Or that Tesla prefers a steady stock climb so that the employee incentives are consistent and positive. When we went through this year of being well under the 800's, all those employees saw their options shrink in value. And now, they're all Teslanaires and may not be so motivated moving forward. I bet it messes with performance on the grand scale.Maybe Musk is a little peeved that everyone is crediting Hertz for his team’s accomplishments

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

But it’s ok if the Hertz CEO paints the same thing as a done deal?If I were Hertz CEO, I would be upset with that kind of attitude displayed in public.

Phobi

Member

Starting work early it seems…

...my shopping bag is ready

...my shopping bag is ready

samppa

Active Member

Model 3 has been updated now at least in EU configurator.

SR+ is now just Model 3, and has more range and slower acceleration.

I guess these would be cars with the rumored 60kWh LFP battery.

SR+ is now just Model 3, and has more range and slower acceleration.

I guess these would be cars with the rumored 60kWh LFP battery.

do like i do, show spouse literally last week the graph of TSLA from beginning then 1/2 the graph in a reverse “powers of 2” type slide show, spouse says buy more the day after earnings! (40 shares on a DCA/rage buy at $852) (was that really last week, or just the week before) and go for a walk, or bicycle ride, or pedal kayak ride or whatever relaxes you.How much further do you think we'll run before we get a dip?

