Moderator Forward:

Here begins a thread compiling participants’ predictions as to what major accomplishments, releases, etc. Tesla will have by year-end 2023.

This thread will remain open until -

NB: I had to append this to @CYBRTRK420 's post in order that all makes good sense. His post follows.

=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=--=-=-=-=-=-=-=-=-=-=-=

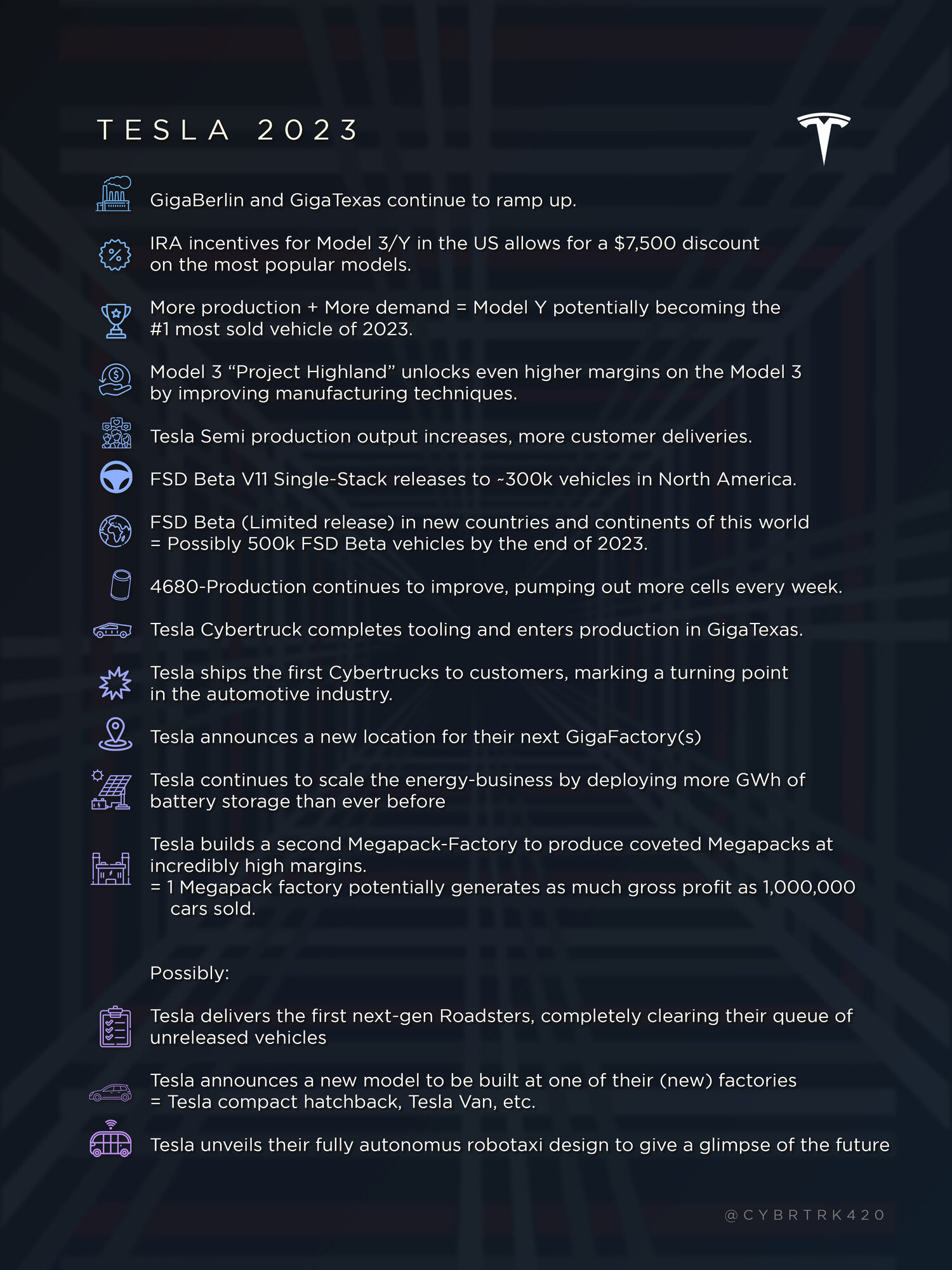

Just created this list of likely achievements / events by Tesla in 2023.

Did I miss anything?

Here begins a thread compiling participants’ predictions as to what major accomplishments, releases, etc. Tesla will have by year-end 2023.

This thread will remain open until -

- 31 January 2023. OR

- The first such accomplishment previously listed by two or more participants occurs

NB: I had to append this to @CYBRTRK420 's post in order that all makes good sense. His post follows.

=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=--=-=-=-=-=-=-=-=-=-=-=

Just created this list of likely achievements / events by Tesla in 2023.

Did I miss anything?

Last edited by a moderator: