Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

glen thomson

Member

yep and the Olympics may end up being canceled which would be devastating to japan. This situation is much worse than most realizeTravel and tourism was 10.5% of global GDP in 2018. The sector is unravelling before our eyes. What does closing Italy off to tourism do to its already near bankrupt banking system? What does that in time do to the economic and political integrity of the Eurozone?

calculations have been done that shows Iran already has 10s of thousands of cases , you calculate it by finding out how many people with the virus turn up in other countries from Iran which is now 100 yet they are only reporting a few hundred cases the math doesn't add up at all.

Artful Dodger

"Neko no me"

I have about 10 N95 masks, lots of shoe covers and a few white protective suits I bought last year cleaning out my mother's house after my sister had 31 cats (Sorry @Kruggerand I'm not a fan of cats) and no litter boxes. Maybe we can get together and start a business removing all the CV casualties from their homes. Finally a use for the tow hitch on my X. Anyone corner the market on Purell? There are still some money making opportunities out there with a little imagination.

Bullish AF?

/s

Singer3000

Member

My initial complacency over this was because aggressive containment measures made in SE Asia and China appeared to have made this an Asian only event. That’s been blown out the water.yep and the Olympics may end up being canceled which would be devastating to japan. This situation is much worse than most realize

calculations have been done that shows Iran already has 10s of thousands of cases , you calculate it by finding out how many people with the virus turn up in other countries from Iran which is now 100 yet they are only reporting a few hundred cases the math doesn't add up at all.

It’s still perfectly possible for individual countries to achieve the same result as for example in Singapore. But it will require the large scale cessation of international travel and a degree of economic self harm that I think most in the rest of the world have been blissfully unaware has been taking place in Asia.

1101011

Proud TSLA/SCTY shareholder since 2013.

OT

Free-range Teslas in my own neighborhood aren't prevelant. So seeing about a dozen (mostly M3s) in less than twenty-four hours while visiting in Victoria, BC, is quite exhilarating.

Free-range Teslas in my own neighborhood aren't prevelant. So seeing about a dozen (mostly M3s) in less than twenty-four hours while visiting in Victoria, BC, is quite exhilarating.

KSilver2000

Active Member

This was spotted at the factory in Fremont just recently. It's happening!

Excuse me if this has already been confirmed and mentioned somewhere. But, does anyone know whether the Y has an automatic powered lift gate like the X? Would love to be able to remotely open it up all the way like with the X.

Stretch2727

Engineer and Car Nut

Thinking of buying some TSLA long dated calls on this dip. I have sold covered calls in the past, first time buying calls but pretty comfortable with my understanding and the risk.

Does anyone have recommend site for analysis of different options possibly comparing options pricing across different expirations?

Does anyone have recommend site for analysis of different options possibly comparing options pricing across different expirations?

Expanded my TSLA holdings by 5% this morning at $639, not trying to catch the low but just trying to convince myself that the drop wasn’t likely to continue much more. Plus I had read the FUD about the drop being caused by bad China sales numbers, and knew (thx to you folks) that this was completely falsifiable BS. And good grief, with MY introduction and Q1 numbers and battery day and China production ramp up and GF Berlin news and PG&E project, there is plenty of good news in the pipeline.

Now I am delighted that my timing looks fine. My TSLA portfolio is quite small but keeps growing bit by bit. I have made myself a promise that when it goes back up to the 800-900 range, I will just leave it alone, there is plenty there now to make a difference long term (and have my money manager start asking when I am gonna sell some).

Now I am delighted that my timing looks fine. My TSLA portfolio is quite small but keeps growing bit by bit. I have made myself a promise that when it goes back up to the 800-900 range, I will just leave it alone, there is plenty there now to make a difference long term (and have my money manager start asking when I am gonna sell some).