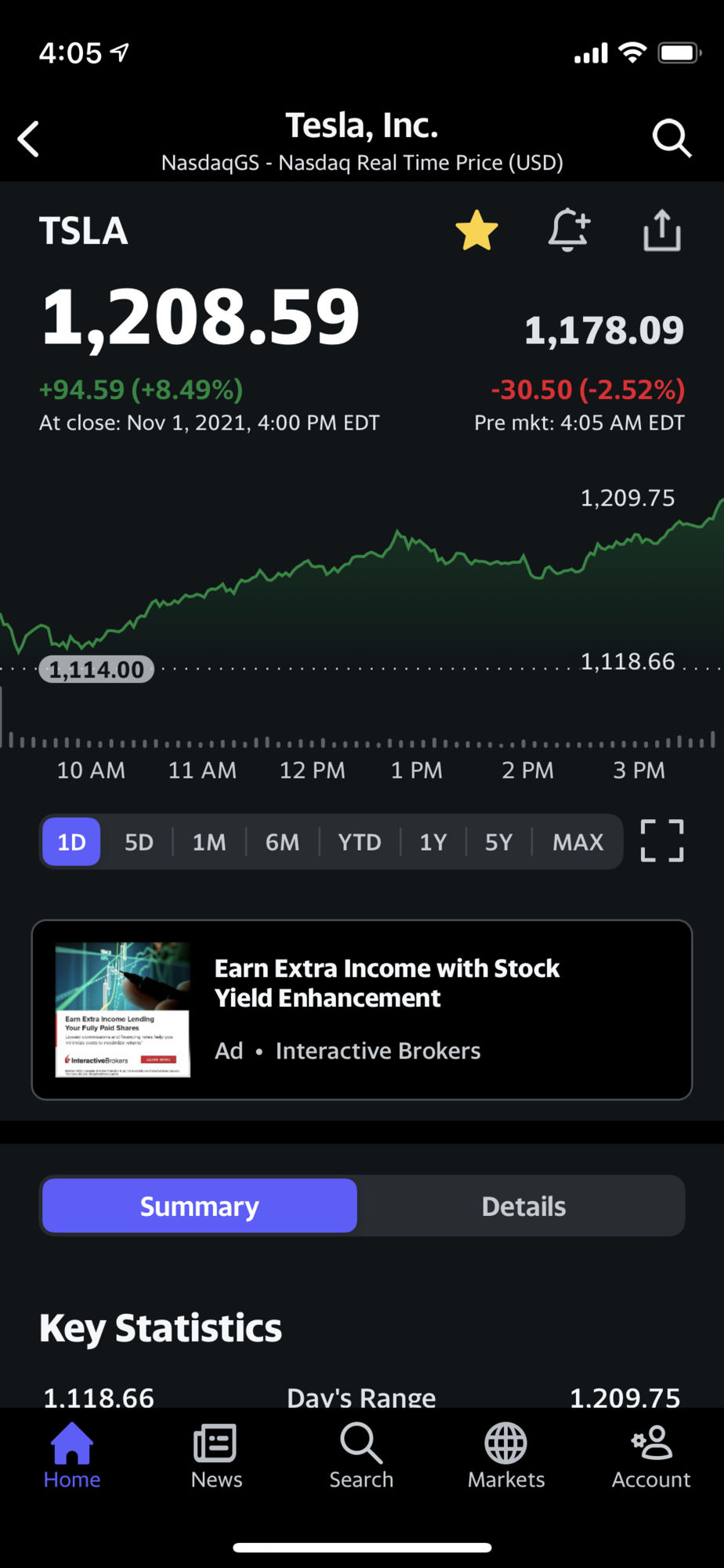

go for leisurely kayak ride for 5 hours get back at 4:10 in afternoon she’s screaming

(oh dear, she found the excess halloween candy wrappers is the first thought)

1208 1208!

just from HODL and DCA/rage buying/going “all in”

whatta “melt up”

Looks like unless 1-2 whales decide to get out, this thing gonna keep going up ....

IIRC, read Ballie sold some before Q3 ending ...

The run up of the last 10 days may have started based on fundamentals but we are past that point. The most reasonable explanation is the one many have made, including Gary Black, that the public are buying a massive amount of short term OTM calls and MM are forced to buy stock to hedge. This can and will reverse (public sells the calls to cash in and MM will sell the stock) and some on here will complain that the stock is being manipulated. Anyone who’s been here a while has seen this happen.The good thing about this run up is that it's not based on nonsense like stock split or S&P. It's more fundamentally based due to their operating margin breaking out of big autos despite headwind.

S

Sofie

Guest

Yes already one (many times over now).Don't worry, the fomo goes away once you are a teslanair.

You are here long enough now you should be one already or close to it.

But I still want to buy even if it’s buying while it’s running hot. Call it “fomo” or whatever you want, I’m just enthusiastic about my company and I’m not ashamed of that.

raffiniert

Member

Don't think there's a real debate but rather some might find annoyance that Elon's attempt of more "stock price is too high" tweets in the form of "stop assigning special valuation to the Hertz deal, it's not even a deal, there's no signed contracts and they make zero difference in the grand scheme of things".

I can say that I am not one of them.

What should we expect from Elon? Pushing the stock for no reason other than the stockprice? Doesn't make sense and I would not want to invest in a company that does.

The run up in the last days was certainly too steep, and a pullback will come - but it doesn't matter.

Mid to long term I'm bullish af and so I will simply HODL.

Cheers to the longs!

anthonyj

Stonks

Wow I’ve never seen 700k shares traded at 5am. This dump is hilarious. I love Elon

Wow I’ve never seen 700k shares traded at 5am. This dump is hilarious. I love Elon

He's just shaking out the weak. He wants real investors in this stonk.

UnknownSoldier

Unknown Member

Someone is trying to pull the rug. I'm interested in seeing how the day goes once we open.Wow I’ve never seen 700k shares traded at 5am. This dump is hilarious. I love Elon

anthonyj

Stonks

My thoughts exactlyHe's just shaking out the weak. He wants real investors in this stonk.

And

Just a bit of life advice it’s almost never wise to taunt someone. Good day fine sir

Wow, that didn't age well at all. Is that why you down vote all my posts?

It looks like in the last six days you have missed out on around $225 per share.

Wow, that didn't age well at all. Is that why you down vote all my posts?

It looks like in the last six days you have missed out on around $225 per share.

And your taunt couldn’t have been any worse timed either. Tesla plummets 7% like 2 hours afterwards.Wow, that didn't age well at all. Is that why you down vote all my posts?

It looks like in the last six days you have missed out on around $225 per share.

Just a bit of life advice it’s almost never wise to taunt someone. Good day fine sir

And

And your taunt couldn’t have been any worse timed either. Tesla plummets 7% like 2 hours afterwards.

