At least they said something. Car and Driver pretends Tesla doesn't exist. Perhaps the first large publication that recognize Tesla not being a car company...lol.

J.D. Power ranks Genesis at top of Tech Experience Study, but Tesla unofficially took first place

For the second year in a row Genesis has been ranked as top automotive brand by J.D. Power in their 2022 Tech Experience Index Study (TXI). Also for the second year in a row, Tesla […]driveteslacanada.ca

TL : DR

View attachment 846617

View attachment 846618

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

WRT to ‘not much at all’:It is great news that I was wrong! The last I heard was that 'as much LNG as possible' was not much at all.

Thanks very much for this information.

”In total, Germany is hoping to build up a regasification capacity with the four charters of around 20 BCM per year, approximately half of its Russian gas import volume. Combined, all of Germany’s LNG project plans foresee a total import capacity of 68 BCM, surpassing the amount of Russian gas generally piped into the country.”

See Germany fast-track building its first LNG terminal, operational by end of year (with also the German Economics Ministers using the term ‘Tesla speed’).

2daMoon

Mostly Harmless

I so seldom log into my brokerage account because I am playing dead  to maximize my gains. Over the weekend I got bored and took a peek to verify the post-split share count. All was well.

to maximize my gains. Over the weekend I got bored and took a peek to verify the post-split share count. All was well.

Now for the good news. It seems my former employer at some point had deposited additional funds into their 401K, which was news to me. There is not quite enough for a couple of chairs once I transfer the 401K to the Rollover IRA.

The best part of this is knowing that once the rollover clears, and the Infinite Improbability matrix is engaged, the SP should shoot up in time to thwart having enough idle $$ to buy those two shares. If I have done the Bistromath correctly there is no way the price will drop enough for me to avoid adding some to the account for the purchase.

It would be beneficial at this point if @StarFoxisDown! could post something negative about the SP to amplify the effect.

HODL

Now for the good news. It seems my former employer at some point had deposited additional funds into their 401K, which was news to me. There is not quite enough for a couple of chairs once I transfer the 401K to the Rollover IRA.

The best part of this is knowing that once the rollover clears, and the Infinite Improbability matrix is engaged, the SP should shoot up in time to thwart having enough idle $$ to buy those two shares. If I have done the Bistromath correctly there is no way the price will drop enough for me to avoid adding some to the account for the purchase.

It would be beneficial at this point if @StarFoxisDown! could post something negative about the SP to amplify the effect.

HODL

Last edited:

ZeApelido

Active Member

Awesome. The Limiting Factor's videos were essential in laying out the battery portion of the IRA bill.

StarFoxisDown!

Well-Known Member

I'd say the ball is really in Tesla's court right now in terms of what happens off of Q3 P/D numbers. I mean, if they come out with a 400k Q3 P/D number, all bets are off as far as I'm concerned. Macro's could continue to crap themselves and I still think TSLA would march higher to say something like 350-375 leading into Q3 earnings.I don't see that as the most likely scenario. There is a lot of money on the sidelines that is ready to front-run any Q3 earnings blowout significantly in advance of the actual earnings release. The Production and Delivery numbers come weeks before earnings and, depending upon actual margins and management guidance given during the Q3 conference call, we could see an initial runup based on front-running Q3 P&D and/or earnings, followed up by further runup based on blowout earnings/management guidance. Of course this is only one possible scenario of many but, from what we know right now, probably one of the more likely ones. Because a lot of investors don't wait for the gap up caused by blow-out results, they front-run it. I think we will begin to see that no later than the third week of September and maybe even as early as starting this week. Q3 earnings are not until mid-late October.

Time will tell but sitting on the sidelines until the news is actually announced is not how an investor captures the biggest gains.

Our first real clue will be China numbers in about a week and a half.

StarFoxisDown!

