My guess is none. I don't think the restrictions this year are a result of minerals. The cells were still made in China, which is the no-no this year. What this probably means is that vehicles will keep the credits next year where they otherwise might have lost it.I was just about to post this, saw it earlier this morning. It SEEMS like a pretty big deal for sector at least, I wonder when/if someone will derive which auto’s were to date excluded and which will unlock the $3750 or $7500 credits again.?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

For $AAPL it’s NOT the WWDC that is in June, but rather next week just most likely new ipad release (which is LONG overdue) and possibly some other items. It will be most likely just be recorded videos of new products.. June 10th this year is the next BIG event catalyst which is WWDC and we are expecting more significant AI related IOS integration and possibly some tease for future hardware integrations. That should prove healthy to provide lift or support at least.That's seem to be good new. Back in green.

AAPL is holding 184 like a rock. Big Conference next Tuesday. Thus Monday leading into the Conference Tuesday should help maintain green for AAPL.

Buy the rumors sell the news.....

EVNow

Well-Known Member

People are going to crib if their options go ITM - but that is part of the risk. But the market thread is just an echo chamber that endlessly pumps the stock and The Great Leader can do no wrong. Thats why rarely visit it these days. This place is a lot more open to people writing about why they think SP will either go down or up here. Lot more open to how news can affect SP and what we should be weary of.When the SP goes down and you don’t want it to, it’s Elon and Tesla’s fault for an endless list of reasons. When it goes up and you don’t think it should, suddenly Elon is pumping the stock, so his fault again.

Still most people here are long term TSLA investors and want to see the company prosper. So, even here there is an inherent bullish bias.

