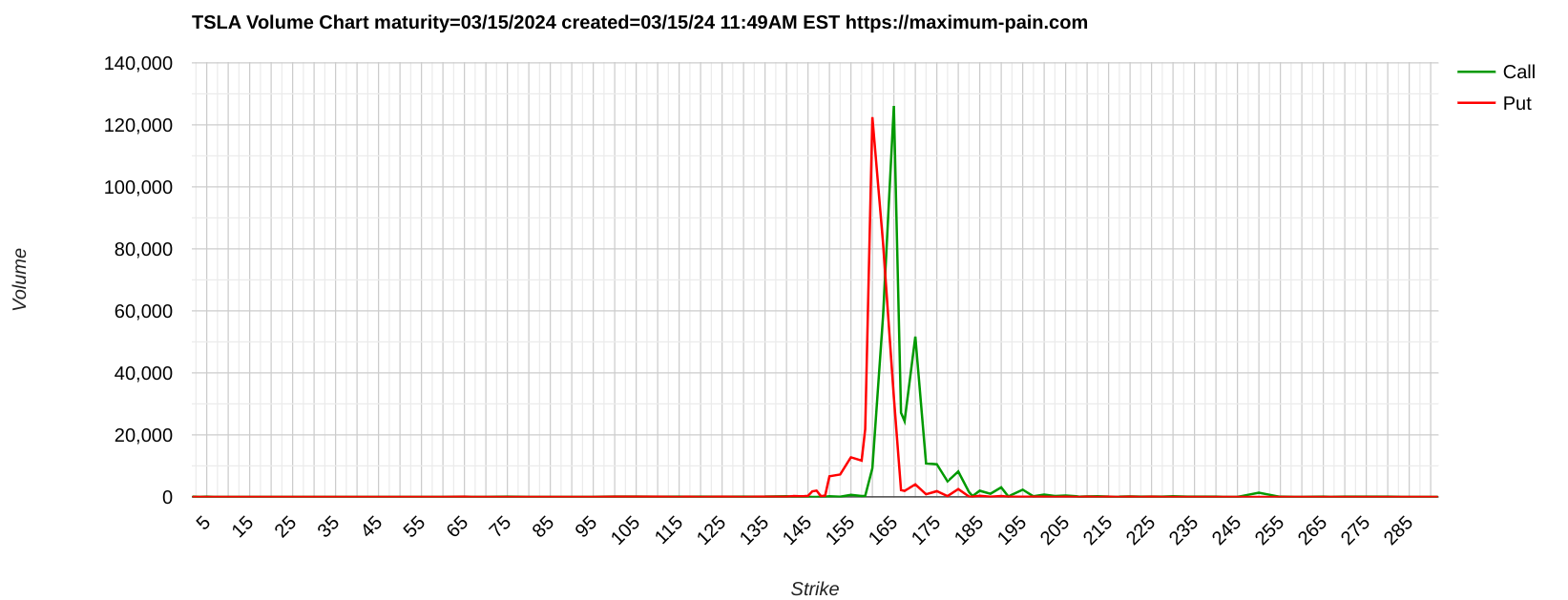

TSLA market participants expecting 150ish

NVDA

SMCI

TSLA market participants expecting 150ish

NVDA

SMCI

I looked at March again and there's so little volume and OI it seems January is a lot better to hide among the crowed.Why not write 10x -c240's at the same 3/2025 strike? Do we think the SP will be there by then? I personally don't think so and there'd be plenty of time to roll up if the SP did rally

Perhaps:

Roll 10x -P250 9/20/24 @88.00 (extrinsic $0.70) to 10x -P240 1/17/25 @ 81.20 (extrinsic $3.65; OI 13,000)

Debit: -$7,000

STO 10x -C260 12/17/25 @7.75

Credit: +$7,750

Is that about right?

Also, maybe I should wait to trigger it until we lose $158.00 or just do it now?

The good news with your current 9/20 -p250's is that there's a lot of OI >12k, but almost zero volume, so no-one is trading them and unless they all get exercised at once, you'd be unlucky.

What do you mean by this. I thought the greater the OI the less likely I'll get assigned (even at 0.00 extrinsic). Highly unlikely all 12,000 contracts get assigned (unless we're in the $140-120's maybe...but I would have rolled by then I hope)

Last edited:

interesting PA today between the two mountains. Would expect it to touch $160 today and I'd get out of my CCs. If it doesn't, happy to roll out.

