Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I don't know how to read it... so I don't try to play it. We are at about half of our 52-week high though and a P/E around 40. Price targets ranging from $14-2,000. We obviously have a big macro component going on as well. I'm hoping tomorrow I can get some trading in with an environment I am more comfortable with.TSLA missed shipment with the 1st YOY decline since 2020 and we are now in Green.

Keep this up and Future/Uber Guy will say his 180-220 is on the marked by end of week

thenewguy1979

"The" Dog

Might pull a rabbit out during ER. Seem he's working extra hard to pump the SP.

EVERYONE was saying today was going to be Green, but I still panicked at SP 164 after open and sold my CCs for next week at that point (to protect my margin) instead of waiting. That is what the threat of margin calls does to my trading....

I keep going back to my history "...and then Steve Jobs died." That was a tough one to recover from financially, took 3 years. The importance of understanding your exposures-- margin, macro, random, concentration/diversification, etc. can never be understated.margin concerns make for terrible trades. Aside from situations like the one you describe, I have also lost so much money over the years holding protective positions that I would have gladly dumped for massive profits at certain opportunities, but which ended up expiring worthless, because I didn't want to lose the hedge.

A lot of it is like people's propensity to over-insure. Low-probability, high-impact events are hard for us to properly grasp.

Yes, because we TSLA die-hards are so beaten to a pulp the landing will be soft: Plop!

StarFoxisDown!

Well-Known Member

Would be quite entertaining if Tesla lined up the release of the remaining FSD functionality (Smart Summon, Reverse, autonomously park itself) with the announcement that a auto maker is going to license the FSD. Peak bearishness going into earnings only to have the mother of all earnings announcements.Might pull a rabbit out during ER. Seem he's working extra hard to pump the SP.

But in reality, based on Elon's other tweets about Q1 numbers, he's in defensive mode. There's clearly no bait.

This whole thing with Tesla is really a shame because if they had just gone the Amazon route a year ago...saying they're firmly going to push production as hard as possible to increase the fleet size, they don't care about short term profits because the real profits are realized as FSD comes of age and it's makes more financial to get as many FSD capable cars out on the road as possible, I doubt they'd be in this position.

Isn't that exactly what they said on the past 2-3 calls ("sell cars even at zero margin"; "FSD deployment greatest step-change in value," "Tesla will be worth greater than Apple, Aramco, etc.")? I don't think that's what WS wanted to hear (see SP since then). Unless I misunderstood your point.This whole thing with Tesla is really a shame because if they had just gone the Amazon route a year ago...saying they're firmly going to push production as hard as possible to increase the fleet size, they don't care about short term profits because the real profits are realized as FSD comes of age and it's makes more financial to get as many FSD capable cars out on the road as possible, I doubt they'd be in this position.

tivoboy

Active Member

@Knightshade in 5Would be quite entertaining if Tesla lined up the release of the remaining FSD functionality (Smart Summon, Reverse, autonomously park itself) with the announcement that a auto maker is going to license the FSD. Peak bearishness going into earnings only to have the mother of all earnings announcements.

But in reality, based on Elon's other tweets about Q1 numbers, he's in defensive mode. There's clearly no bait.

This whole thing with Tesla is really a shame because if they had just gone the Amazon route a year ago...saying they're firmly going to push production as hard as possible to increase the fleet size, they don't care about short term profits because the real profits are realized as FSD comes of age and it's makes more financial to get as many FSD capable cars out on the road as possible, I doubt they'd be in this position.

4

3

2

1

StarFoxisDown!

Well-Known Member

No, Tesla and Elon mention it here and there but in a messy, meandering kind of way. They don't present an actual plan and path to the goal. It's just a incoherent "Oh yeah we believe eventually all of the value will be in FSD". Wall St reads that as hopes and dreams, not a gameplan. They also contradict themselves many times and muddy up the messaging by making excuses and complaining.Isn't that exactly what they said on the past 2-3 calls ("sell cars even at zero margin"; "FSD deployment greatest step-change in value," "Tesla will be worth greater than Apple, Aramco, etc.")? I don't think that's what WS wanted to hear (see SP since then). Unless I misunderstood your point.

Amazon, pretty much from the start, presented a clear goal and path to that goal. All of their choices and actions tied back to that goal.

There's a big difference in how Amazon controlled their narrative (while posting some quarters of big losses) verses what how Tesla has controlled the narrative over the past year and a half.

Last edited:

Hilarious. Posts like this remind me that half the time I think I just trade TSLA to pass the time and virtually shoot the *sugar* with you all.

