I'm visiting my son in LA. Driving the freeways today I was actually surprised by how many non-Tesla cars are on the road. Despite all the sales in California, they have still barely tapped the market. Of course the rest of the country represents an even bigger opportunity. This makes me confident that they won't have a demand problems for decades. Looking forward to the post-virus climb, and will start leveraging up below 500 in the meantime.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

400K in the 1st minute After-hrs is typical trading activity for TSLA, especially on an Options Expiry Friday.On Feb 20 there were 400k shares traded the first minute of after hours. At closing price if I remember correctly. I asked about it then and got one answer that said it was standard. Haven't really seen this behavior any other time though so I'm still wondering.

Any chance/risk this was more shenanigans like your post above?

What is HIGHLY unusual is to see 300K volume in a minute after 7 pm, unless associated.with Earnings or some big news. Friday had neither. And that trade closely matched the total volume of naked short selling before 4 pm that day.

Highly suspect.

Regards,

Lodger

EVNow

Well-Known Member

Hmmm … just like most recent polls suggested.Biden crushing South Carolina coupled with the world not ending over the weekend should push Monday until rebound mode. Maybe just for one day, but we'll see.

EVNow

Well-Known Member

I got a call from Tesla too asking whether I want to switch to 5 seater. Don't know what to make of that. And they have invited LR/AWD folks to config as well (apart from Perf).I'm still waiting for my email. White / Black Interior / FSD / 5 Seater. I do think that people (Fred) are making a big deal saying there is a lack of demand just because Tesla offered some 7 seater reservation holders to change to be able to take delivery in March.

The Model Y is going to sell like gangbusters at full price (no subsidies).

SMAlset

Well-Known Member

While driving tonight with Bloomberg Radio on, Luke Kawa was on talking about Reddit trader and using options to pump up the stock market. Tesla stock trading featured in the story. Found the radio broadcast that you can listen to, apparently tonight was a rebroadcast with the orginal from 2/26.

Bloomberg - Are you a robot?

Bloomberg - Are you a robot?

Last edited:

tinm

2020 Model S LR+ Owner

We joked here for years when TSLA was range bound that THIS time, it really is the last chance to buy below 300. We all assumed in the last month or two that the joke was finally dead. I’m now not so sure.

Either way, you’d think that buying at 400 - 600 is gonna look like a great entry price 5 years from now. Wouldn’t be surprised if there are better entry points than even that still to come though. Alls you can do is drip buy rather than aiming for the bottom.

Never said I was aiming for the bottom. No idea where that is. My drip buys don’t kick in until 350-400 is all. If that never happens, great, no prob. If it does happen, we all prolly have bigger things to worry about.

Fact Checking

Well-Known Member

This implies strongly that this was a prearranged trade which did not go through the order book, else it would have had substantial effect upon the SP. It did not.

That's wrong. In a pre-arranged trade the following happens:

- Seller X and buyer Y agree to perform a pre-arranged trade at the current after-hours price of $373.68.

- Seller adds a 301,654 shares sized sell limit order of $673.68.

- Buyer sees the new liquidity and enters a 301,654 shares sized buy limit order of $673.68.

- The Nasdaq computers match the two orders and 301,654 shares are transferred from seller to buyer.

- The "quiet" after-hours session makes it more probable that others do not interfere and change the price.

- The price doesn't change, and shortly afterwards there's still the usual low after-hours liquidity.

- The orders went through the order book, which is why it showed up on the tape, which is why we are able to see it to begin with.

One reason for the shortfall might be last minute excercises of 3,000 options contracts between $667 closing price and the $674 after-hours price by options holders who are speculating on a good Monday open. Nasdaq trading closes at 4pm, but options can be exercised until 5:30pm, and when the after-hours price moved beyond $670 holders of $670 strikes might have decided to excercise.

The motivation of the seller is a good after-hours price he could not sell into otherwise without crashing the price due to low liquidity.

Last edited:

StealthP3D

Well-Known Member

Public safety has always trumped civil rights in the U.S. The patriot act is one such example. Another one is Stop and Frisk.

Exactly. Try using "freedom of speech" as a defense when you are being tried for manslaughter trampling deaths after yelling "Fire!" in a crowded theater.

"But I'm an American, I have freedom of speech, it's my First Amendment right!"

