Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Yeah, no. Punctuated equilibria FTW.FSD isn't solved. Elon hasn't said that it will be any time soon. All the chatter is about big improvements and "feature complete" which are only the first steps towards it working well, never mind being accredited and approved and legal.

The whole thing will be a gradual process towards being adequate, with many steps both forward and backward. So don't imagine any sudden "we're got it!" moment. If the stock price starts to respond to FSD expectations, it will just fall hard as reality bites.

Hey, a fun and helpful driver assist that keeps on getting better is a wonderful thing. It's just not full autonomy by a long stretch.

Couple that with the 180 pounds per shot number from Wikipedia and we get 811 castings per day per machine. Or 6,488 a day for 8 machines. Lends itself to the idea they are casting more than one part. Rear section, front motor cradle, rear motor cradle, and front including firewall? Battery pack housing?

The planning documents submitted for GF4 state 95kg of molten aluminium per batch. (Source: 3.1.2 A002 casting.pdf)

So that would be 6,155 casts max per day for the 8 machines. Allowing for some downtime etc that could be in the order of 5,500+ units per day. Stage 1 of GF4 is supposed to have an annnual capacity of 250,000 cars. So assuming 5,500 per day and 350 ave days production per year, that would be around 7 to 8 castings per car. These figures sound high but it shows that they will be doing much more than just one rear body casting per car.

I just realised that with the sale of one set of call options, I have now cashed out 2 X my original investment in 4 years !! So I can never lose on $TSLA

I still have 10 X my original investment by way of shares and LEAPS.

I still have 10 X my original investment by way of shares and LEAPS.

Thekiwi

Active Member

Cannot wait for the movie to come out on Tesla. Wonder who will play Tesla Charts?? danny devito? The dwarf from game of thrones??

why would a movie about Tesla include him? he is completely meaningless to the Tesla story.

Joesantelli

Member

Wait. What? You mean just like TSLA rose gradually until now based on Tesla’s progress?No, it won't "detonate the SP to the moon". It could do that only if it were unexpected. Its gradual improvement and acceptance will mean that that can't happen. The stock price will rise gradually as the likelihood of FSD completion increases.

Of course FSD could appear instantaneously and surprisingly if a full super-human artificial general intelligence appears (i.e. the Singularity), but that would upend everything so it's not really worth considering.

No offense, I foresee it differently.

* Progress will not be steady in the sense of incremental improvements nor will it appear so. This upcoming release of the rebuilt stack will exhibit a jump.

* People will continue to underestimate the progress in front of their eyes: Virtually nobody is a good futurist by nature — especially not by virtue of being experts in their field nor, ahem, having worked in tech.

* Acceptance, including regulatory, will start earlier than most expect, but will be spotty geographically for a bit. Then, it will become commonplace in a rush. Similar to other disruptive tech.

* Finally, it won’t be fully priced in to the stock price until

Last edited:

This explains why you are a late riser for the nasdaqTake that back, 389 USD...

Heck, I might be up all night! But I doubt it... it will still be there in the morning...This explains why you are a late riser for the nasdaq

Wait. What? You mean just like TSLA rose gradually until now based on Tesla’s progress?

No offense, I foresee it differently.

* Progress will not be steady in the sense of incremental improvements nor will it appear so. This upcoming release of the rebuilt stack will exhibit a jump.

* People will continue to underestimate the progress in front of their eyes: Virtually nobody is a good futurist by nature — especially not by virtue of being experts in their field nor, ahem, having worked in tech.

* Acceptance, including regulatory, will start earlier than most expect, but will be spotty geographically for a bit. Then, it will become commonplace in a rush. Similar to other disruptive tech.

* Finally, it won’t be fully priced in to the stock price untilautonomy bites people in the assrobotaxi’s are picking up fares. Maybe we will be hover at the $7K/5 +/- mark until we snap up at that point.

Agree - the truth is, nobody outside of the FSD team knows how far along they really are. The 4d rewrite is a fundamentally new and different beast that no customer has experienced.

I expect many people extrapolate from self driving progress over the past 2-3 years and estimate that it’ll take at least a decade before robotaxis are ready. But this is misguided.

With a well designed backbone, Tesla will solve FSD through collection and analysis of massive amounts of training data from the fleet. Corner and edge cases that need to be overcome to enable robotaxis etc require large amounts of data - and that is growing exponentially. How long will it take? I don’t know, but Elon Musk seems very confident that Tesla is much closer than people realize.

