Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

stealthology

Member

The ending to that fight looked great to me. Big volume last 2 mins. Shorts may not have as much leeway anymore. Who knows.

stealthology

Member

You know, reading what @Papafox said and just all the information consumed over the past month.. Elon may be trying to tell us longs: It may look a little funny, but I got this. Profitability is in the bag, we'll have 2-3 more catalysts before year end, merger will be fine, we'll raise money at some point, and we'll kill it with Model 3.

Or, I could be wrong.

Or, I could be wrong.

Connecting the dots . . .

When Elon said that 3Q16 might be Tesla's best quarter yet, there was ambiguity about whether he was referring to delivery numbers or financials. From the Q3 delivery numbers, we know now that he was talking about financials, because there was no question that the previous delivery numbers would be annihilated. So, if he felt that Q3 financials might be best ever, would he put the kibosh on discounting a week before the end of the quarter if he was unsure whether Telsa would reach profitabllity in Q3? Would he remove the non-gaap accounting if TSLA was going to be non-gaap profitable in Q3 but not gaap profitable in Q3? Would there have been 5500 vehicles in transit at end of Q3 with a note in delivery numbers release that vehicles aren't counted as sold until all paperwork is completed perfectly? To each of these questions, I see the answer as "no". Thus, I am assuming Telsa has profitability in Q3.

So, when do you let the cat out of the bag if Tesla is profitable in Q3? It's been done on delivery numbers day back in 2013. It could be done any day now via a tweet from Elon that basically says "Preliminary computations suggest that Tesla has achieved profitability in Q3", or the numbers can be released at the Q3 ER. Each has their advantages and tells us something about both the merger vote possibilities and the cap raise possibilities. If the merger vote is scheduled before the 3Q ER and Elon thinks he has the vote in the bag, then he might hold off on the profitability info until the Q3 ER. If Q3 was not quite profitable, then he would definitely not say anything until after the SCTY vote, but I don't think this is the case. The advantage of releasing the profitability info after the vote is that if TSLA SP sags after the vote, which is entirely possible, revealing Q3 profitability will bring it back rather quickly and help remove criticism of the merger.

For clues about profitability, look at timing of the vote and cap raise. If both take place after the 3Q16 ER, then I think that's a great sign that profitability is there. If the vote is scheduled before the Q3 ER, then there's the likelihood of Elon letting Q3 profitability out of the bag through a tweet ahead of the vote if he feels there's any question of it passing. We can indeed get clues about profitability, likelihood of SCTY merger success, and likelihood of capital raise success by using the scheduling of these events to read the tea leaves.

I'm not sure if I agree or understand everything you are saying, but I like the deduction. My 2 cents is the merger vote has pretty much been in the bag ever since it went public, there's nowhere near as much uncertainty with it as the headlines suggest, otherwise they would have waited until a more opportune time. The Q3 number and the cap raise are the two things to watch, if there were q3 profits I would expect the cap raise to come after that is announced, if not then before.

You know, reading what @Papafox said and just all the information consumed over the past month.. Elon may be trying to tell us longs: It may look a little funny, but I got this. Profitability is in the bag, we'll have 2-3 more catalysts before year end, merger will be fine, we'll raise money at some point, and we'll kill it with Model 3.

Or, I could be wrong.

Pretty much sums it up.