ChiefRollo

Member

Wish I were there having a beer with you.There's quite a few here with a hell of a lot more $portfolio than me, that's for sure, and mine is around 40% of where it was in November 2021, although to be fair with the cash I took out in the interim, probably more like 55% down

For sure if I had just kept my original shares, never traded anything, my account would be 25% lower than it is right now

Right, I'm off down the pub...

gamma magnet is more 160ish than 165ishinteresting PA today between the two mountains. Would expect it to touch $160 today and I'd get out of my CCs. If it doesn't, happy to roll out.

View attachment 1028316

Last edited:

And me as well. Super painful to get assigned on puts on the march down to $100, but I f*ing did it, and ended up acquiring about ~30% more shares at an average of $160'ish, which is what was super painful as I was exasperated and emotionally drained thinking I might be crazy to think valuation was closer to $400. I feel similarly still and my time at SpaceX this past year has only emboldened me more as the folks there are so 'in it to win it' that you wouldn't believe. I shared beers with a few folks this week to talk about V12.3, Starship and all things are progressing well.There's quite a few here with a hell of a lot more $portfolio than me, that's for sure, and mine is around 40% of where it was in November 2021, although to be fair with the cash I took out in the interim, probably more like 55% down

For sure if I had just kept my original shares, never traded anything, my account would be 25% lower than it is right now

Right, I'm off down the pub...

This rodeo I'm collecting more cash with CCs and NOT doing puts as I want to buy calls when we are close to $100 (if that materializes).

ChiefRollo

Member

Many of us belong to the richest 1%, but don't realise it.

How much wealth gets you into the global top 1%?

Using the Knight Frank Wealth Sizing Model, we reveal how deep your pockets need to be to join the wealthiest 1% in selected countries and territories.

In the US its about $5M to be top 1% (net worth).

:max_bytes(150000):strip_icc()/GettyImages-1173201538-d8be565ff6d943848ce1655bd36d5fc0.jpg)

What Is the Average Net Worth of the Top 1%?

An American household would need to be worth a minimum of $11.1 million to get into the 1% club. Here's a look at the super-rich in the U.S.

I still think of myself as middle class, or maybe middle class, as that's where I've been in my life. But that's not reality.

thenewguy1979

"The" Dog

Guess the Dog ranked in the top 1% ........ counting from bottom up

How much wealth gets you into the global top 1%?

Using the Knight Frank Wealth Sizing Model, we reveal how deep your pockets need to be to join the wealthiest 1% in selected countries and territories.www.knightfrank.com

In the US its about $5M to be top 1% (net worth).

$400-600k (individual, family) for top 1% income in the US.:max_bytes(150000):strip_icc()/GettyImages-1173201538-d8be565ff6d943848ce1655bd36d5fc0.jpg)

What Is the Average Net Worth of the Top 1%?

An American household would need to be worth a minimum of $11.1 million to get into the 1% club. Here's a look at the super-rich in the U.S.www.investopedia.com

I still think of myself as middle class, or maybe middle class, as that's where I've been in my life. But that's not reality.

Trying to make just $100 buck a week for a bag of kibbles.

Here we go.....more downward pressures.

You realize the loss whatever you roll to. What you're talking about is cash flow - -$6k cash flow will realize that loss, and establish a new cost basis that will eventually lead to another realized gain/loss.@Max Plaid @MikeC I'm preparing a plan for my 10X -P250 9/20 (extrinsic is $0.80 currently) in case extrinsic drains out in the low $150's and at risk of assignment.

Looking at the chain I can debit roll it down and out to 10x -P240 for 3/2025 (6 months further out; more time for SP to recover or just bounce; gain $5.15 in extrinsic). It will have a debit of about $6,000 which I assume is better than booking a $37,210 loss (the delta between $192.21 CB and ~$155) if I was assigned and immediately sold the shares. I can easily earn the $6k back through my regular scalping.

As an aside, if assigned I can also sell ATM calls for about $10k the week of assignment to help recover some of the loss.

Am I missing something?

Is there a better roll that's not too far out?