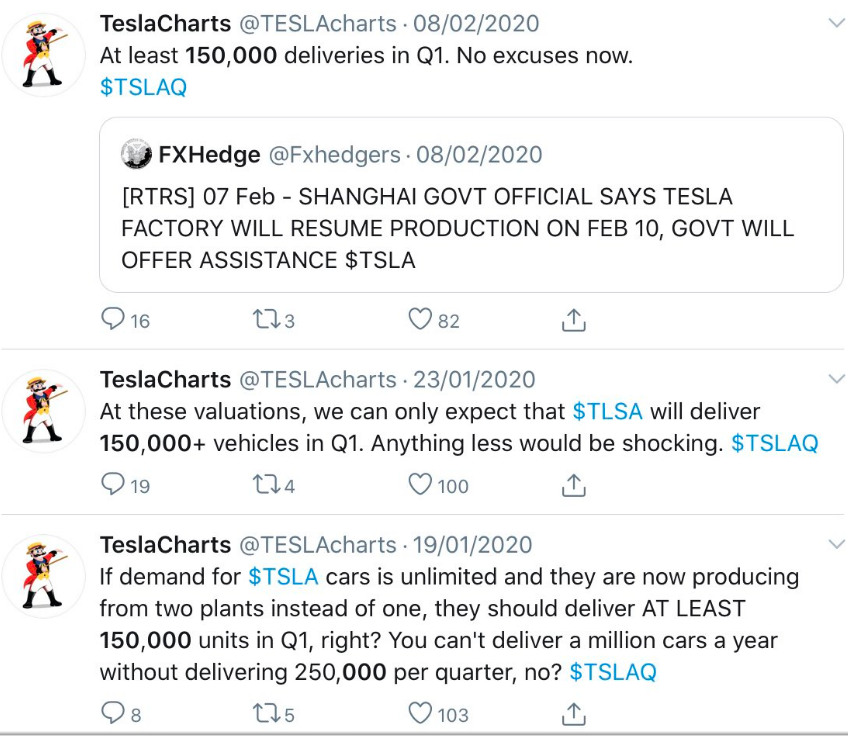

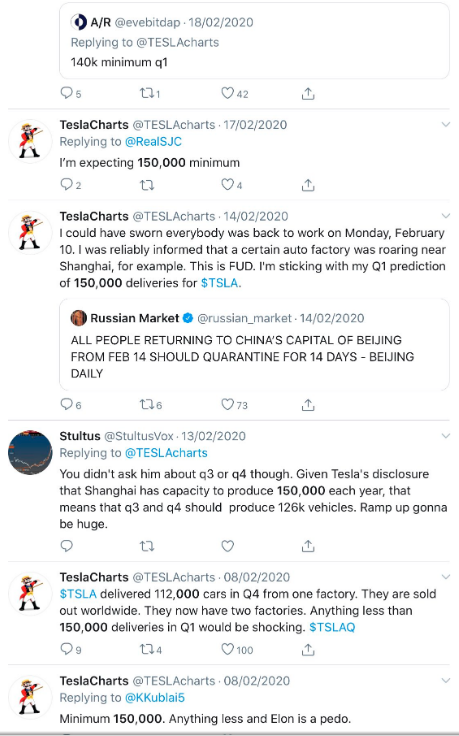

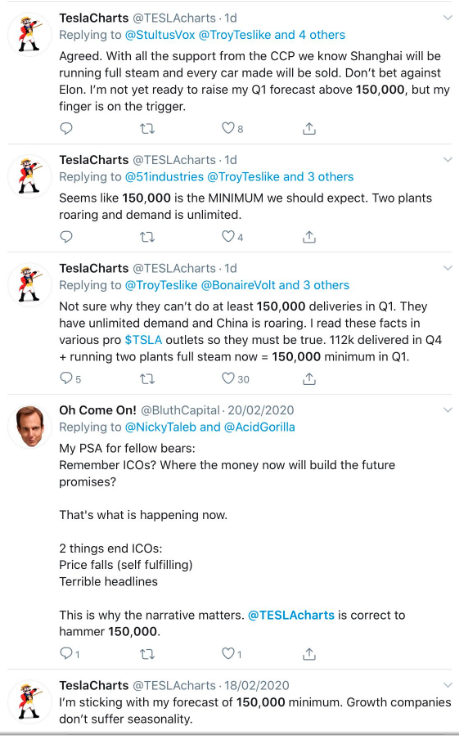

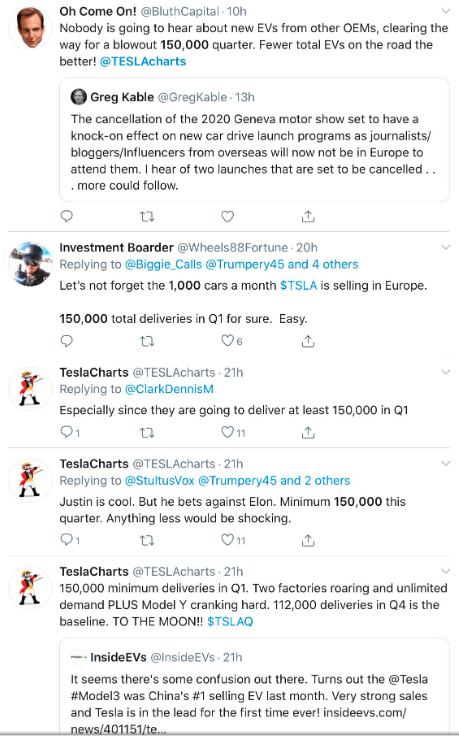

Behold, TSLAQ's embarrassingly bad, embarassingly transparent campaign to try to set Q1 expectations to 150k.

The problem I don't think they've realized is...

Nobody cares about what they write.

The problem I don't think they've realized is...

Nobody cares about what they write.

KSilver2000

Active Member

Yes but they can keep people from defaulting on mortgages and debt as a result of not working.

So, the vast majority of companies then?

Years of working in consulting has shown me that most middle and upper managers are incredibly short sighted.

This isn't the Bernie show. No way this gov will institute some kind of loan deferment mandate to the lenders.

I do agree with you regarding the time off policy effect.

Another thing that I noticed having worked at both startups and large companies, employees at companies that provide unlimited PTO tend to actually stay at home when sick but not go on as many vacations. Whereas, at companies with a set accrual rate of PTO, employees tend to take time off more but come to work even when sick. Just my personal observation at the particular places I've worked at. Could be different for others and in different geographies.

MC3OZ

Active Member

The degree of complacency on this thread is something to behold.

The US govt has advised against all but essential travel to fellow G7 country Italy and the world’s second largest economy China. Let that sink in.

Japan, the third largest economy, has shut schools nationwide for a month. The Uk, the 6th largest, is considering the same but for two months. All around Europe businesses are telling their employees to cancel all business travel and work from home (matching the advice in Asia). Airlines are slashing routes because already they have insufficient passengers. Country after country are instituting bans on travel from certain countries and quarantining or self isolation of visitors.

We are witnessing the rapid unravelling of international travel, the key plank of our globalised economy, and that is without factoring in the likely interruption to internationally integrated supply chains and the shock to aggregate demand everywhere covid-19 takes a hold.

I suspect as others have noted, it won’t take long for the market to shrug off Friday’s positive noises from the Fed. Because unlike in 2008, this time a rates cut is not going to do anything to loosen corporate travel bans or encourage households to go out and spend more money, until they feel the personal risk is reduced to a satisfactory level.

Sorry if this sounds miserable but I fear we have barely scratched the surface in terms of how badly this crisis will impact markets and underlying economies.

Thank god Tesla raised that cash when it did, at least when this is all over it will still be there to continue its work. It will be a different matter for many other corporate giants.

You are not saying this will still be a problem in 5 years time, or Tesla will not survive 5 years?

I agree the extra cash for the raise is very handy, in terms of surviving...

I suggest if this is still a problem in 5 years time and organised society has collapsed, it will not matter what you are invested in...

A good investment is still a good investment, even in bad times, more so in bad times....

Outside of Tesla I think yes a lot of the market may be overvalued and a correction is warranted regardless.

Tesla is going with the general flow of the market now, but if it survives in 5 years time, it will be valued on earnings...

