Ignoring the moves off the BBs at your peril?

Paying attention to them. More a hogs get slaughtered issue. lol

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Ignoring the moves off the BBs at your peril?

Coinstar... hmmm, had forgotten about that metallic asset. I might be able to buy half a share!If NAS and market weren't such a POS today...$TSLA would prob be $450....oh well...just more time to pick up some shares when i cash in my coinstar coupon.

Did you happen to try trading around MMD?FWIW I day trade this stock to get funds to buy more shares for my long account. I'm still up a lot for the year [duh], but I've gotten hosed in the past few trading days. lol

My best success recently has been buying at close and selling ~7:30am. If I just did that and backed away it would be a much different story. ah well.

Can't win em all.

I didn't expect today to happen this way at all, but worked out OK anyway.Well, I stocked up today, averaging about $435. If I hadn't bought earlier in the day, it could have been lower. Oh well.

Put a buy order in at $429.50 thinking it wouldn't reach but hey....i have 17 more new shiny shares thanks partly to all my change i cashed inI didn't expect today to happen this way at all, but worked out OK anyway.

I think Nancy threw a dry dog biscuit knowing it would go nowhere just to drive her point. It sure tracked the NASDAQ like I've never seen in my life here.

Did you happen to try trading around MMD?

Ah, that Core... For me it changed over time, but mostly bc I changed to the 50/50 strategy. I missed out on a lot of upside, but still made out and felt safer in these times. Right now I'm TSLA heavy so looking to sell a few sometime Wed in afterhours maybe. Or not.I need to remember that's what my long account is for.

I didn't hit the disagree post on your original post but I do disagree with it. Tesla is not priced for perfection. Its priced where it is because Tesla is executing on its growth strategy and expanding a tech and software lead. The tech and software importance to value is debatable, but Tesla executing on their growth plan isn't.

Simply put, if you believe in Tesla’s production road map for the next 2 to 3 years, Tesla shares are not overvalued and could be easily argued that they're undervalued. Again, this only makes sense if you believe in Tesla's growth road map. Next year, I believe Tesla will make 1 million vehicles which will generate revenue, profits, and free cash flow that makes Tesla shares today pretty cheap. I'm confident in that growth.

I would imagine the people that did disagree with your original post might feel the same way. There's no need to caution about your view being pessimistic.....as long as your expectations of Tesla’s next 1 to 2 years accurately reflects that. If you are saying you think Tesla will deliver 1 million cars next year and that the share price will only be 600-700.....I would say somethings off with your calculations or that you're being pessimistic for no reason other than to be pessimistic. If you personally think Tesla will only deliver 750k vehicles or so in 2021, then your 600 to 700 share price would make a lot of sense.

Yeah that's what I've been doing, usually with great success. The past few weeks the bounce off MMD hasn't been as sustained as expected. The patterns seemed to have changed in September for reasons beyonds my pay grade. It used to be buy the dip ~9:40 and sell around noon. All this while of course playing the BB etc. I think unfortunately there's the change in my pattern my keeping the emotions out of it. There were many days I was up $500 and should have known to walk away, only to end up down double that. Since my Friday error I was on tilt today. I just need to hit the reset button. I was making $250 in a couple hours easy but got greedy as I kept being frustrated on missing out on the upside. I need to remember that's what my long account is for. I've been dealing with [maybe post COVID] fatigue and an inflamed heart [pericarditis] so that's not helping on a number of levels as I'm unable to run [which is my life] and my brain is going to *sugar*..