Well-Known Member

Don't worry, @TheTalkingMule 's optimism has already set the course for the week. His optimism trounces my negativity when it comes to setting the direction for the shares price for the week.I so seldom log into my brokerage account because I am playing deadto maximize my gains. Over the weekend I got bored and took a peek to verify the post-split share count. All was well.

Now for the good news. It seems my former employer at some point had deposited additional funds into their 401K, which was news to me. There is not quite enough for a couple of chairs once I transfer the 401K to the Rollover IRA.

The best part of this is knowing that once the rollover clears, and the Infinite Improbability matrix is engaged, the SP should shoot up in time to thwart having enough idle $$ to buy those two shares. If I have done the Bistromath correctly there is no way the price will drop enough for me to avoid adding some to the account for the purchase.

It would be beneficial at this point if @StarFoxisDown! could post something negative about the SP to amplify the effect.

HODL

I could post the most negative thing ever and it wouldn't matter..........

slow day .... (good thing is price holding out and we don't have a big drop ... so likely the worst of last weeks Fed talk is over ....)

Tranche 1.

pigg(CC)y bank shares back to Jun 24 300 leaps. (31 calls)

~ 1:3 Delta

Hoping I can gain some shares quickly if market/SP gains momentum. cheers!!

(either direction is fine) (until I run out of tranches

(until I run out of tranches  )

)

Tranche 1.

pigg(CC)y bank shares back to Jun 24 300 leaps. (31 calls)

~ 1:3 Delta

Hoping I can gain some shares quickly if market/SP gains momentum. cheers!!

(either direction is fine)

Last edited:

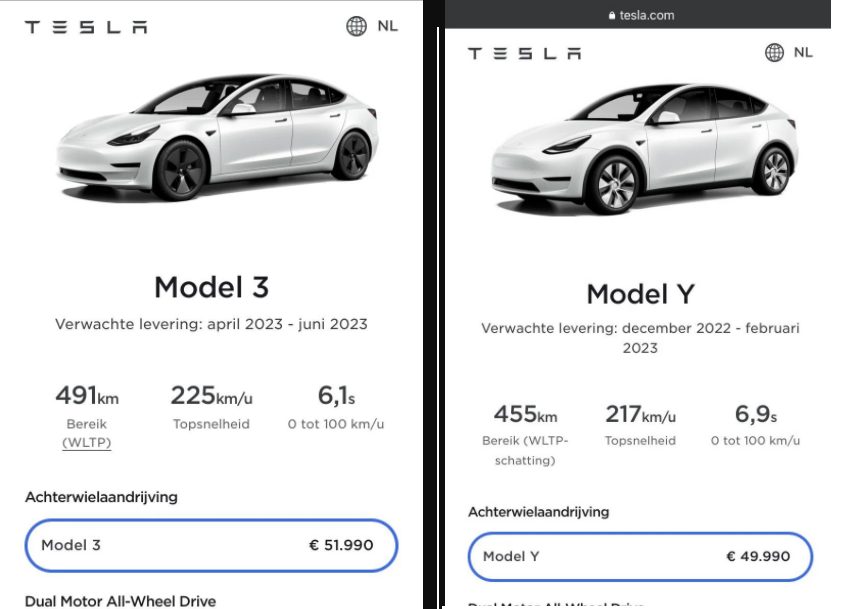

This is new . . . Model Y standard range is cheaper than Model 3 in Netherlands

(but not elsewhere yet)

(Quotes from reddit)

- Tesla store Eindhoven said both standard range vehicles come from Shanghai so it didn't make any sense to him either.

- LR Y and Performance Y come from Berlin. Not the Standard Range (the guy in Eindhoven said)

My theory is that Tesla is starting to pass the actual cost to buyers, since Model Y is actually cheaper to build than model 3, as was said on the earnings call.

The other reason may be the shorter range, lower top speed, and the slower acceleration for the Y due to the cheaper battery.

Link to Reddit

(but not elsewhere yet)

(Quotes from reddit)

- Tesla store Eindhoven said both standard range vehicles come from Shanghai so it didn't make any sense to him either.