Ty

A roll transaction is really 2 transactions that the broker does as a single transaction for you. The benefit, besides the convenience, is that the proceeds from one of those transactions can be used in the other transaction. In this instance you would be paying the $6k different, rather than needing all of the cash to buy out the starting position, to then replace it when opening the replacement position.

I've been in a situation where the roll enabled me to do something I couldn't do as 2 independent transactions. Of course I could just do the same roll via independent transactions by making them smaller. Maybe I can afford to close 5 contracts, but not 20, all at the same time. Close the 5, open the new 5. Repeat until all 20 are rolled via 2 transactions each - this is the real benefit of the roll, at the possible expense of extra bid/ask slippage (have you ever noticed that spreads never get price improvement, while market and limit orders on a single option contract do? At least at Fidelity anyway)

ChiefRollo

Member

I know sentiment is at its low point right now; I want to thank you while I’m thinking of it for creating this thread. I’ve learned quite a bit and have much more to learn. More importantly I enjoy having daily visits and connections with this community you helped put together.

How much wealth gets you into the global top 1%?

Using the Knight Frank Wealth Sizing Model, we reveal how deep your pockets need to be to join the wealthiest 1% in selected countries and territories.www.knightfrank.com

In the US its about $5M to be top 1% (net worth).

$400-600k (individual, family) for top 1% income in the US.:max_bytes(150000):strip_icc()/GettyImages-1173201538-d8be565ff6d943848ce1655bd36d5fc0.jpg)

What Is the Average Net Worth of the Top 1%?

An American household would need to be worth a minimum of $11.1 million to get into the 1% club. Here's a look at the super-rich in the U.S.www.investopedia.com

I still think of myself as middle class, or maybe middle class, as that's where I've been in my life. But that's not reality.

thenewguy1979

"The" Dog

ChiefRollo

Member

Same at e*trade…You realize the loss whatever you roll to. What you're talking about is cash flow - -$6k cash flow will realize that loss, and establish a new cost basis that will eventually lead to another realized gain/loss.

A roll transaction is really 2 transactions that the broker does as a single transaction for you. The benefit, besides the convenience, is that the proceeds from one of those transactions can be used in the other transaction. In this instance you would be paying the $6k different, rather than needing all of the cash to buy out the starting position, to then replace it when opening the replacement position.

I've been in a situation where the roll enabled me to do something I couldn't do as 2 independent transactions. Of course I could just do the same roll via independent transactions by making them smaller. Maybe I can afford to close 5 contracts, but not 20, all at the same time. Close the 5, open the new 5. Repeat until all 20 are rolled via 2 transactions each - this is the real benefit of the roll, at the possible expense of extra bid/ask slippage (have you ever noticed that spreads never get price improvement, while market and limit orders on a single option contract do? At least at Fidelity anyway)

i posted earlierNext week Yoona?

ChiefRollo

Member

dc_h

Active Member

I dream about going to the stockholders call and asking Elon how he gets feedback in the company. I feel that anyone with enough gravitas to call him out on bullshit is gone and the people close to him are toadys and leaches. On the bright side, FSD may really be a year away, battery storage should be solid growth story, but if its not up 75-100% this year, it is coming up well short of Elon's 2022 public expectations.My problem is that I'm not getting any younger, I'm 58 this year and don't really have the time-frame to sink a ton of capital into a stock that might not go anywhere for several years

And I really am tired of the drama and seriously question the judgement of Musk going forwards, I think would be better if he left, let the stock crash, then recover under a more stable leadership - if it dumped way below 100 then maybe

In retrospect, Zach was the one steadying the ship, has been downhill since he left

And let's not forget that we are seriously overdue a macro correction, S&P has been straight-line +25% since end of October, this is not normal

Based on the TA people, I did make a small bet that we will decline to or toward the 144 gap and sold 1 150 CC. I have a lot of CC's (for me) from 200 March 28, 225 April 19, 250 May and July and then 300+ in 2025. If 144 sticks, the window to move 2025 CC's to lower priced 2024 calls is closing, but anything around 250 in 2024 seems pretty safe at this point.

It's always darkest before the dawn, but dawn after a storm can really reveal the *sugar*. Hopefully 144 is our low and truck and energy, lower input costs and steady 3/Y deliveries the rest of the year will carry us forward to better results in 2025.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K