Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

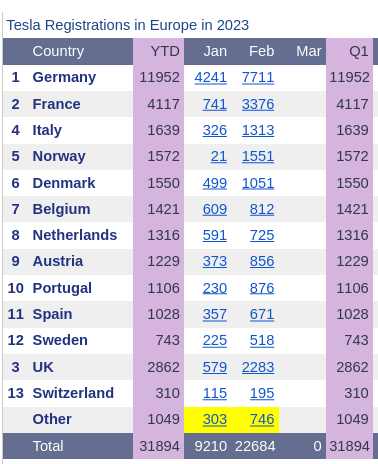

There’s an interesting development in the evolution of Tesla deliveries in the 4 EU countries that have real time registration reporting: Electric Vehicle registrations in Europe: 14 countries, 90+% of BEV market

The deliveries this quarter started much earlier than previous quarter, but at a lower rate. Today the delivery graph is crossing below the Q4 graph. But this quarter’s graph is much more linear. It looks like (visually extrapolating) these countries may have only 10K deliveries this quarter, versus 15K previous quarter, if there is no end of quarter rush.

No end-of-quarter rush would mean that deliveries remain roughly at the current rate. This quarters deliveries started around day 20, the previous quarter at day 40. If we have the same improvement in Q2, we’re witnessing the end of the EOQ delivery rush in Europe right now. At the current rate, Q2 could see 15K deliveries again, spread linearly over the quarter, and the end of the inventory buildup caused by ending the wave.

The deliveries this quarter started much earlier than previous quarter, but at a lower rate. Today the delivery graph is crossing below the Q4 graph. But this quarter’s graph is much more linear. It looks like (visually extrapolating) these countries may have only 10K deliveries this quarter, versus 15K previous quarter, if there is no end of quarter rush.

No end-of-quarter rush would mean that deliveries remain roughly at the current rate. This quarters deliveries started around day 20, the previous quarter at day 40. If we have the same improvement in Q2, we’re witnessing the end of the EOQ delivery rush in Europe right now. At the current rate, Q2 could see 15K deliveries again, spread linearly over the quarter, and the end of the inventory buildup caused by ending the wave.

Xepa777

Banned

Careful you’re saying something negative here so the hive mind will downvote you lol.Riddle me this:

The CEO proclaims demand for Tesla vehicles is excellent, if not "unlimited". Then a few days later cuts prices both in Europe and USA.

Meanwhile @Troy has been more accurate than everyone on this forum in his tracking of "demand issues" and indicates there are still demand issues in China.

With all these cuts, it seems more likely than not Q1 earnings will be quite low. $0.86 EPS is the current mean estimate (already down QoQ). Will it end up below that?

As you are aware, companies valued on the assumption of high growth get pounded if that growth doesn't show up.

Tesla might need a Megapack miracle to avoid dropping back below $150.

I'd love for that not to happen, so please convince me otherwise.

You can tell when Elon shifted tone from being so insistent tht demand exceeded supply until investor day when he said “there’s a strong demand impact on lowering prices.”

1) uhh…duh?

2) yah Tesla could sell infinite model 3s if the prices were cut to $15k but then Tesla wouldn’t be profitable if that happened now would it?

3) combine with what Elon said on Twitter about pedal to the metal even if he has to sell cars at negative margin and there, despite all the pedantic responses from TMCers the past week (check my post history) they just refuse to see what’s coming, which is a relentless attack on margins out of necessity.

These price cuts will keep happening, especially as main street really starts to feel a recessionary environment this year, and Teslas growth story will be challenged due to its evaporating margins.

I can already foresee debates here in August about Tesla doing great because of increased car sales (even if only at 30% growth and dangerously approaching sun 15% gross margin) and that it’s undervalued. Contrast this with early 2022 when everyone said “50% growth and 30% auto gross margin long term baby!!!!” You know who you are..:like 80% of this board lol.

Q1 gonna be bad. Just admit it, will be better for your mental health!

Again, Tesla going to be biggest company in the world, I believe FSD and some form of robotaxi eventually happens (just debated a cruise employee friend at Stanford last weekend on this lol), Tesla energy will be meaningful (+ insurance + charging + eventual App Store), and the fact that I have to qualify all that is sorta sad.