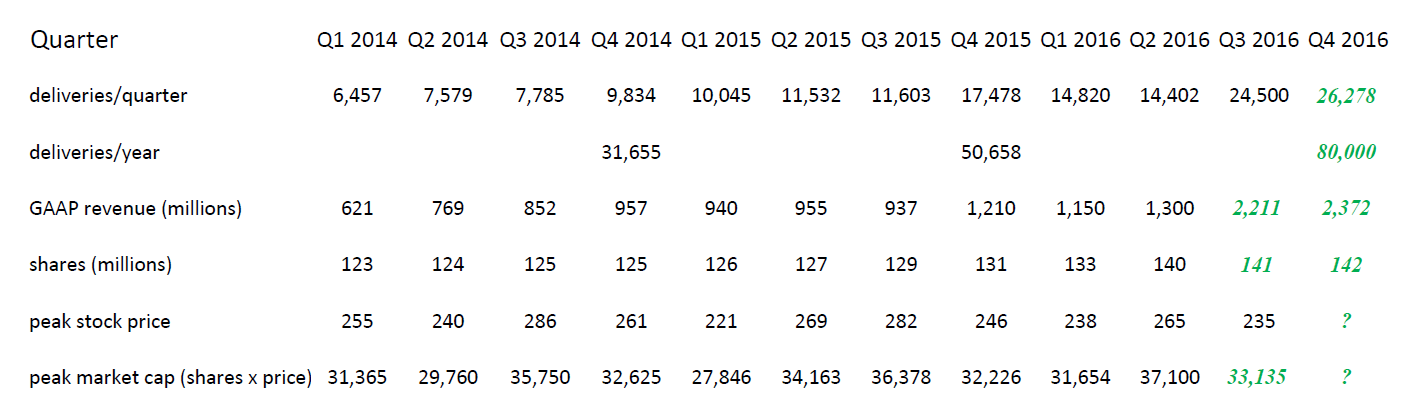

I updated the table posted just before the delivery numbers came out. The estimates in green assume Tesla meets 2H guidance of 80,000 cars. GAAP revenue is extrapolated from the ratio to deliveries from Q2 2016. Share dilution does not include merger with Solar City or a capital raise. The table shows how far Tesla has come without a significant rise in stock price. We can assume that the merger with Solar City and the expected capital raise are weighing down the stock price, but we can also assume that Tesla Energy, 20 billion worth of Model 3 reservations, and projected high growth in all areas should be stimulating the stock price. Not sure what catalyst will square up a stagnant stock price with a very strong performance by Tesla. Tesla has done their part. It's not as though there are a lot of great growth stories, like Tesla, to invest in.

Attachments

Given the nature of the auto business (extremely capital intensive) and the established players (well-funded companies with 100 years of history), I think they need to push growth as fast as possible. If Tesla wants to make a dent in worldwide sales and push the others to join (the end of the ICE age) or die, it's a race.It seems that there are 2 bear cases that hold any water at all: valuation and dilution.

The valuation argument we've beaten to death...you either think TSLA is just another car company you you think it's something more.

The dilution argument does concern me more as an investor. I'm all for rapid growth, but don't want to give away the store.

Tesla could have chosen a much more cautious path but I think it's all but proven that they've chosen the right path (reckless growth). Check out the competitors. They are scrambling to try and catch up now. A slower, ICE-minded Tesla would have released the S in 2013, waited for profitability to occur naturally, release the X with fewer features in 2017/18 and maaaaybe get the 3 out by 2020. Instead, everything is about 2-3 years faster. Tesla made these grand plans while the other automakers were busy laughing at them and confidently thinking they could stomp them out at any time if it was worth the effort.

Suddenly, the Model S is eating their lunch, the Model X is beginning to roll and the Germans are waking up in a cold sweat about the Model 3. Ideas floating around about a Model Y and Tesla truck don't seem all that far fetched. It all kind of happened at once. Now, they are all tripping over themselves to announce EVs that aren't even competitive with the 2012 version of the Model S.

The race is kind of over already. It's like when I turn on my TV to watch the college football game I DVR'd a couple hours earlier. The channel is already set to ESPN and I catch a glimpse of the score in the 4th quarter before hitting play. I see we are up 45-7, but I'm still going to watch the whole thing.

I came up with non-GAAP eps very similar to yours (0.38). Writing details in the Q3 discussion thread.OK! Plugged new numbers into my (100% amateur) model after trying to redo all the new GAAP stuff and got the following:

non-GAAP profit: $0.37

GAAP profit: ($0.01)

Free Cash Flow: $51 million (not CF from Ops, actual FCF)

So, right next to GAAP profitability and positive cash flow. I hope this is somewhere near correct. Here's some of my key assumptions:

non-GAAP GM: 22.7% (0.8% increase over Q2)

non-GAAP Opex: $475 million (increase from $452 million)

GAAP Stock-based Comp Opex: $46.7 million (decrease from $60.8 million)

CapEx: $425 million (increase from $295 million)

ZEV credits: $10 million

non-GAAP revenue: $2.67 billion

As always, don't trade based on this. Track record: last month I predicted EPS of (0.63) nG and (1.94) G after getting the real deliveries numbers and it was actually (1.07) nG and (2.09) G. So, off by a good chunk. There's more uncertainty than ever before with the accounting changes so I could be wildly off in either direction.