Just a bit of life advice it’s almost never wise to taunt someone. Good day fine sir

Drops a bit in the pre-market so it's well above the $1000 you sold out at? You sir, made a mistake and followed it up with "I would say I’m wishing you all the best but of course I’m not". And you sir, are now making a fool of yourself.

I can understand Elon wants to talk down the stock price. It’s been going up way too fast, causing all kinds of issues:

I think it would be a good thing if the stock moves back to 1000, to start a steady ascent from there, bringing it to maybe 1200 again next spring, 1500-2000 in 2 to 3 years time and 2500 in 2025. That’s better for everyone, excepts for those wanting to cash out now. But who would want to do that? We are all HODL’ers, aren’t we? A quick rise to 1800 and drop back to 1000 isn’t helping anyone. Too many people are buying calls (the surest way to lose your money) or dipping into margin to buy shares, which is a recipe for disaster when the stock shoots up too much and then crashes.

A slow but steady rise is the best way forward.

- Elon is receiving a lot of flak for getting $20 billion richer every day. Being the richest person on earth, now by far, causes many to expect him to solve all the world’s problems. He must feel the pressure, even if he doesn’t show it.

- Elon has to pay a lot more taxes on his options, possible forcing him to sell more shares than he would like to.

- Tesla needs to recruits tens of thousands of workers for Giga Berlin and Giga Austin but is not able to offer them attractive options package at these high prices.

- Tesla needs to keep talent onboard and that is getting harder when people have option packages that are now worth millions, making early retirement from a demanding job more attractive.

I think it would be a good thing if the stock moves back to 1000, to start a steady ascent from there, bringing it to maybe 1200 again next spring, 1500-2000 in 2 to 3 years time and 2500 in 2025. That’s better for everyone, excepts for those wanting to cash out now. But who would want to do that? We are all HODL’ers, aren’t we? A quick rise to 1800 and drop back to 1000 isn’t helping anyone. Too many people are buying calls (the surest way to lose your money) or dipping into margin to buy shares, which is a recipe for disaster when the stock shoots up too much and then crashes.

A slow but steady rise is the best way forward.

Spacep0d

Active Member

I'm cashing out my moderate ETF positions and going all in on TSLA!

I agree with the slow and steady sentiment, although maybe more with the “steady” than the “slow” part. I think it should (and will) achieve those prices more quickly than you outline. $2500 in 2025, for example, seems too low assuming continued execution towards FSD, 4680 production, fully ramped Austin/Berlin, scaling Tesla Energy, etc.I can understand Elon wants to talk down the stock price. It’s been going up way too fast, causing all kinds of issues:

So no, there will not be a stock split soon. No, the deferred tax allowance will not be recognized soon.

- Elon is receiving a lot of flak for getting $20 billion richer every day. Being the richest person on earth, now by far, causes many to expect him to solve all the world’s problems. He must feel the pressure, even if he doesn’t show it.

- Elon has to pay a lot more taxes on his options, possible forcing him to sell more shares than he would like to.

- Tesla needs to recruits tens of thousands of workers for Giga Berlin and Giga Austin but is not able to offer them attractive options package at these high prices.

- Tesla needs to keep talent onboard and that is getting harder when people have option packages that are now worth millions, making early retirement from a demanding job more attractive.

I think it would be a good thing if the stock moves back to 1000, to start a steady ascent from there, bringing it to maybe 1200 again next spring, 1500-2000 in 2 to 3 years time and 2500 in 2025. That’s better for everyone, excepts for those wanting to cash out now. But who would want to do that? We are all HODL’ers, aren’t we? A quick rise to 1800 and drop back to 1000 isn’t helping anyone. Too many people are buying calls (the surest way to lose your money) or dipping into margin to buy shares, which is a recipe for disaster when the stock shoots up too much and then crashes.

A slow but steady rise is the best way forward.

And I’m hoping this spring sees us somewhere more in the 1300-1500 range. I would certainly feel less short-term anxiety if we reach that price over the course of 5 months instead of 5 weeks.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K