StealthP3D

Well-Known Member

That's wrong. In a pre-arranged trade the following happens:

@Curt Renz or @Hock1 might be able to confirm that this is how arranged trades are executed typically, and that it's often for benign reasons, such as an institutional options writer not having enough inventory of shares to deliver on Monday, and wants to be delta neutral over the weekend.

- Seller X and buyer Y agree to perform a pre-arranged trade at the current after-hours price of $373.68.

- Seller adds a 301,654 shares sized sell limit order of $373.68.

- Buyer sees the new liquidity and enters a 301,654 shares sized buy limit order of $373.68.

- The Nasdaq computers match the two orders and 301,654 shares are transferred from seller to buyer.

- The "quiet" after-hours session makes it more probable that others do not interfere and change the price.

- The price doesn't change, and shortly afterwards there's still the usual low after-hours liquidity.

- The orders went through the order book, which is why it showed up on the tape, which is why we are able to see it to begin with.

Well, I know nothing about pre-arranged trades. With that out of the way, I think there is likely a mechanism to allow for pre-arranged trades that is more secure than the way you proposed. A mechanism that doesn't risk a third party who is not privy to the trade swooping in and "stealing" the other side of the trade.

The rules of Wall Street are set up to facilitate trading and benefit the established players, big funds, billionaires, etc. They can do anything they want that is not obviously nefarious (and some things that are) and the rules are set up to be flexible and meet every player's needs and desires (mostly within reason). Because of this, I'm assuming a pre-arranged trade can only be completed by the intended party.

Fact Checking

Well-Known Member

First let me say that MMs can and do abuse the rules and they deserve much greater scrutiny than the SEC has ever given. However, Options Market Makers do need to keep themselves near delta neutral, and buying and selling stock to achieve that is a bona fide market making activity.

That's true, if the magnitude of the selling is justified by the put exposure, which the SEC should be able to verify easily by pulling the transaction logs of that MM and correlating the put and call exposure of the entire firm with the delta inventory and proprietary positioning.

If it turns out that the market maker sold beyond their delta hedging needs, for the sole purpose to increase the value of puts another arm of the investment bank or hedge fund is holding, or simply to reduce the value of call option payouts on the following Friday, then I believe it's an illegal abuse of market maker privileges in the Nasdaq trading system where they are allowed naked short selling without having the shares borrowed or having a proof of options exposure.

Bona fide market making becomes bona fide illegal market manipulation.

Last edited:

Fact Checking

Well-Known Member

Well, I know nothing about pre-arranged trades. With that out of the way, I think there is likely a mechanism to allow for pre-arranged trades that is more secure than the way you proposed. A mechanism that doesn't risk a third party who is not privy to the trade swooping in and "stealing" the other side of the trade.

There's no such risk: the seller likely has flashed that order in the order book already, and didn't get any buyers in sufficient volume.

If a buyer does show up in such volume the seller doesn't care (he gets the intended high price), and the pre-arranged buyer has to find another source of liquidity - he is back to where he was 1 minute before the transaction. In reality interaction rarely happens, and if it does it's just for a few hundred shares with much of the sale going through, and any residual exposure can be cleaned up immediately afterwards.

In any case, what I wanted to point out is that the whole notion that large pre-arranged trades must affect the after-hours price shows a misunderstanding of how the order book works and what pre-arranged trades are.

The rules of Wall Street are set up to facilitate trading and benefit the established players, big funds, billionaires, etc. They can do anything they want that is not obviously nefarious (and some things that are) and the rules are set up to be flexible and meet every player's needs and desires (mostly within reason). Because of this, I'm assuming a pre-arranged trade can only be completed by the intended party.

They generally trust the Nasdaq order book more than each other, which is why pre-arranged trades go through the exchange to begin with.

Last edited:

Singer3000

Member

You are free to follow TSLAQ and put me on Ignore if your brain is unable to handle dissenting opinion.How come you haven't left yet??

Fact Checking

Well-Known Member

Wow, GF3 Phase III. construction has started!

If they match last year's construction speed they might start Model Y production later this year, and will be able to use the established Model 3 supply chain.

The foundations being laid for the Model Y factory appear to be as large as the Model 3 factory - doubling the size of GF3.

If they match last year's construction speed they might start Model Y production later this year, and will be able to use the established Model 3 supply chain.

