Anyone use the 34-day EMA and understand it's role? Seems to have been in play for TSLA (and other tickers) pretty consistently:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

Weekend is here, risk off. Didn't trade TSLA, have small 4/26 -130p/+140p that I will hang onto. Trying to figure out if I should just take the good credit now and sell the Jan '25 +p180 ... at SP 170 they are looking good, would hate to be holding these if we magically get to 180s, 190s. Hard to read based on OI going into ER.

Meanwhile, traded three IC this week:

--> SMCI, +730p/-830p/-1040c/+1140c, 1.25 on Wednesday, closed down Thursday morning, booked .54

--> MSTR, +1110p/-1210p/-1730c/+1830c, 1.30, left open ... not seeing 1210p a risk

I then scaled in on this one Thursday using the freed margin from the SMCI shutdown trade.

Opened sold legs at about .05 and .06 delta 1DTE,

--> MSTR, +1270p/-1370p/-1750c/+1850c, 2.50

To end the day and start the weekend, I bought back the risky sold put at 1370 for .60 , left the rest of that IC in place.

Ended the week at about 3.75 using 100k margin , each trade 5 contracts, 100 wide P and C legs , aiming for .04/.05 delta Wednesday, .04/.05/.06 delta Thursday - thanks @Yoona !

GLTA!

Meanwhile, traded three IC this week:

--> SMCI, +730p/-830p/-1040c/+1140c, 1.25 on Wednesday, closed down Thursday morning, booked .54

--> MSTR, +1110p/-1210p/-1730c/+1830c, 1.30, left open ... not seeing 1210p a risk

I then scaled in on this one Thursday using the freed margin from the SMCI shutdown trade.

Opened sold legs at about .05 and .06 delta 1DTE,

--> MSTR, +1270p/-1370p/-1750c/+1850c, 2.50

To end the day and start the weekend, I bought back the risky sold put at 1370 for .60 , left the rest of that IC in place.

Ended the week at about 3.75 using 100k margin , each trade 5 contracts, 100 wide P and C legs , aiming for .04/.05 delta Wednesday, .04/.05/.06 delta Thursday - thanks @Yoona !

GLTA!

if BPS gets in trouble, the easy escape is STC the +p for credit, wait for rise then roll down the -p using the credit; strangle it or leave it as pure -p ready for wheel if necessaryWeekend is here, risk off. Didn't trade TSLA, have small 4/26 -130p/+140p that I will hang onto. Trying to figure out if I should just take the good credit now and sell the Jan '25 +p180 ... at SP 170 they are looking good, would hate to be holding these if we magically get to 180s, 190s. Hard to read based on OI going into ER.

Meanwhile, traded three IC this week:

--> SMCI, +730p/-830p/-1040c/+1140c, 1.25 on Wednesday, closed down Thursday morning, booked .54

--> MSTR, +1110p/-1210p/-1730c/+1830c, 1.30, left open ... not seeing 1210p a risk

I then scaled in on this one Thursday using the freed margin from the SMCI shutdown trade.

Opened sold legs at about .05 and .06 delta 1DTE,

--> MSTR, +1270p/-1370p/-1750c/+1850c, 2.50

To end the day and start the weekend, I bought back the risky sold put at 1370 for .60 , left the rest of that IC in place.

Ended the week at about 3.75 using 100k margin , each trade 5 contracts, 100 wide P and C legs , aiming for .04/.05 delta Wednesday, .04/.05/.06 delta Thursday - thanks @Yoona !

GLTA!

this is another reason why we don't use up all capital since the exit plan will need more buying power (but is now less risky than being a spread)

Last edited:

Aside a general market correction (long overdue IMO) and these shares being assigned almost at ATH (-p950), I do see the narrative on NVDA shifting a bit, plus I can sell puts against the puts, so it's not going to be wasted money even if the stock goes up from here - no way I'd sell naked puts on NVDA, not up hereI'm not hedging the downside much on NVDA personally. I'll be selling 10-15DTE ATM calls against any shares assigned, and keep writing puts up to my ladder limit. The premiums are solid enough that my effective cost basis YTD doesn't warrant a whole lot of extra insurance yet.

So they are both a hedge and an income generation tool

Dunno, looking pretty bearish and mega-low volumeMy 170CCs are hoping for a 170 close.... But will probably be 172.5....

I think any real change there will be in Q3 or early Q4 personally. Through then they are almost guaranteed market leading earnings growth.I do see the narrative on NVDA shifting a bit

My 170CCs are hoping for a 170 close.... But will probably be 172.5....

I was toying with the idea of closing out my short puts before the weekend to re-enter on Monday - all this talk of Iran attacking Israel, but from what I have read, Iran's capability is very limited, so it might just end up as something symbolic, who knows...

But then when I consider that my main two short puts positions TSLA 100x 4/26 -p165 & NVDA 4/19 -p850 are both straddled with the same number of calls, at much higher premiums, well I figure it would need to gap down quite a bit to be an issue

So I'll take the risk and let them be

Note #BTC is down 7% and the VIX up 22%!!