I miss the times where optimism was based on the long term product projections and a general financial market sizing direction, not the defense of long term financial projections that are incredibly volatile and subject to the often ridiculous assumptions of the given poster. And posters calling Tesla/Elon a company “not trained in deception.” Lmao.

It’s like people have gone from placing their spiritual allegiance from organized religion to politics/investments.

Xepa777

Banned

Called it last year - Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

Much more H/W info posted on Omar's Twitter including camera views and possible cameras in front vent.

Actually in a YouTube video I made in 2021 (and privately much earlier) but that’s one of the earlier instances on tmc.

Part 2 of my prediction, watching James Duoma do a total 180 on teslas sufficiency of its sensor suite and radarless approach to do robotaxi. Whether he makes a hard pivot now or a soft pivot over course of 3 years we will see but telling y’all that dude is full of *sugar* as a total charlatan.

Thekiwi

Active Member

What you are seeing is likely the more continuous flow of Berlin production to Europe markets - the end of quarter flood of ships from Shanghai will be delivered in the next four weeks.There’s an interesting development in the evolution of Tesla deliveries in the 4 EU countries that have real time registration reporting: Electric Vehicle registrations in Europe: 14 countries, 90+% of BEV market

The deliveries this quarter started much earlier than previous quarter, but at a lower rate. Today the delivery graph is crossing below the Q4 graph. But this quarter’s graph is much more linear. It looks like (visually extrapolating) these countries may have only 10K deliveries this quarter, versus 15K previous quarter, if there is no end of quarter rush.

No end-of-quarter rush would mean that deliveries remain roughly at the current rate. This quarters deliveries started around day 20, the previous quarter at day 40. If we have the same improvement in Q2, we’re witnessing the end of the EOQ delivery rush in Europe right now. At the current rate, Q2 could see 15K deliveries again, spread linearly over the quarter, and the end of the inventory buildup caused by ending the wave.

Thekiwi

Active Member

“Q1 gonna be bad. Just admit it, will be better for your mental health!”Careful you’re saying something negative here so the hive mind will downvote you lol.

You can tell when Elon shifted tone from being so insistent tht demand exceeded supply until investor day when he said “there’s a strong demand impact on lowering prices.”

1) uhh…duh?

2) yah Tesla could sell infinite model 3s if the prices were cut to $15k but then Tesla wouldn’t be profitable if that happened now would it?

3) combine with what Elon said on Twitter about pedal to the metal even if he has to sell cars at negative margin and there, despite all the pedantic responses from TMCers the past week (check my post history) they just refuse to see what’s coming, which is a relentless attack on margins out of necessity.

These price cuts will keep happening, especially as main street really starts to feel a recessionary environment this year, and Teslas growth story will be challenged due to its evaporating margins.

I can already foresee debates here in August about Tesla doing great because of increased car sales (even if only at 30% growth and dangerously approaching sun 15% gross margin) and that it’s undervalued. Contrast this with early 2022 when everyone said “50% growth and 30% auto gross margin long term baby!!!!” You know who you are..:like 80% of this board lol.

Q1 gonna be bad. Just admit it, will be better for your mental health!

Again, Tesla going to be biggest company in the world, I believe FSD and some form of robotaxi eventually happens (just debated a cruise employee friend at Stanford last weekend on this lol), Tesla energy will be meaningful (+ insurance + charging + eventual App Store), and the fact that I have to qualify all that is sorta sad.

I miss the times where optimism was based on the long term product projections and a general financial market sizing direction, not the defense of long term financial projections that are incredibly volatile and subject to the often ridiculous assumptions of the given poster. And posters calling Tesla/Elon a company “not trained in deception.” Lmao.

It’s like people have gone from placing their spiritual allegiance from organized religion to politics/investments.

What’s your definition of “bad”? Because 30%+ growth year on year in vehicle deliveries in the seasonally weakest quarter isn’t usually considered bad from where I’m from.

What you are seeing is likely the more continuous flow of Berlin production to Europe markets - the end of quarter flood of ships from Shanghai will be delivered in the next four weeks.

Tesla Finland has been inviting customers to pick up their Tesla's from harbour of Hanko on 15-28th of March. This is the first time as far I know and it was caused by strike of dockworkers.

