Charging stations per state:

Anyone have a dataset for Tesla superchargers (which should be added to the above dataset once other EVs can use it) on a per state basis?

I'd like to do some analysis of vehicle registration / superchargers / population, if possible.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

B

betstarship

Guest

Searchable Supercharger location data, with filters on fields including State/Province:

Chairs!

Thank you and sweet! It has the number of stalls.

I'm taking from the alternative fuels' historical station count spreadsheet and going per-state from 2007-2021. I'll post the spreadsheet here for free when I'm done.

Might be the first thumbs down I've ever given you. We used to get run-ups into earnings, but as an active TSLA options trader, I can tell you it hasn't been happening for a while. It's seems like the MM have gotten very good at playing chicken, and manage to keep the SP down through short selling until the bitter end. If Macros improve in the next month, I expect TSLA to climb with it, but otherwise the SP isn't going to deviate much from the NASDAQ until earnings week. Which means we might go down 10+% in the next month, and Q3 earnings will just get us back to where we are now. So let's hope this inflation selling silliness ends and we start seeing another leg up in the markets (starting with a Green Day tomorrow?).I don't see that as the most likely scenario. There is a lot of money on the sidelines that is ready to front-run any Q3 earnings blowout significantly in advance of the actual earnings release. The Production and Delivery numbers come weeks before earnings and, depending upon actual margins and management guidance given during the Q3 conference call, we could see an initial runup based on front-running Q3 P&D and/or earnings, followed up by further runup based on blowout earnings/management guidance. Of course this is only one possible scenario of many but, from what we know right now, probably one of the more likely ones. Because a lot of investors don't wait for the gap up caused by blow-out results, they front-run it. I think we will begin to see that no later than the third week of September and maybe even as early as starting this week. Q3 earnings are not until mid-late October.

Time will tell but sitting on the sidelines until the news is actually announced is not how an investor captures the biggest gains.

Looks like Elon is visiting Giga Berlin after attending conference in Norway this morning:

Deutsche Bank raises price target to $375 after visit to Giga Berlin:

Interesting:

Interesting:

The company acknowledged some production risk from any potential German Gas Crisis, confirming Giga Berlin's energy supply is similar to other

OEMs producing in Germany, but pointed to its strong flexibility in steering its global vehicle production to regions where it sees strong demand," the analyst added.

B

betstarship

Guest

Done, the numbers get weird (only stations, not stalls per state) starting in 2013 and before...I was able to go from 2014 - 2021.

Attachments

Last edited by a moderator:

Artful Dodger

"Neko no me"

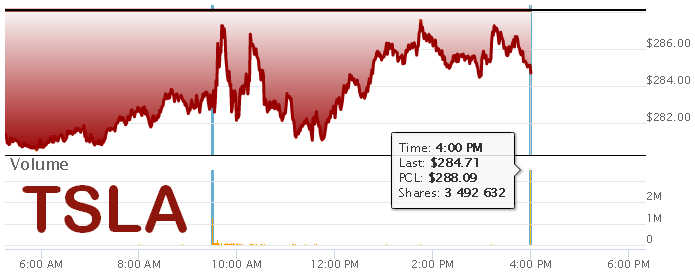

Another day of heavy SP manipulation in the early pre-Market (when its mostly MMs and hedgies trading), followed by extreme volume at the Closing Cross: (3.5M shares, or 1.16M pre-split equiv.) as shortzes cover:

Paging @Papafox

Paging @Papafox

Last edited:

ZeApelido

Active Member

Lots of 4680 battery packs in Austin

via Joe Tegtmeyer's video

via Joe Tegtmeyer's video

In honor of Elon visiting:

Buckminster

Well-Known Member

Hey, I thought you said I was the special one. You even gave me that special TMC holiday last year as a reward.Everyone here always should be bullish on the near future value of Tesla shares. And the far future value.

It’s just that….it’s just….

Well, you’re a special case.

