My prediction for today, in about half an hour, MM would have sold enough puts, so they would start to reverse the direction, and today we close within +- 0.2 of Max pain.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

CNBC highlights TSLA as one of the markets "biggest movers" in the pre-market.

How much is it down to make this list? It's up 1%. Lol!

I wonder the same thing. It's funny on the days Tesla makes the biggest moves, they're never mentioned on CNBC's "biggest movers" section. On Monday and Wednesday of this week when Tesla made huge gains, not a mention of Tesla at all.

I'm sorry if this has been posted (out of town with limited computer time). I'm seeing Max Pain today at 975. Anyone see different?

Here's what Papafox wrote late last night:

"Looking at the max pain chart, you can see that put and call options are almost even with each other at 1000-strike, which gives honest market makers little incentive to push the stock price below 1000. Moreover, looking to the left of 1000, you can see that puts dominate, which suggests a finish closer to 1000 would serve market-makers better this week than further decline."

He also has an accompanying graph. Can max pain change that quickly in just a few hours overnight?

StealthP3D

Well-Known Member

The question of starting the Tesla Network with human drivers has been brought up to Elon before, I think on a earnings call, and as I recall he said that was a good idea. I don't know that they will have a special purchase program for Tesla Network drivers, but other than that I expect it to arrive sometime in the future.

A Tesla rideshare program would sell a lot of Teslas to Millenials still living with their folks who otherwise couldn't afford them. They would rack up high mileage and displace a lot of ICE miles. "Look mom, I signed myself up for a job!". Tesla sells another car, thousands of people are exposed to Teslas and the air gets cleaner! Win, win, win!

Thoughts on macros? Is this the beginning of the 2nd big dip due to C19? Sure feels like it. I have a hunch it is. Mostly cashing out all my positions except TSLA and NVNXF. Thoughts? Ideas?

And mom and dad let them charge for free at night. Zero expenses.A Tesla rideshare program would sell a lot of Teslas to Millenials still living with their folks who otherwise couldn't afford them. They would rack up high mileage and displace a lot of ICE miles. "Look mom, I signed myself up for a job!". Tesla sells another car, thousands of people are exposed to Teslas and the air gets cleaner! Win, win, win!

jeewee3000

Active Member

My thought is that you're easily spooked.Thoughts on macros? Is this the beginning of the 2nd big dip due to C19? Sure feels like it. I have a hunch it is. Mostly cashing out all my positions except TSLA and NVNXF. Thoughts? Ideas?

The macro "dip" end of this week will most likely be undone by the end of next week.

For TSLA specifically I'm bullish short term (<3months) given battery day/Q2 potential.

Yeah, I don't get why so many sees this as a new idea. The robotaxi network will start with drivers. That's a given. What's not clear is how and if Tesla will help getting cars in the hand of willing drivers but it's seems logical that they will have some kind of profit sharing deal available.

Adding to this, Tesla could conceivably run the Tesla Network in a neutral profit manner as they build it out. Uber/Lyft don’t have other revenue streams to do the same. This would be extremely interesting if true....

Jumped on another 500 shares at $940, so if you're right I owe you a beer.My prediction for today, in about half an hour, MM would have sold enough puts, so they would start to reverse the direction, and today we close within +- 0.2 of Max pain.

willow_hiller

Well-Known Member

He also has an accompanying graph. Can max pain change that quickly in just a few hours overnight?

I think @Papafox is visually assessing open interest. Even though max-pain might technically be at a certain level, large volumes of calls can create a spike where it looks like market-makers would target. Here's my two charts generated just now based off of live open interest (11:16 AM EST):

My thought is that you're easily spooked.

The macro "dip" end of this week will most likely be undone by the end of next week.

lol! Thanks. Needed some outside perspective for sure. Much appreciated.