(By the way, Model Y February YOY sales in Finland were +700 %.)

Yes, if it's really 10x improvement this year and 100x improvement next year then FSD is very likely to be solved rather soon. And Optimus will be quite useful rather soon. And we will all be rich rather soon.Today Tesla has a bunch of Tasks they want to run. For example training the FSD neural network, generate labels using Autolabel, development etc. Let's say a specific job takes 24h using the entire cluster today. In by the end of the year they will be able to do ~10 of those jobs in 24h on the cluster. By the end of 2024 they will be able to do ~100 of those jobs in 24h.

This is a combination of many things:

1. More and better compute hardware(Dojo, nVidia etc)

2. Better network, storage etc

3. Lots of software optimizations

4. More effecient neural net training methods

Basically Tesla will have the option of doing a combination of

1. Training the same tasks for longer on bigger datasets to improve performance

2. Training more iterations of the same task to try out more new architectures that are better, get more commits to their repository

3. Train larger models(HW4, Autolabel)

4. Add more tasks that need training(additional FSD networks, Semi/HW4/HW3 specific neural networks, Tesla Bot, factory cameras, autobidder, simulation etc)

Details?I believe FSD and some form of robotaxi eventually happens (just debated a cruise employee friend at Stanford last weekend on this lol),

petit_bateau

Active Member

For context I've lived in a few of these countries.I should’ve verified that more before posting it. My fault.

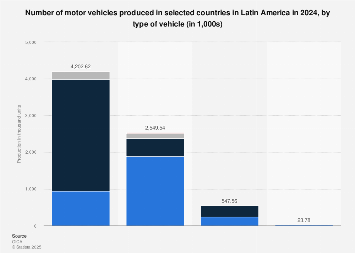

Likewise with the US and Canadian comparison numbers, which peaked pre-COVID at almost 19 million cars and light trucks sold. The point is that the new car market in North America (Mexico included) is approximately triple the market in South America, as measured by unit volume.

“Brazil alone” does almost 90% of car production in South America, so production there essentially is representative of the entire continent.

Motor vehicle production in Latin America by type 2022 | Statista

Mexico is the largest motor vehicle manufacturer in Latin America, based on number of units.www.statista.com

I’m not sure I even know what the conventional wisdom is on this topic; I’m just looking at macroeconomic statistics. Even if LatAm will grow demand from 6M to 8M vehicles per year, the 2M or more output from Giga Mexico would imply unprecedented market share for Tesla in any market except maybe Norway. It might happen, but it seems more likely that GigaMex will export a significant portion of production northward and a future factory in Brazil will be established.

Another factory in Brazil would also save quite a bit on shipping costs and is much closer to the lithium triangle and comes with many advantages for SpaceX as well. Monterrey is pretty far from wealthier S American countries like Brazil, Argentina and Chile, and the exports must cross the Gulf of Mexico with all its pesky hurricane disruptions.

There is indeed a lot of good demand in LatAm but it does depend on stuff. The biggest market and biggest auto manufacturer is of course Brazil. The wealth is not evenly distributed. The wealthy are seriously rich, as @unk45 points out just check out the helicopter market is Sao Paulo for example - the rich there hardly ever get in a car. But they still have many vehicles in and for their households, and money is no object. The middle classes (a broad term) will buy anything from a Gol (think 2/1, but they'll make the 2 via the Tesla stretch) to a big SUV (so typical Y/X buyers), but for them an important consideration is credit availability - especially so for the enterpreneurial middle class in the countryside who will be natural markets for the CT (and they'll charge from their own solar on their own property) but really the urban markets are where the action will be for the next 5 years. Navigating the financial package will be an important consideration for Tesla in the coming years, especially given the various currency fluctuations.

Another key enabling factor is the dramatically reduced protectionism within/amongst the key LatAm nations over the last few decades. If you add the Brazil and Mexico markets together you get 5m/yr. So a 20% take of that is 1m/yr. You can clearly see that putting a 2m/yr factory into Mexico is going to have happy hunting provided it makes a suitable product suite. If 50% of the Monterrey factory output goes to LatAm and the other 50% heads north to US/Can that would be just fine.