- LR Y and Performance Y come from Berlin. Not the Standard Range (the guy in Eindhoven said)

My theory is that Tesla is starting to pass the actual cost to buyers, since Model Y is actually cheaper to build than model 3, as was said on the earnings call.

The other reason may be the shorter range, lower top speed, and the slower acceleration for the Y due to the cheaper battery.

Link to Reddit

Last edited:

My grandfather was blind in one eye. He drove all his life with no problems.Strangely enough, my one eyed cat can judge distances, climbs trees, jumps between chairs and does not smash into things any more often than the typical 19 year old cat.

The vet assures us we do no not need to install Radar or LIDAR on her to make up for this deficit.

TL;DR - If the Fed keeps aggressively hiking rates, I'd presume that Tesla's Altman Z should be able to weather this possible recession storm.

Is it just me or do others feel like these Fed hikes are replaying the past with the aggressive hikes started on 2004?

It seems that the Fed could have essentially 'stress tested' the economy and subprime lending was the weakest link.

I hadn't pulled this very basic data before today as @Papafox got me thinking why wall street seemingly is overreacting to JPs comments.

But could wall street already see a recession coming as these hikes are even more aggressive than 04?

Makes me glad that Tesla has no debt and a ton of cash as it could be necessary keep the supply chain from collapsing if a recession is in the cards.

Is it just me or do others feel like these Fed hikes are replaying the past with the aggressive hikes started on 2004?

It seems that the Fed could have essentially 'stress tested' the economy and subprime lending was the weakest link.

I hadn't pulled this very basic data before today as @Papafox got me thinking why wall street seemingly is overreacting to JPs comments.

But could wall street already see a recession coming as these hikes are even more aggressive than 04?

Makes me glad that Tesla has no debt and a ton of cash as it could be necessary keep the supply chain from collapsing if a recession is in the cards.

WRT to ‘not much at all’:

”In total, Germany is hoping to build up a regasification capacity with the four charters of around 20 BCM per year, approximately half of its Russian gas import volume. Combined, all of Germany’s LNG project plans foresee a total import capacity of 68 BCM, surpassing the amount of Russian gas generally piped into the country.”

See Germany fast-track building its first LNG terminal, operational by end of year (with also the German Economics Ministers using the term ‘Tesla speed’).

Some additional info: there are 45 floating LNG barges in the world. 10 of those are being transferred to Europe: 4 to Germany, 3 to Italy, 2 to The Netherlands, with other EU countries working on acquiring more LNG barges: Belgische reddingsboei voor Nederlandse gasvoorziening

All EU storage is approaching 100% before the heating season starts, and the floating LNG barges add a lot of capacity on top of the already existing fixed LNG terminals.

The price of the gas will be a bigger factor this winter than actual availability of the gas.

TheTalkingMule

Distributed Energy Enthusiast

This all sounds very familiar. Crude is on the tail end of running basically the same exact scam.All EU storage is approaching 100% before the heating season starts, and the floating LNG barges add a lot of capacity on top of the already existing fixed LNG terminals.

The price of the gas will be a bigger factor this winter than actual availability of the gas.

Good thing the global press isn't interested in scaring people to death for clicks!

Belgium, Tesla & Elon related

> Google translate required <

> Google translate required <

Captkerosene

Member

A 40 P/E on next years earnings would do it. The IRA is starting to look like it could drop many additional Billions to the bottom line.I don't see that as the most likely scenario. There is a lot of money on the sidelines that is ready to front-run any Q3 earnings blowout significantly in advance of the actual earnings release. The Production and Delivery numbers come weeks before earnings and, depending upon actual margins and management guidance given during the Q3 conference call, we could see an initial runup based on front-running Q3 P&D and/or earnings, followed up by further runup based on blowout earnings/management guidance. Of course this is only one possible scenario of many but, from what we know right now, probably one of the more likely ones. Because a lot of investors don't wait for the gap up caused by blow-out results, they front-run it. I think we will begin to see that no later than the third week of September and maybe even as early as starting this week. Q3 earnings are not until mid-late October.