TSLA

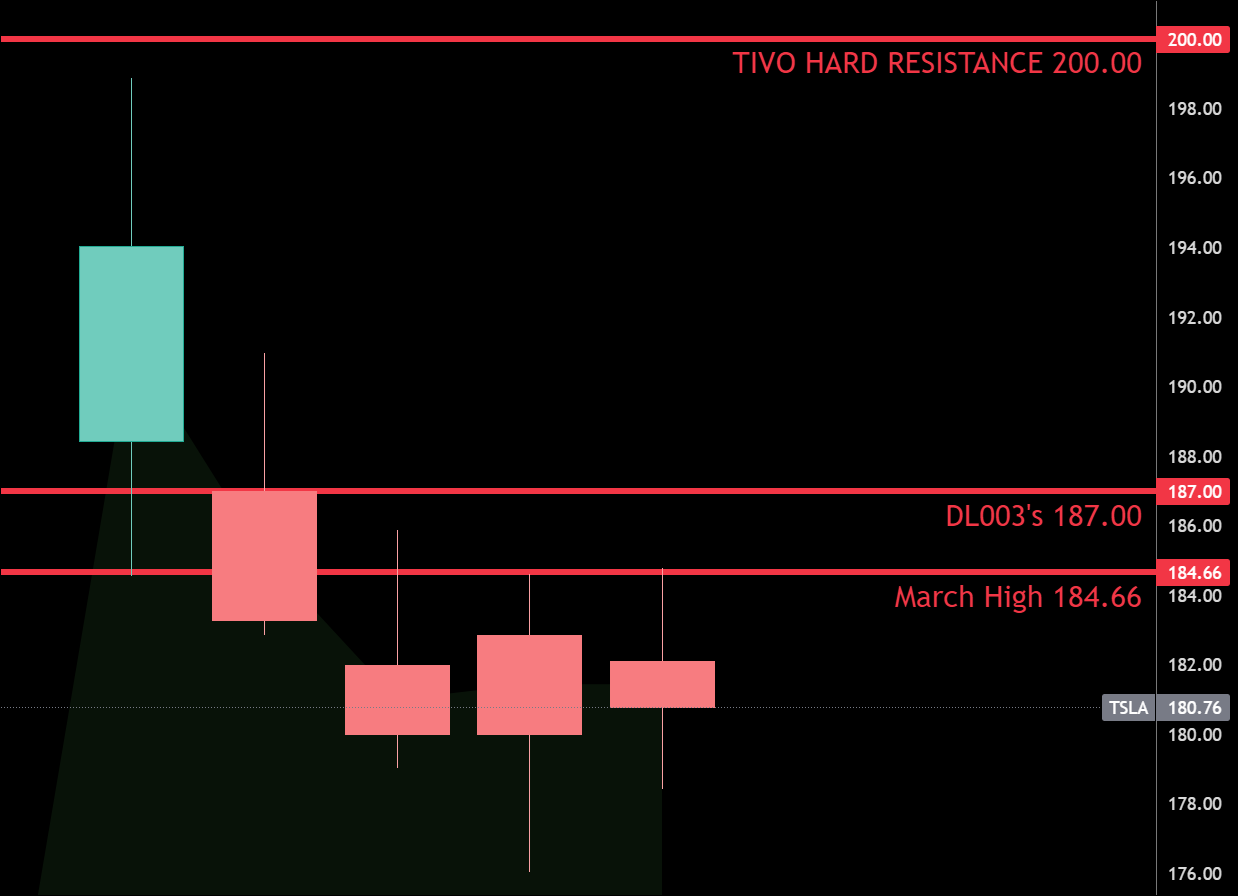

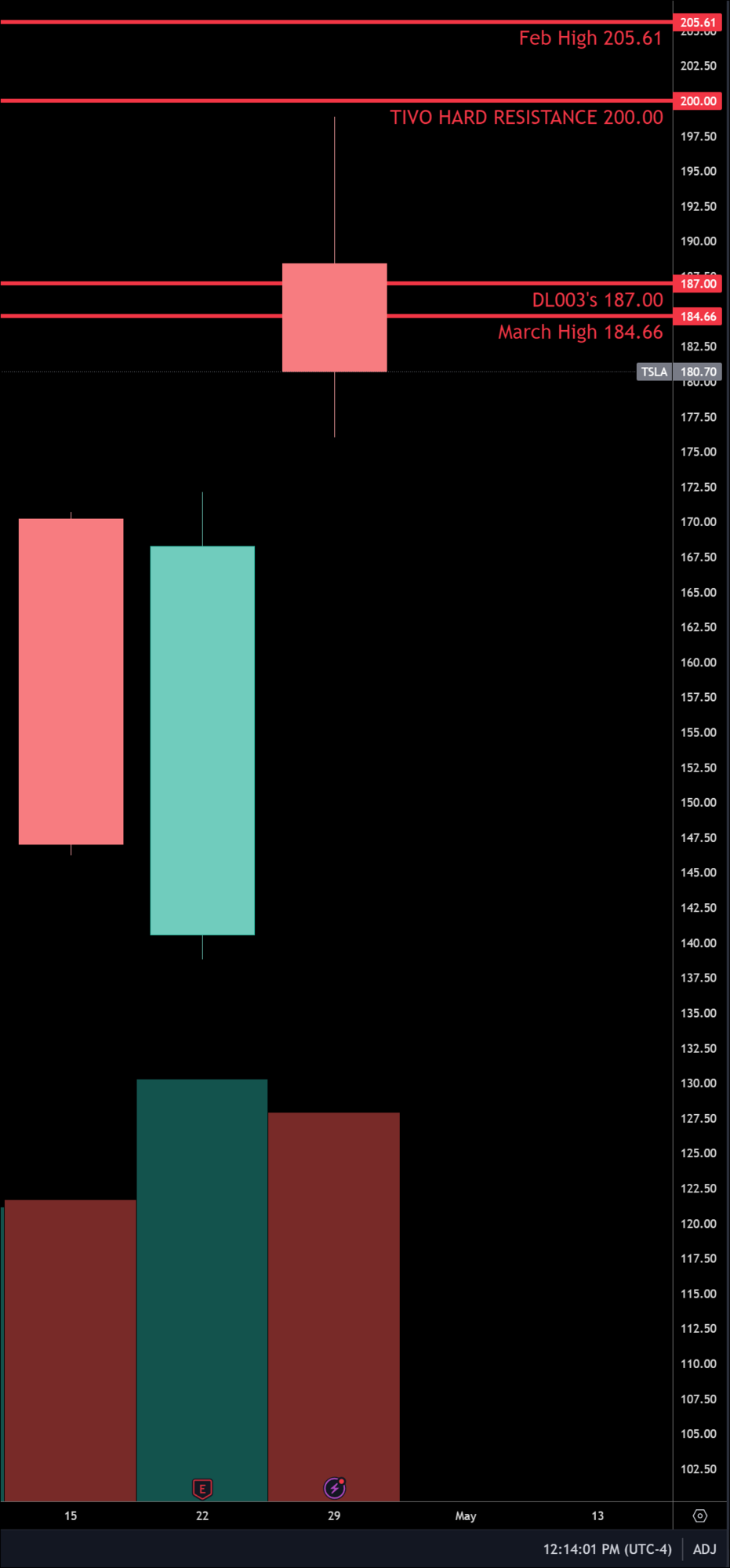