Building out the Supercharger network enough in Mexico and Brazil to drive the sales in the key adopter markets is not going to be any more challenging than has already been achieved elsewhere. The majority of the SCs will go around the big conurbations which are truly big (Rio, Mexico City, Sao Paulo, Bs As). Then run the main highways (e.g. Rio de Janiero down to Mar del Plata, plus the existing buildout in Mexico) and I think that'll do for the next 3-4 years in network terms. The infill will flow naturally. Praise be that CCS rules. (It will be interesting to see if they hit Lima as well, or more to the point, when).

Once a car is on a boat then it is relatively cheap to move it around. That's why it is economic to ship from Shanghai to Europe. It is no different doing Altamira to Brazil, but a lot quicker. If Brazil wants to keep its balance of payments under control then they'll need to get battery mineral production up and running PDQ, ideally with added value cell manufacture. Done right the empty vessels can take cell production back the other way - Caterpillar used to be past masters at vessel routings like this between their various factories.

============

I thought it had already left. But something is going to have to be installed fairly soon, as I don't see China remaining forever happy with exporting all the LFP and not getting another car plant for their troubles. And if the Chinese LFP dries up then Berlin is in trouble unless it has 4680 up and running. Tesla may want to play chess, but the CCP ain't dumb, and nor is the German or EU governments. The US-IRA is blatantly protectionist, but will get countered, and I'm sure Tesla is thinking ahead about how to reshuffle the deck at the correct moment.I though the Berlin 4680 equipment was being moved to the U.S.?

Last edited:

nativewolf

Active Member

I am not as sanguine about the ev transition in Latin America. I think the supercharging rollout and indeed the home rollout will be slow. I actually think the CT will do wonderfully. Electricity generation in Brazil is particularly troubling, they have an over reliance on Hydro and biomass, the hydro has proven to be chimeric as climate change is impacting reliability while biomass creates a large and wealthy pool of folk that are wedded to the current ICE model. Thus, I think you'll find it hard to get state support that will enable an ev transition. Mexico is different but I still think an inexpensive CT will do about as well as a small EV.

It seems Tesla intends to run factories at full speed and set the prices according to their algorithm to match demand and supply. Lots of small adjustments. So far it's been a lot of down adjustments as they have increased output YoY. Market is starting to get a bit saturated, not everyone wants to drive the same car as everyone else on the block. But at the right price they will reconsider.

This will create a pretty interesting situation I am not sure we have seen before. Tesla used to be a luxury brand that only the rich people could afford. Then it became a middle class and their TCO was lower than the ICE options for many people if they could just afford to buy it. Now they will keep lowering the prices and starting to become a budget brand with gen3 and government rebates. Meanwhile they have kept improving their specs and quality. It's becoming a luxury car for budget prices.

Buying that Toyota Corolla for the same price as a Model 3 in many countries will become the luxury option, even though its a worse experience to own it. Buying a VW ID4 instead of a Model Y will be the luxary option, you miss out on autopilot, supercharger network, get worse specs but get that luxury "gefühl".

Still Tesla will continue to grow supply and lower the prices... Competition has no idea what's coming for them. As the supercharger network improves the charging anxiety will go away. FSD will keep improving, HW4, LMFP, new motors etc. Bigger scale sharing the costs between more vehicles. Prices go down, scale goes up. Meanwhile competition will lose their profitable car sales, petrol stations will start to close down, service centers will close down, unclear if the companies will even survive people will reconsider buying the car from them and risking having support issues in the future. Resale values plummeting making TCO handicap even bigger...

Competition is so screwed...

TrendTrader007

Active Member

It seems Tesla intends to run factories at full speed and set the prices according to their algorithm to match demand and supply. Lots of small adjustments. So far it's been a lot of down adjustments as they have increased output YoY. Market is starting to get a bit saturated, not everyone wants to drive the same car as everyone else on the block. But at the right price they will reconsider.

This will create a pretty interesting situation I am not sure we have seen before. Tesla used to be a luxury brand that only the rich people could afford. Then it became a middle class and their TCO was lower than the ICE options for many people if they could just afford to buy it. Now they will keep lowering the prices and starting to become a budget brand with gen3 and government rebates. Meanwhile they have kept improving their specs and quality. It's becoming a luxury car for budget prices.

