Fact Checking

Well-Known Member

This week, Monday opened super weak, and with below average trading volume many days, it was hard to cover the hedge need of nearly 14 million shares. Luckily, as the stock stabilized, thru end of day Wednesday, the deficit was absorbed.

Trouble started Thursday as stock fell another 80 points or so, triggering another 13 million or so shares to be sold. And total volume was light. So that couldn't happen. Friday AM looked like it was almost a premarket pump to help short at higher prices. But the huge hedging appetite pushed it down quickly. So here we are, with lot of good news re the Y, but at distressed levels.

Note that there were also two pieces of well-placed disinformation on Friday: the SolarCity trial FUD and the Fremont coronavirus FUD, distorted and magnified by the usual suspects. Judging by past (alleged) patterns of criminal short-and-distort behavior by Lora Kolodny, I suspect the release of the article was calculated and coordinated with put option buying and short selling.

Lora in particular seems very invested in her Tesla and Elon hate, and will eventually commit a mistake and might go to jail or at minimum face significant legal expenses. That's the thing with criminals, a single mistake per lifetime can sink them.

If the current TSLA price is right for you, just use it as a discount offered by the shortz.

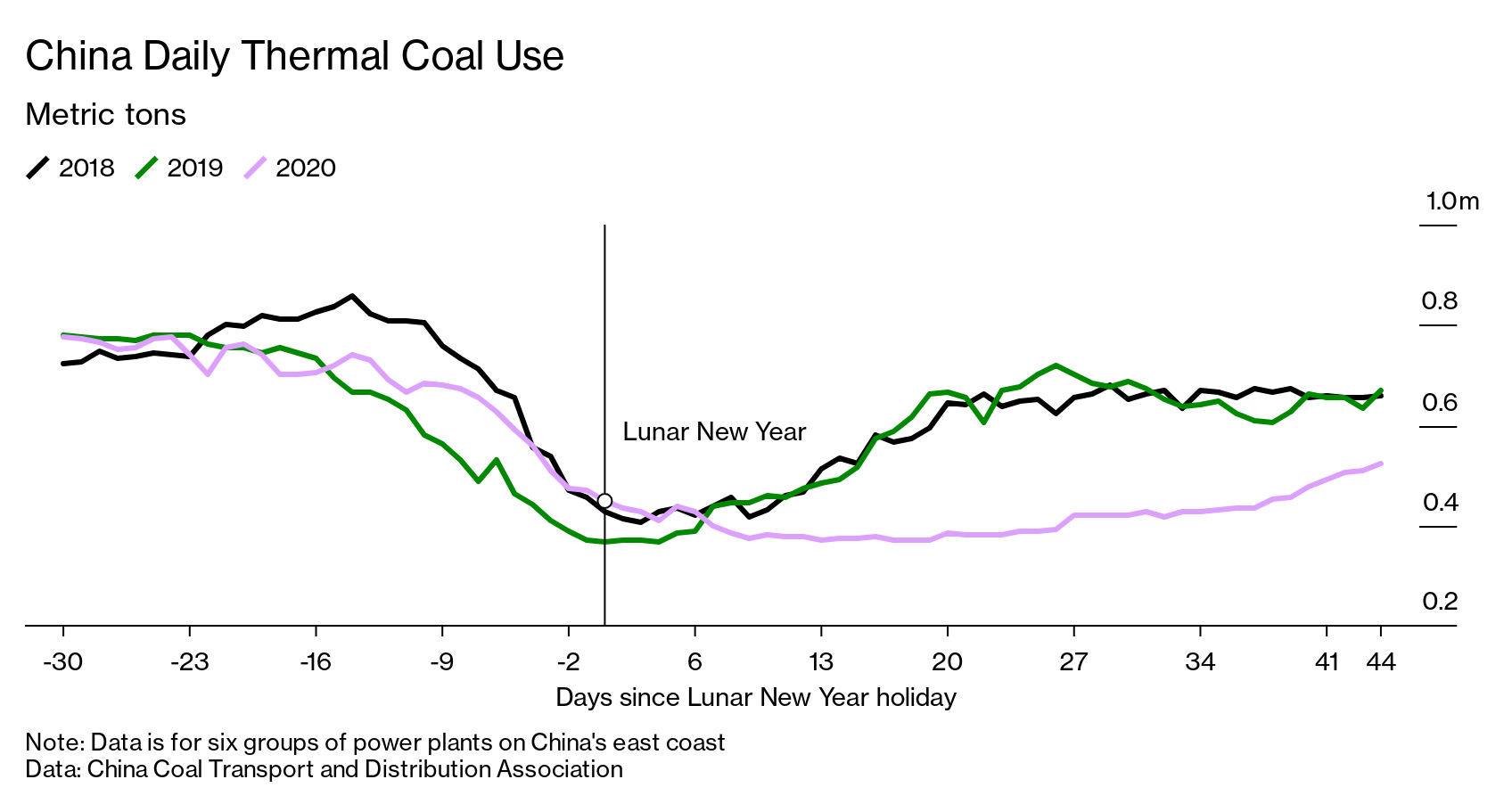

Be mindful of the U.S. still apparently underestimating the extent of the coronavirus damage though, and this might negatively affect Tesla as well. See my next post about the macro scenario, which doesn't look good IMO. Not advice.

Last edited: