Artful Dodger

"Neko no me"

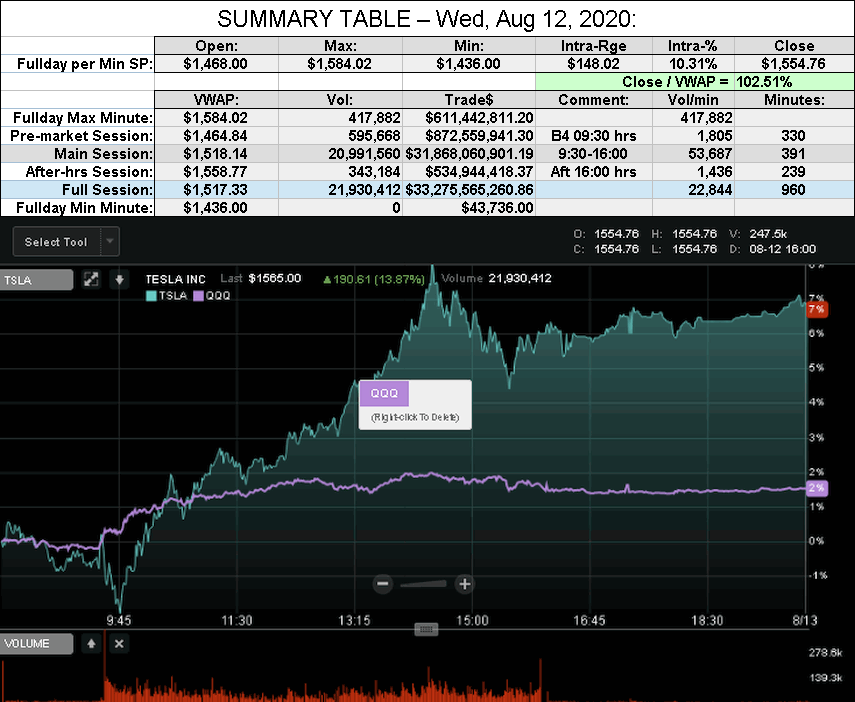

After-action Report: Wed, Aug 12, 2020: (Full-Day's Trading)

Headline: "TSLA Roars After Stock Split Announcement"

TSLA 1-mth Moving Avg Market Cap: $278.62

TSLA 6-mth Moving Avg Market Cap: $170.53

Nota Bene: Elon's CEO comp. plan 2nd tranche vested July 24, 2020

'Short' Report:

Comment: "But not all MMs have capitulated, it seems"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Roars After Stock Split Announcement"

Traded: $33,275,565,260.86 ($33.28 B)

Volume: 21,930,412

VWAP: $1,517.33

Closing SP / VWAP: 102.51%

(TSLA closed ABOVE today's Avg SP)

Mkt Cap: TSLA / TM = $289.748B / $192.389B = 150.61%

Volume: 21,930,412

VWAP: $1,517.33

Closing SP / VWAP: 102.51%

(TSLA closed ABOVE today's Avg SP)

Mkt Cap: TSLA / TM = $289.748B / $192.389B = 150.61%

TSLA 1-mth Moving Avg Market Cap: $278.62

TSLA 6-mth Moving Avg Market Cap: $170.53

Nota Bene: Elon's CEO comp. plan 2nd tranche vested July 24, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 50.2% (50th Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 45.3% (47th Percentile rank Shorting)

FINRA Short Exempt Volume was 1.40% of Short Volume (52nd Percentile Rank)

FINRA Short/Total Volume = 45.3% (47th Percentile rank Shorting)

FINRA Short Exempt Volume was 1.40% of Short Volume (52nd Percentile Rank)

Comment: "But not all MMs have capitulated, it seems"

View all Lodger's After-Action Reports

Cheers!