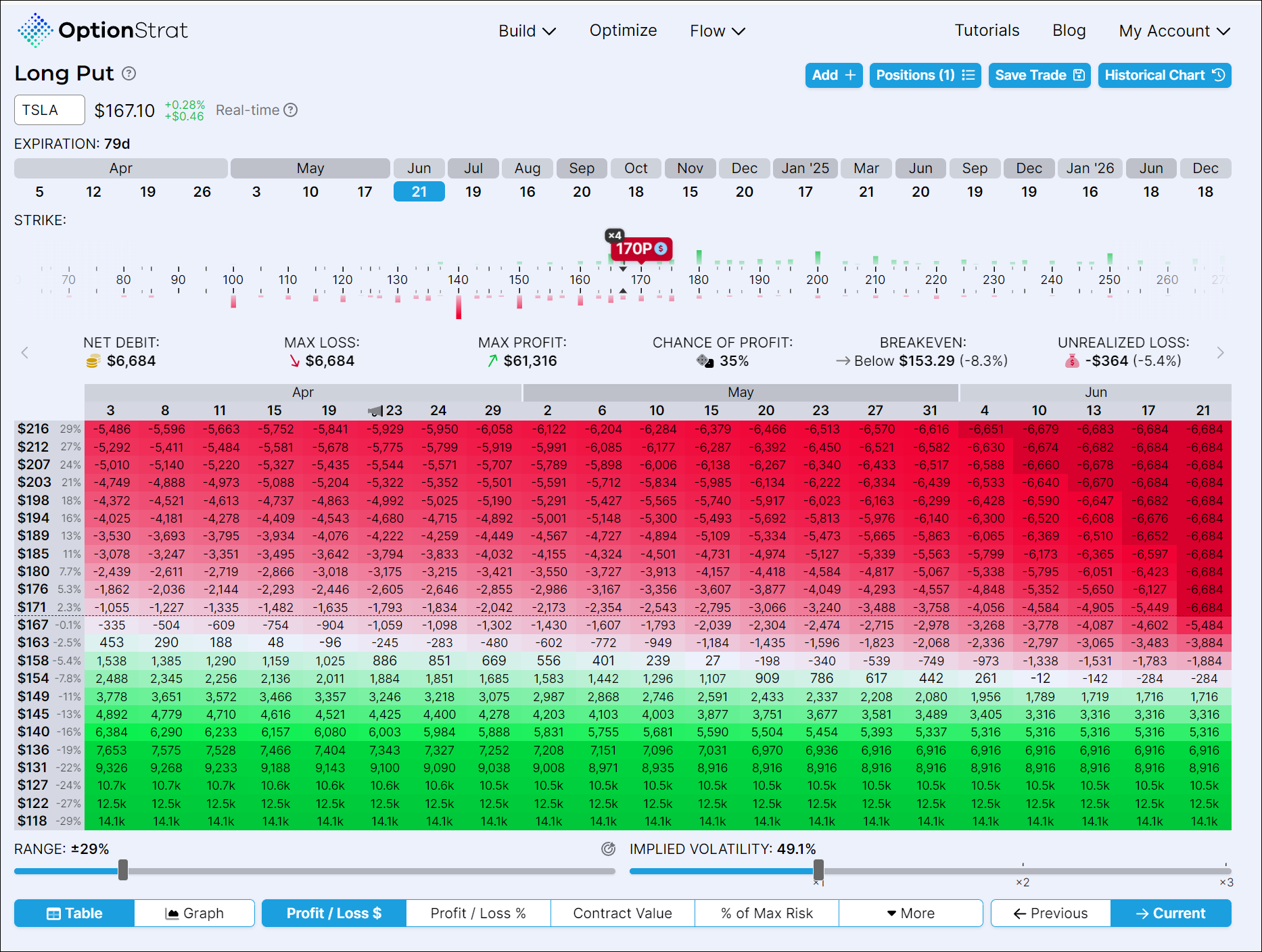

@tivoboy I'm legging into a new +P170 6/21/24 hedge position around here (took profit on the old one at yesterday's lows). Does the strike and expiration still make sense, and worth adding to this position? NFA of course.

Also sold today at pop: 5x -C180 4/26 @5.00; 10x -C185 5/17 @6.00; 10x-C190 5/17 @4.75. Saving rest of available CC's I can sell in case we get a run.

Link to the +P170 trade plot:

www.optionstrat.com/GBpnDcJL5NDi

Also sold today at pop: 5x -C180 4/26 @5.00; 10x -C185 5/17 @6.00; 10x-C190 5/17 @4.75. Saving rest of available CC's I can sell in case we get a run.

Link to the +P170 trade plot:

www.optionstrat.com/GBpnDcJL5NDi

The last few weeks he has been pumping the stock a lot. Until recently he didn’t seem to care much about the stock price. Let’s hope there is no need to sell shares to fund a certain enterprise.

The last few weeks he has been pumping the stock a lot. Until recently he didn’t seem to care much about the stock price. Let’s hope there is no need to sell shares to fund a certain enterprise.

Truthfully I'm happy to see him more engaged, and I'd take any pump he orchestrates....and sell what I have right alongside him!!!

My CB is $328...yuck...but probably now around $280’s from scalping CC's and selling -P's while holding since 2022.

Last edited:

john tanglewoo

2012 Roadster Owner

STO 43x -C200 5/17 @3.01

Still holding 380x +P145 that I'll sell puts to pay for if stock dips below 160s

Still holding 380x +P145 that I'll sell puts to pay for if stock dips below 160s

Tesla buying X.ai and giving Elon enough shares to get to 25% might be a white swan? Otherwise, I don’t like the direction this is heading.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K