Give it some time. 220s, 240s and beyond are on the horizon. Seeking alpha can publish FUD this quarter, but the results are all the same, demand is rising!

Is that a chart of explosive growth?

This time last year there were over 30,000 MX reservations. Something like 16,000 sold and not much evidence of a big backlog so not sure where evidence "demand is rising" is.

Well, they definitely didn't get it to 212.x.

If anyone wants to add additional shares tomorrow, I'd be on my toes during the first half hour. The low today came 8 minutes after opening, and it must have been selling by shorts because what long would be selling at that price after Sunday's news? Don't be surprised to see shorts try another fear push in the morning, but it's likely to be unsuccessful because the longs are really waking up now. Volume was nearly 6 million shares, which is quite a switch from the 2.5 M shares we've been seeing recently. If we climb above the 50 DMA and 200 DMA tomorrow, we could see a nice rally as weak (i.e. "intelligent") shorts join in the buying. The flip side would be lots of shares to short coming available later in the day and a downward push by shorts taking place during the low volume afternoon hours. If we breach the 215 area and climb higher, though, the shorts might be too much in turmoil to mount a successful downward push.

I was encouraged by today's close because there was no significant dip.

Last Tuesday I thought TSLA had reached a point where demand for shares to short was less than the supply of available shares, but on Wednesday I realized I was wrong because only 3X,000 shares were available at IB and none at Fidelty. Shorts are still encouraged by a lack of shares to short, which implies more are coming and as shorts pour in, the SP will decline (as they see it). What we need to do this week is get to the point where plenty of shares to short are available but they're not being used because TSLA keeps rising and the shorts thesis now has holes in it. Just as longs hate to try catching falling knives, shorts hate to try catching rising missiles.

I think you nailed it.You know, reading what @Papafox said and just all the information consumed over the past month.. Elon may be trying to tell us longs: It may look a little funny, but I got this. Profitability is in the bag, we'll have 2-3 more catalysts before year end, merger will be fine, we'll raise money at some point, and we'll kill it with Model 3.

Or, I could be wrong.

stealthology

Member

The dilution argument does concern me more as an investor. I'm all for rapid growth, but don't want to give away the store.

This is just the way I see it, and there's LOTS of people on here who know more than I do:

You're right, the dilution/fear of dilution has caused a suppressed share price. However, I feel like Tesla Enery and even moreso The M3 is too much of a no brainer HUGE success story to not do what it takes to raise more money, even if they've been raising more than they initially planned in years past.

Next year, while Model 3 and Tesla Energy begin to show how real they are, S & X should be able to hold down the fort through expansion, more cars on the road = word of mouth, better margins/labor efficiencies, and new product features. Before you know it, Tesla issues 2017 guidance, which will be achievable.. then it's like, wait how many cars are they doing this year? Great news is there's basically no more concern over production capability. GAAP profitability will be our near term punch.

Man, only if Tesla was a private company. But then, I likely wouldn't be important enough or have enough to invest in it.

The chart and the conclusions are so stupid, I almost didn't bite. They have more than one model now. Sales of Tesla vehicles is up over 100% from last year. 100% growth is not a demand problem in anyone's book.View attachment 197318

Is that a chart of explosive growth?

This time last year there were over 30,000 MX reservations. Something like 16,000 sold and not much evidence of a big backlog so not sure where evidence "demand is rising" is.

Quesder

Member

you are doing exactly what I expected a short was about to say. I posted my prediction yesterday. Ha HaView attachment 197318

Is that a chart of explosive growth?

This time last year there were over 30,000 MX reservations. Something like 16,000 sold and not much evidence of a big backlog so not sure where evidence "demand is rising" is.