Plenty of people a panicking I just don't think it achieves anything.

.

in no longer than 2 years will will probably have a vaccine and the worst will be over, a lot of other stocks that were overvalued will be correctly valued.

I expect Tesla to still be doing well in terms of production and deliveries... after a while people will stop panicking and get on with life. and then some of them will want a new car...

I can;t predict how long the panic will last, I'm not even going to try..

Are you kidding? Everything Elon says, touches, or looks at sideways affects Tesla. You may not have noticed, but the market is emotional. The Bears chose a strategy long ago to 'play the man, not the ball'. They can not win on facts, so they attack the man. Ad hominem.

I posted the Youtube version of the interview as a reply to a previous post (follow the up-arrow for discussion). My comment is intended to assist international-based members to watch Elon's interview without having to access a US Military owned/controlled website. Or did it not occur to you that might be a problem for some viewers?

Now ask yourself what value your comment brought? I'm struggling to see it.

Chill dude. I already deleted my post. It isn’t good form to post links or videos without explaining why you are posting it. That’s universal. Can’t read your mind or your posting history easily.

Motor Mouth

Member

Tell me about it...I agree , I tried to rais concerns about how serious this was days ago but had multiple of my posts removed by mods so frustrating, now we are witnessing the first break out in america in California . imagine if we find out next week the Fremont factory has to shut down over the virus.

Sherlo

Member

You are not saying this will still be a problem in 5 years time, or Tesla will not survive 5 years?

I agree the extra cash for the raise is very handy, in terms of surviving...

I suggest if this is still a problem in 5 years time and organised society has collapsed, it will not matter what you are invested in...

A good investment is still a good investment, even in bad times, more so in bad times....

Exactly, it's all relative to an investor's time horizon. If you are trying to buy and time the low of any pullback then good luck. Otherwise, long term (5 years+) investors will see these pullbacks for what they are...an opportunity.

For the second day ARK Invest was buying more shares of TSLA for ARKK (19.959) and ARKW (5,651).

TSLA is the top holding in ARKK at 9.92%. Most unusually, 295 shares of ARKK traded during after-hours at 18:53 EST. That was at the Ask price of $54.01, well above the closing price of $52.84. Someone must have noticed that some of ARKK's holdings are up during after-hours (including TSLA) and figured the Ask price for ARKK is a deal.

2020 Air Warfare Symposium Day 2 - Fireside Chat: Elon MuskLol at the moment in the Musk introduction where Elon looks somewhat confused: “you may remember him from dial up modems”

2020 Air Warfare Symposium Day 2 - Fireside Chat: Elon Musk

(45 minutes mark)

How to protect Intellectual Property

Tesla open source all its patents to encourage other companies to make EV

By the time competitors make use of the patents, they are several years old and that is fine.

Tesla protect IP by making sure rate of innovation is fast and accelerating. Innovation is not useful unless the rate is high.

Most organization gets less innovative (relatively and absolutely) as they become big, because of poor incentive structure

(18 minutes mark)

To incentivize innovation, those in a role where innovation should be happening but is not must be exited.

Innovation failure must be an option unless it is catastrophic. There should be minor consequences for trying and failing.

Must reward and promote those with successful innovation.

If innovation failure is punished, things might go backwards in an organization.

Let's be clear: people are not going to hunker down in their homes for months. It's just not going to happen.

You know what people like more than not catching a virus? Eating. Having healthcare. Having the lights stay on. Not getting their home repossessed.

Spanish Flu was far deadlier, and people still went to work. Today? A disease which has a 1% fatality rate outside of Wuhan - 0,2-0,3% for working-age people - and this is before retrovirals, which should be approved in a couple months - in an environment with modern communications and disease control measures, rather than during a World War - isn't going to do the trick.

This is hardly the first time things have scared people. Remember 9/11 in the US, how freaked out people were about terrorism striking anywhere, anytime? Yep.... yet they still went to work. Even people in jobs in public places that would be likely targets. They were scared. But they were even more scared of losing everything they owned and ending up on the streets because they decided to become a shut-in out of fear of terrorists.