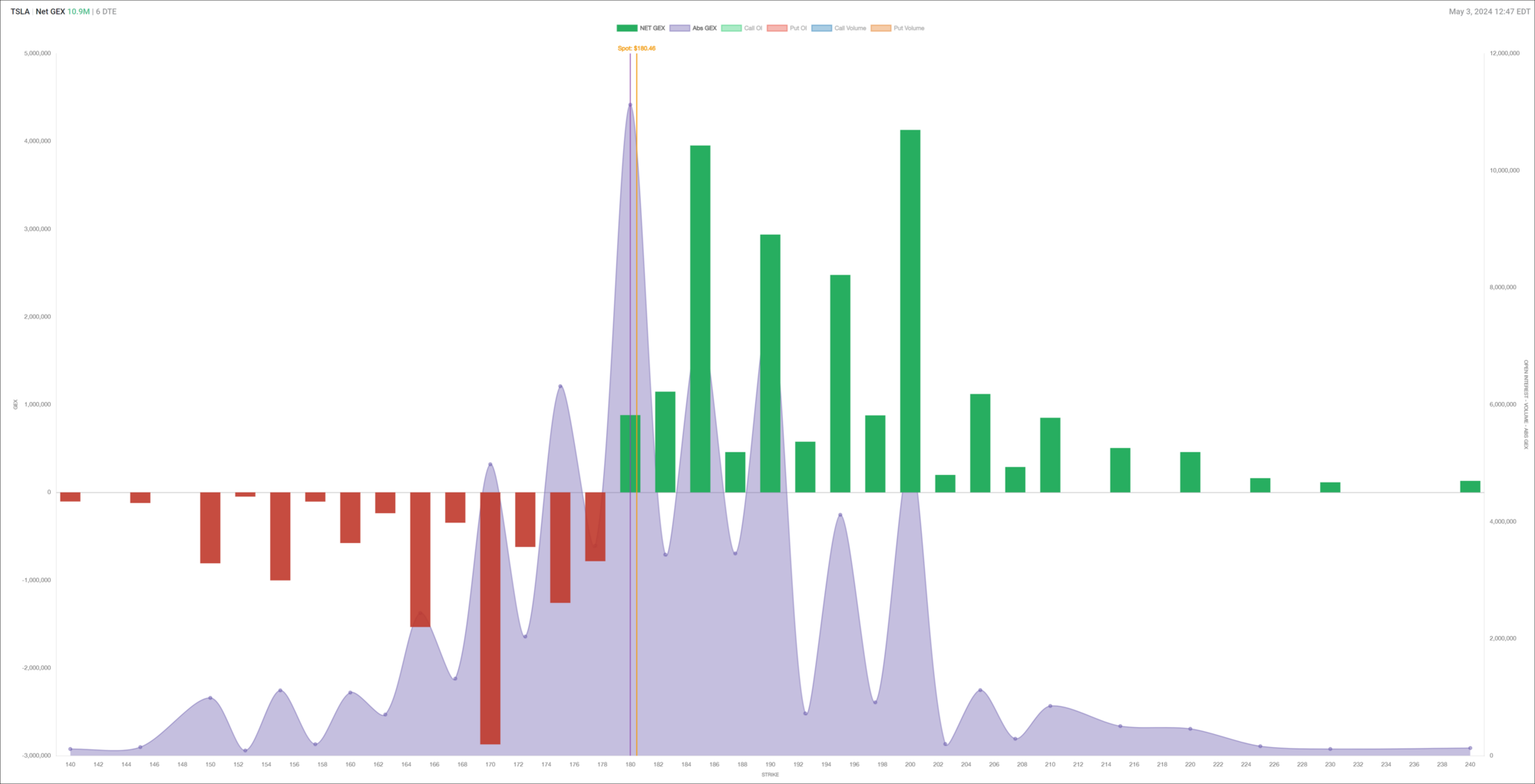

$185 is hard to break and stay over...