Joesantelli

Member

392.35$ in Germany LETS GO ! I was expecting much worse with Nasdaq down so much

Joesantelli

Member

Germany is buying the dip $393.24.

I'm taking the wife to Germany for our next vacation have to support the economy after helping us buy the dip

I'm taking the wife to Germany for our next vacation have to support the economy after helping us buy the dip

Criscmt

Member

Gamma squeeze: To what degree is TSLA affected?

There has been a lot of talk on high volume OTM call buying leading to share price gains.

Whether it the influence of call buying by retail is more of was buying by institutions more is a different question.

The volume of options, at least the numbers quoted (if true) imply this theory as credible.

From what I read, TSLA if anything has more vulnerability to Gamma squeeze.

How much of this do you guys think contributed to the TSLA price gain in the last couple of months?

If significant, I see a significant downside risk.

I do think upcoming events can help mitigate a significant downside risk.

But if the unwinding of this Gamma Squeeze happens across tech stocks, I would think TSLA would get significantly impacted not withstanding the upcoming positive events.

@FrankSG @generalenthu @dl003 @StealthP3D Tagging you guys based on my perception of your knowledge on this from your earlier comments on this thread

Edit: I would add that, the Gamma Squeeze impacting share price movement up can also be seen from an organic growth point of view.

In other words, one can say, retail started buying TSLA options once they started seeing the strong growth potential of TSLA since Q3, Q4 2019. More retails coming in, perhaps coinciding with more retail getting into options in general (how true?) amplifies the call buying and thus Gamma squeeze.

Prior to Q3, Q4 the call buying (and buying common) wasn't significant enough to cause the squeeze.

There has been a lot of talk on high volume OTM call buying leading to share price gains.

Whether it the influence of call buying by retail is more of was buying by institutions more is a different question.

The volume of options, at least the numbers quoted (if true) imply this theory as credible.

From what I read, TSLA if anything has more vulnerability to Gamma squeeze.

How much of this do you guys think contributed to the TSLA price gain in the last couple of months?

If significant, I see a significant downside risk.

I do think upcoming events can help mitigate a significant downside risk.

But if the unwinding of this Gamma Squeeze happens across tech stocks, I would think TSLA would get significantly impacted not withstanding the upcoming positive events.

@FrankSG @generalenthu @dl003 @StealthP3D Tagging you guys based on my perception of your knowledge on this from your earlier comments on this thread

Edit: I would add that, the Gamma Squeeze impacting share price movement up can also be seen from an organic growth point of view.

In other words, one can say, retail started buying TSLA options once they started seeing the strong growth potential of TSLA since Q3, Q4 2019. More retails coming in, perhaps coinciding with more retail getting into options in general (how true?) amplifies the call buying and thus Gamma squeeze.

Prior to Q3, Q4 the call buying (and buying common) wasn't significant enough to cause the squeeze.

Last edited:

MC3OZ

Active Member

Only about a dozen workers on site. Pumping of flooding continues. Possible outline of third factory building at 6:50 (which I don't is quite correct).

Building 3 makes some sense to me, but it may just be a giant car park/ logistic yard in phase 1.

What is different to Shanghai IMO is that building 1 and 2 may be built in Phase 1.

That is something the size of Shanghai in one phase.

I think Phase 1 can possibly do Cybertruck, Semi, Model 3 and Model Y.

Last edited:

2

22522

Guest

Elon's trip was a stock price piton for labor day in the US markets.Germany is buying the dip $393.24.

I'm taking the wife to Germany for our next vacation have to support the economy after helping us buy the dip

That is correct.correct me if Im wrong, but Ark doesnt account for energy in their model, right?