But then when I consider that my main two short puts positions TSLA 100x 4/26 -p165 & NVDA 4/19 -p850 are both straddled with the same number of calls, at much higher premiums, well I figure it would need to gap down quite a bit to be an issue

So I'll take the risk and let them be

Note #BTC is down 7% and the VIX up 22%!!

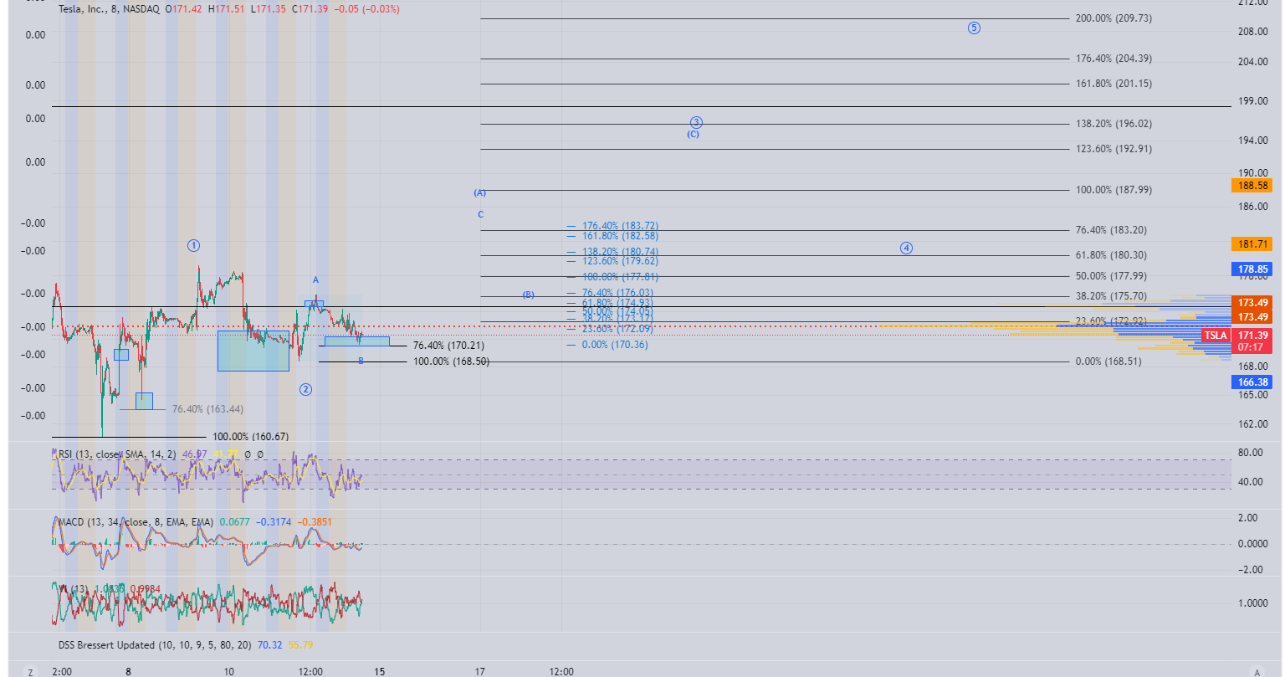

EW technicians will need a few drinks this weekend after trying to finagle and chart some semblance of TSLA’s torturous waves

today's High is the fib ceiling and the Low is the ascending channel = perfect algo

weekly bearish engulfingCould you share your chart and reasoning?

Daily bearish divergence

Intraday change of characteristics last week where it couldn't hold a gap up and at the end of the day didn't squeeze much higher than the first hour.

Yesterday was simply a VIX crush-fueled bounce. Underneath the hedges were real changes in momentum.I sold 5/3 200C & bought 160/150P

As for SPY, I'm waiting for the ideal entry. Maybe 517.5-518.

Last edited:

tivoboy

Active Member

Staircase up. Elevator down.weekly bearish engulfing

View attachment 1038076

Daily bearish divergence

View attachment 1038080

Intraday change of characteristics last week where it couldn't hold a gap up and at the end of the day didn't squeeze much higher than the first hour.

View attachment 1038081

Yesterday was simply a VIX crush-fueled bounce. Underneath the hedges were real changes in momentum.

tivoboy

Active Member

Lots of tech breaching 50’s. Some in death cross too. ABDE looks sickly. I guess my. May 625 -calls aren’t being called away.

no, that's a new chart@Yoona not sure if you posted this before.

For every SPY red day 1.5%+ what the likelihood of a green day the day after?

So, to capture more premium, would you sell 4/26 TSLA CCs today vs next week?weekly bearish engulfing

View attachment 1038076

Daily bearish divergence

View attachment 1038080

Intraday change of characteristics last week where it couldn't hold a gap up and at the end of the day didn't squeeze much higher than the first hour.

View attachment 1038081

Yesterday was simply a VIX crush-fueled bounce. Underneath the hedges were real changes in momentum.

for TSLA I dont have a clear direction. the ST chart looks bullish enough so now Im placing my bearish bets on SPY instead, shorting naked 560C exp September.So, to capture more premium, would you sell 4/26 TSLA CCs today vs next week?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K