Quesder

Member

All right, instead of feeding the troll, let's do something more meaningful. According to InsideEV, Q3 US delivery is 9625+ 5800 = 15425. And Tesla says global delivery is 24500 . That is 24500/15425 = 1.588 ratio. Assume the production rate doesn't change so dramatically like Aug->Sep again in Nov->Dec (actually, may decrease because of shutdown), can we estimate Q4 Global easily when InsideEV post US delivery of Oct and Nov on 12/2,3... ?

i.e., (Oct # + Nov#) * (3/2) * 1.588 ?

i.e., (Oct # + Nov#) * (3/2) * 1.588 ?

dennis

Model S Plaid

The dilution argument does concern me more as an investor. I'm all for rapid growth, but don't want to give away the store.

It depends on how effectively Tesla uses the capital it receives for the dilutive stock issuance. If done well, your smaller piece of the bigger pie should be worth more in absolute value. Getting bigger faster is critical for Tesla given the scale of the markets they play in and the competition they will face.

Quesder

Member

Below is how I estimated Q3 delivery on Sep 2 or 3. The US number is big off. The ratio is big off. And didn't expect that there will be more car in the delivery pipeline (5500)All right, instead of feeding the troll, let's do something more meaningful. According to InsideEV, Q3 US delivery is 9625+ 5800 = 15425. And Tesla says global delivery is 24500 . That is 24500/15425 = 1.588 ratio. Assume the production rate doesn't change so dramatically like Aug->Sep again in Nov->Dec (actually, may decrease because of shutdown), can we estimate Q4 Global easily when InsideEV post US delivery of Oct and Nov on 12/2,3... ?

i.e., (Oct # + Nov#) * (3/2) * 1.588 ?

"Correct me if you think I am wrong. I assume Sep will do at least as good as Aug. So double the Aug number and add the July number, we get an estimate for Q3 in US: 12850.

Then again I assume US is 50% of the whole world (I heard China was not doing bad). Then we get an estimate 25700 for Q3.

Unless Aug is heavily added up by the "5000 on transit".

"

The Blue Owl

Endangerous Herbivore

Yeah. I mean, Tesla delivered more than twice the number of vehicles compared to Q3 2015, while demand keeps dropping! How are they doing this?! They are falling upwards!you are doing exactly what I expected a short was about to say. I posted my prediction yesterday. Ha Ha

View attachment 197318

Is that a chart of explosive growth?

This time last year there were over 30,000 MX reservations. Something like 16,000 sold and not much evidence of a big backlog so not sure where evidence "demand is rising" is.

You're using the wrong chart. Tesla's production of the S and the X are co-mingled in many places:

From: Tesla (TSLA) delivers a record-breaking 24,500 vehicles during the last quarter, and 5,500 more in transit

And very importantly, the additional data points in the next 12 quarters.

As for evidence of backlog, well, the only real evidence you have is this one:

Customer deposits: $679,834,000 as of June 30, 2016.

Assuming Model 3 reservations was $395,000,000, that's about $285 million in S+X deposits, or about 50,000 S+X vehicles. Note that the number includes some $40k or so signature X deposits for Europe and Asia.

We'll obviously get a new read at the Q3 ER.

You do not know the current backlog in China or any RHD markets for the Model X. And Model X to Europe only really started in earnest in Q3. I suspect that's why there's still a lot of cars in transit. Yes, in the U.S., it is much easier to get an X now. However, certain configurations are still not yet available. Furthermore, it took about a year to really clear off the Model S reservation list... it'll probably take an additional 2 quarters beyond that for the X. While the S was being sold and there were still lots of people on the reservation list, new orders were also coming in an being satisfied. Maybe you don't know this history?

Also, Tesla's presence outside of certain markets is still quite underdeveloped. Lots of the U.S., Canada, and many parts of Europe are really just warming up for Tesla, especially as service centers and galleries are being built. So to think that the demand pretty much anywhere except for California, Washington State, Norway, Netherlands, and Switzerland is mature is greatly mistaken. Furthermore, Tesla just entered 3 markets... South Korea, Taiwan, and Mexico.

It is, in many cases, easier to push some U.S. fence sitters off the fence, hence sometimes Tesla pushes those demand levers. In other areas, Tesla is steadily pushing the slower to develop demand levers of service center geographical footprint and the Supercharger network footprint. Those take longer and can't really be pushed within a quarter. But one shouldn't mistake Tesla's use of short term demand levers with saturation.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 897

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K