Artful Dodger

"Neko no me"

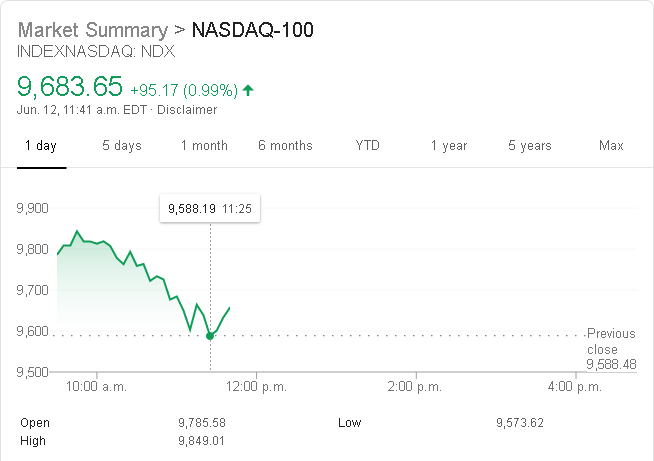

Okay, the NASDAQ-100 just touched yesterday's Close (9,588.48)

Let the bounce commence.

EDIT: macros bottomed at 11:24 ET, now trading at about ~1% over yesteday's Close.

TSLA: bottomed at 11:22 ET w. VWAP of $929.53 (1-min avg SP)

EDIT2: MMs have learned that if they spread their hunnert dollar cash grab over TWO days, the SEC doesn't care. For example, from Wed's Hi to today's Lo we get:

'jus sayin'.

Let the bounce commence.

EDIT: macros bottomed at 11:24 ET, now trading at about ~1% over yesteday's Close.

TSLA: bottomed at 11:22 ET w. VWAP of $929.53 (1-min avg SP)

EDIT2: MMs have learned that if they spread their hunnert dollar cash grab over TWO days, the SEC doesn't care. For example, from Wed's Hi to today's Lo we get:

1027.48 - 928.51 = $98.97

'jus sayin'.

Last edited:

Adding to this, Tesla could conceivably run the Tesla Network in a neutral profit manner as they build it out. Uber/Lyft don’t have other revenue streams to do the same. This would be extremely interesting if true....

Another thought: Uber/Lyft drivers are, for the most part, pretty savvy. The fact that many of them drive for both Uber and Lyft and how they use surge pricing to their advantage. Imagine a Tesla network driver who continues to drive for Uber and Lyft as the network starts rolling out. They could then promote the Tesla network to their current Uber/Lyft passengers. As the Tesla network grows, costs go down and fares will eventually beat Uber/Lyft and that will be how Tesla pulls a Trojan horse type move into ride hailing!

Serious question. Does this happen to S&P 500 companies?Okay, the NASDAQ-100 just touched yesterday's Close (9,588.48)

Let the bounce commence.

EDIT: macros bottomed at 11:24 ET, now trading at about ~1% over yesteday's Close.

TSLA: bottomed at 11:22 ET w. VWAP of $929.53 (1-min avg SP)

View attachment 550793

EDIT2: MMs have learned that if they spread their hunnert dollar cash grab over TWO days, the SEC doesn't care. For example, from Wed's Hi to today's Lo we get:

1027.48 - 928.51 = $98.97

'jus sayin'.

A worldwide "Driver/Agent program" of mobile 1-on-1 human marketing consultants trained to ask casual questions and tailor their presentation based on the riders demographics provided by Tesla's ride share program and whatever they learn about that customer on each trip would pay off well.Another thought: Uber/Lyft drivers are, for the most part, pretty savvy. The fact that many of them drive for both Uber and Lyft and how they use surge pricing to their advantage. Imagine a Tesla network driver who continues to drive for Uber and Lyft as the network starts rolling out. They could then promote the Tesla network to their current Uber/Lyft passengers. As the Tesla network grows, costs go down and fares will eventually beat Uber/Lyft and that will be how Tesla pulls a Trojan horse type move into ride hailing!

Last edited:

Artful Dodger

"Neko no me"

dunno. I only hold TSLA.Serious question. Does this happen to S&P 500 companies?

Anyone? Bueller? TIA.