The foundations being laid for the Model Y factory appear to be as large as the Model 3 factory - doubling the size of GF3.

Last edited:

Buckminster

Well-Known Member

Even if the world loses control over -19, slowing it down through these measures initially could be critical. Going into the summer will slow the virus - better that 1% of the world has it than 10% as it now may never get to 10%.What exactly is your solution?

So far I’ve read you preaching:

Don’t wear masks

Don’t test

Don’t quarantine

Because you think it’s all useless.

Perfect is the enemy of the good. You need to do everything possible to reduce the probability of infections, particularly for very low cost actions like these. Per $, thorough testing of flu cases and hand washing are by far the most effective methods of stopping the virus. It’s ridiculous to attack every method of prevention because it isn’t 100% perfect. It is the same as arguing against self driving cars because they‘ll never have 0% chance of an accident.

MC3OZ

Active Member

Dahn made it pretty clear that a lot of his research was about fundamentals and the choice of his materials was often more about convenience rather than "this is what we plan to use". For example, he was using 532 pouch cells to test electrolyte additives, not because Tesla plans to use 532 pouch cells, but because he could buy them by the thousands from China without an electrolyte, then inject thousands of different electrolyte combinations and measure their performance.

NMC and NCA are quite similar chemistries, and I'm not sure how important it is to make a big deal of the difference between one and another. Both manganese and alumium service the same oxygen-scavenging role.

Yes, I assumed there was some significance to Tesla using NMC with energy storage batteries which are intended to be cycled daily.

Even if that was true, the Dahn/Maxwell findings change everything so at best my hunch is outdated.

Did we watch the same video? He mentioned that he expects energy storage to be a $30 billion business in 2025.

My mistake, I was just listening to the Pierre Ferragu interview (Tesla Daily Podcast) in the background. I'm a Millenial, it's normal. His voice isn't the easiest to half-listen to and I missed any talk of Tesla Energy. In my defence he spent very little time talking about anything other than cars and autonomy. Even early on in the video when he was explaining the range of "price targets" he had in mind, he said that they can range from Tesla being "a very successful car company with leading margins" and "you can go beyond that [to include Tesla insurance]`". He then mentioned mentioning "energy storage" for about a second. He did mention the energy side later in the video, but only fairly briefly. I understand why he only mentioned it briefly, he doesn't place much weight on that element of the business over the next 5 years. So it was easy to miss.

[For reference, main energy mention was about 16 mins in].

Last edited:

Tslynk67

Well-Known Member

Overall, I liked some of his ideas, but I can't help but lose all respect for an analyst who gets AI/FSD so wrong.

I watched the whole thing and found his viewpoints on AI and the solvability to be reasonable. Is he right or wrong, I don't know, I'm no expert either, hell according to Jim Keller, it's just "ballistics", which Lex Fridman doesn't agree with at all - Pierre is in this latter camp.

To "lose all respect" because you didn't agree on this point of view seems very harsh to me, especially when the methodology, research and reasoning they put into their Tesla price targets appears to be extremely well done.