Stay safe all! <3

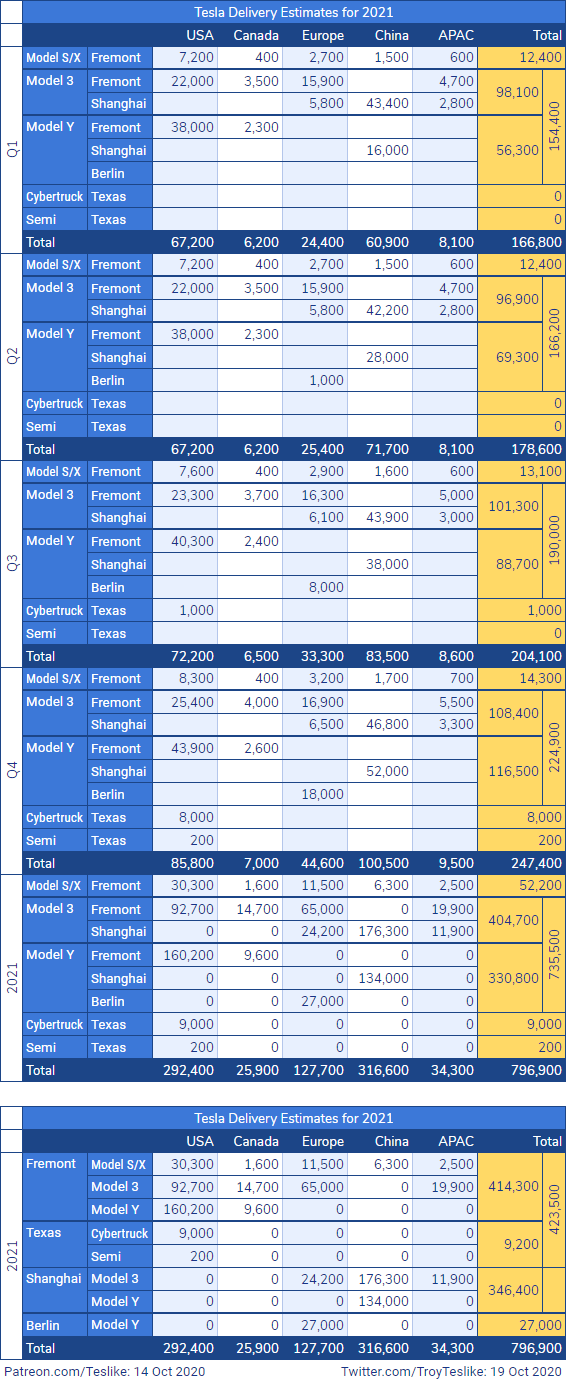

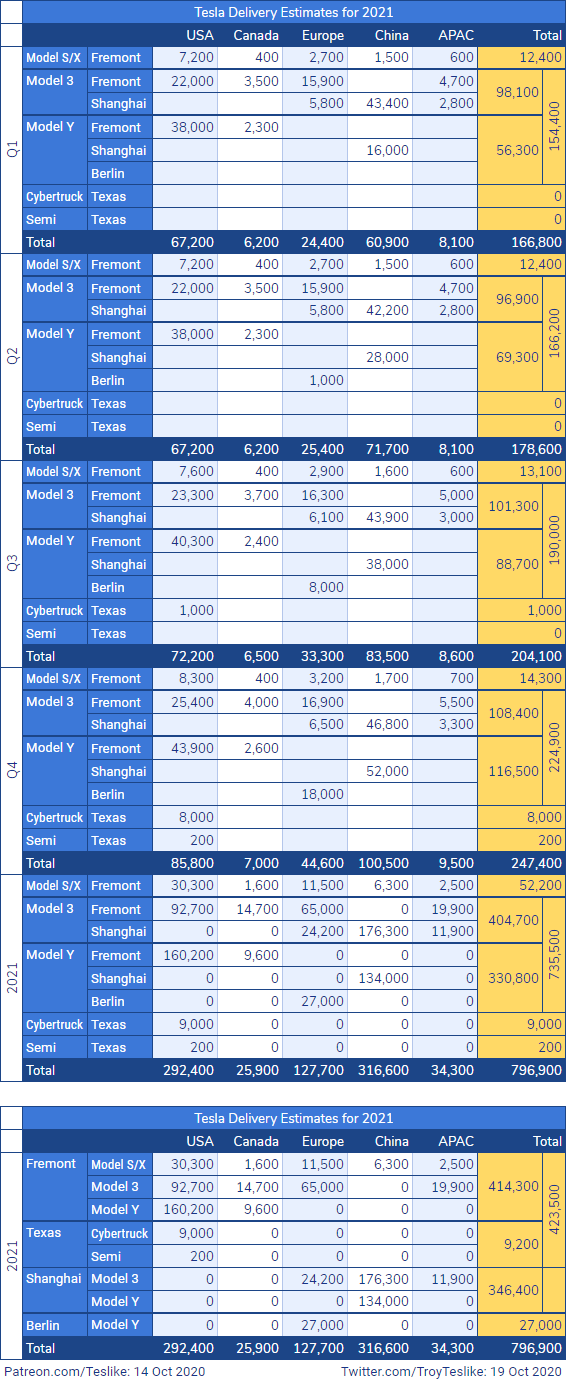

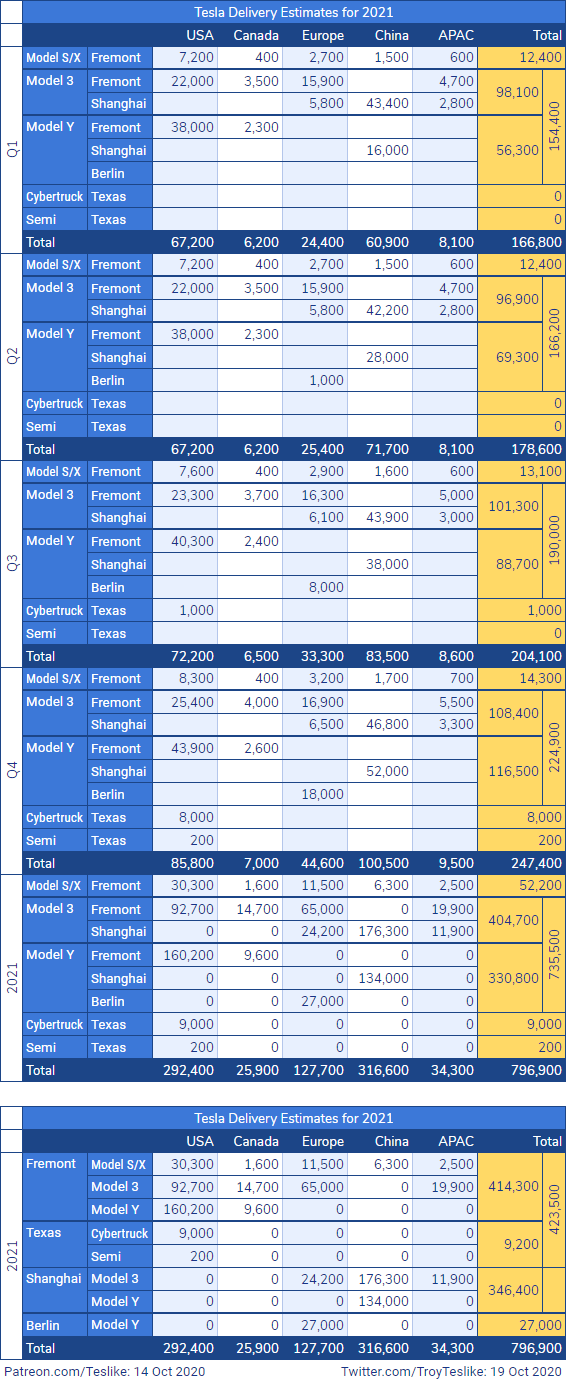

His Model 3/Y projection for Fremont is well below capacity and I believe (hope?) Berlin starts sooner and ramps up much faster than he does. Berlin's ramp is subject to how fast they get the bugs out of the new battery lines.For what it's worth, Troy has just posted his 2021 delivery estimate - he's forecasting 60% growth in deliveries relative to his expectation for 2020 (500k).

As a point of reference, Volvo delivered 705k in 2019.

https://twitter.com/TroyTeslike/status/1318253550665949184

View attachment 600260

For what it's worth, Troy has just posted his 2021 delivery estimate - he's forecasting 60% growth in deliveries relative to his expectation for 2020 (500k). Glancing over his numbers, seems like there is still quite a bit of upside potential there, especially for Giga Berlin.

As a point of reference, Volvo delivered 705k in 2019.

https://twitter.com/TroyTeslike/status/1318253550665949184

View attachment 600260

His Model 3/Y projection for Fremont is well below capacity and I believe (hope?) Berlin starts sooner and ramps up much faster than he does. Berlin's ramp is subject to how fast they get the bugs out of the new battery lines.

This puts a damper on my hopes for 1 million in 2021, but whatever. 1M is just an arbitrary number.

His Model 3/Y projection for Fremont is well below capacity and I believe (hope?) Berlin starts sooner and ramps up much faster than he does. Berlin's ramp is subject to how fast they get the bugs out of the new battery lines.

This puts a damper on my hopes for 1 million in 2021, but whatever. 1M is just an arbitrary number.

His Model 3/Y projection for Fremont is well below capacity and I believe (hope?) Berlin starts sooner and ramps up much faster than he does. Berlin's ramp is subject to how fast they get the bugs out of the new battery lines.

This puts a damper on my hopes for 1 million in 2021, but whatever. 1M is just an arbitrary number.