Cheers!

Jack6591

Active Member

My thought is that you're easily spooked.

The macro "dip" end of this week will most likely be undone by the end of next week.

For TSLA specifically I'm bullish short term (<3months) given battery day/Q2 potential.

I am not easily spooked; I am easily pissed-off. The older I get, the less I seem to be able to tolerate bullshit.

They made a movie about me once. I think it was called “Grumpy Old Men.”

J

jbcarioca

Guest

I quote you in full because I desperately want to think you're correct! I worry that many drivers on less-demanding routes than yours might be less well prepared. OTPH, everyone now deals with multiple screens to cope with reporting and tacking of disparate topics. FWIW that seems to be true also for nearly all EU lorries as well, more so for TIR, specialty/hazardous materials. Possibly the ones I know are only the decrepit ones. I have reason to accept that thesis. If you're correct then the appeal of Tesla Semi may well be enhanced immeasurably by the technological integration, not to mention the increased stability when driving. Finally, I repeat how much I hope you're correct.As a Pro driver who just spent the winter operating a 90ft (300,000lb loaded) vacuum tanker driving on ice-roads in the Prudhoe Bay hinterlands, I am going to have to disagree with you on this one point. Drivers manage GPS touch screens with integrated Bluetooth coms and often-times poorly written software for tracking hours, plus their phones and company radios (all while operating the truck). Driving the equipment is anything but trivial. Heavy trucks are down-right dangerous if not operated by an extremely alert driver. I just spent 30 minutes going over the Model 3's screen functions last week and got 90% of it down pat.

New Tesla trucks will be assigned to the best drivers first. You can be absolutely certain that the new truck won't leave the yard until the driver knows the software screens inside and out. Drivers will come in on their own (unpaid) time to learn it because that's what good drivers in this industry do.

adiggs

Well-Known Member

I show max pain (I believe it's as of start of day) at $975. I think more importantly, for this sort of analysis, I look for what's within 5% of that max pain (measured in pain, not strike prices) in order to understand the range of prices that are likely to be acceptable.

I made up the 5% number.

For today's expiration, that range is $955 to $995. And yes, max pain will move throughout the day. I think on the final day I wouldn't expect a really large move. I conclude that somewhere in that range is where the market makers would like it to end, with a preference for $975, and with that preference moving throughout the day.

However next week's max pain is up to $790 today from $775 yesterday, and $675 from about a week ago. For trying to understand how much movement is readily available for a week like next week, I look at what's within 1% (again, my made up # - not back tested etc..). With max pain next week at $790, $755 to $805 are within 1%. So I'd expect max pain tomorrow (Monday) to be anywhere in that range, and given today's share price I expect $805 (another $15 daily move, in an expiration week that's been moving $15 to $25 every day for more than a week).

I made up the 5% number.

For today's expiration, that range is $955 to $995. And yes, max pain will move throughout the day. I think on the final day I wouldn't expect a really large move. I conclude that somewhere in that range is where the market makers would like it to end, with a preference for $975, and with that preference moving throughout the day.

However next week's max pain is up to $790 today from $775 yesterday, and $675 from about a week ago. For trying to understand how much movement is readily available for a week like next week, I look at what's within 1% (again, my made up # - not back tested etc..). With max pain next week at $790, $755 to $805 are within 1%. So I'd expect max pain tomorrow (Monday) to be anywhere in that range, and given today's share price I expect $805 (another $15 daily move, in an expiration week that's been moving $15 to $25 every day for more than a week).

Artful Dodger

"Neko no me"

Likely delayed, at least in America, until after a vacine is in wide-spread use. I've written about this here before, for ridesharing there's a privacy hurdle to jump wrt pax tracking, contract tracing, testing, ID card nightmare... not worth it yet IMO.A worldwide "Driver/Agent program" of mobile 1-on-1 human marketing consultants trained to ask casual questions and tailor their presentation based on the riders demographics provided by Tesla's ride share program and whatever they learn about that customer on each trip.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K