JohnnyEnglish

Member

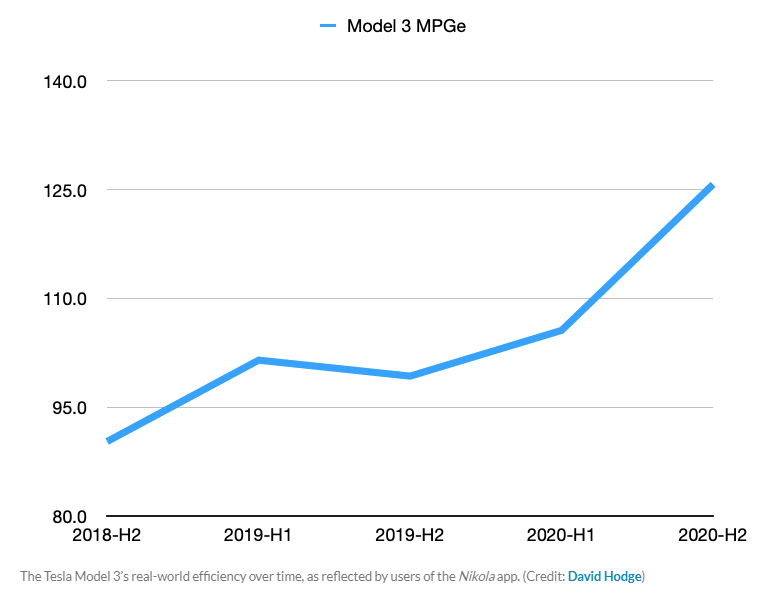

The graph below is taken from a teslarati article yesterday Tesla Model Y efficiency exceeds early-production Model 3, data shows.

I am not familiar with how MPGe ratings are worked out so wondered if any of you guys could help clarify if this means that there has been a 20% increase in range in Model 3s produced now vs 2020H1? There is a similar bump for Model Y

If this is correct am I right to infer that a significant part of this range increase will be due to battery improvements. Weight reduction seems unlikely to provide this improvement, especially as the 3 has been around for 2 years now. Efficiency from the other parts of the drivetrain (motor etc) also seem less likely for an improvement of this magnitude.

Not enough info in the article to know how software improvements are taken into account (is the data the current MPGe being reported by the vehicles - hence including the impact of software improvements - or the figures when the vehicle was new. I lean towards the first option as this info has been collected by an app).

Which brings me back to how MPGe is calculated. According to Google ' The EPA calculates that 33.7 kilowatt-hours of electricity is the equivalent to one gallon of gas, so an electric or hybrid vehicle that uses 29 kWh per 100 miles would get a combined 115 MPGe rating.' Is this based on a measured battery capacity? Just wondering what happens when Tesla improve battery chemistry and hence capacity. Is the new battery capacity taken into account in the calculation or is it still based on the original battery capacity (as originally measured by EPA).

Thoughts/feedback really welcome as this is not clear to me. I think this is positive news but want to understand exactly how it is positive

I am not familiar with how MPGe ratings are worked out so wondered if any of you guys could help clarify if this means that there has been a 20% increase in range in Model 3s produced now vs 2020H1? There is a similar bump for Model Y

If this is correct am I right to infer that a significant part of this range increase will be due to battery improvements. Weight reduction seems unlikely to provide this improvement, especially as the 3 has been around for 2 years now. Efficiency from the other parts of the drivetrain (motor etc) also seem less likely for an improvement of this magnitude.

Not enough info in the article to know how software improvements are taken into account (is the data the current MPGe being reported by the vehicles - hence including the impact of software improvements - or the figures when the vehicle was new. I lean towards the first option as this info has been collected by an app).

Which brings me back to how MPGe is calculated. According to Google ' The EPA calculates that 33.7 kilowatt-hours of electricity is the equivalent to one gallon of gas, so an electric or hybrid vehicle that uses 29 kWh per 100 miles would get a combined 115 MPGe rating.' Is this based on a measured battery capacity? Just wondering what happens when Tesla improve battery chemistry and hence capacity. Is the new battery capacity taken into account in the calculation or is it still based on the original battery capacity (as originally measured by EPA).

Thoughts/feedback really welcome as this is not clear to me. I think this is positive news but want to understand exactly how it is positive

dc_h

Active Member

I believe Energy could be similar to Auto with FSD. The battery and solar market will grow fast, but eventually will be surpassed by the software grid market solution. TE will become a software grid, on top of the physical grid. It is possible they won't get to scale, but they seem best positioned to take an early lead. The software grid will allow car owners to share burst energy during premium demand and delay charging, commercial buildings to charge at night cheaply and run batteries during peak demand, consumer solar\battery customers to share their power during peak demand and for large scale utility providers to leverage peak demand solutions. If Tesla can capture some microtranasction payments by providing the market, it will provide tremendous value and profit for all of these participants and create a more resilient grid that will grow faster then the economy. The electricity market should grow faster then the overall energy market as fossil fuels decline, even as the cost per KWh falls over the next decade. This could be a trillion dollar market, with 10's of billions of profits annually by 2030.That is correct.

I would expect Tesla to be forced to spin off energy from auto, as the scale of the company grows more powerful than governments will be comfortable to accept. From a value perspective that would be a rounding error once this business is at scale and could be more valuable to spin off.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K