Daily Chart

Weekly

(is that equal outflows to the inflows?)

$185 is hard to break and stay over...

Daily Chart

Weekly

(is that equal outflows to the inflows?)

Last edited:

I'd like to discuss, but don't want to pollute this thread, we can DM it, or if you prefer to have it "in the open" start a new thread so we can argue in publicYou might want to take a look at yourself and this thread before casting stones. The EXACT same thing happens here when the SP doesn’t move in the desired direction of your (specific and general) options.

When the SP goes down and you don’t want it to, it’s Elon and Tesla’s fault for an endless list of reasons. When it goes up and you don’t think it should, suddenly Elon is pumping the stock, so his fault again.

I dare you to go back and read all the posts from P&D to now and then come back and lie about how you and many others behaved. Pay particular attention to @dl003 who on a number of occasions pointed out the bad behavior.

I dare you to go back and read all the posts from P&D to now and then come back and lie about how you and many others behaved. Pay particular attention to @dl003 who on a number of occasions pointed out the bad behavior.

Please lose the negativity, no one asked for it.

We keep things light and friendly in this part of town.

I'd like to discuss, but don't want to pollute this thread, we can DM it, or if you prefer to have it "in the open" start a new thread so we can argue in public

IMO don't feed the trolls or take the bait

Perhaps its algos responding to simplistic headlines, then (somewhat) cooler heads prevail.So then consumer goods companies should trade lower as no-one is buying their stuff. The ones that can afford it likely don't care about interest rates anyway...

Trouble is that every other day there's some kind of stat, indicator, speech or even happening that irrationally moves the markets

Was it always the case, just that we didn't notice it?

EVNow

Well-Known Member

I think starting with Covid - obviously the market has gyrated a lot. The market always moves a lot (and what you may call irrationally) as even small bits of news either reinforce or contradict the prevailing narrative. We had a relatively long period of stability after the 2008 crash till Covid - and the markets probably didn't see this much volatility during that time.Trouble is that every other day there's some kind of stat, indicator, speech or even happening that irrationally moves the markets

Was it always the case, just that we didn't notice it?

ChiefRollo

Member

Okay.I'm not sure about the "politics" part.

High rates are bad because they can lead to more unemployment. Unemployment hurts people - that's why its bad. Nothing to do with politics.

Has been looking like a 180 close since, what Tuesday already...?

No MMD to trade out/in the -c175's, but being capped here is also OK

We've had two hot macro days in a row, reasonable chance Monday's red I would say... pure guesswork on my part

No MMD to trade out/in the -c175's, but being capped here is also OK

We've had two hot macro days in a row, reasonable chance Monday's red I would say... pure guesswork on my part

Can also be the case that many of us were long term TSLA shareholders and went through the inflationary phase in 2020/2021 where it just seemed to go up every day regardless of anythingI think starting with Covid - obviously the market has gyrated a lot. The market always moves a lot (and what you may call irrationally) as even small bits of news either reinforce or contradict the prevailing narrative. We had a relatively long period of stability after the 2008 crash till Covid - and the markets probably didn't see this much volatility during that time.

Happy times!

I rolled my 3May$187.50 to 10May$187.50 as latter had bumped much higher than the former during this morning’s RMU (random morning uptick), and I doubted same net $2.88 would be available on Monday if I were to let the buy-write expire or assign.Yesterday's 10 hour surgery got moved to today. I'm going to have to scrub out at 1:40 MDT to possibly manage 187.5 (my mom's) and 190CCs (mine).... Hopefully we stop at 185. Alarm set on my phone.

Have shifted this smaller account’s strategy to weekly buy-writes using income to buy back 16Aug$180 in the main IRA — seems I can kill 1-2/week doing this, and more if we get a pullback.