That's not to say that these things have no impact. The airline industry was heavily impacted by 9/11. With COVID-19, I'd expect the same thing to happen to the tourism industry for this spring / summer season.

But meanwhile, life goes on. It always does. One can only keep their fear level high for so long. And there are lots of scarier things out there than this. Heck, if life can go on in South Korea when the president of the US and Kim Jong Il are threatening nuclear war and there's tens of thousands of artillery pieces aimed across the border, many at Seoul, along with shells and missiles full of chemical weapons and bioweapons produced in staggering volumes.... If people there could still go about their normal lives under that threat... and they did... I think we can handle what's in effect a worse version of a seasonal flu.

You know what people like more than not catching a virus? Eating. Having healthcare. Having the lights stay on. Not getting their home repossessed.

Spanish Flu was far deadlier, and people still went to work. Today? A disease which has a 1% fatality rate outside of Wuhan - 0,2-0,3% for working-age people - and this is before retrovirals, which should be approved in a couple months - in an environment with modern communications and disease control measures, rather than during a World War - isn't going to do the trick.

This is hardly the first time things have scared people. Remember 9/11 in the US, how freaked out people were about terrorism striking anywhere, anytime? Yep.... yet they still went to work. Even people in jobs in public places that would be likely targets. They were scared. But they were even more scared of losing everything they owned and ending up on the streets because they decided to become a shut-in out of fear of terrorists.

That's not to say that these things have no impact. The airline industry was heavily impacted by 9/11. With COVID-19, I'd expect the same thing to happen to the tourism industry for this spring / summer season.

But meanwhile, life goes on. It always does. One can only keep their fear level high for so long. And there are lots of scarier things out there than this. Heck, if life can go on in South Korea when the president of the US and Kim Jong Il are threatening nuclear war and there's tens of thousands of artillery pieces aimed across the border, many at Seoul, along with shells and missiles full of chemical weapons and bioweapons produced in staggering volumes.... If people there could still go about their normal lives under that threat... and they did... I think we can handle what's in effect a worse version of a seasonal flu.

Last edited:

Artful Dodger

"Neko no me"

crazy! So do these guys now take a 13 day break and try this **** again?

Yes, I think so. I speculated about this tactic here on TMC last year. I think MMs are so desperate to cover that they've decided to try to create mass panick amongst Long TSLA shareholders, Shake'n'Bake-style. Look at the net covering reported as of Feb 14: over 4m shares in 2 weeks, a record. Panick works, at least on weak longs.

I draw your attention to the trading executions problems this week commented upon by several members here. I futher would not be surprised if there's mass front-running of TSLA trades, and deliberate throttling of data feeds, again to advantage brokers and MMs.

MMs want to play the other side of the trade now, but their millions of outstanding short commitments means they want to find a way to cover without drastically increasing the SP. But with short interest around 20% the SP has been suppressed for literally years.

S&P 500 inclusion can't come soon enough. MMs know Tesla is likely to become a multi-Trillion dollar enterprise, and MMs like UBS, M-S and others are positioned wrongly for that future. And the SEC has turned a blind eye to any crimes they commit while scrambling to reposition themselves.

Market-making and proprietary trading are fundamentally incompatible activitIes. Would you play a hockey game where the Ref was sitting in the other team's locker room between periods? Then going for drinks with their team after the game?

#SEC

lafrisbee

Active Member

I am of the opposite opinion... I put money in tsla just to buy the cyber. And it is perhaps the smartest move one could do. You see IF tesla is as good as it is claimed then the stock will grow enough in the next two years to cover the cost of the cyber. If the company isn't then the truck won't be that good, and the money won't be there. And I'll buy something less ambitious with the money.If you are planning to spend 50k on a car in the nearer future, that money should not be in something as volatile as stocks.

StealthP3D

Well-Known Member

Read Papafox’s TMC thread - check

make limit order $635 right at the lower BB while brewing morning coffee - check

make money - check

Did you sell at the close? Or how did you make money?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M