Buying that Toyota Corolla for the same price as a Model 3 in many countries will become the luxury option, even though its a worse experience to own it. Buying a VW ID4 instead of a Model Y will be the luxary option, you miss out on autopilot, supercharger network, get worse specs but get that luxury "gefühl".

Still Tesla will continue to grow supply and lower the prices... Competition has no idea what's coming for them. As the supercharger network improves the charging anxiety will go away. FSD will keep improving, HW4, LMFP, new motors etc. Bigger scale sharing the costs between more vehicles. Prices go down, scale goes up. Meanwhile competition will lose their profitable car sales, petrol stations will start to close down, service centers will close down, unclear if the companies will even survive people will reconsider buying the car from them and risking having support issues in the future. Resale values plummeting making TCO handicap even bigger...

Competition is so screwed...

Totally agree

I get a hint of a future where buying a Tesla resembles a commodity futures market. Auto-bidder like market SW allows for bidding for “future delivery” vs daily market price.so called “competition” will be decimated

Totally agree

Could this maximize production, deliveries and margins? So many demand levers…

nativewolf

Active Member

but a lot of profitModel S/X is less than 5% of total revenue...

We have EU Q2 results:

it really seems we are ending "the wave", but I suspect March will be bigger still than Jan and Feb. It seems Berlin is going very well and incentives are working. For comparison, 22 Jan-Feb were at ~16k cars.

With the price cuts, I really don't see sales slowing.

it really seems we are ending "the wave", but I suspect March will be bigger still than Jan and Feb. It seems Berlin is going very well and incentives are working. For comparison, 22 Jan-Feb were at ~16k cars.

With the price cuts, I really don't see sales slowing.

petit_bateau

Active Member

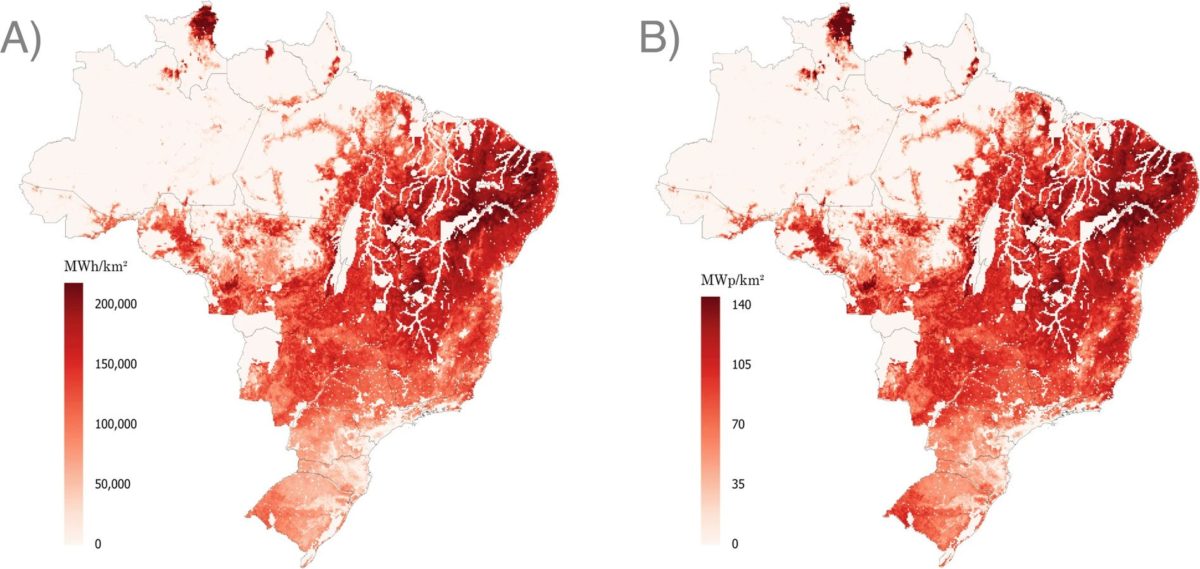

The Brazilian grid is actually quite good, and solar and wind are increasingly running on the grid. The hydro-wind-solar combo is well placed for Brazil as it means that water can be husbanded more carefully. This is important given the droughts that have affected Brazil hydro output. The Chinese are pushing heavily into Brazil renewables & mining.I am not as sanguine about the ev transition in Latin America. I think the supercharging rollout and indeed the home rollout will be slow. I actually think the CT will do wonderfully. Electricity generation in Brazil is particularly troubling, they have an over reliance on Hydro and biomass, the hydro has proven to be chimeric as climate change is impacting reliability while biomass creates a large and wealthy pool of folk that are wedded to the current ICE model. Thus, I think you'll find it hard to get state support that will enable an ev transition. Mexico is different but I still think an inexpensive CT will do about as well as a small EV.

The biomass energy you refer to is not likely to grow any more (imho), though I'd be interested to hear local opinions on that re the ethanol blending and sugar cane plantation growth.

Brazil hits 22 GW milestone

Brazil has deployed 7 GW of utility-scale solar and 14.98 GW of distributed-generation PV projects below 5 MW in size to date.

New database for Brazil’s solar generation potential

Scientists have calculated the solar generation potential of every Brazilian state. The study show that the nation has the potential to install 337.83 GW of solar. The state of Bahia leads with 43.97 GW, followed by Minas Gerais with 41.84 GW and Mato Grosso with 39.73 GW.

dhrivnak

Active Member

Yes I agree there is a problem but when people over emphasize the risk I feel the do as much harm as over emphasizing the non risk. Many use him as a quack to show how wrong climate scientists are.OT... Many say the same about Elon.It's a purposeful style, got my attention, learned lots, donated.

FYI, my post is not just about him. He (and I) cite numerous sources to show that the alarm is continually ignored. Agree there?

Well cost reduction can either be used to generate demand or margins. Tesla did take 3hrs to explain their additional path to cost reduction.Careful you’re saying something negative here so the hive mind will downvote you lol.

You can tell when Elon shifted tone from being so insistent tht demand exceeded supply until investor day when he said “there’s a strong demand impact on lowering prices.”

1) uhh…duh?

2) yah Tesla could sell infinite model 3s if the prices were cut to $15k but then Tesla wouldn’t be profitable if that happened now would it?

3) combine with what Elon said on Twitter about pedal to the metal even if he has to sell cars at negative margin and there, despite all the pedantic responses from TMCers the past week (check my post history) they just refuse to see what’s coming, which is a relentless attack on margins out of necessity.

These price cuts will keep happening, especially as main street really starts to feel a recessionary environment this year, and Teslas growth story will be challenged due to its evaporating margins.

I can already foresee debates here in August about Tesla doing great because of increased car sales (even if only at 30% growth and dangerously approaching sun 15% gross margin) and that it’s undervalued. Contrast this with early 2022 when everyone said “50% growth and 30% auto gross margin long term baby!!!!” You know who you are..:like 80% of this board lol.

Q1 gonna be bad. Just admit it, will be better for your mental health!

Again, Tesla going to be biggest company in the world, I believe FSD and some form of robotaxi eventually happens (just debated a cruise employee friend at Stanford last weekend on this lol), Tesla energy will be meaningful (+ insurance + charging + eventual App Store), and the fact that I have to qualify all that is sorta sad.

I miss the times where optimism was based on the long term product projections and a general financial market sizing direction, not the defense of long term financial projections that are incredibly volatile and subject to the often ridiculous assumptions of the given poster. And posters calling Tesla/Elon a company “not trained in deception.” Lmao.

It’s like people have gone from placing their spiritual allegiance from organized religion to politics/investments.

There are 2 camps of people.

Camp 1 are people who want Tesla to release new models, new refreshes, advertise, go hardcore pr , etc to generate demand. They see lowering prices to generate demand as margin killing. By doing the above, you can maintain prices higher, however it increase cost dramatically.

Camp 2 are people who thinks cost reduction can have you lower prices to generate demand, which is what Tesla picked.

So question one should ask as an investor as Tesla cranks out more and more cars. Would a lower priced car generate millions of additional demand or would a newer car generate millions of additional demand? Elon believes affordability in a high interest rate environment or just affordability period is the limiting factor to infinite demand.

After catching up from all the post's this weekend, I am reminded of one of my favorite sayings:

"Cherish those who seek the truth but beware of those who find it"

Way too many certainties in many post's.

"Cherish those who seek the truth but beware of those who find it"

Way too many certainties in many post's.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K