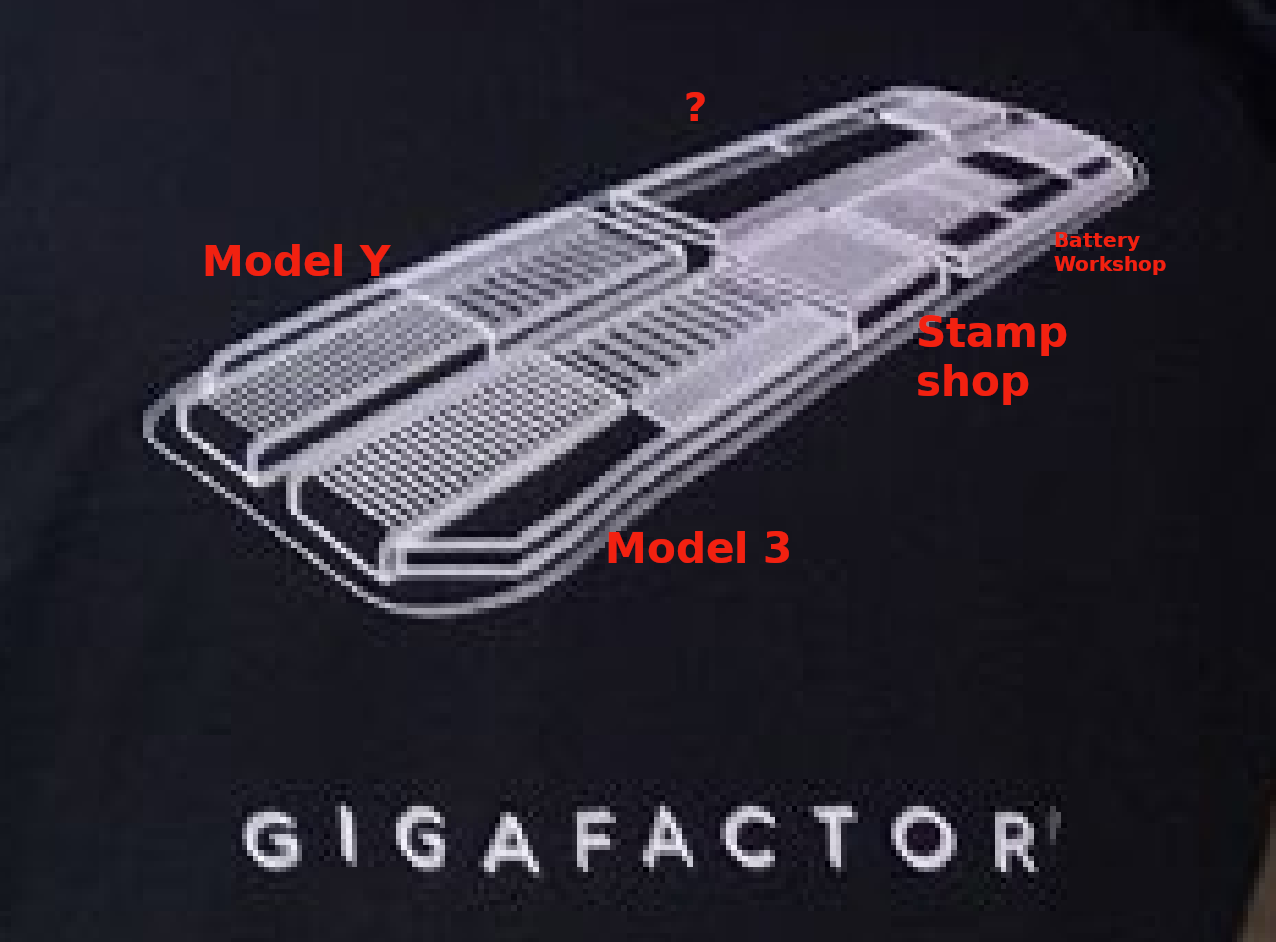

The foundations being laid for the Model Y factory appear to be as large as the Model 3 factory - doubling the size of GF3.

That's correct if you exclude the stamping area from the model 3 building.

I'm pretty sure that the Model Y building won't have a stamping area, see picture from your post on Jan. 6th below (mind the red labeling of the Model Y building is probably wrong; switched with the question mark).

Check out google maps for some better proportions: Google Maps

Model 3 building without stamping: 650m

From South boarder road to "recycling tent": 650m

So it looks as if they expand the stamping are of the Model 3 building and use them for 3 and Y. No idea what's needed for that crazy Model Y casting machine.

So I'd say the GF3 layout/plan is probably legit, genuine and the latest version:

Fact Checking

Well-Known Member

That's correct if you exclude the stamping area from the model 3 building.

I'm pretty sure that the Model Y building won't have a stamping area, see picture from your post on Jan. 6th below (mind the red labeling of the Model Y building is probably wrong; switched with the question mark).

Check out google maps for some better proportions: Google Maps

Model 3 building without stamping: 650m

From South boarder road to "recycling tent": 650m

So it looks as if they expand the stamping are of the Model 3 building and use them for 3 and Y. No idea what's needed for that crazy Model Y casting machine.

Agreed.

Note that the Model Y labeling in this map is wrong:

The new Model Y foundations in the new video are in the quadrant marked with "?".

(Or I could claim the "?" stood for the "why".

I think the new foundations next to the stamp shop might be the foundry:

And the existing stamp shop might have enough capacity for the Model Y as well? Pure speculation though.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K