Last edited:

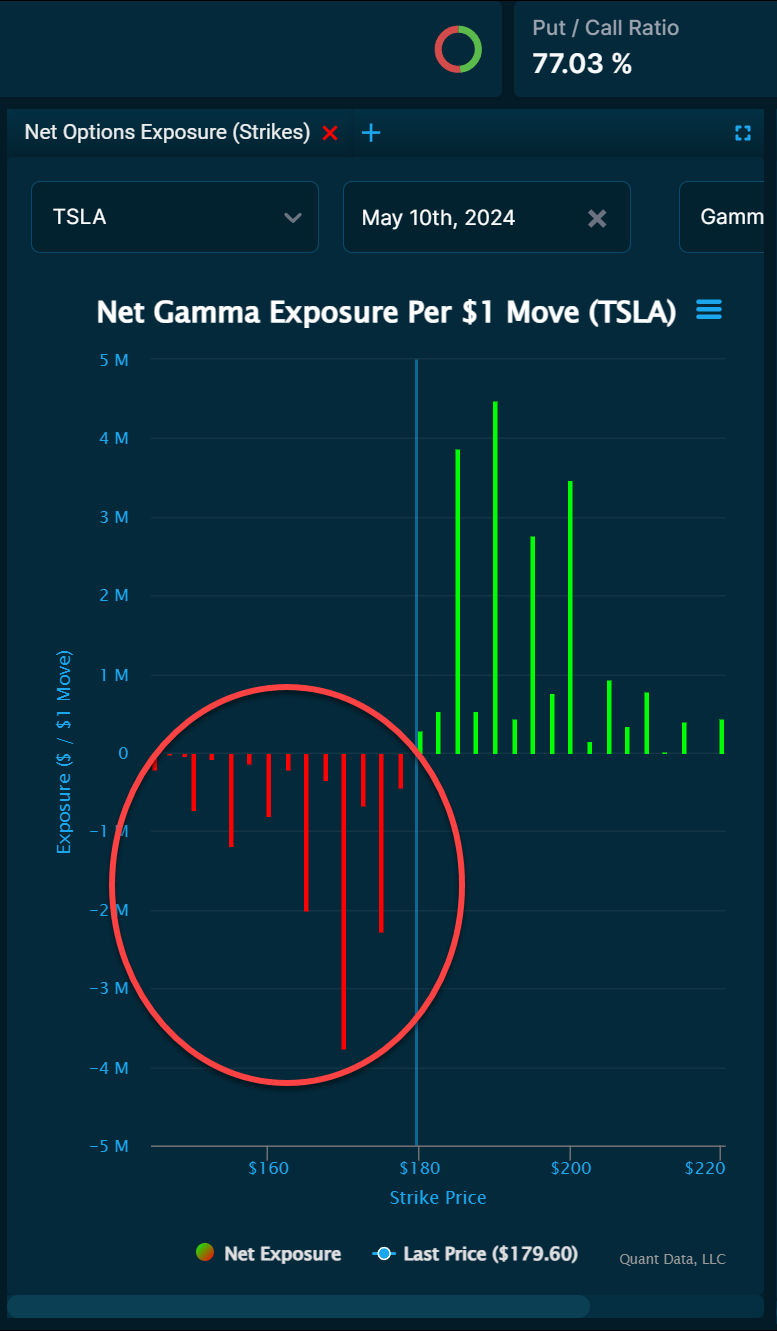

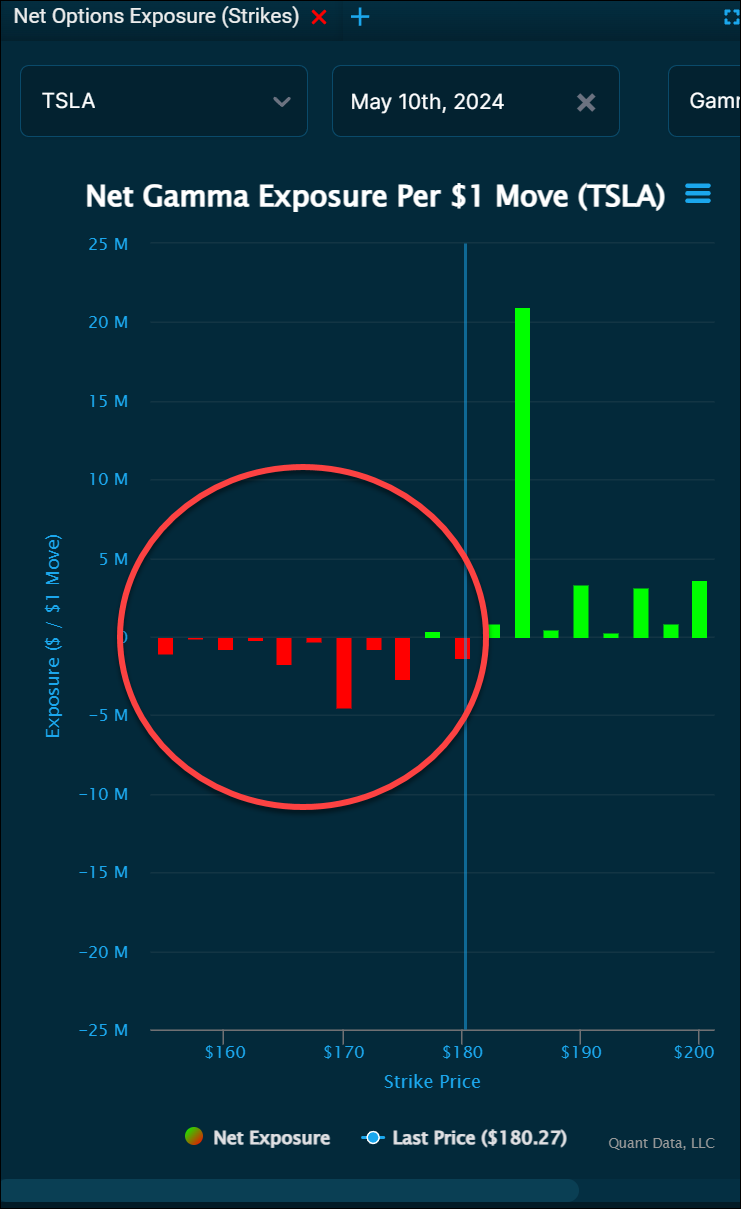

Seems shift in puts for next week (many closed out today)

EARLIER TODAY

CURRENTLY

EARLIER TODAY

CURRENTLY

tivoboy

Active Member

5130 is strong resistance.. we’d have to have ppl really change opinion about Fed cuts (which HAVE changed a bit today for July/Sept cuts probability). Then 5180 is pretty strong resistance.. so getting past 5130 and filling that whole gap to 5180 I think there isn’t enough juice for that.@tivoboy In your opinion, any chance SPY has juice to stretch to $518-$522 next week to buy some puts, or this is about all she wrote and buying some SPY +P495 6/28 or 7/31 may make sense today?

I RE-added some June 21 SPY 490 today at 3$ again, a bit more than I paid in the last round.

US Electric Vehicle Companies Shares Mixed Friday After White House Extends Tax Credits for Another 2 Years

May 3, 202411:57 EDTShares of Rivian Automotive

US consumers will continue to be eligible for up to $7,500 in savings through the US Department of the Treasury program meant to encourage domestic EV production and sales. Beginning next year, however, the tax breaks will start to be phased out for vehicles containing graphite and critical minerals produced in China and other jurisdictions perceived as unfriendly to US interests.

The new rules provide EV companies with a two-year window to rework their supply chains to eliminate Chinese sources of critical materials.

Chinese EV manufacturers were mostly lower in US trading on Friday, with Li Auto

Rivian shares were hanging on for a 2% gain, giving back an early 6% advance that initially followed the Treasury Department announcement. The "Big Three" domestic automakers also were mostly higher, with Stellantis

So, if everyone is now heavily positioned for the upside, then surely the stock will go down, right...?Seems shift in puts for next week (many closed out today)

EARLIER TODAY

View attachment 1044043

CURRENTLY

View attachment 1044045

View attachment 1044047

Since today seems to be a minimal movement day, anyone doing anything with NVDA? I had opened a 5/10 -945c/1100c BCS last week, and it's at 50% profit now. I'm tempted to open a second, assuming today's rally will revert by Monday, but I'm also expecting a run-up to their earnings call on 5/22. Anyone else think the same?

dc_h

Active Member

Consumer goods should decline relative to the market. High growth stocks are more subject to lower rates, which increase the discounted value of future cash flow.So then consumer goods companies should trade lower as no-one is buying their stuff. The ones that can afford it likely don't care about interest rates anyway...

Trouble is that every other day there's some kind of stat, indicator, speech or even happening that irrationally moves the markets

Was it always the case, just that we didn't notice it?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K