Those of us who’ve traveled a great deal in certain parts of the world have rented space in such facilities, much cheaper than buying them.Hard to believe or not, it’s true: never once have I bought a filling station restroom.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

B

betstarship

Guest

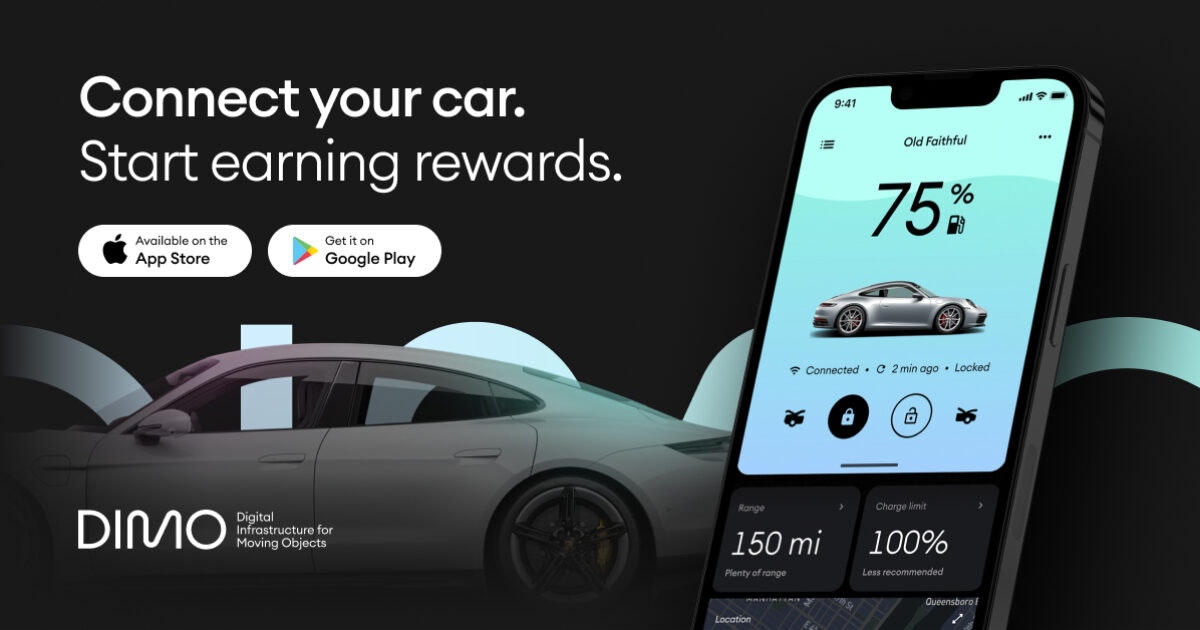

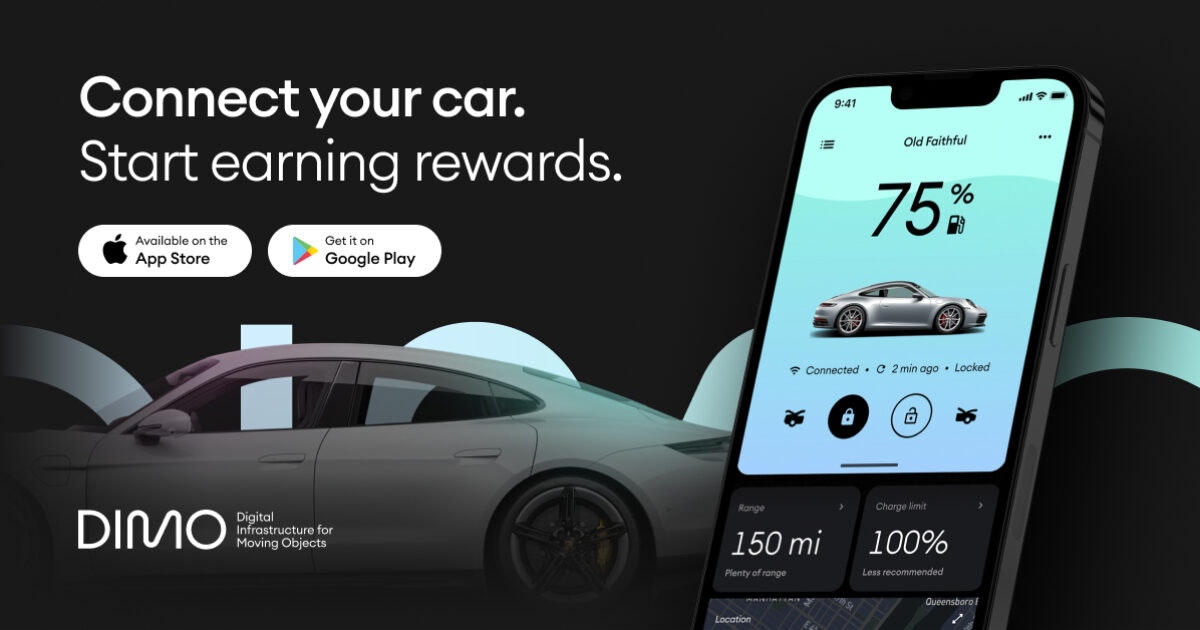

Has anyone tried this for their Tesla vehicle? If so, has it helped?

dimo.zone

dimo.zone

Connect Your Car and Earn Rewards

DIMO helps drivers get more from their cars. Gain insights into vehicle health and performance and get rewarded for helping to build the future of mobility.

Thumper

Active Member

I won’t be using any third party apps that ask for my Tesla credentials.