Time will tell but sitting on the sidelines until the news is actually announced is not how an investor captures the biggest gains.

I put a new high by the end of the year at 50/50.

SebastienBonny

Member

Hopefully De Croo learned something from Elon...Belgium, Tesla & Elon related

> Google translate required <

Krugerrand

Meow

Every single person who’s going to repeat that result; that’s who cares. For starters every employee of Hyundai. Then every current Genesis owner and every potential Genesis owner. Then everyone else who has ever repeated a JD Power result and everyone gullible enough to believe JD Power. Obviously, that’s enough people to keep JD Power in business and OEMs trying to get on the top of their lists.JD who? Who cares?

The answer is: more than two care.

B

betstarship

Guest

This chart is going to be cray for 2022 if Tesla holds on for the rest of the year:

Are there any other states that (e.g. Texas) it might take over the #1-3 spot by year end?

Most Popular Cars in America | Edmunds

These are the top selling cars in America for this year. The most popular car in your state might surprise you.

www.edmunds.com

Are there any other states that (e.g. Texas) it might take over the #1-3 spot by year end?

For those of who are lamenting the decline of Tesla service, I offer some recent positive experiences.

All communication was done via the app and text. The experience could not have been better. He arrived. I pulled the car out of the garage for him. We had a nice chat. I learned some things as did he. TMC is awesome. I helped him by holding the yoke as he torqued it. He seemed happy as an employee and eager to be of service.

My only complaint about service these days? We need a desktop/full size site for managing service interactions. Typing and interacting on a phone is not the best experience for me (not so young male).

Both techs arrived in Teslas by the way. First one in a modified Palladium S and the second in a X. They really need a Tesla Transit equivalent platform but it’s good to see them utilizing EVs for remote service visits.

[Corrected my misspelling of yoke for our resident editor in chief. Or is that chef? ]

]

- A few weeks ago, a mobile ranger came to the house to replace the bumper stop on my trunk. Great tech (I knew him from previous visits in our 5 year Tesla lifetime) came out with a brand new part because the Service Center had given me one taken from another car. We could not ascertain any physical difference. What he brought and what I had were same part number and revision. Just new and unused. This is attention to detail.

- Earlier this month I posted a bug report that my left turn signal on my SPlaid was intermittent. Out of twenty touches it triggered once. Other times it was fine. I put in a service request. Today, a wonderful gentlemen arrived and swapped out my yoke in ten minutes. At my house. This is customer centric thinking, design, and logistics geared to address issues off site.

All communication was done via the app and text. The experience could not have been better. He arrived. I pulled the car out of the garage for him. We had a nice chat. I learned some things as did he. TMC is awesome. I helped him by holding the yoke as he torqued it. He seemed happy as an employee and eager to be of service.

My only complaint about service these days? We need a desktop/full size site for managing service interactions. Typing and interacting on a phone is not the best experience for me (not so young male).

Both techs arrived in Teslas by the way. First one in a modified Palladium S and the second in a X. They really need a Tesla Transit equivalent platform but it’s good to see them utilizing EVs for remote service visits.

[Corrected my misspelling of yoke for our resident editor in chief. Or is that chef?

Last edited:

B

betstarship

Guest

Charging stations per state:

Anyone have a dataset for Tesla superchargers (which should be added to the above dataset once other EVs can use it) on a per state basis?

I'd like to do some analysis of vehicle registration / superchargers / population, if possible.

Anyone have a dataset for Tesla superchargers (which should be added to the above dataset once other EVs can use it) on a per state basis?

I'd like to do some analysis of vehicle registration / superchargers / population, if possible.

Artful Dodger

"Neko no me"

Anyone have a dataset for Tesla superchargers (which should be added to the above dataset once other EVs can use it) on a per state basis?

Searchable Supercharger location data, with filters on fields including State/Province:

Chairs!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K