Say what now?!"Manufacturers only got serious about electric vehicles

dhanson865

Well-Known Member

Speculation is that the new roundish wheel from the Semi will replace the current wheel + stalks on the 3 and Y starting around the end of this year/switch to 2023.

www.notateslaapp.com

www.notateslaapp.com

Model 3 and Y to lose steering wheel stalks; gain touch-sensitive wheel a la Model S

Tesla is expected to move the Model 3 and Model Y to a steering wheel with touch-sensitive buttons

navguy12

Active Member

My share count (CIBC) still shows pre split as of 1722 EDT, 29 Aug 2022.I so seldom log into my brokerage account because I am playing deadto maximize my gains. Over the weekend I got bored and took a peek to verify the post-split share count. All was well.

B

betstarship

Guest

Done, the numbers get weird (only stations, not stalls per state) starting in 2013 and before...I was able to go from 2014 - 2021.

I added in state population data and divided the number of people in end of 2019 (no, I didn't find the state populations per year) by the number of stalls per state, over time, from 2014 to 2021. Based on the data, the curve looks like the strategy is to try to reduce the amount of people per stalls across each state. You can see the broad variance in 2014 and how it drives towards 1 stall per < 10,000 people by 2021. The best state (minimum # of people per stall) in 2021 has ~700 people / stall and that's Vermont. It's the best every year since 2014! California is a close second every year.

The worst are Alaska and Louisiana.

Last edited by a moderator:

Lucid opened the ability to sell up to $8 billion in future offering (but not selling anything today) for those wondering what is going on with their stock AH. Just a 30% dilution on a rainy day. Nothing to see here.

Don't you just love the insinuation of this article...'proposed class action', when in reality it is just one owner doing the proposing:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AKFOWASOMZP63B4FROLOZ6PHC4.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AKFOWASOMZP63B4FROLOZ6PHC4.jpg)

Tesla hit with proposed class action over phantom braking issue

A California owner of a Tesla Model 3 sued the electric vehicle maker in a proposed class action over cars suddenly stopping for non-existent obstacles, calling it a "frightening and dangerous nightmare," according to the lawsuit.

StarFoxisDown!

Well-Known Member

Imagine investing in a stock where there's an overhang over a 30% dilution that can/will happen at any moment......Lucid opened the ability to sell up to $8 billion in future offering (but not selling anything today) for those wondering what is going on with their stock AH. Just a 30% dilution on a rainy day. Nothing to see here.

It's somehow even worse to know it's coming at some point instead of just being surprised lol

Agree 100%. Tesla should replicate most (if not all) of the app functionality on the Web. It is almost criminal to not give access to all the Tesla solar system data on the web and confine it all to the small screen app! Most people inevitably have a few days here and there with no mobile access (lost phone, broken phone, etc.), and those days are a pain in the ass already. God forbid if you need access to some Tesla app-only functionality or data at that time, it would turn an already PITA day into a major PITA!My only complaint about service these days? We need a desktop/full size site for managing service interactions. Typing and interacting on a phone is not the best experience for me (not so young male).

My nightmare scenario is losing access to my mobile phone for a few days, and then losing web access to other stuff like my email accounts, bank accounts, etc., because I can't verify my identity with my mobile phone! And now, all my Tesla stuff joins that list of critically mobile dependent.

I think they will draw on those shares via stock based compensation. If they are not generating any revenue, they have to get paid somehow...by retail suckers.Imagine investing in a stock where there's an overhang over a 30% dilution that can/will happen at any moment......Now imagine they have to do it at an even lower valuation than today which turns it into a 40-50% dilution

It's somehow even worse to know it's coming at some point instead of just being surprised lol

B

betstarship

Guest

Tbh, after running through the charging stall exercise per state...

...

...it looks like it's all compliance from the government side. At least the supercharging network is done based no use case and demand! I don't know how climate change is averted unless its California as the only state that survives. Either that or financial institutions throw just a ton of money into Tesla to put superchargers everywhere. They're certainly not making enough cars to get rid of the entire automotive fleet anytime soon.

...

...it looks like it's all compliance from the government side. At least the supercharging network is done based no use case and demand! I don't know how climate change is averted unless its California as the only state that survives. Either that or financial institutions throw just a ton of money into Tesla to put superchargers everywhere. They're certainly not making enough cars to get rid of the entire automotive fleet anytime soon.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K