The Accountant

Active Member

GLJ manufacturing FUD and Trolling Martin Viecha

He shows less than 90k units sold in Q2 in the US while Automotive News estimated 118,700.

Automotive News Q2 Numbers Here

He shows less than 90k units sold in Q2 in the US while Automotive News estimated 118,700.

Automotive News Q2 Numbers Here

ZeApelido

Active Member

JRP3

Hyperactive Member

Competing with BMW for ugliest grill ever. It looks glued on as an afterthought.I think I just threw up in my mouth a little bit.

StarFoxisDown!

Well-Known Member

Math sure is hard for GordoGLJ manufacturing FUD and Trolling Martin Viecha

He shows less than 90k units sold in Q2 in the US while Automotive News estimated 118,700.

Automotive News Q2 Numbers Here

BrownOuttaSpec

Active Member

"Overall earnings estimates have been revised higher since the company's last earnings release"

Umm... I don't think that is true. Today the EPS is $1.73 per the article linked above, on April 20th 2022 Tesla released it's last earnings and the estimated EPS was about $2.34 per my link on April 21st: Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

$1.73 is not higher than $2.34

If the article is going to lie about something so simple that can EASILY be fact checked, what else are they going to lie about?

It looks to me like the car's tongue is hanging out.Competing with BMW for ugliest grill ever. It looks glued on as an afterthought.

Apparently Toyoda has put all his most brilliant engineers on making bigger and bigger grills instead of developing a decent EV.It looks to me like the car's tongue is hanging out.

dhanson865

Well-Known Member

not quite OT, tangential to TSLA as all the vehicles in loop are made by Tesla.

Anyway this interview has two interviewers interviewing 1 head of a casino and 1 Vegas official. All of the above speaking glowingly about the Loop as is and as will be.

a recent event had 5,000 trips at $1.50 a piece in 3 days with all positive reviews.

first 22 mins is about Loop

Anyway this interview has two interviewers interviewing 1 head of a casino and 1 Vegas official. All of the above speaking glowingly about the Loop as is and as will be.

a recent event had 5,000 trips at $1.50 a piece in 3 days with all positive reviews.

first 22 mins is about Loop

Vegas Revealed: Boring Company Adds Vegas Loop Station, NoMad Pool, Thunder From Down Under Celebrates, Off-Strip Las Vegas Restaurant Find | Ep. 126 on Apple Podcasts

Show Vegas Revealed, Ep Boring Company Adds Vegas Loop Station, NoMad Pool, Thunder From Down Under Celebrates, Off-Strip Las Vegas Restaurant Find | Ep. 126 - Jul 16, 2022

podcasts.apple.com

Last edited:

Apparently I insulted him by asking if he will get any dumber this year. I thought it was a fair question.GLJ manufacturing FUD and Trolling Martin Viecha

He shows less than 90k units sold in Q2 in the US while Automotive News estimated 118,700.

Automotive News Q2 Numbers Here

GLJ manufacturing FUD and Trolling Martin Viecha

He shows less than 90k units sold in Q2 in the US while Automotive News estimated 118,700.

Automotive News Q2 Numbers Here

His own graph shows Tesla's market share increased, so how could any (alleged) drop in sales be due to competition?

He ain't the shiniest piston in the engine.

StarFoxisDown!

Well-Known Member

I mean, it’s simple math considering we know Shanghai’s numbers for Q2.His own graph shows Tesla's market share increased, so how could any (alleged) drop in sales be due to competition?

He ain't the shiniest piston in the engine.

Like………real simple math

Despite a sluggish first half for automakers (GM, VW, and Mercedes), they continue to reiterate end of year vehicle production targets. They all seem to believe chip and other supply related issues will ease enough that strong growth in the second half of the year will allow them to hit their targets. Toyota is one of the automakers who thinks they will continue to see supply issues affecting them into 2023.

I find this to be a bullish indicator for Tesla and look forward to Q2 earnings where we will hopefully hear about current annualized production rates. I hope we get some more info on production targets for Q3 and Q4 too.

I find this to be a bullish indicator for Tesla and look forward to Q2 earnings where we will hopefully hear about current annualized production rates. I hope we get some more info on production targets for Q3 and Q4 too.

bkp_duke

Well-Known Member

Competing with BMW for ugliest grill ever. It looks glued on as an afterthought.

I swear the moron that designs grills like this has never, NOT ONCE, hand washed a car. The more complex the girl, the longer it takes to get the bugs out.

Teslas rock on bug removal.

you mean something like this?It looks to me like the car's tongue is hanging out.

2daMoon

Mostly Harmless

Your Freudian slip is showing...I swear the moron that designs grills like this has never, NOT ONCE, hand washed a car. The more complex the girl, the longer it takes to get the bugs out.

Teslas rock on bug removal.

I’d go further. I won’t use any third party apps until Tesla updates their API with some more granular security.I won’t be using any third party apps that ask for my Tesla credentials.

Accident

Member

That’s the total daily volume for that contract. It’s hard to tell how many of those trades were short or long. Volume for puts at $700 was also above 13,000.13,516 $800 contracts represents $1.08bn if exercised. I'm seeing about $4.30 for the Friday price of those, thus ~$58,120 to control a bucketload. Heh. Somethingmakes me sense there may be another - or several other - sides to those trades.

I wouldn’t think too much of the volume at a single strike, and I’m not sure why they are including it with the earnings preview.

However, the options flow this week for contracts sold above the ask was slightly bullish.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K