ZeApelido

Active Member

Elon stated that GigaAustin is to grow by 500ft over time. I interpret it as the main building growing - but that seems odd given it's a complete factory. Not sure how else to read it?

Photo-voltaic induced excitation.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Elon stated that GigaAustin is to grow by 500ft over time. I interpret it as the main building growing - but that seems odd given it's a complete factory. Not sure how else to read it?

Good point. According to google maps there is plenty of roomThey could expand the stamping section toward the south, where they removed a detention pond (is that remaining one 500' away). Similar to Shanghai's expansion (though that end was not chamfered).

Mordor->GondorElon stated that GigaAustin is to grow by 500ft over time. I interpret it as the main building growing - but that seems odd given it's a complete factory. Not sure how else to read it?

Or wrap the casting area around the top...They could expand the stamping section toward the south, where they removed a detention pond (is that remaining one 500' away). Similar to Shanghai's expansion (though that end was not chamfered).

Most east China factories are built to withstand typhoon, as it happens almost every year in different places.

It appears that flooding and storm surge are quite serious in the Shanghai region .

Tesla factory appears to be in the direction of the storm surge. Apparently ships have been removed from ports.

Any information available regarding current status of risk for Tesla Shanghai operations from typhoon In-fa?

50% annual growth is over 5x by 2025:

2021 = 1

2022 = 1.5

2023 = 2.25

2024 = 3.38

2025 = 5.06

So why not 5x the share price by 2025?

That would be over $3,000 per share. Doesn’t seem like much of a stretch to reach $4k especially as new revenue streams are added

Because the share price likely won't grow linearly with revenues. The PE ratio is high now and that will come down as Tesla grows larger, thus the share price won't increase in step with the financials. I wish it would, but I don't think it will, and I doubt Wall Street will allow it to happen.

Tesla's mission is not to create the most profits, it is to accelerate the transition to green energy. Even if that means lowering profit margins to bring prices lower to increase adoption as manufacturing capacity allows. I know most people think we'll be keeping current Tesla profit margins but my gut feeling is Tesla will lower them as production outpaces demand down the road. And that will lower revenues, making the share price increase slower than we might predict today.

Just my gut feeling, I could be wrong.

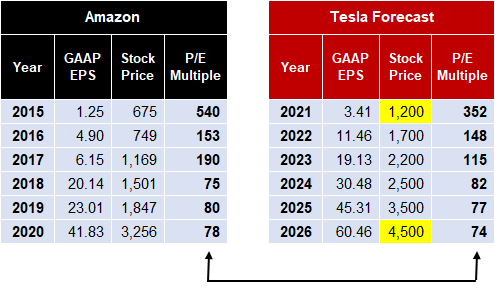

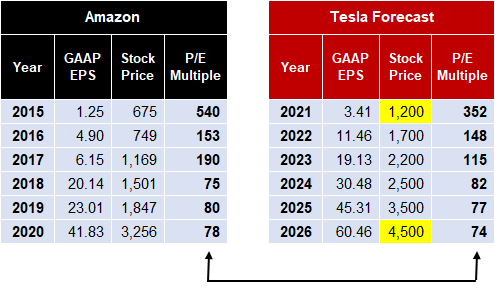

I like that guy…Instead of guessing at future share price, one could look at @The Accountant 's model of future share prices.

Tesla Valuation Based on 5 Year Outlook

I am going to break up my valuation work into 6 posts. Please refrain from responding until I have completed the 6 posts so as to keep a continuous string. Edit - Done posting - feel free to commentteslamotorsclub.com

Instead of guessing at future share price, one could look at @The Accountant 's model of future share prices.

Tesla Valuation Based on 5 Year Outlook

I am going to break up my valuation work into 6 posts. Please refrain from responding until I have completed the 6 posts so as to keep a continuous string. Edit - Done posting - feel free to commentteslamotorsclub.com

That is interesting and informative insight, and to me - an admitted irrittee* of the whole cryptocurrency fracas - a compelling reason to have kept that wolf far thence**. At this stage of its corporate life, Tesla does not need asterisks in its explanations either of its income statements or its balance sheet.Tesla defines Non-GAAP and it is possible that they could remove the Bitcoin charge when presenting Non-GAAP.

The SEC scrutinizes the use of Non-GAAP by companies. They tolerate stock based comp adjustments but tend to send letters to companies when they start to add new items (asking for justification).

So it is possible that Tesla starts to add Bitcoin as an adjustment to Non-GAAP but what I think they will do is state what earnings would be without the charge in the press release. Something like "Non-GAAP EPS was $1.06; excluding the Bitcoin charge of $104m, Non-GAAP EPS would have been $1.14."

I feel like you're very misinformed hereYep, his model and predictions are great and roughly match my own in many ways, EXCEPT if you look at his profit margins going forward he predicts they will actually increase over the next five years. That's where I feel people are being too optimistic, as I think Tesla will purposefully lower margins to bring prices lower and keep demand high as production ramps into overdrive.

If the Model Y stays priced as high as it is today it will never sell as numerously as the Toyota Corolla does today, I really think Tesla will lower prices and margins over time. It's just what I'm expecting to see, doesn't mean I'm right.

Over time they may lower margins on vehicles (hardware) but that will likely be offset by high margin software (one-time and subscription). Think fsd subscription, robotaxi, dojo as a service, fsd for other oems, etc.Yep, his model and predictions are great and roughly match my own in many ways, EXCEPT if you look at his profit margins going forward he predicts they will actually increase over the next five years. That's where I feel people are being too optimistic, as I think Tesla will purposefully lower margins to bring prices lower and keep demand high as production ramps into overdrive.

If the Model Y stays priced as high as it is today it will never sell as numerously as the Toyota Corolla does today, I really think Tesla will lower prices and margins over time. It's just what I'm expecting to see, doesn't mean I'm right.

I think Tesla will purposefully lower margins to bring prices lower and keep demand high as production ramps into overdrive.

I expect profit margins to increase as Tesla develops ever more efficient manufacturing processes - including batteries. This is a focus of Ark invest , who often refer to Wright’s law “… it states that for every cumulative doubling of units produced, costs will fall by a constant percentage.”Yep, his model and predictions are great and roughly match my own in many ways, EXCEPT if you look at his profit margins going forward he predicts they will actually increase over the next five years. That's where I feel people are being too optimistic, as I think Tesla will purposefully lower margins to bring prices lower and keep demand high as production ramps into overdrive.

It's just what I'm expecting to see, doesn't mean I'm right.

ark-invest.com

ark-invest.com

Elon has said Tesla cars are too expensive so he wants to lower the price so that more people can afford to buy them to replace ICE cars to save the planet. He also said the self driving car will be an appreciating asset.Yep, his model and predictions are great and roughly match my own in many ways, EXCEPT if you look at his profit margins going forward he predicts they will actually increase over the next five years. That's where I feel people are being too optimistic, as I think Tesla will purposefully lower margins to bring prices lower and keep demand high as production ramps into overdrive.

If the Model Y stays priced as high as it is today it will never sell as numerously as the Toyota Corolla does today, I really think Tesla will lower prices and margins over time. It's just what I'm expecting to see, doesn't mean I'm right.

There have been some MY test chassis spotted at Austin, have there been any at Berlin yet?