The Accountant

Active Member

Working Capital is Self Funding at Tesla

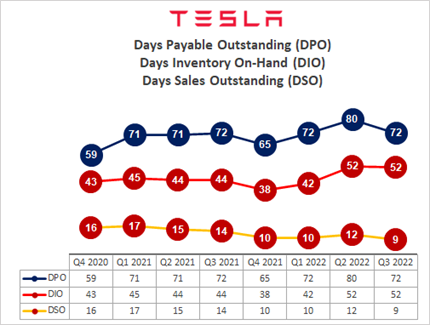

In Q3, Tesla had enough inventory for 52 days of sales (includes healthy safety stock buffer)

. . . . . and had 9 days of sales uncollected; that’s cash tied up for 61 days (52+9)

Still cash flow positive as Tesla pays vendors on average in 72 days (payment terms typical within industry).

With self-funding working capital, Tesla's operations will generate enough cash to cover future capital expenditures and add significant funds to their cash balances each quarter.

In Q3, Tesla had enough inventory for 52 days of sales (includes healthy safety stock buffer)

. . . . . and had 9 days of sales uncollected; that’s cash tied up for 61 days (52+9)

Still cash flow positive as Tesla pays vendors on average in 72 days (payment terms typical within industry).

With self-funding working capital, Tesla's operations will generate enough cash to cover future capital expenditures and add significant funds to their cash balances each quarter.