Maybe folks could help me sort out these different metrics of oil consumption and production per BP statistical review. Let me paste some of the notes that BP provides.

Oil Production: "Includes crude oil, shale oil, oil sands, condensates (both lease condensate and gas plant condensate) and NGLs (natural gas liquids - ethane, LPG and naptha separated from the production of natural gas)."

Crude Oil and Condensate (C&C) Production: "Includes crude oil, shale oil, oil sands, condensates (both lease condensate and gas plant condensate) and NGLs (natural gas liquids - ethane, LPG and naptha separated from the production of natural gas)."

Natural Gas Liquids (NGL) Production: "Includes ethane, LPG and naphtha separated from the production of natural gas. Excludes condensates."

Oil Consumption: "Inland demand plus international aviation and marine bunkers and refinery fuel and loss. Consumption of biogasoline (such as ethanol), biodiesel and derivatives of coal and natural gas are also included."

"Notes: Differences between these world consumption figures and world production statistics are accounted for by stock changes, consumption of non-petroleum additives and substitute fuels, and unavoidable disparities in the definition, measurement or conversion of oil supply and demand data."

So oil consumption is the most inclusive category, including biofuels, and derivates for natural gas and coal. Oil production seems to be the sum of C&C and NGL production. Let's look at 2018 figures in kboe/d units.

Oil Prod: 94,718

C&C Prod: 83,161

NGL Prod: 11,557

Biofuels: 1,788

Oil Cons: 99,843

Oil Cons net of Oil Prod and Biofuels: 3,337

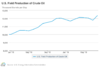

So a substantial portion of what counts as consumption is derived from natural gas and coal and net changes in stock. Additionally NGLs from oil production are a really large share of to total oil production as well. This fraction of NGLs has been increasing over the last 18 years. The derivates from NG and coal are mostly NGLs as well (if I understand this correctly).

Gases are great for petrochem and process heat, but when we are thinking about EVs disrupting oil, we are not really aiming at gases and petrochem. Rather our concern is about motor fuels. So perhaps we should be looking at C&C plus maybe biofuels as the universe of products that batteries and EVs most directly displaces.

In terms of revenue for oil producers C&C is the most relevant figure. And perhaps Brent is the more relevant price for C&C rather than NGLs. So my closest estimate for revenue available to oil producers is C&C times Brent. It sure looks like peak revenue years are well in the past for crude.